To corporate America, even French law looks inviting - MarketWatch

MarketWatch First Take

July 28, 2014, 3:25 p.m. EDT

To corporate America, even French law looks inviting

Opinion: Pressure building for corporate tax reform as inversions mount

By

Steve Goldstein, MarketWatch

WASHINGTON (MarketWatch) — The published reports that Hospira may merge with a division of Danone leads to a rather unsettling conclusion: To corporate America, even the famously hostile-to-business France looks more inviting.

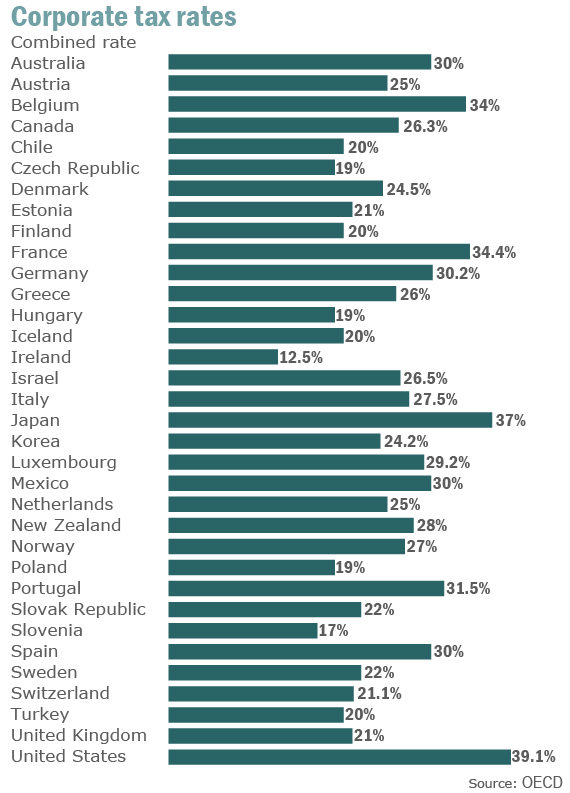

But it’s true. According to the Organization for Economic Cooperation and Development, U.S. companies pay a tax rate of 39.1% (when the average state tax is factored in). French companies, by contrast, pay 34.4%.

Now, it’s important to note that not every U.S. company pays 39.1% of its earnings, or anywhere close to it. Various loopholes, deductions and international operations allow the effective rate for many companies to be far lower.

Take, for example, um, Hospira (NYSE:HSP) ! Over the past five years, the company has enjoyed a cumulative $216.5 million in tax benefits. That’s right — it’s earned $571.1 million before tax, and earned $787.6 million after tax.

True, it’s benefited from charges it’s taken that aren’t necessarily going to recur in future years as well as retroactive application of the research-and-development tax credit. In the first quarter, Hospira said it paid a tax rate of 24.5%.

It’s important to note that not every company can take advantage of these transactions, called inversions. Apple, for instance, would find a hard time finding another company large enough to swallow 20% of the iPhone maker, as the inversion loophole requires.

And, corporate tax represents a tiny part of the tax base anyway. According to data from ConvergEx, just under 9.9% of total tax and withholding came from corporate tax last year. (Through this fiscal year, corporate tax revenue is up about 9%.)

But it’s the principle, and of course, the sound bites, that make this an area ripe for reform, not to mention the potential for job losses when headquarters move abroad. President Barack Obama has called for retroactive action to early May to stamp out practices he calls “wrong.”

The politics aren’t easy though. “Inversions” aren’t catchy on the campaign trail, and it’s important to stress that even Senate Democrats, much less Republicans, are not in agreement on what to do with them. Politicians from both parties are keen to bundle inversions into a broader corporate-tax reform package, consisting of lower top tax rates and various changes and eliminations to the tax code.

It goes without saying that such tax reform can’t get done before the election, and in today’s 24-hour news cycle, it’s not a cinch that it can be done in 2015, either.

There may be another way. An article in Tax Notes suggests existing law allows Treasury to set standards on when a financial instrument should be treated as debt. Classifying any new debt issued to the foreign company as equity would eliminate the tax deductibility, points out Stephen Shay, a Harvard Law School professor and former Treasury official. While it wouldn’t eliminate this particular loophole, it would for instance lower the benefit of Walgreen’s (NYSE:WAG) possible transaction “by hundreds of millions of dollars,” Shay writes.

In any case, Treasury is under the gun. Shay himself talked to a banker who said the volume of deals to be announced in September will be double what was seen in June and July.

By then half of American corporations may be talking French.