LeveragedBuyout

SENIOR MEMBER

- Joined

- May 16, 2014

- Messages

- 1,958

- Reaction score

- 60

- Country

- Location

Revised Payroll Data Show Better Mix of Jobs, Nearly Same Total - Real Time Economics - WSJ

ByEric Morath

The Labor Department’s number crunchers pretty much nailed it.

A preliminary annual revision to payroll data, released Thursday, shows an earlier count of how many people were employed in the U.S. in March was off by just 7,000. (Total payrolls equaled 138 million that month.)

The adjustment of less than 0.05% would be the smallest annual revision in at least the past 10 years if the preliminary numbers hold when they’re finalized early next year. Typically annual revisions move the total payroll figure by 0.3%, or by a few hundred thousand jobs.

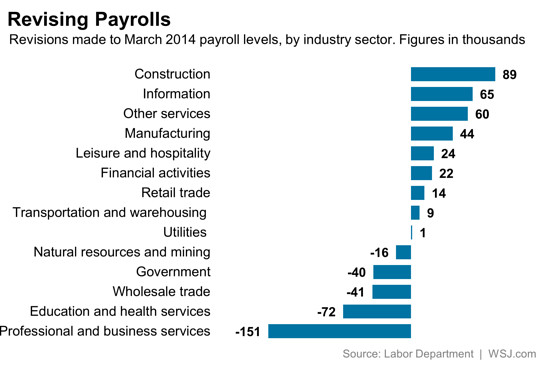

The new revisions do show somewhat strong job creation in a few sectors. From April 2013 through March 2014, the construction industry added 89,000 jobs more than previously reported and manufacturing added 44,000 more.

The change could be meaningful because those fields provide well-paying, middle-class jobs. Meanwhile, employment in education and health services was revised down by 72,000 and employment in wholesale trade was reduced by 41,000.

“The good news is that the goods producing sector—higher paying and more cyclical—was revised upward,” said Raymond Stone, managing director of Stone & McCarthy Research Associates. “While the offset was in the service-producing sector wherein the wage rate is typically lower.”

The Labor Department surveys a sample of employers to calculate monthly payroll figures. Those numbers are then revised annually with data from state unemployment insurance tax records that covers nearly all employers.

Thursday’s preliminary figure will be followed by a final benchmark revision published in February 2015, with the release of next January’s jobs report.

The small overall revision, of course, does little to reshape the view of the economy. Spread out over 12 months, the recasting changes the average number of jobs created monthly from April 2013 through March 2014 to 191,000 from 190,000.

In the past five months, job creation has accelerated somewhat, growing on average by 231,000, according to monthly figures.

- September 18, 2014, 11:19 AM ET

ByEric Morath

The Labor Department’s number crunchers pretty much nailed it.

A preliminary annual revision to payroll data, released Thursday, shows an earlier count of how many people were employed in the U.S. in March was off by just 7,000. (Total payrolls equaled 138 million that month.)

The adjustment of less than 0.05% would be the smallest annual revision in at least the past 10 years if the preliminary numbers hold when they’re finalized early next year. Typically annual revisions move the total payroll figure by 0.3%, or by a few hundred thousand jobs.

The new revisions do show somewhat strong job creation in a few sectors. From April 2013 through March 2014, the construction industry added 89,000 jobs more than previously reported and manufacturing added 44,000 more.

The change could be meaningful because those fields provide well-paying, middle-class jobs. Meanwhile, employment in education and health services was revised down by 72,000 and employment in wholesale trade was reduced by 41,000.

“The good news is that the goods producing sector—higher paying and more cyclical—was revised upward,” said Raymond Stone, managing director of Stone & McCarthy Research Associates. “While the offset was in the service-producing sector wherein the wage rate is typically lower.”

The Labor Department surveys a sample of employers to calculate monthly payroll figures. Those numbers are then revised annually with data from state unemployment insurance tax records that covers nearly all employers.

Thursday’s preliminary figure will be followed by a final benchmark revision published in February 2015, with the release of next January’s jobs report.

The small overall revision, of course, does little to reshape the view of the economy. Spread out over 12 months, the recasting changes the average number of jobs created monthly from April 2013 through March 2014 to 191,000 from 190,000.

In the past five months, job creation has accelerated somewhat, growing on average by 231,000, according to monthly figures.