How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

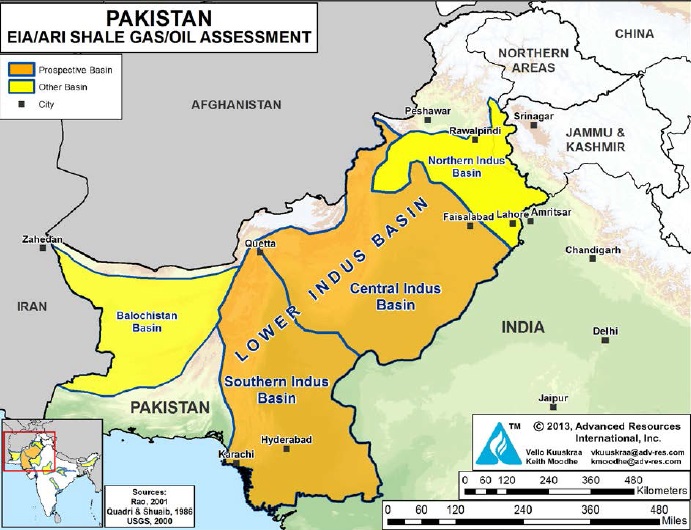

Pakistan has 10,159 tcf of shale gas deposits: USAID

- Thread starter farhan_9909

- Start date

Pindi Boy

FULL MEMBER

- Joined

- Jun 2, 2015

- Messages

- 1,685

- Reaction score

- 0

- Country

- Location

(Off topic)

Be aware, of USA.They'll soon declare you Terrorist State(because u have oil) and might help u to setup peace by sending 20-30k soldiers.

Be Aware

Well Said

Shotgunner51

RETIRED INTL MOD

- Joined

- Jan 6, 2015

- Messages

- 7,165

- Reaction score

- 48

- Country

- Location

Pakistan Shale Gas reserves

EIA

586 TCF shale gas

9.1Billion barrel Shale oil

USAID funded survery,released yesterdat.Joint venture of USAID and OGDCL

10159 TCF of shale gas

2300 Billion barrel of shale oil

Pakistani Survey

200 TCF Shale gas

58 Billion barrels of Shale oil

I have read about EIA reports before. For Pakistan (and India, a combined report) please check this:

http://www.eia.gov/analysis/studies/worldshalegas/pdf/India_Pakistan_2013.pdf

On page 10 it summarizes: "Overall, ARI estimates a total of 1,170 Tcf of risked shale gas in-place for India/Pakistan, 584 Tcf in India and 586 Tcf in Pakistan. The risked, technically recoverable shale gas resource is estimated at 201 Tcf, with 96 Tcf in India and 105 Tcf in Pakistan, Tables XXIV-1A and XXIV-1B. In addition, we estimate risked shale oil in-place for India/Pakistan of 314 billion barrels, with 87 billion barrels in India and 227 billion barrels in Pakistan. The risked, technically recoverable shale oil resource is estimated at 12.9 billion barrels for these two countries, with 3.8 billion barrels for India and 9.1 billion barrels for Pakistan."

How credible you think is the USAID funded survey?On page 10 it summarizes: "Overall, ARI estimates a total of 1,170 Tcf of risked shale gas in-place for India/Pakistan, 584 Tcf in India and 586 Tcf in Pakistan. The risked, technically recoverable shale gas resource is estimated at 201 Tcf, with 96 Tcf in India and 105 Tcf in Pakistan, Tables XXIV-1A and XXIV-1B. In addition, we estimate risked shale oil in-place for India/Pakistan of 314 billion barrels, with 87 billion barrels in India and 227 billion barrels in Pakistan. The risked, technically recoverable shale oil resource is estimated at 12.9 billion barrels for these two countries, with 3.8 billion barrels for India and 9.1 billion barrels for Pakistan."

Please provide direct link if you have any for in-depth reading, thanks bro!

niaz

PDF THINK TANK: CONSULTANT

- Joined

- Jun 18, 2006

- Messages

- 5,164

- Reaction score

- 211

- Country

- Location

@niaz

Sir your opinion on this? Is it viable? Do we have the technology and resources to extract it and what will be environmental costs?

Hon Paksanity,

Answer to your question is not straight forward. For the sake of those who are not familiar with Shale/tight oil & gas. Let us first understand what is shale oil & shale gas.

Oil shale refers to any sedimentary rock that contains ‘Kerogen’ which is a mixture of organic compounds that form part of the composition of the rock. Oil Shale will yield petroleum like liquids when heated.

Shale gas on the other hand is primarily methane which cannot flow thru rock because of its extremely low permeability. The shale rock needs to be crushed before the gas is released. Tight gas is a little easier to extract than shale gas but the process is the same.

Extraction of both the shale gas & shale oil is therefore lot more expensive than normal oil drilling where you drill a well at 90 degrees and when it bores thru the hydrocarbon bearing structure, oil or gas gushes out. A major problem with fracking is depletion. A normal oil/gas producing well depletes at around 2% per annum, hence its life is easily about 20 years. An added advantage of the long-life is that ups & down of the oil prices can be absorbed as the fluctuations are averaged out over the life of the well.

Fracking is more like mining operation where after one vein is exhausted you got to look for a new vein. We only have US experience of fracking. Fracking wells in Montana & North Dakota have extremely short life span and shrinkage of about 70% year has been known. In other words production from a 1000 bbl. per day well will decline to just 300 bbl. per day in the second year. This means one needs to constantly drill new wells to maintain production level.

On an approximate basis, it costs about $4-million to drill an on-shore oil or gas well in the US. In the Bakken formation (Montana & North Dakota) a standard fracking well (10, 00 feet vertical & 8,000 ft. horizontal) costs between $4 to $6-million to drill. Another $4 to 5 million for fracking & surface facilities say a total of $10-million per producing well. Thus a fracking well is twice as expenses and with the production life of about 3 to 4 years only.

Based the above, B/E cost of shale gas from the new well is $4 to $6 per million Btu. Crude oil production cost from a 10-year old oil well in the United States in about $20 per bbl. (mostly variable costs). According to Mr Puyanne, CEO of the French oil company TOTAL, similar costs for the shale oil vary between $60 to $75 per bbl. Due to innovation & streamlining shale oil production cost may possibly have gone down to $50 per bbl.

In the light of the above facts, it is clear that at the current price levels we are not going to attract any foreign oil company to fund exploitation of Pakistani shale reserves. As along as oil prices stay below $50 per bbl., it would also make poor ecomomic sense for Pakistani companies or GOP to pour money into shale oil & gas exploration.

I would therefore conclude that for the time being GOP should spend a small amount (say about $50-million) for a couple exploratory wells and the geological studies to obtain all the preliminary data about our shale oil & gas reserves.

that is about all.

This would enable us to be ready to start developing our shale oil & gas resources when oil prices break the $60; which could be as early as 2017. In the meantime we should rely on imported LNG and oil product imports.

I would like to make it clear that the information given above has been obtained from different industry journals and newspapers which I peruse regularly to keep myself up to date. The same info is also available to anyone who is keen and knows where to look.

Last edited:

farhan_9909

PROFESSIONAL

- Joined

- Oct 21, 2009

- Messages

- 8,989

- Reaction score

- 10

- Country

- Location

I have read about EIA reports before. For Pakistan (and India, a combined report) please check this:

http://www.eia.gov/analysis/studies/worldshalegas/pdf/India_Pakistan_2013.pdfHow credible you think is the USAID funded survey?

On page 10 it summarizes: "Overall, ARI estimates a total of 1,170 Tcf of risked shale gas in-place for India/Pakistan, 584 Tcf in India and 586 Tcf in Pakistan. The risked, technically recoverable shale gas resource is estimated at 201 Tcf, with 96 Tcf in India and 105 Tcf in Pakistan, Tables XXIV-1A and XXIV-1B. In addition, we estimate risked shale oil in-place for India/Pakistan of 314 billion barrels, with 87 billion barrels in India and 227 billion barrels in Pakistan. The risked, technically recoverable shale oil resource is estimated at 12.9 billion barrels for these two countries, with 3.8 billion barrels for India and 9.1 billion barrels for Pakistan."

Please provide direct link if you have any for in-depth reading, thanks bro!

Brother,i don't have the direct link.

I believe the numbers provided by EIA are more correct.Infact even 105TCF shale gas and 9Billion barrel of shale oil are enough for Pakistan.

LeGenD

MODERATOR

- Joined

- Aug 28, 2006

- Messages

- 15,813

- Reaction score

- 162

- Country

- Location

Oil prices are expected to go down in the near future because sanctions on Iranian oil exports will be lifted soon and Iran have decided to significantly increase its oil exports afterwards.Hon Paksanity,

Answer to your question is not straight forward. For the sake of those who are not familiar with Shale/tight oil & gas. Let us first understand what is shale oil & shale gas.

Oil shale refers to any sedimentary rock that contains ‘Kerogen’ which is a mixture of organic compounds that form part of the composition of the rock. Oil Shale will yield petroleum like liquids when heated.

Shale gas on the other hnad is primarily methane which cannot flow thru rock because of its extremely low permeability. The shale rock needs to be crushed before the gas is released. Tight gas is a little easier to extract than shale gas but the process is the same.

Extraction of both the shale gas & shale oil is therefore lot more expensive than normal oil drilling where you drill a well at 90 degrees and when it bores thru the hydrocarbon bearing structure, oil or gas gushes out. A major problem with fracking is depletion. A normal oil/gas producing well depletes at around 2% per annum, hence its life is easily about 20 years. An added advantage of the long-life is that ups & down of the oil prices can be absorbed as the fluctuations are averaged out over the life of the well.

Fracking is more like mining operation where after one vein is exhausted you got to look for a new vein. We only have US experience of fracking. Fracking wells in Montana & North Dakota have extremely short life span and shrinkage of about 70% year has been known. In other words production from a 1000 bbl. per day well will decline to just 280 bbl. per day in the second year. This means one needs to constantly drill new wells to maintain production level.

On an approximate basis, it costs about $4-million to drill an on-shore oil or gas well in the US. In the Bakken formation (Montana & North Dakota) a standard fracking well (10, 00 feet vertical & 8,000 ft. horizontal) costs between $4 to $6-million to drill. Another $4 to 5 million for fracking & surface facilities say a total of $10-million per producing well. Thus a fracking well is twice as expenses and with the production life of about 3 to 4 years only.

Based the above, B/E cost of shale gas from the new well is $4 to $6 per million Btu. Crude oil production cost from a 10-year old oil well in the United States in about $20 per bbl. (mostly variable costs). According to Mr Puyanne, CEO of the French oil company TOTAL, similar costs for the shale oil vary between $60 to $75 per bbl. Due to innovation & streamlining shale oil production cost may possibly have gone down to $50 per bbl.

In the light of the above facts, it is clear that at the current price levels we are not going to attract any foreign oil company to fund exploitation of Pakistani shale reserves. As along as oil prices stay below $50 per bbl., it would also make poor ecomomic sense for Pakistani companies or GOP to pour money into shale oil & gas exploration.

I would therefore conclude that for the time being GOP should spend a small amount (say about $50-million) for a couple exploratory wells and the geological studies to obtain all the preliminary data about our shale oil & gas reserves.

that is about all.

This would enable us to be ready to start developing our shale oil & gas resources when oil prices break the $60; which could be as early as 2017. In the meantime we should rely on imported LNG and oil product imports.

I would like to make it clear that the information given above has been obtained from different industry journals and newspapers which I peruse regularly to keep myself up to date. The same info is also available to anyone who is keen and knows where to look.

Paksanity

SENIOR MEMBER

- Joined

- Dec 18, 2014

- Messages

- 2,376

- Reaction score

- 40

- Country

- Location

Hon Paksanity,

Answer to your question is not straight forward. For the sake of those who are not familiar with Shale/tight oil & gas. Let us first understand what is shale oil & shale gas.

Oil shale refers to any sedimentary rock that contains ‘Kerogen’ which is a mixture of organic compounds that form part of the composition of the rock. Oil Shale will yield petroleum like liquids when heated.

Shale gas on the other hnad is primarily methane which cannot flow thru rock because of its extremely low permeability. The shale rock needs to be crushed before the gas is released. Tight gas is a little easier to extract than shale gas but the process is the same.

Extraction of both the shale gas & shale oil is therefore lot more expensive than normal oil drilling where you drill a well at 90 degrees and when it bores thru the hydrocarbon bearing structure, oil or gas gushes out. A major problem with fracking is depletion. A normal oil/gas producing well depletes at around 2% per annum, hence its life is easily about 20 years. An added advantage of the long-life is that ups & down of the oil prices can be absorbed as the fluctuations are averaged out over the life of the well.

Fracking is more like mining operation where after one vein is exhausted you got to look for a new vein. We only have US experience of fracking. Fracking wells in Montana & North Dakota have extremely short life span and shrinkage of about 70% year has been known. In other words production from a 1000 bbl. per day well will decline to just 280 bbl. per day in the second year. This means one needs to constantly drill new wells to maintain production level.

On an approximate basis, it costs about $4-million to drill an on-shore oil or gas well in the US. In the Bakken formation (Montana & North Dakota) a standard fracking well (10, 00 feet vertical & 8,000 ft. horizontal) costs between $4 to $6-million to drill. Another $4 to 5 million for fracking & surface facilities say a total of $10-million per producing well. Thus a fracking well is twice as expenses and with the production life of about 3 to 4 years only.

Based the above, B/E cost of shale gas from the new well is $4 to $6 per million Btu. Crude oil production cost from a 10-year old oil well in the United States in about $20 per bbl. (mostly variable costs). According to Mr Puyanne, CEO of the French oil company TOTAL, similar costs for the shale oil vary between $60 to $75 per bbl. Due to innovation & streamlining shale oil production cost may possibly have gone down to $50 per bbl.

In the light of the above facts, it is clear that at the current price levels we are not going to attract any foreign oil company to fund exploitation of Pakistani shale reserves. As along as oil prices stay below $50 per bbl., it would also make poor ecomomic sense for Pakistani companies or GOP to pour money into shale oil & gas exploration.

I would therefore conclude that for the time being GOP should spend a small amount (say about $50-million) for a couple exploratory wells and the geological studies to obtain all the preliminary data about our shale oil & gas reserves.

that is about all.

This would enable us to be ready to start developing our shale oil & gas resources when oil prices break the $60; which could be as early as 2017. In the meantime we should rely on imported LNG and oil product imports.

I would like to make it clear that the information given above has been obtained from different industry journals and newspapers which I peruse regularly to keep myself up to date. The same info is also available to anyone who is keen and knows where to look.

Thank you sir. I'm grateful for making me informed on the subject.

In the light of your post I think we should consider them as our strategic reserves for any difficult times ahead. Meanwhile we should wait till technology develops further and cost of exploiting shale comes down. Lower oil prices at the moment are giving us enough space to breath comfortably.

Shotgunner51

RETIRED INTL MOD

- Joined

- Jan 6, 2015

- Messages

- 7,165

- Reaction score

- 48

- Country

- Location

Brother,i don't have the direct link.

I believe the numbers provided by EIA are more correct.Infact even 105TCF shale gas and 9Billion barrel of shale oil are enough for Pakistan.

Well let's see how the USAID funded survey is evaluated by the pros, maybe it is a pleasant surprise! Yes, even if we look at EIA data, Pakistan still has very rich reserves, and actually ranks quite high in the world.

U.S. Energy Information Administration (EIA)

Such reserves may come in handy when market dynamics are right. After all, tech does evolve hence getting more economical, and sooner or later conventional gas/oil will deplete.

Last edited:

The Sandman

ELITE MEMBER

- Joined

- Aug 26, 2015

- Messages

- 8,645

- Reaction score

- 16

- Country

- Location

So should we be ready for some freedom!!!

Soldier 99

FULL MEMBER

New Recruit

- Joined

- Oct 24, 2015

- Messages

- 15

- Reaction score

- 0

- Country

- Location

British and Indians cheated at the time of division of resources and now Almighty Allah blessed us with endless resources. All praises to Almighty Allah, our country is heaven on earth and one day it will be the super power insha Allah. Let the green eyed monsters burn!

Talwar e Pakistan

SENIOR MEMBER

- Joined

- Dec 30, 2014

- Messages

- 6,525

- Reaction score

- 12

- Country

- Location

But instead of getting focus on it focus should be on nonrenewable energy ,solar, wind etc If you use all the shale resource them self you them self finished yourself only becauseof there pollution effects.

I have read about EIA reports before. For Pakistan (and India, a combined report) please check this:

http://www.eia.gov/analysis/studies/worldshalegas/pdf/India_Pakistan_2013.pdfHow credible you think is the USAID funded survey?

On page 10 it summarizes: "Overall, ARI estimates a total of 1,170 Tcf of risked shale gas in-place for India/Pakistan, 584 Tcf in India and 586 Tcf in Pakistan. The risked, technically recoverable shale gas resource is estimated at 201 Tcf, with 96 Tcf in India and 105 Tcf in Pakistan, Tables XXIV-1A and XXIV-1B. In addition, we estimate risked shale oil in-place for India/Pakistan of 314 billion barrels, with 87 billion barrels in India and 227 billion barrels in Pakistan. The risked, technically recoverable shale oil resource is estimated at 12.9 billion barrels for these two countries, with 3.8 billion barrels for India and 9.1 billion barrels for Pakistan."

Please provide direct link if you have any for in-depth reading, thanks bro!

It wouldnt be a suprise if USAID is true; most of Pakistan is above massive Shale deposits.

farhan_9909

PROFESSIONAL

- Joined

- Oct 21, 2009

- Messages

- 8,989

- Reaction score

- 10

- Country

- Location

Well let's see how the USAID funded survey is evaluated by the pros, maybe it is a pleasant surprise! Yes, even if we look at EIA data, Pakistan still has very rich reserves, and actually ranks quite high in the world.

U.S. Energy Information Administration (EIA)

Such reserves may come in handy when market dynamics are right. After all, tech does evolve hence getting more economical, and sooner or later conventional gas/oil will deplete.

Another very credible news agency is also quoting them.

Pakistan has more than 10,000 trillion cubic ft shale gas reserves: USAID report

Pak shale gas, oil reserve far higher than previous estimates | Business Standard News

but i don't know where the hell the original USAID report is.But as per the news,it took more than an year for the survey

Providence

BANNED

- Joined

- Dec 24, 2014

- Messages

- 2,899

- Reaction score

- -5

- Country

- Location

USAID reports are not gospel. If you guys don't believe it, conduct your own survey. Either way, USAID don't give a damn & neither should you !!

Shotgunner51

RETIRED INTL MOD

- Joined

- Jan 6, 2015

- Messages

- 7,165

- Reaction score

- 48

- Country

- Location

Another very credible news agency is also quoting them.

Pakistan has more than 10,000 trillion cubic ft shale gas reserves: USAID report

Pak shale gas, oil reserve far higher than previous estimates | Business Standard News

but i don't know where the hell the original USAID report is.But as per the news,it took more than an year for the survey

Thanks bro, I checked the first link, yes they quoted the same. I will skip the second link, have experience with disinformation there.

So this is a OGDC, PPL joint survey with support from USAID. Since OGDC, PPL have been given directives by government to hunt for shale hydrocarbon reserves in the country, I suppose they would naturally be more ambitious in their survey. Knowing reserves are abundant, just as @niaz has mentioned it will be worthwhile for GOP (or by OGDC, PPL) to continue investing a fair amount of money to maintain exploratory efforts and geological studies to obtain all the preliminary data about oil & gas reserves.

Situation is similar in China, shale gas and oil reserves are in abundance. OGDC and PPL may work closer with Chinese counterparts like SINOPEC, PetroChina, etc.

Last edited:

Similar threads

- Replies

- 5

- Views

- 404

- Replies

- 6

- Views

- 1K

- Replies

- 1

- Views

- 567

- Replies

- 0

- Views

- 362

Latest posts

-

Bajwa calls Bushra's allegations against Saudi Arabia 'baseless'

- Latest: Novus ordu seclorum

-

-

-

-

Pakistan Affairs Latest Posts

-

Bajwa calls Bushra's allegations against Saudi Arabia 'baseless'

- Latest: Novus ordu seclorum

-

-

-

-