ST1976

FULL MEMBER

- Joined

- Jul 25, 2006

- Messages

- 878

- Reaction score

- 0

- Country

- Location

List of countries by government debt

List of countries by government debt - Wikipedia

.

=> General government gross debt

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

| Rank | Country | Debt levels as % of GDP for 2021 |

| 1 | Venezuela ² | 304 |

| 2 | Japan | 256.5 |

| 3 | Sudan | 211.7 |

| 4 | Greece | 210.1 |

| 5 | Eritrea | 175.6 |

| 6 | Suriname | 157.4 |

| 7 | Italy | 157.1 |

| 8 | Lebanon ² | 154 |

| 9 | Barbados | 143 |

| 10 | Maldives | 139.7 |

| 11 | Cabo Verde | 137.6 |

| 12 | Belize | 134.6 |

| 13 | United States | 132.8 |

| 14 | Portugal | 131.4 |

| 15 | Singapore | 129.5 |

| 16 | Bahrain | 129.4 |

| 17 | Mozambique | 125.3 |

| 18 | Bhutan | 123.4 |

| 19 | Zambia | 118.7 |

| 20 | Spain | 118.4 |

| 21 | Canada | 116.3 |

| 22 | Belgium | 115.9 |

| 23 | France | 115.2 |

| 24 | Cyprus | 113 |

| 25 | Angola | 110.7 |

| 26 | United Kingdom | 107.1 |

| 27 | Sri Lanka | 105.4 |

| 28 | Argentina (2) | 103 |

| 29 | Brazil | 98.4 |

| 30 | Jamaica | 96.5 |

| 31 | Dominica | 96.4 |

| 32 | Montenegro | 94.6 |

| 33 | Egypt | 92.9 |

| 34 | Jordan | 91.2 |

| 35 | Tunisia | 91.2 |

| 36 | Congo, Republic of | 90.5 |

| 37 | Bahamas, The | 88.6 |

| 38 | El Salvador | 88.2 |

| 39 | Mauritius | 87.7 |

| 40 | Pakistan | 87.7 |

| 41 | Austria | 87.2 |

| 42 | India | 86.6 |

| 43 | Croatia | 86.3 |

| 44 | Fiji | 83.6 |

| 45 | Iceland | 82.5 |

| 46 | Ghana | 81.5 |

| 47 | South Africa | 80.8 |

| 48 | Slovenia | 80.5 |

| 49 | Hungary | 80 |

| 50 | Israel | 78.3 |

| 51 | Guinea-Bissau | 78.1 |

| 52 | Mongolia | 77.9 |

| 53 | Morocco | 77.1 |

| 54 | Malawi | 76.8 |

| 55 | Burundi | 75.6 |

| 56 | Albania | 75.4 |

| 57 | Grenada | 74.5 |

| 58 | Gambia, The | 73.9 |

| 59 | Kyrgyz Republic | 73.4 |

| 60 | Yemen | 73 |

| 61 | Costa Rica | 72.5 |

| 62 | São Tomé and Príncipe | 72.4 |

| 63 | Australia | 72.1 |

| 64 | Kenya | 71.5 |

| 65 | Namibia | 71.4 |

| 66 | Oman | 71.3 |

| 67 | Gabon | 71.1 |

| 68 | Germany | 70.3 |

| 69 | Armenia | 69.9 |

| 70 | Iraq | 69.7 |

| 71 | China, People’s Republic of | 69.6 |

| 72 | Bolivia | 69 |

| 73 | Finland | 68.8 |

| 74 | Lao P.D.R. | 68.3 |

| 75 | Uruguay | 68 |

| 76 | Malaysia | 67 |

| 77 | Senegal | 66.8 |

| 78 | Dominican Republic | 66.6 |

| 79 | Rwanda | 66 |

| 80 | Ecuador | 65.1 |

| 81 | Puerto Rico | 64.8 |

| 82 | Colombia | 64.2 |

| 83 | Slovak Republic | 64 |

| 84 | Emerging market and developing economies | 64 |

| 85 | Georgia | 63.9 |

| 86 | Algeria | 63.3 |

| 87 | Ireland | 63.2 |

| 88 | Trinidad and Tobago | 62.1 |

| 89 | Panama | 61.4 |

| 90 | Mexico | 60.5 |

| 91 | Togo | 60 |

| 92 | Qatar | 59.8 |

| 93 | Serbia | 59 |

| 94 | Ukraine | 58.1 |

| 95 | Malta | 57.9 |

| 96 | Poland | 57.4 |

| 97 | Liberia | 57 |

| 98 | Mauritania | 56.3 |

| 99 | Netherlands | 56.1 |

| 100 | Ethiopia | 56 |

| 101 | Thailand | 55.9 |

| 102 | Honduras | 53.9 |

| 103 | North Macedonia | 53.8 |

| 104 | Korea, Republic of | 53.2 |

| 105 | Romania | 52.6 |

| 106 | Philippines | 51.9 |

| 107 | Zimbabwe | 51.4 |

| 108 | Lesotho | 49.8 |

| 109 | Tajikistan | 49.8 |

| 110 | Nepal | 49.6 |

| 111 | Papua New Guinea | 49.6 |

| 112 | Lithuania | 49.5 |

| 113 | Myanmar | 49.1 |

| 114 | Samoa | 49 |

| 115 | Uganda | 48.8 |

| 116 | Vietnam | 48 |

| 117 | West Bank and Gaza | 47.9 |

| 118 | Benin | 47.7 |

| 119 | Nicaragua | 47.6 |

| 120 | Latvia | 47.2 |

| 121 | South Sudan, Republic of | 47 |

| 122 | Madagascar | 46.9 |

| 123 | Burkina Faso | 46.8 |

| 124 | New Zealand | 46.4 |

| 125 | Côte d’Ivoire | 46.3 |

| 126 | Mali | 46.1 |

| 127 | Belarus | 45.7 |

| 128 | Switzerland | 44.8 |

| 129 | Niger | 44.5 |

| 130 | Equatorial Guinea | 44.1 |

| 131 | Czech Republic | 44 |

| 132 | Tonga | 43.7 |

| 133 | Cameroon | 42.5 |

| 134 | Guinea | 42.3 |

| 135 | Uzbekistan | 42.3 |

| 136 | Central African Republic | 42.2 |

| 137 | Chad | 41.7 |

| 138 | Denmark | 41.6 |

| 139 | Norway | 41.6 |

| 140 | Guyana | 41.4 |

| 141 | Indonesia | 41.4 |

| 142 | Sweden | 40.4 |

| 143 | Bangladesh | 40.2 |

| 144 | Djibouti | 40.2 |

| 145 | Moldova | 39.5 |

| 146 | Bosnia and Herzegovina | 38.6 |

| 147 | Tanzania | 37.9 |

| 148 | Turkey | 37.1 |

| 149 | United Arab Emirates | 37.1 |

| 150 | Iran | 36.6 |

| 151 | Paraguay | 35.7 |

| 152 | Peru | 35.4 |

| 153 | Chile | 33.6 |

| 154 | Cambodia | 33.4 |

| 155 | Guatemala | 33.1 |

| 156 | Taiwan Province of China | 32.5 |

| 157 | Nigeria | 31.9 |

| 158 | Saudi Arabia | 31 |

| 159 | Azerbaijan | 30.9 |

| 160 | Kazakhstan | 27 |

| 161 | Luxembourg | 26.8 |

| 162 | Haiti | 26 |

| 163 | Turkmenistan | 26 |

| 164 | Bulgaria | 25.5 |

| 165 | Botswana | 25.3 |

| 166 | Estonia | 25.1 |

| 167 | Marshall Islands | 23.3 |

| 168 | Kiribati | 21.4 |

| 169 | Russian Federation | 18.1 |

| 170 | Micronesia, Fed. States of | 15.3 |

| 171 | Timor-Leste | 15 |

| 172 | Kuwait | 13.7 |

| 173 | Congo, Dem. Rep. of the | 12.4 |

| 174 | Tuvalu | 11.8 |

| 175 | Afghanistan | 8.8 |

| 176 | Brunei Darussalam | 2.3 |

| 177 | Hong Kong SAR | 0.9 |

| 178 | Macao SAR | 0 |

www.economicshelp.org

www.economicshelp.org

www.economicshelp.org

www.economicshelp.org

Difference between debt and deficit

Government debt is the total amount of outstanding liabilities. The deficit is the annual amount by which spending exceeds income. The debt is the accumulation of past deficits.

For example in 2020, the US deficit was $3.13 trillion. The US total debt is $29 trillion.

Causes of national debt

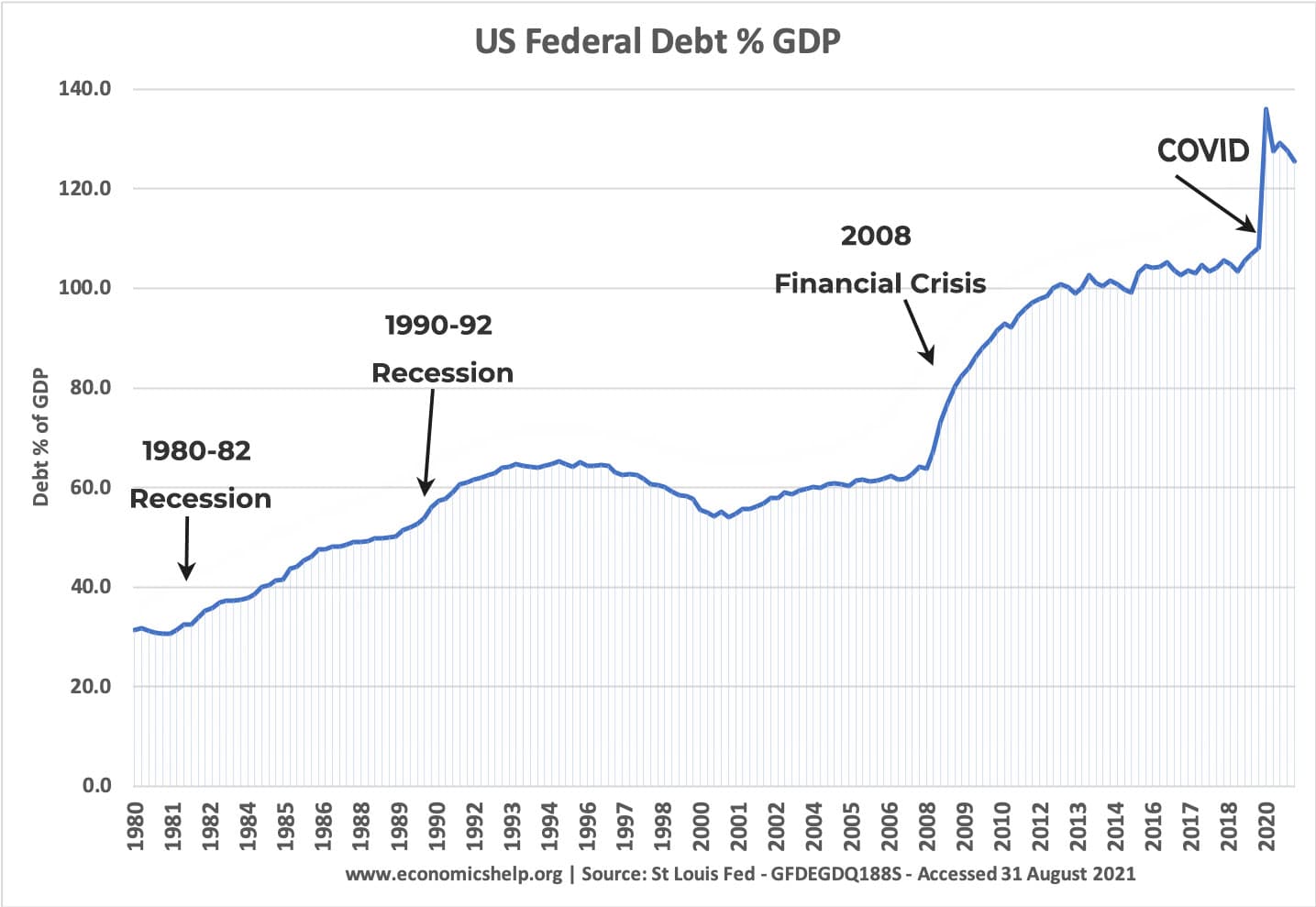

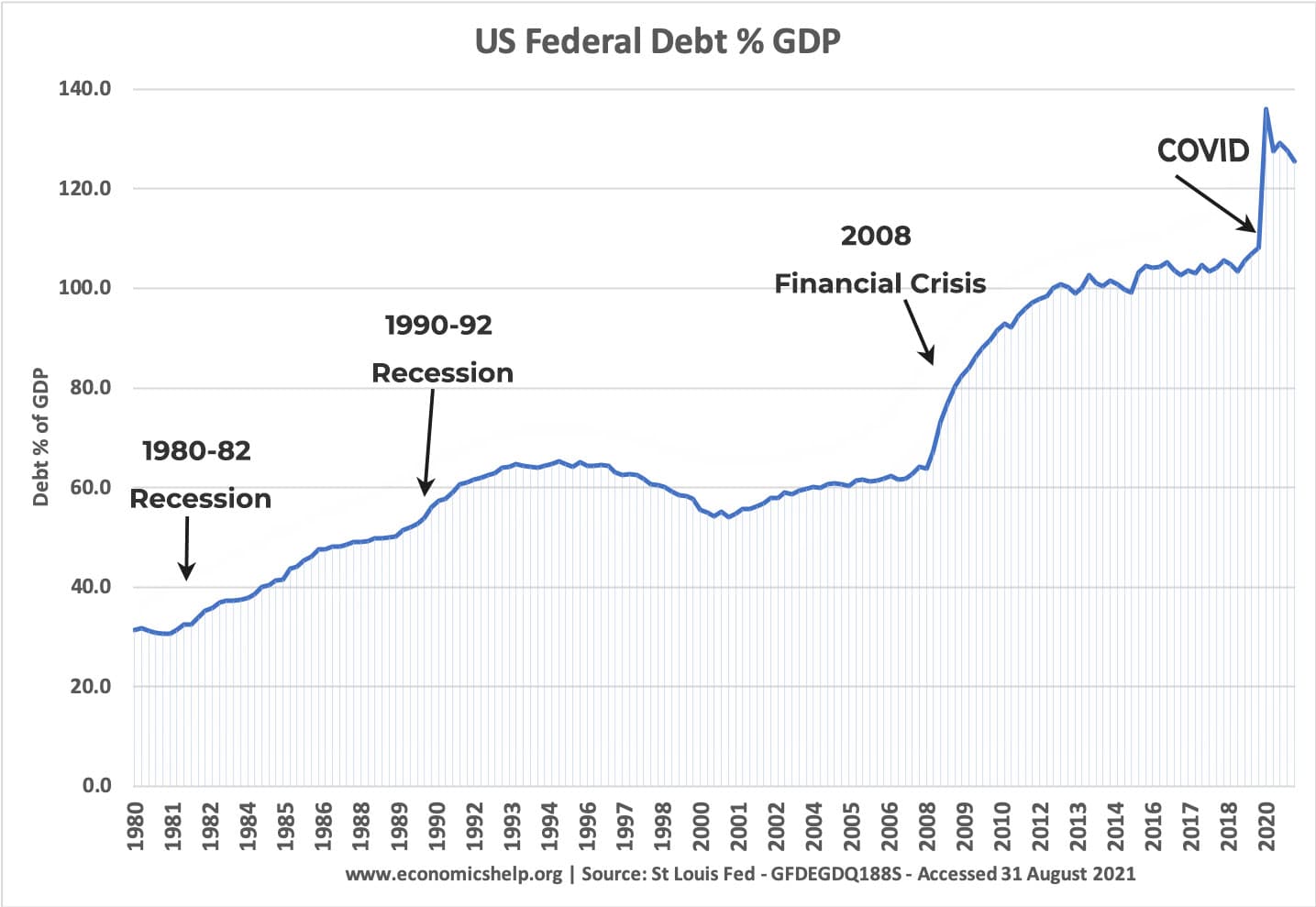

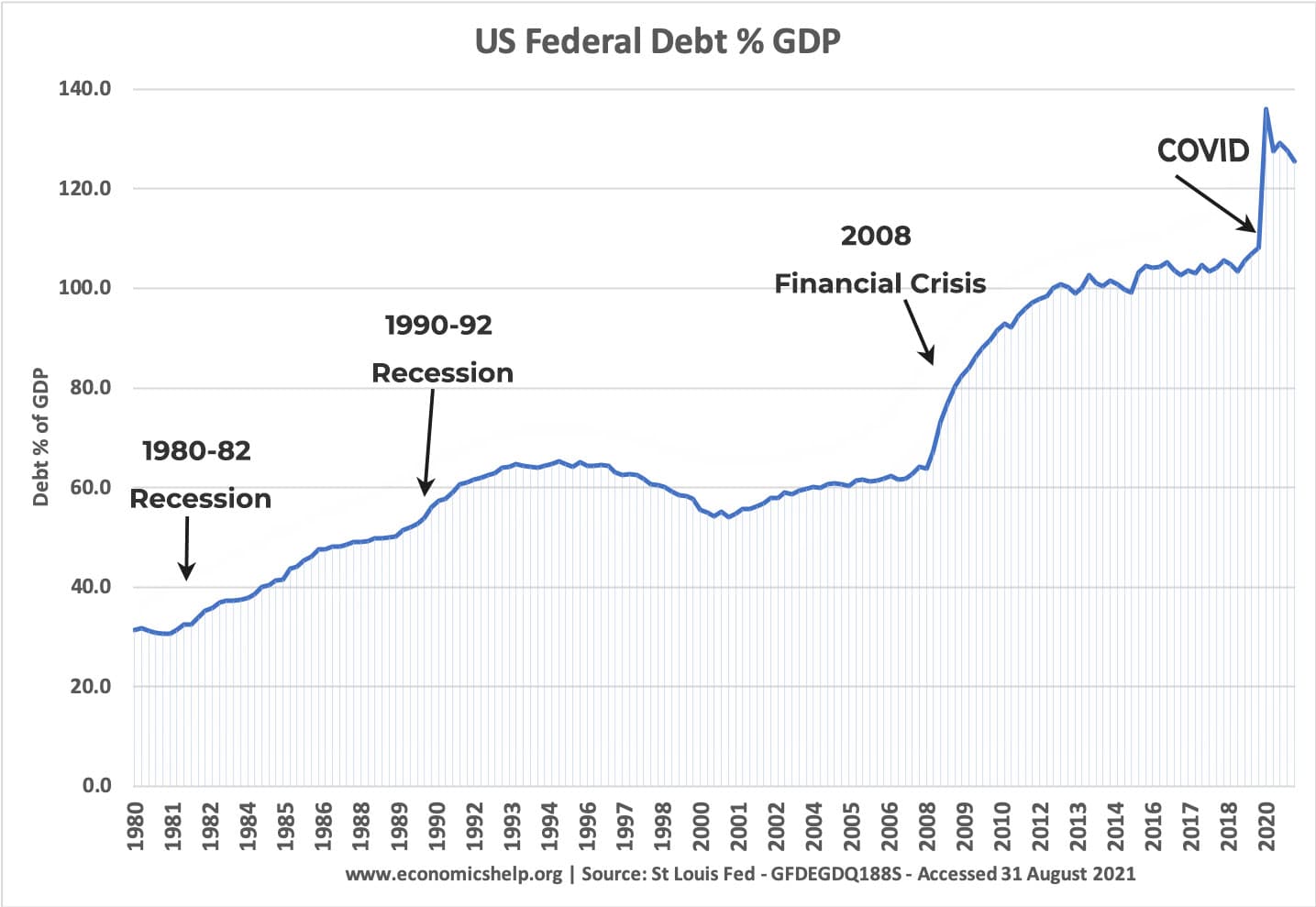

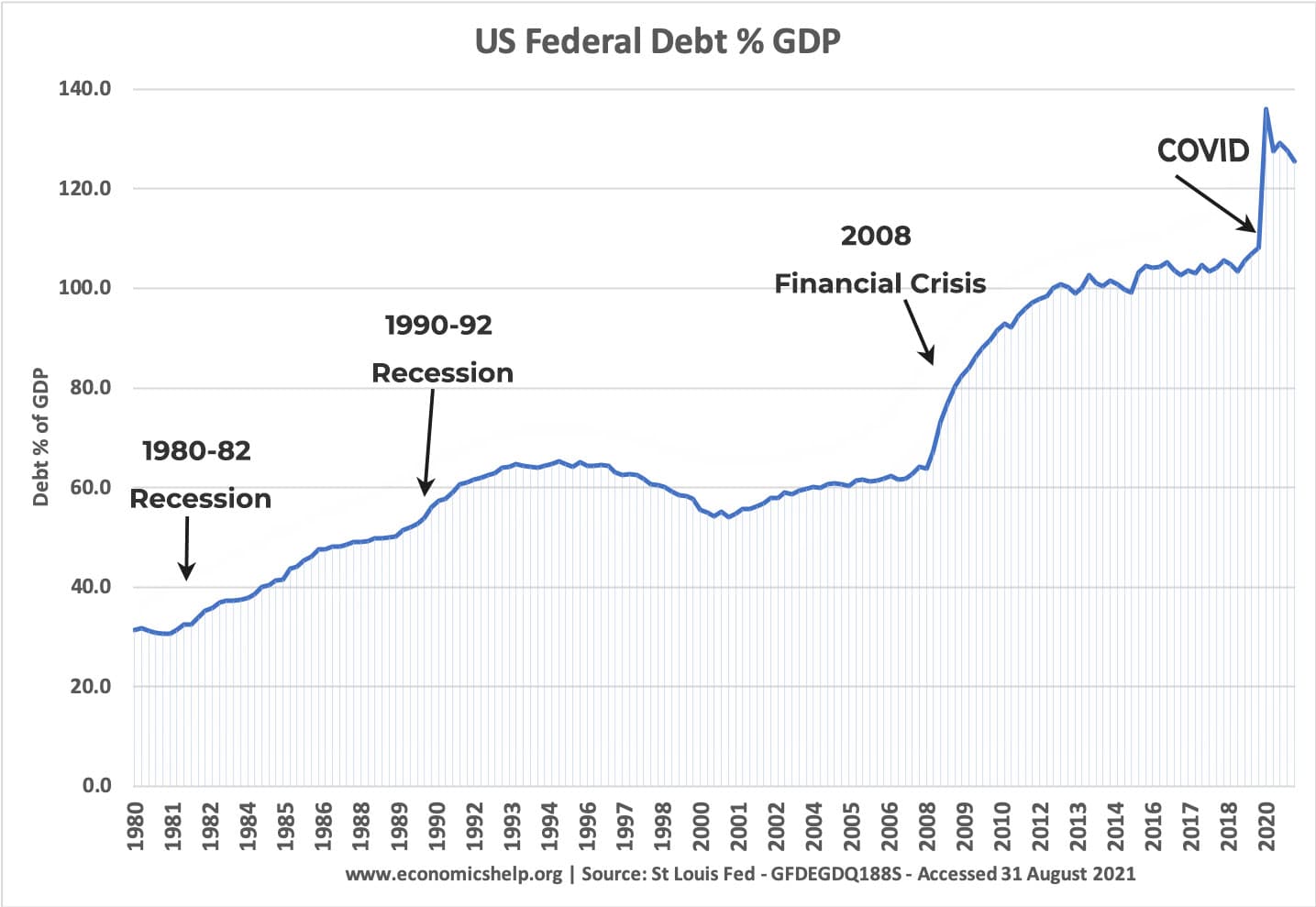

View attachment 960638

This graph for US national debt shows how national crisis leads to a rise in government borrowing. This isn’t necessarily a bad thing. Government debt enabled the US government to finance the short-term costs of the two world wars. It also enabled the government to respond to the crisis of the 2008 financial crash and the 2020 Covid crisis. Causes of national debt can include

- Recession – tax revenues fall when the economy shrinks. Also the government spend more on unemployment benefits

- Investment – Governments might borrow to build new roads, schools and hospitals.

- Finance war –

- Demographic changes and welfare spending. An ageing population tends to place more strain on government finances with older people requiring more health care spending, pensions and also they pay less income tax.

- Political decisions. Some governments may support higher spending on welfare programmes, whearas other governments may target a balanced budget.

List of National Debt by Country - Economics Help

An updated list of countries national debt as % of GDP. From Venezuela at over 300% of GDP to Hong Kong and Brunei at close to 0%. Causes | problems| Explanation of national debt.www.economicshelp.org

List of National Debt by Country - Economics Help

An updated list of countries national debt as % of GDP. From Venezuela at over 300% of GDP to Hong Kong and Brunei at close to 0%. Causes | problems| Explanation of national debt.www.economicshelp.org

www.visualcapitalist.com

www.visualcapitalist.com

Many PDF Indians have been under the impression that China is heavily indebted and India is not.

In truth, it is just the opposite.

Chinese government debt can be misleading because chunk of liabilities are held by local governments.

(As per recent data, China's government debt is also higher than India)

If you take into account total debt-to-gdp ratio then:

China: 295%

India: 170%

View attachment 960676

Chinese government debt can be misleading because chunk of liabilities are held by local governments.

(As per recent data, China's government debt is also higher than India)

If you take into account total debt-to-gdp ratio then:

China: 295%

India: 170%

View attachment 960676

The source of your data?

According to the June 2023 statement of the Chinese Ministry of Finance.

China's central government debt was RMB 16.19 trillion cny; China's local government debt was RMB 37.8 trillion cny;

the total was RMB 53.99 trillion, accounting for 44.6 per cent of total GDP (121 trillion cny)

财政部:截至8月末 全国地方政府债务余额控制在全国人大批准的限额之内-新闻-上海证券报·中国证券网

上证报中国证券网讯 财政部9月26日发布的2023年8月地方政府债券发行和债务余额情况显示,截至2023年8月末,全国地方政府债务余额387480亿元,控制在全国人大批准的限额之内。其中,一般债务149314亿元,专项债务238166亿元;政府债券385822亿元,非政府债券形式存量政府债务1658亿元。具体情况如下: 一、全国地方政府债券发行情况 (一)当月发行情况。news.cnstock.com

View attachment 960685

Do you have comprehension issues? I talked about total debt, not government debt.You count private sector credit into government liabilities?

Do you have comprehension issues? I talked about total debt, not government debt.

There were 2 parts to my reply. The government debt you can find on IMF website. Total debt, I've provided the source.

Anyway who foots the bill in China if Evergrande defaults?

Stop blabberingIn case you didn't know, Evergrande is listed in Hong Kong, domiciled in the Cayman Islands, and gets most of its debt from Wall Street. And under Chinese law, Evergrande's assets must be prioritised to pay off domestic Chinese debt. So almost all of Evergrande's debt is paid for by Wall Street. Don't you know that Evergrande has filed for bankruptcy in the US, but not in China?

What's more, more credit for the private sector represents a more active economy and investment. This is not a pernicious indicator. You can look at all the developed countries, where the size of private credit is large, and the poor countries, where this indicator is low.

According to Chinese law, the order in which the bankrupt company pays off its debts is as follows:Stop blabbering