Can't make an assessment without seeing the percentage of how many actually come back pre-FATCA. If it is very very very low would that affect your opinion?

We will probably never know the change, given that the Census Bureau doesn't even know for certain how many citizens live abroad, let alone return. Given the increased number of renounced citizenships since Dodd-Frank was passed, it seems certain that the percent of non-returnees has increased (or if nothing else, the percent that

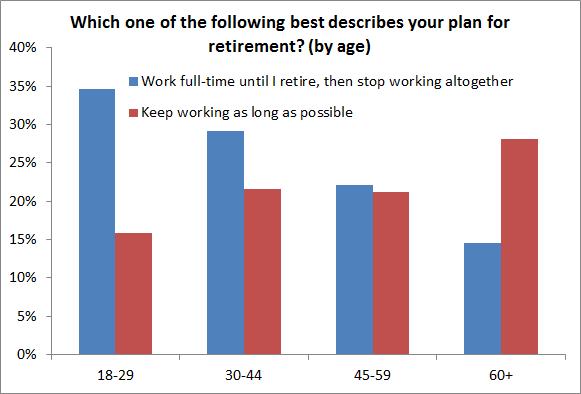

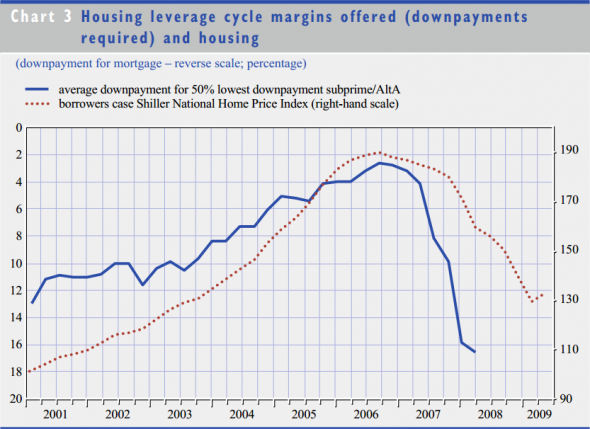

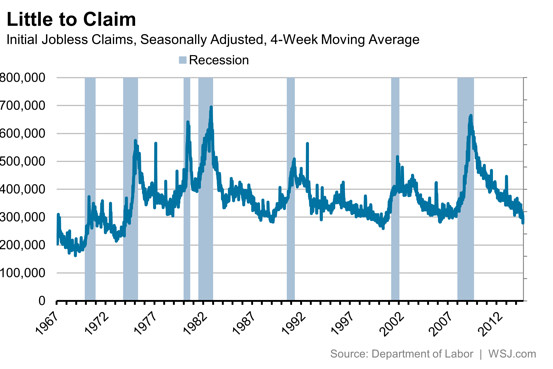

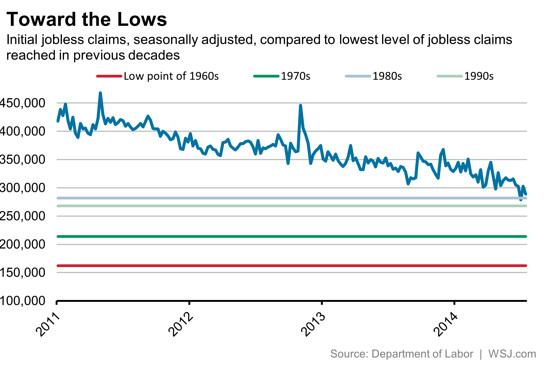

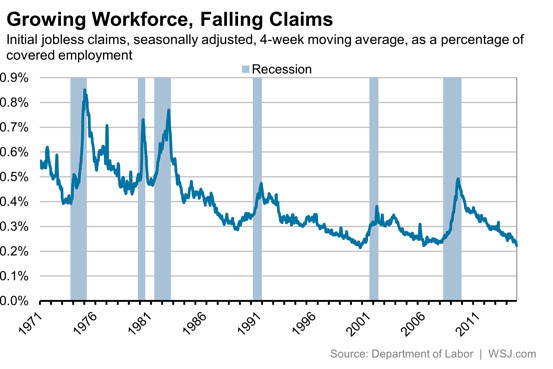

cannot return has increased). That said, it's not merely the change in percent of returnees that makes my blood boil over FATCA and FBAR, it's the burden that is placed on law-abiding American citizens abroad simply because they live abroad, especially because this is a sledgehammer of a law aimed at a tiny percentage of ultra-wealthy tax dodgers, but lands most heavily on middle class professionals (please take special note of the graphs):

http://online.wsj.com/articles/more...with-uncle-sam-to-escape-tax-rules-1402972439

Expatriate Americans Break Up With Uncle Sam to Escape Tax Rules

Record Numbers Living Abroad Renounce U.S. Citizenship over IRS Reporting Requirements

Updated June 16, 2014 11:08 p.m. ET

Patricia Moon, shown in her Toronto home, renounced her U.S. citizenship after living abroad for three decades. Philip Cheung for The Wall Street Journal

Patricia Moon was born in Dayton, Ohio, to a family descended from Quakers who settled in the New World before the American Revolution.

As a young woman, Ms. Moon fell for a Canadian man and moved to Toronto. The 59-year-old homemaker, who still visits the U.S. to see relatives, said she feels American in her bones, even after three decades abroad.

Yet despite her deep roots, Ms. Moon walked into a U.S. consulate two years ago, raised her right hand and recited an oath renouncing her U.S. citizenship. Afterward, she said, "I bawled my eyes out."

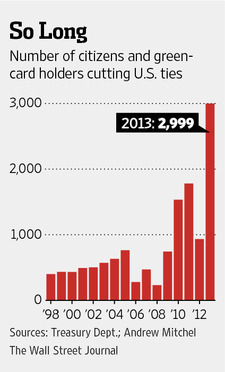

Ms. Moon is among record numbers of Americans cutting ties. U.S. offices abroad reported that 1,001 U.S. citizens and green-card holders had renounced their allegiance in the first three months of the year, according to Andrew Mitchel, a lawyer in Centerbrook, Conn., who analyzes Treasury Department data. That figure puts 2014 on track to top last year's total of 2,999 renunciations, he said, which was the most since the government began disclosing the data.

Helping boost the exodus, experts say, is a five-year-old U.S. campaign to hunt for undeclared accounts held by Americans abroad.

Since 2009, the government campaign has collected more than $6 billion in taxes, interest and penalties from more than 43,000 U.S. taxpayers. Federal prosecutors have filed more than 100 criminal indictments, including the high-profile case of Beanie Babies inventor Ty Warner, who last year pleaded guilty to tax evasion involving secret Swiss bank accounts.

The tax dragnet has also swept up many middle-income Americans living abroad, prompting some to give up their U.S. citizenship. While people who renounce aren't freed of taxes due for past years, they don't want to risk sizable taxes and penalties for them and their children in the years ahead, experts say. Nearly 8,000 taxpayers have renounced U.S. citizenship in the past five years, Mr. Mitchel found, compared with fewer than 5,000 in the preceding decade.

"The increase is due to current and future changes in tax law and enforcement," said Freddi Weintraub, a New York attorney at the Fragomen firm who specializes in immigration law. She said in recent years she has seen a threefold increase in expatriation inquiries related to taxes.

Ms. Moon, for example, feared the IRS could charge her family nearly a half-million dollars in penalties on undeclared savings and checking accounts—even though, she said, the accounts never held more than $102,000, weren't intentionally hidden and didn't have any U.S. taxes owed. "I was afraid we would have to cash in our retirement accounts and sell our home," she said.

Experts say the U.S. campaign could affect millions of Americans like Ms. Moon—people who aren't wealthy, pay taxes in their host country, and who say they weren't trying to dodge U.S. taxes.

"We have reached the point where middle-class American citizens abroad are being forced to renounce—especially if they have assets and are moving toward retirement—because of taxes, paperwork and huge potential penalties," said John Richardson, a Toronto lawyer with dual U.S. and Canadian citizenship. He and Ms. Moon help run a nonprofit group seeking to keep Canada from sharing private account information with U.S. authorities.

As word spreads, experts said, more Americans are likely to consider surrendering their citizenship. The State Department estimates that 7.6 million American citizens live outside the U.S., but only a fraction file required financial disclosure forms.

Mark Mazur, the Treasury Department's assistant secretary for tax policy, said the government's new enforcement was intended to help make sure all taxpayers pay what they owe "regardless of where they live."

At the same time, Mr. Mazur said, Treasury needs to "maintain a balance between enforcement efforts and equity, including the burdens that may be placed on taxpayers."

Mr. Mazur said Treasury was looking into how best to work with Congress and the IRS to fine-tune the system: "You can always improve."

U.S. officials launched their campaign after Swiss banking giant UBS AGUBSN.VX -0.45% admitted in 2009 that it helped wealthy American taxpayers hide money overseas. To avoid criminal charges, the bank paid $780 million to the U.S. and turned over information on more than 4,400 accounts, ending decades of Swiss bank secrecy.

In May, Credit Suisse Group CSGN.VX -1.47% pleaded guilty to similar charges and agreed to pay $2.6 billion. Dozens of other Swiss banks are currently negotiating penalties with the U.S. Department of Justice, officials said.

Following the UBS revelations, U.S. officials announced they would begin vigorously enforcing both new and long-dormant tax rules.

Unlike other developed nations, the U.S. government taxes citizens on income they earn anywhere in the world. The rule dates to the Civil War, when Ms. Moon's great-great grandfather served with Union forces.

U.S. tax liabilities also cover children born to Americans abroad, extending the reach of the IRS across generations, as well as oceans.

For decades, wealthy taxpayers were able to hide foreign assets in countries where bank-secrecy laws fostered attractive tax havens, including Switzerland, the Cayman Islands and Panama.

But the UBS case signaled the beginning of the end for such havens. Armed with information from the Swiss bank, U.S. authorities pursued individuals for back taxes, and pressured the tax professionals who helped them.

As a result of the crackdown, Ms. Moon and others learned they had failed to comply with the law. "We call it the 'Oh, my God! moment.' Every expatriate has it," Ms. Moon said. "They were going to take every dime we had, that was my fear."

The violations often don't involve unpaid U.S. taxes on wages: The law currently exempts about $100,000 of income earned abroad each year. Ms. Moon, for example, didn't owe any income tax. She said she never made more than $11,000 a year when she worked from 2007 to 2012 as a bookkeeper for a business run by her husband, who earned about $65,000 a year devising special effects for movies and TV.

The most common mistakes usually involved Americans failing to submit a form called the Foreign Bank Account Report, or Fbar. Since 1970, U.S. taxpayers have been required to file if they held one or more foreign accounts totaling more than $10,000 over the course of a year. Until the enforcement push, many Americans never filed an Fbar.

The law is more than 40 years old, but "no one ever heard of it" before the crackdown, said Edward Kleinbard, a former chief of staff on Congress' Joint Committee on Taxation, and an expert in international tax law at the University of Southern California.

Fbar penalties are as steep as 50% of the highest value of the account for each year no report was filed. The IRS fined one taxpayer for Fbar violations in four separate years, and a settlement reached this month in the case yielded $1.7 million in penalties, which was more than the account held at the time. Experts say the stiff penalties were originally enacted to discourage wealthy tycoons from hiding assets abroad.

In the fall of 2011, Ms. Moon learned she should have been filing Fbar forms on joint accounts she held with her husband. She calculated she could owe about $455,000 in penalties for the years she failed to file.

The IRS was unlikely to have imposed penalties that high, experts said, but it could have. "Getting professional help to correct her mistakes could easily have cost $15,000 to $20,000," said Bryan Skarlatos, a lawyer with Kostelanetz & Fink in New York, which has advised thousands of taxpayers with secret offshore accounts.

Ms. Moon considered what to do. One of the IRS's limited-amnesty programs had just ended and a new one didn't start until 2012. She said she wouldn't have entered a program in any case because she considered Fbar penalties too steep for "failing to file a piece of paper." Penalties and other costs can amount to a third of the balance in an account or more.

"The programs are best for people who have done things serious enough to land them in prison and are willing to pay huge penalties to stay out," said Philip Hodgen, an international tax lawyer in Pasadena, Calif.

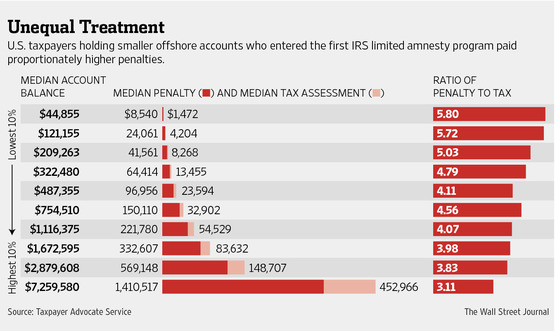

Americans with smaller offshore accounts who entered the first IRS limited amnesty program paid proportionately higher penalties than taxpayers with larger accounts, according to Nina Olson, the National Taxpayer Advocate, an IRS ombudsman.

The typical taxpayer with less than $45,000 in undeclared accounts paid nearly six times the back taxes owed, while the typical taxpayer with more than $7 million in such accounts paid closer to three times their back taxes, Ms. Olson found.

IRS officials "didn't think about the demographics of the population" of overseas Americans, Ms. Olson said, often treating middle-class taxpayers the same as "bad actors."

"There's an awful lot of minnows caught up in this," said Marvin Van Horn, a 66-year-old retired financial controller for Alaska Airlines. He said he entered an IRS limited-amnesty program in 2009: "I assumed it would be very clear I was not one of those quote-unquote offshore tax cheats, those big whales they were looking for."

In prior U.S. tax filings, Mr. Van Horn said he hadn't declared rental income from a house he and his Australian wife own in New Zealand, as well as interest income. He said he didn't know such declarations were required.

"I have to take some responsibility," Mr. Van Horn said. "It was stupidity and not paying attention on my part."

The IRS fined him more than $172,000, roughly eight times his back taxes, which amounted to about $21,000 over six years, Mr. Van Horn said. With help from Ms. Olson's office, he said, the fine was reduced to about $25,000. Spokesmen for the IRS and Ms. Olson said they couldn't comment on individual cases.

In a June 3 speech, IRS Commissioner John Koskinen said the agency may not have been accommodating enough to U.S. citizens who have lived abroad for years. "We have been considering whether these individuals should have an opportunity to come into compliance that doesn't involve the type of penalties that are appropriate for U.S.-resident taxpayers who were willfully hiding their investments overseas," he said.

Scrutiny of Americans abroad will intensify, however, under the Foreign Account Tax Compliance Act, or Fatca, which Congress passed in 2010. The law's main provisions, which take effect in July, will require foreign financial institutions to report income of their U.S. customers to the IRS, much as U.S. banks and brokers file 1099 forms.

Middle-class Americans "face overwhelming problems when they try to engage in standard financial practices, such as having a small business, saving for retirement, investing, buying life insurance, and making wills and trusts," because of the laws governing assets abroad, said David Kuenzi, a financial planner with Thun Financial Advisors in Madison, Wis., who works with expatriates.

The U.S. tax code, for example, doesn't recognize Australia's version of an individual retirement account, Mr. Kuenzi said. American taxpayers with these accounts must file at least two forms a year declaring the account a "foreign trust," and paying taxes on annual appreciation.

The penalty for failing to file can be as much as 35% of both contributions and withdrawals each year, plus 5% of the assets, said Mr. Hodgen, the Pasadena tax lawyer.

Ms. Moon learned that U.S. law requires her to file annual reports on retirement accounts, such as her Tax-Free Savings Account—similar to a Roth IRA.

Her husband, Ken Whitmore, objected to divulging financial information on joint accounts to the IRS. "Would you want the Canada revenue service to know what your financial situation is?" he said.

Ms. Moon concluded that even if the IRS didn't levy the stiffest fines, the potential consequences down the road for missing a deadline or making a mistake were too costly. She later learned she would have been required to pay U.S. taxes on part of the gain on the couple's Toronto house, which they hope to sell for a retirement nest egg. They bought the house in the mid-1980s for $125,000, she said, and it was now worth an estimated $800,000.

Before renouncing her citizenship, Ms. Moon spoke with her sister, Sue Moon, a certified public accountant in Kansas City, Mo.

"U.S. citizenship is the most coveted citizenship in the world. To give it up, it has to be pretty serious," Sue Moon said. "There was just a sadness on her part, that she had to make that decision. She didn't take it lightly."

Months after Ms. Moon renounced her citizenship, her official notice arrived in Toronto. Ms. Moon went to the U.S. consulate to pick it up and paid a $450 processing fee. She told the clerk it was "the saddest $450 I'll ever spend."

JIA) was recently down 161 points to 16,719.

JIA) was recently down 161 points to 16,719.