Muhammed45

ELITE MEMBER

- Joined

- Oct 2, 2015

- Messages

- 10,321

- Reaction score

- -18

- Country

- Location

Talk about your debt that generations after you have to pay.We sold our islands to Germans?

Instead of lifting Israeli balls by false claims.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Talk about your debt that generations after you have to pay.We sold our islands to Germans?

www.visualcapitalist.com

www.visualcapitalist.com

You worry about us? Which are the false claims,habibi?Talk about your debt that generations after you have to pay.

Instead of lifting Israeli balls by false claims.

Of course not. You arw a piece of shit that i am sure about.You worry about us? Which are the false claims,habibi?

They didn't attack civilians?Prove us that Hamas killed babies and attacked civilians Greco

They are mostly ok, but as you wrote in #22, total debt figures may not tell the true picture.would you like to make comment on my last few posts#22,#23,#24,#28, about Foreign Reserve/GDP to Foreign debt ratio for India-China and Pak-Indon?

They are mostly ok, but as you wrote in #22, total debt figures may not tell the true picture.

Apart from public and private debt, some other parameters like maturity of debt (short term, long term), ratio of short term debt to foreign reserves, external debt service ratio etc may provide a better understanding of sovereign debt.

External debt going more than 100% of foreign reserves is also okay, it again depends on the debt profile, maturity period and the ability to pay back debt(debt servicing).

www.itsuptous.org

www.itsuptous.org

In case you didn't know, Evergrande is listed in Hong Kong, domiciled in the Cayman Islands, and gets most of its debt from Wall Street. And under Chinese law, Evergrande's assets must be prioritised to pay off domestic Chinese debt. So almost all of Evergrande's debt is paid for by Wall Street. Don't you know that Evergrande has filed for bankruptcy in the US, but not in China?

What's more, more credit for the private sector represents a more active economy and investment. This is not a pernicious indicator. You can look at all the developed countries, where the size of private credit is large, and the poor countries, where this indicator is low.

Country List Government Debt to GDP | Europe

This page displays a table with actual values, consensus figures, forecasts, statistics and historical data charts for - Country List Government Debt to GDP. This page provides values for Government Debt to GDP reported in several countries part of Europe. The table has current values for...tradingeconomics.com

Country Last Previous Reference Unit

Belgium 105 109 Dec/22 %

Euro Area 91.5 95.4 Dec/22 %

Germany 66.3 69.3 Dec/22 %

Italy 145 150 Dec/22 %

Spain 113 118 Dec/22 %

United Kingdom 101 97.2 Dec/22 %

Greece 171 195 Dec/22 %

France 112 113 Dec/22 %

=> https://en.wikipedia.org/wiki/List_of_countries_by_GDP_(PPP)

China's PPP GDP is 2.5, not 1.5, times of that of India according to your chart.

It's a city of billionaires.

For real dude. On Russian streets every other chick is maria sharapova

Acha bhai Russia mil gaya Russian nahi mili

That just shows an unequal distribution of wealth. Moscow on the other hand has an average high income lifestyle. While Mumbai has a slum right next to ambani house.we have a news here for year 2022, as below. here, what would be the total numbers of Billionaires of South Asia as whole?

.

=>

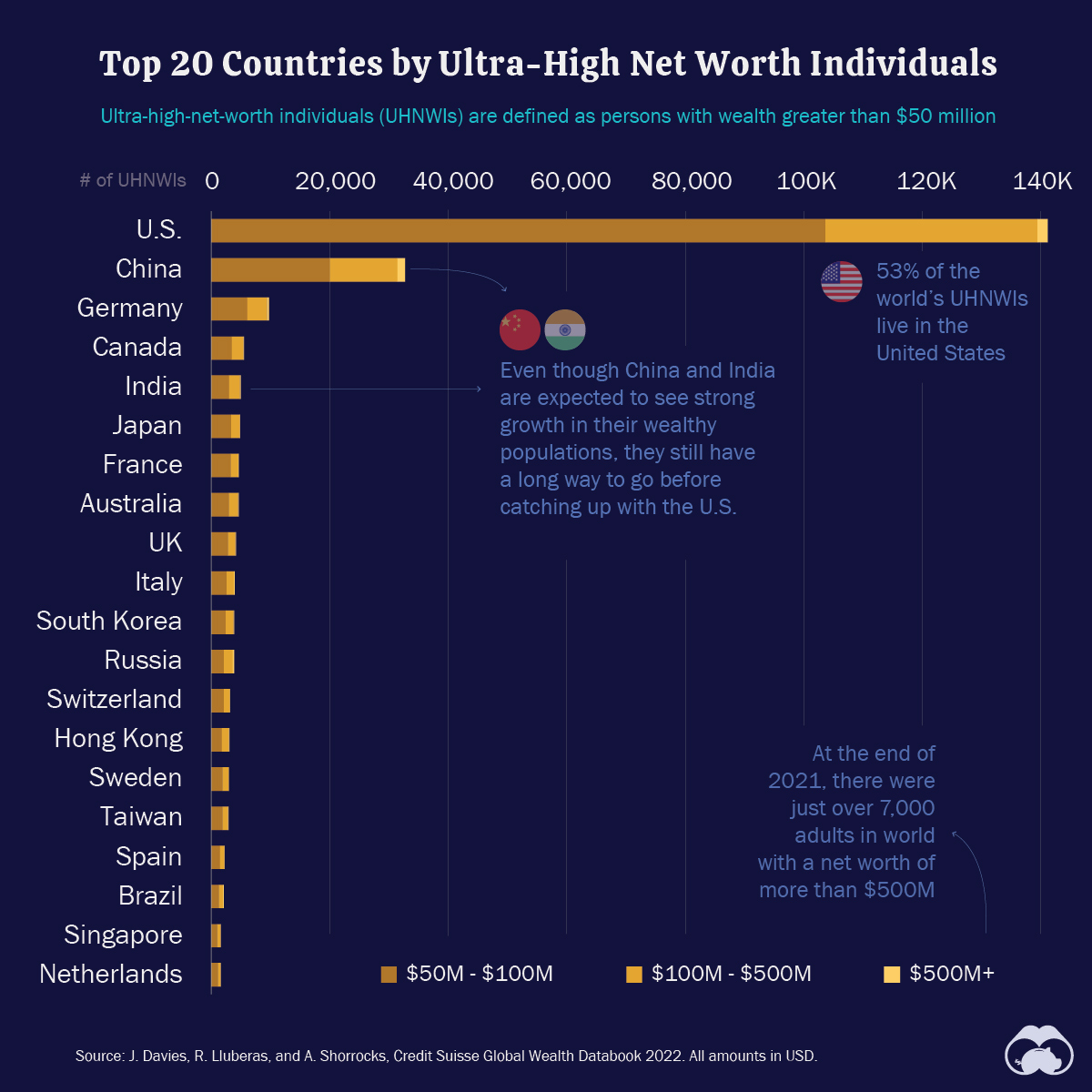

India’s ultra-high-net-worth individuals (UHNWI) with net worth over $30 million is estimated to rise by 58.4% in the next five years to 19,119 individuals in 2027 from 12,069 in 2022. India’s billionaire population is expected to move up to 195 individuals in 2027 from 161 individuals in 2022, showed a Knight Frank India report.

India’s ultra wealthy population to grow by 58.4% in next five years, Knight Frank

The Knight Frank India report estimates that the number of ultra-high-net-worth individuals (UHNWIs) in India will rise by 58.4% in the next five years to 19,119 individuals in 2027 from 12,069 in 2022. The Indian high-net-worth-individual (HNI) population, with asset value of $1 million and...economictimes.indiatimes.com