LeveragedBuyout

SENIOR MEMBER

- Joined

- May 16, 2014

- Messages

- 1,958

- Reaction score

- 60

- Country

- Location

Five Charts: U.S. Home Prices Are Cooling Off - Real Time Economics - WSJ

ByNick Timiraos

The rate of U.S. home price increases is decelerating, and that home-price slowdown is a mixed bag.

It looks unlikely for now, but if prices turn negative again year-over-year, that would exact a toll on would-be buyers’ psyche. A sharp run-up in prices, meanwhile, has dented affordability and is one reason the entry-level buyer has been absent.

The best scenario: price gains advance at their current slower-but-steady pace. “In housing, boring is better,” writes Zillow’s Stan Humphries.

Five charts help tell the story.

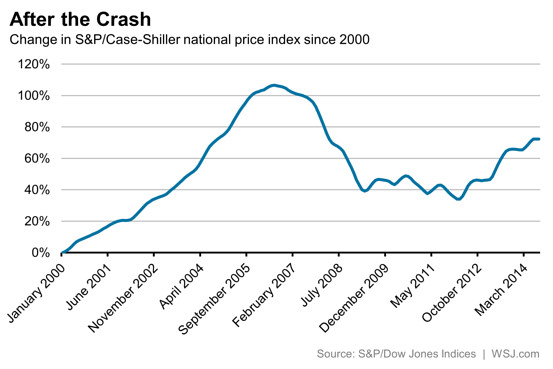

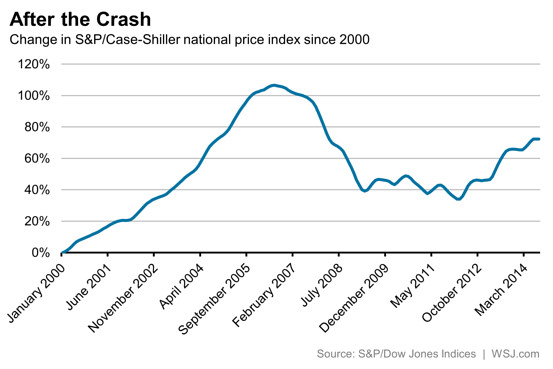

Prices fell sharply during the crash as supply greatly exceeded demand, especially as foreclosures overwhelmed the market. These properties tend to sell for less than traditional properties because they’re not as well maintained and mortgage companies aren’t emotional about selling in the way traditional owners might be.

But over the past two years, prices rebounded. The share of homes selling out of foreclosure was falling, and those properties had attracted growing interest from investors, which supported prices. Meanwhile, low interest rates and pent-up demand from traditional buyers led to bidding wars.

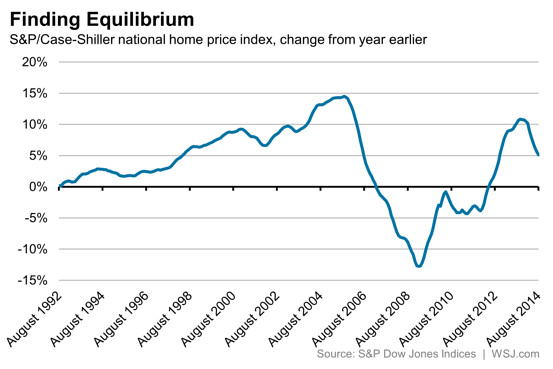

Now the market has cooled down. The monthly increases have slowed considerably over the past four months.

Of course, there’s a strong seasonal component to housing, with more activity—and price gains—during the spring and summer. Looking at prices over the same time period in each of the last 13 years helps clarify the picture. Since December, prices are up 5.2%. That’s less than during the frenzy of the last two years or the bubble of the past decade.

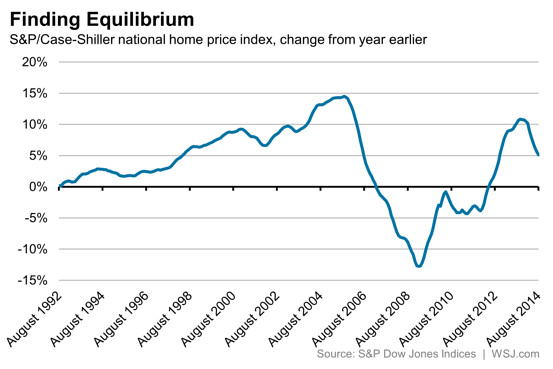

The big question now is whether these year-over-year increases slow even further and if so, where they might find equilibrium. (A reminder: the Case-Shiller index is reported with a two-month delay, and it’s a three-month moving average of prices. That means prices in Tuesday’s report cover the three-month period ending in August, and those homes would have gone to contract in the late spring or early summer.)

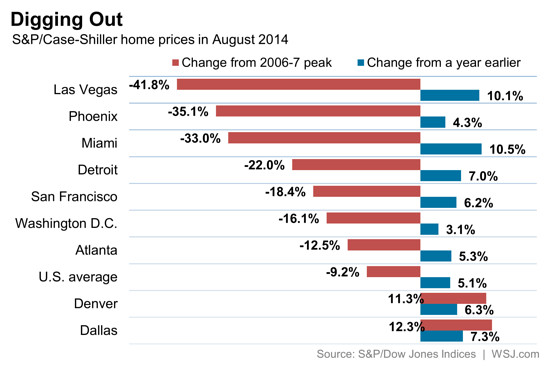

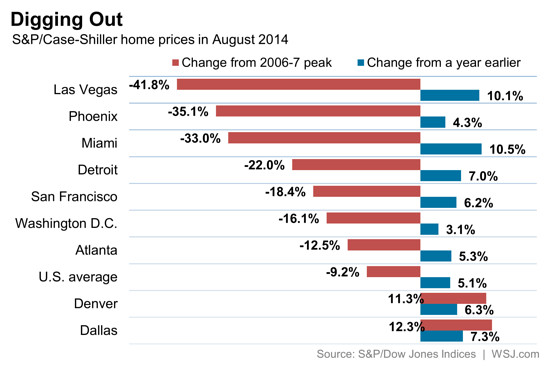

Prices are still rising on a year-over-year basis in all 20 cities tracked by the index, but the pace of gains has slowed in nearly all of them. And in many cities, such as Miami and Las Vegas, prices are still down considerably from their peaks of 2006.

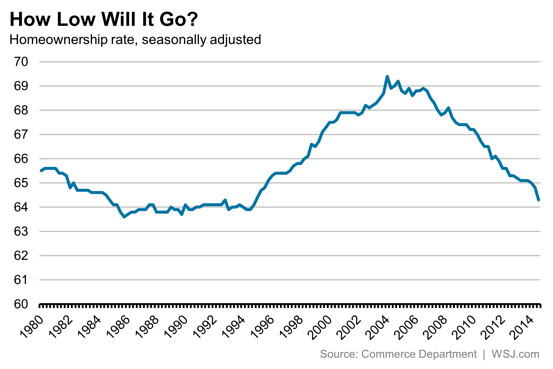

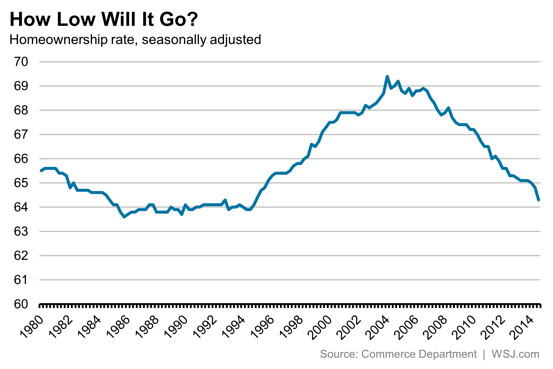

Rising prices, of course, make homes less affordable to entry-level buyers. A separate report from the Commerce Department on Tuesday showed that the homeownership rate dropped again to 64.4%, the lowest level since 1995.

- October 28, 2014, 2:28 PM ET

ByNick Timiraos

The rate of U.S. home price increases is decelerating, and that home-price slowdown is a mixed bag.

It looks unlikely for now, but if prices turn negative again year-over-year, that would exact a toll on would-be buyers’ psyche. A sharp run-up in prices, meanwhile, has dented affordability and is one reason the entry-level buyer has been absent.

The best scenario: price gains advance at their current slower-but-steady pace. “In housing, boring is better,” writes Zillow’s Stan Humphries.

Five charts help tell the story.

Prices fell sharply during the crash as supply greatly exceeded demand, especially as foreclosures overwhelmed the market. These properties tend to sell for less than traditional properties because they’re not as well maintained and mortgage companies aren’t emotional about selling in the way traditional owners might be.

But over the past two years, prices rebounded. The share of homes selling out of foreclosure was falling, and those properties had attracted growing interest from investors, which supported prices. Meanwhile, low interest rates and pent-up demand from traditional buyers led to bidding wars.

Now the market has cooled down. The monthly increases have slowed considerably over the past four months.

Of course, there’s a strong seasonal component to housing, with more activity—and price gains—during the spring and summer. Looking at prices over the same time period in each of the last 13 years helps clarify the picture. Since December, prices are up 5.2%. That’s less than during the frenzy of the last two years or the bubble of the past decade.

The big question now is whether these year-over-year increases slow even further and if so, where they might find equilibrium. (A reminder: the Case-Shiller index is reported with a two-month delay, and it’s a three-month moving average of prices. That means prices in Tuesday’s report cover the three-month period ending in August, and those homes would have gone to contract in the late spring or early summer.)

Prices are still rising on a year-over-year basis in all 20 cities tracked by the index, but the pace of gains has slowed in nearly all of them. And in many cities, such as Miami and Las Vegas, prices are still down considerably from their peaks of 2006.

Rising prices, of course, make homes less affordable to entry-level buyers. A separate report from the Commerce Department on Tuesday showed that the homeownership rate dropped again to 64.4%, the lowest level since 1995.