I worked in BD in BD work permit. It was the most difficult work permit, tougher than China.@itsanufy, watch the video below on how so many Indians are already coming to Bangladesh to get jobs.

No doubt, these Indians will try to destroy our living standards. They will make BD an open sewer land.

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

West Bengal interested to invest in economic zones

- Thread starter Black_cats

- Start date

my2cents

SENIOR MEMBER

- Joined

- Apr 8, 2011

- Messages

- 5,631

- Reaction score

- -9

- Country

- Location

In what field did you work? Don't you have to be sponsored by a company?I worked in BD in BD work permit. It was the most difficult work permit, tougher than China.

my2cents

SENIOR MEMBER

- Joined

- Apr 8, 2011

- Messages

- 5,631

- Reaction score

- -9

- Country

- Location

How many Indians do you think come to your country to work? Give me a rough estimate.Indians come to BD to seek jobs and BD citizens go to India for medical treatment and to visit Azmer Sharif.

Do you see the difference?

Attachments

Black_cats

ELITE MEMBER

- Joined

- Dec 31, 2010

- Messages

- 10,024

- Reaction score

- -5

How many Indians do you think come to your country to work? Give me a rough estimate.

Please stop that propaganda. No Bangladeshi immigrant can send money to Bangladesh legally. It has been explained number of times in the past that money were mostly business expenses.

Plus who gave that figure to pew research? Some bhakth of BJP who launch propaganda that 20 million illegal Bangladeshi live in India?

my2cents

SENIOR MEMBER

- Joined

- Apr 8, 2011

- Messages

- 5,631

- Reaction score

- -9

- Country

- Location

If you divide 4 billion dollars by $1000/ head , the figure comes to 4 million illegals. I am assuming they send $1000 per head as remittances back to BD. If you go lower say $500/head then the figure comes to 8 million illegals.Please stop that propaganda. No Bangladeshi immigrant can send money to Bangladesh legally. It has been explained number of times in the past that money were mostly business expenses.

Plus who gave that figure to pew research? Some bhakth of BJP who launch propaganda that 20 million illegal Bangladeshi live in India?

Black_cats

ELITE MEMBER

- Joined

- Dec 31, 2010

- Messages

- 10,024

- Reaction score

- -5

If you divide 4 billion dollars by $1000/ head , the figure comes to 4 million illegals. I am assuming they send $1000 per head as remittances back to BD. If you go lower say $500/head then the figure comes to 8 million illegals.

You can make 20 or 50 milllion illegal or whatever number your bhakth mind say but the thing is you can not send money to BNgladesh from India using legal channel. It’s explained many times only business expenses or Indian run business goes through legal channel but this is doubtful if that’s something can be called remittance or from which Vedic source the number came from.

Black_cats

ELITE MEMBER

- Joined

- Dec 31, 2010

- Messages

- 10,024

- Reaction score

- -5

As mention the 4 billion USD remittance to Bangladesh from India is the Vedic number based on the assumption 4-5 million illegal Bangladeshi lives in India propagated by different bhakth group. The pew research just multiplied that with average remittence send by Bangladeshis to get the figure.

Though it has been said time and time again that’s a propaganda that large number of Bangladeshis lives in India illegally. There are no such proof nor India provided any. It’s just election time hot air by radical Hindu groups like BJP/RSS etc to promote anti Muslim sentiment.

Following article nicely described the above propaganda launched by India.

By the way why there are no figures after this propaganda piece in 2017?

Bilateral remittance flow between Bangladesh and India: Do World Bank estimates make sense?

03 April, 2020, 11:35 am

Last modified: 03 April, 2020, 05:16 pm

www.tbsnews.net

www.tbsnews.net

Bilateral remittance flow between Bangladesh and India is a topic that occasionally comes up in the media and drives passionate discussions. Many foreign workers, including Indians and other nationals who work in Bangladesh, often enjoy a lax regulatory oversight that leads to loss of tax revenue for the government and unauthorized transfer of money, despite contributing to our economy.

Among all the nationals working in Bangladesh, Indians are likely to remit the largest amount of money from Bangladesh mainly because they are in higher numbers here, as reported by the recently published annual report of Bangladesh Investment Development Authority (BIDA).

Conversely, the Indian intelligentsia and parts of their media claim the amount of money remitted from India to Bangladesh is also very high.

To uncover the source of such claims I recently looked into the data publishedby the Pew Research Center, a Washington DC-based nonpartisan think tank, for authentic figures of the remittance flow between India and Bangladesh.

The Pew Research Center is a source of information for the public on important global issues. Among many other things, it presents the bilateral remittance flow data, as estimated by the World Bank, on its web portal.

Upon looking at the figures presented on its web portal, questions came to my mind regarding the methodology of the World Bank estimates and their reliability as accurate estimates of actual remittance flows. In particular, do World Bank estimates on bilateral remittance flows between India and Bangladesh make sense?

While the World Bank may be doing a pretty good job of informing policy makers and interested stakeholders with data on many fronts, these figures on bilateral remittance flows, however, appeared inaccurate to me – particularly in the case of Bangladesh and India.

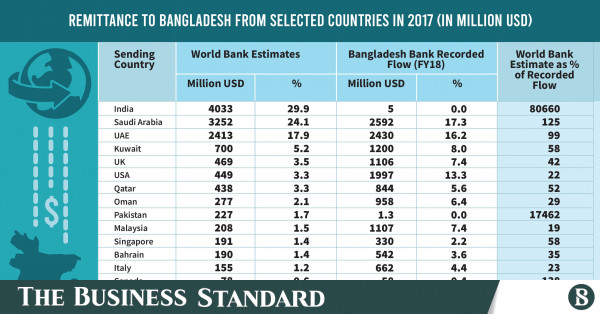

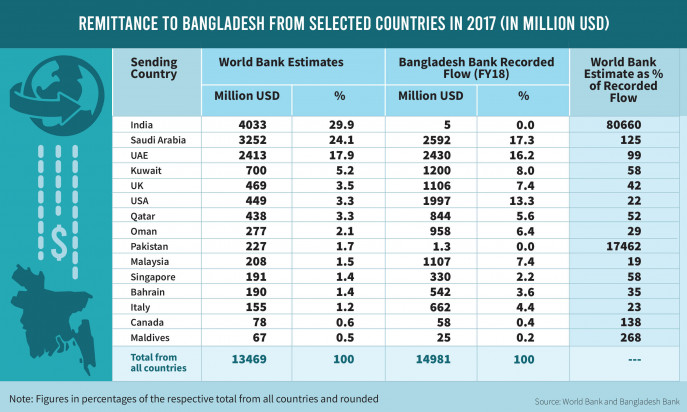

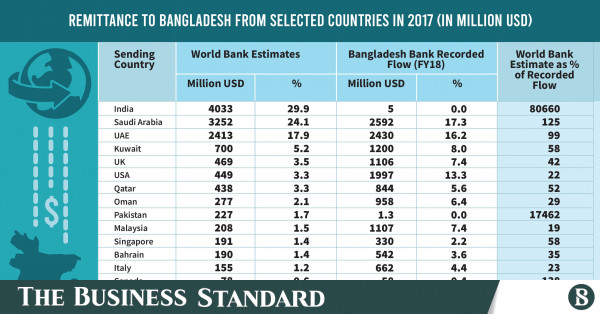

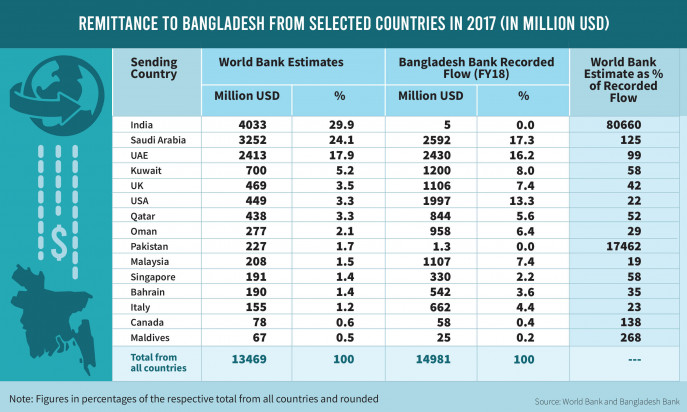

Take a quick look at the estimates of the World Bank and also the figures presented by Bangladesh Bank which are actual recorded flows, presented here in infographic format. Both of these data sets include only the remittances sent via formal channels, such as banks and other businesses that transfer money.

As these figures are supposed to pick up the remittance flow through official channels, they do not estimate the actual remittance flow, which include both the official and unofficial channels. It is widely believed that unofficial flows are a large part of the actual remittance flow, though currently there are no reliable estimates of flows through unofficial channels.

According to the World Bank estimates, readers may be surprised to learn that India ranks number one in sending remittance to Bangladesh; the country sent a staggering $4,003 million in remittance to Bangladesh in 2017. India is followed by Saudi Arabia with $3,252 million, and then by UAE with $2,413 million.

Notably, the World Bank estimates also show that Pakistan is ranked in the list of the top 10 countries sending remittance to Bangladesh - with the remittance amounting to $227 million. This amount is more than the remittance sent from Malaysia with $208 million, Singapore with $191 million, Bahrain with $190 million, and Italy with $155 million.

But how do we know the actual recorded flows? The actual remittance flows through banking and other formal channels are recorded by the central bank. It will be interesting to compare the World Bank figures with the Bangladesh Bank figures on remittances which are based on recorded flows through official channels.

As readers can see, the actual recorded data of Bangladesh Bank shows Saudi Arabia ranks number one among the countries that sent remittance to Bangladesh with $2,592 million, followed by UAE with $2,430 million, USA $1,997 million, and Kuwait $1,200 million, and then other countries.

The remittance from India to Bangladesh, however, was a paltry $5 million in 2017-18, and from Pakistan, it was only $1.3 million.

Given the recorded flows and World Bank estimates, it is evident that the World Bank figures underestimate the remittance flow for almost all the top ten remittance sending countries, except for Saudi Arabia.

At the same time, the remittance underestimated for top remittance sending countries is imputed to India. This makes India, according to World Bank estimates, the number one country in terms of sending remittance to Bangladesh. This underestimation in comparison to recorded flow figures might have happened for two reasons.

Firstly, the Bangladesh Bank figures are for financial year 2017 to 2018, which include remittances sent from mid-2017 to mid-2018, whereas the World Bank figures include remittances sent during 2017.

If remittances grew during the period covering mid-2017 to mid-2018, the Bangladesh Bank figures would pick up higher remittance flow for the period. However, it is unlikely that the underestimation of remittance flow from the countries mentioned above due to the difference in periods covered will be so high to justify the given figures from the World Bank.

Secondly, the underestimation of remittance from the top remittance sending countries could also happen due to the methodology used by the World Bank. In particular, the allocation rule used by the bank estimates on the basis of migrant stock data that overestimates remittance from India and in some cases Pakistan, to Bangladesh, at the expense of other remittance sending countries.

For example, World Bank estimates are less than one fourth or close to one fourth of the actual recorded remittance flows from countries such as USA, Malaysia, Oman and Italy. It is less than half or close to half of the recorded remittance flows from countries such as the UK, Bahrain, Kuwait, Qatar and Singapore.

Looking at the figures differently, nearly 30 percent of all remittances in 2017 according to World Bank estimates, came from India; whereas remittances from the US and Malaysia were only three and two percent of the total. The totals were less than three percent from the UK. Bahrain and Italy amounted to close to one percent of the total in 2017.

In contrast the actual recorded flow presented by Bangladesh Bank shows remittances from India was less than one percent of the total. From the US, it was over thirteen percent of the total. From Malaysia and the UK, the remittances were nearly seven percent, while Bahrain and Italy stood close to four percent of the total recorded flow.

Given that the estimates differ markedly from actual recorded flows, it will be useful to see how World Bank estimates are calculated.

As reported by the World Bank, the figures are based on a methodology developed by Dilip Ratha and William Shaw in 2007. The methodology can be found in the World Bank working paper "South-South Migration and Remittances".

The authors formulated a statistical model using census data and information on bilateral migrant stocks in a multi-country study of 212 countries. The bilateral remittances are calculated by allocating remittances received by each developing country including Bangladesh and India. The authors devised simple formulas to allocate the recorded remittances received by each country to various source countries.

A simple allocation rule, according to the authors, would assume that a country's remittance receipts from various source countries are proportional to its migrant stocks. The authors also refer to a study which used a similar methodology.

Application of this methodology for estimation of bilateral remittance between Bangladesh and India leads to a highly inflated flow from India to Bangladesh at the cost of remittances from other countries.

The method will be highly sensitive to the estimation of migrant stock, whether foreign born or foreign national, and will produce estimates according to the political definition of migrants in census and other sources of data.

In the case of Bangladesh and India, this data produced estimates that are not reliable which could be seen from the official recorded data. The World Bank recognizes the limitations of the bilateral remittance estimates, specially the fact that the data on migrants in various destination countries are incomplete and inaccurate.

Furthermore, they may also be fraught with all sorts of manipulations that may cater to a political agenda.

As such, the World Bank estimates or the information relayed by Pew Research Center do not appear to be reliable for remittance flow from India to Bangladesh. Referring to these figures will be misleading and counter to objective discussion.

Apart from remittance from India to Bangladesh, there is much clamour about remittance from Bangladesh to India, which is often believed to be very high, given that a significant number of Indian nationals are believed to be working in Bangladesh. The World Bank estimates that remittance from Bangladesh to India was $126 million in 2017.

Having seen the misleading character of the World Bank data on remittance flows between Bangladesh and India, it would be pertinent to conclude with a slight discussion on foreign nationals working in Bangladesh- an issue that often comes up in public discourse.

It has been reported in news media that many foreign nationals currently work in Bangladesh with or without legitimate authorizations from relevant government authority. Consequently, they also send remittances out of Bangladesh to their desired or source countries through official and unofficial channels. In the minds of many, it may appear that foreign nationals are exploiting skill deficits in the country and siphoning off a huge sum of hard earned currency from Bangladesh.

Whether this is true or not, it is important to recognize that foreign workers often bring in new skills and knowledge which help enhancement of productivity and generation of new ideas.

Therefore, the state should facilitate the provision for use of imported skills where it is needed and absent and focus on knowledge and skill development within the country. No matter what the actual flow of remittance is, it is very necessary that the foreign nationals working in Bangladesh are brought under effective regulations, monitoring and proper taxation so that Bangladesh can use the skill sets of foreign professionals within a lawful regime that is beneficial to Bangladesh and that also provides just reward to legally employed foreign workers.

The writer is an economist and Joint Registrar atShanto-Mariam University of Creative Technology

Though it has been said time and time again that’s a propaganda that large number of Bangladeshis lives in India illegally. There are no such proof nor India provided any. It’s just election time hot air by radical Hindu groups like BJP/RSS etc to promote anti Muslim sentiment.

Following article nicely described the above propaganda launched by India.

By the way why there are no figures after this propaganda piece in 2017?

Bilateral remittance flow between Bangladesh and India: Do World Bank estimates make sense?

THOUGHTS

Abdullah Al Masud03 April, 2020, 11:35 am

Last modified: 03 April, 2020, 05:16 pm

Bilateral remittance flow between Bangladesh and India: Do World Bank estimates make sense?

The World Bank may be doing a pretty good job by informing policy makers and interested stakeholders about data on many fronts, but its data on bilateral remittance flows – especially in the case of Bangladesh and India – appeared to be inaccurate

The World Bank may be doing a pretty good job by informing policy makers and interested stakeholders about data on many fronts, but its data on bilateral remittance flows – especially in the case of Bangladesh and India – appeared to be inaccurate

Bilateral remittance flow between Bangladesh and India is a topic that occasionally comes up in the media and drives passionate discussions. Many foreign workers, including Indians and other nationals who work in Bangladesh, often enjoy a lax regulatory oversight that leads to loss of tax revenue for the government and unauthorized transfer of money, despite contributing to our economy.

Among all the nationals working in Bangladesh, Indians are likely to remit the largest amount of money from Bangladesh mainly because they are in higher numbers here, as reported by the recently published annual report of Bangladesh Investment Development Authority (BIDA).

Conversely, the Indian intelligentsia and parts of their media claim the amount of money remitted from India to Bangladesh is also very high.

To uncover the source of such claims I recently looked into the data publishedby the Pew Research Center, a Washington DC-based nonpartisan think tank, for authentic figures of the remittance flow between India and Bangladesh.

The Pew Research Center is a source of information for the public on important global issues. Among many other things, it presents the bilateral remittance flow data, as estimated by the World Bank, on its web portal.

Upon looking at the figures presented on its web portal, questions came to my mind regarding the methodology of the World Bank estimates and their reliability as accurate estimates of actual remittance flows. In particular, do World Bank estimates on bilateral remittance flows between India and Bangladesh make sense?

While the World Bank may be doing a pretty good job of informing policy makers and interested stakeholders with data on many fronts, these figures on bilateral remittance flows, however, appeared inaccurate to me – particularly in the case of Bangladesh and India.

Take a quick look at the estimates of the World Bank and also the figures presented by Bangladesh Bank which are actual recorded flows, presented here in infographic format. Both of these data sets include only the remittances sent via formal channels, such as banks and other businesses that transfer money.

As these figures are supposed to pick up the remittance flow through official channels, they do not estimate the actual remittance flow, which include both the official and unofficial channels. It is widely believed that unofficial flows are a large part of the actual remittance flow, though currently there are no reliable estimates of flows through unofficial channels.

According to the World Bank estimates, readers may be surprised to learn that India ranks number one in sending remittance to Bangladesh; the country sent a staggering $4,003 million in remittance to Bangladesh in 2017. India is followed by Saudi Arabia with $3,252 million, and then by UAE with $2,413 million.

Notably, the World Bank estimates also show that Pakistan is ranked in the list of the top 10 countries sending remittance to Bangladesh - with the remittance amounting to $227 million. This amount is more than the remittance sent from Malaysia with $208 million, Singapore with $191 million, Bahrain with $190 million, and Italy with $155 million.

But how do we know the actual recorded flows? The actual remittance flows through banking and other formal channels are recorded by the central bank. It will be interesting to compare the World Bank figures with the Bangladesh Bank figures on remittances which are based on recorded flows through official channels.

As readers can see, the actual recorded data of Bangladesh Bank shows Saudi Arabia ranks number one among the countries that sent remittance to Bangladesh with $2,592 million, followed by UAE with $2,430 million, USA $1,997 million, and Kuwait $1,200 million, and then other countries.

The remittance from India to Bangladesh, however, was a paltry $5 million in 2017-18, and from Pakistan, it was only $1.3 million.

Given the recorded flows and World Bank estimates, it is evident that the World Bank figures underestimate the remittance flow for almost all the top ten remittance sending countries, except for Saudi Arabia.

At the same time, the remittance underestimated for top remittance sending countries is imputed to India. This makes India, according to World Bank estimates, the number one country in terms of sending remittance to Bangladesh. This underestimation in comparison to recorded flow figures might have happened for two reasons.

Firstly, the Bangladesh Bank figures are for financial year 2017 to 2018, which include remittances sent from mid-2017 to mid-2018, whereas the World Bank figures include remittances sent during 2017.

If remittances grew during the period covering mid-2017 to mid-2018, the Bangladesh Bank figures would pick up higher remittance flow for the period. However, it is unlikely that the underestimation of remittance flow from the countries mentioned above due to the difference in periods covered will be so high to justify the given figures from the World Bank.

Secondly, the underestimation of remittance from the top remittance sending countries could also happen due to the methodology used by the World Bank. In particular, the allocation rule used by the bank estimates on the basis of migrant stock data that overestimates remittance from India and in some cases Pakistan, to Bangladesh, at the expense of other remittance sending countries.

For example, World Bank estimates are less than one fourth or close to one fourth of the actual recorded remittance flows from countries such as USA, Malaysia, Oman and Italy. It is less than half or close to half of the recorded remittance flows from countries such as the UK, Bahrain, Kuwait, Qatar and Singapore.

Looking at the figures differently, nearly 30 percent of all remittances in 2017 according to World Bank estimates, came from India; whereas remittances from the US and Malaysia were only three and two percent of the total. The totals were less than three percent from the UK. Bahrain and Italy amounted to close to one percent of the total in 2017.

In contrast the actual recorded flow presented by Bangladesh Bank shows remittances from India was less than one percent of the total. From the US, it was over thirteen percent of the total. From Malaysia and the UK, the remittances were nearly seven percent, while Bahrain and Italy stood close to four percent of the total recorded flow.

Given that the estimates differ markedly from actual recorded flows, it will be useful to see how World Bank estimates are calculated.

As reported by the World Bank, the figures are based on a methodology developed by Dilip Ratha and William Shaw in 2007. The methodology can be found in the World Bank working paper "South-South Migration and Remittances".

The authors formulated a statistical model using census data and information on bilateral migrant stocks in a multi-country study of 212 countries. The bilateral remittances are calculated by allocating remittances received by each developing country including Bangladesh and India. The authors devised simple formulas to allocate the recorded remittances received by each country to various source countries.

A simple allocation rule, according to the authors, would assume that a country's remittance receipts from various source countries are proportional to its migrant stocks. The authors also refer to a study which used a similar methodology.

Application of this methodology for estimation of bilateral remittance between Bangladesh and India leads to a highly inflated flow from India to Bangladesh at the cost of remittances from other countries.

The method will be highly sensitive to the estimation of migrant stock, whether foreign born or foreign national, and will produce estimates according to the political definition of migrants in census and other sources of data.

In the case of Bangladesh and India, this data produced estimates that are not reliable which could be seen from the official recorded data. The World Bank recognizes the limitations of the bilateral remittance estimates, specially the fact that the data on migrants in various destination countries are incomplete and inaccurate.

Furthermore, they may also be fraught with all sorts of manipulations that may cater to a political agenda.

As such, the World Bank estimates or the information relayed by Pew Research Center do not appear to be reliable for remittance flow from India to Bangladesh. Referring to these figures will be misleading and counter to objective discussion.

Apart from remittance from India to Bangladesh, there is much clamour about remittance from Bangladesh to India, which is often believed to be very high, given that a significant number of Indian nationals are believed to be working in Bangladesh. The World Bank estimates that remittance from Bangladesh to India was $126 million in 2017.

Having seen the misleading character of the World Bank data on remittance flows between Bangladesh and India, it would be pertinent to conclude with a slight discussion on foreign nationals working in Bangladesh- an issue that often comes up in public discourse.

It has been reported in news media that many foreign nationals currently work in Bangladesh with or without legitimate authorizations from relevant government authority. Consequently, they also send remittances out of Bangladesh to their desired or source countries through official and unofficial channels. In the minds of many, it may appear that foreign nationals are exploiting skill deficits in the country and siphoning off a huge sum of hard earned currency from Bangladesh.

Whether this is true or not, it is important to recognize that foreign workers often bring in new skills and knowledge which help enhancement of productivity and generation of new ideas.

Therefore, the state should facilitate the provision for use of imported skills where it is needed and absent and focus on knowledge and skill development within the country. No matter what the actual flow of remittance is, it is very necessary that the foreign nationals working in Bangladesh are brought under effective regulations, monitoring and proper taxation so that Bangladesh can use the skill sets of foreign professionals within a lawful regime that is beneficial to Bangladesh and that also provides just reward to legally employed foreign workers.

The writer is an economist and Joint Registrar atShanto-Mariam University of Creative Technology

Please open the link below to know the reality. It is an industry news reporting. Do not please send unreliable fake news.How many Indians do you think come to your country to work? Give me a rough estimate.

Abdul Rehman Majeed

SENIOR MEMBER

- Joined

- Dec 25, 2019

- Messages

- 5,098

- Reaction score

- -40

- Country

- Location

Where will West Bengal get the funds from? Mamata Begum has already bankrupted the state.

Great that you finally confess that India is bankrupt.

Skull and Bones

ELITE MEMBER

- Joined

- Jan 29, 2011

- Messages

- 18,598

- Reaction score

- -4

- Country

- Location

Great that you finally confess that India is bankrupt.

Tere maa ne tujhe head first giraya tha kya?

I work as a consultant now. Earlier I went to BD for an IT company for non it consultation.In what field did you work? Don't you have to be sponsored by a company?

my2cents

SENIOR MEMBER

- Joined

- Apr 8, 2011

- Messages

- 5,631

- Reaction score

- -9

- Country

- Location

Let's add the math. 10 billion dollars divided by 1 million illegal workers. That comes $10,000 per head. I am very interested in finding out how you can afford to pay $10 billion dollars when your entire remittances are some $20 billion.Please open the link below to know the reality. It is an industry news reporting. Do not please send unreliable fake news.

How big is Indian population in BD in your estimation?I work as a consultant now. Earlier I went to BD for an IT company for non it consultation.

Similar threads

- Replies

- 0

- Views

- 458

- Replies

- 6

- Views

- 797

- Replies

- 1

- Views

- 694

- Replies

- 2

- Views

- 667