How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Oil at $40

- Thread starter New

- Start date

New

PDF THINK TANK: ANALYST

- Joined

- Jul 9, 2012

- Messages

- 2,023

- Reaction score

- 8

- Country

- Location

Thanks man, as expected, quite quality post.Happy to comment, but I will steal a bit from my previous posts on this issue. As you say, shale oil is not going to be easy to kill. From the article:

Oil has dropped 38 percent this year and, in theory, production can continue to flow until prices fall below the day-to-day costs at existing wells. Stevens said some U.S. shale producers may break even at $40 a barrel or less. The International Energy Agencyestimates most drilling in the Bakken formation -- the shale producers that OPEC seeks to drive out of business -- return cash at $42 a barrel.

And with the diversity of shale fields we have, there will be many, many more places where $40 remains viable for drilling:

The U.S. Energy Information Administration estimated in 2009 that the U.S. had 1,722 trillion cubic feet of recoverable natural gas in six key shale formations, including the Marcellus in the northeastern U.S. EIA projected that identified natural gas deposits in the shale plays was enough to supply the country's needs for 90 years at then-current production rates. Other estimates of shale gas reserves extend the supply to 116 years.

Also, as you mentioned and has been said before, fracking technology continues to improve, thus improving productivity and bringing down the break-even price for drilling. Examples are new materials being injected into the rock that increase flow (such as Schlumberger's HIWAY, which adds fibers to the grain solution; more sophisticated pipe fittings that can target specific pockets of oil and gas, which cuts down on the need for water and time; and improved blast technology to break further into the rock to widen the funnel (and increase flow).

Unlike the OPEC members, who basically just had to stick a straw in the ground, fracking is a highly innovative and fast-moving industry. It's not sitting still, to OPEC's great misfortune, and gets harder to kill with each passing month. And between fracking and non-OPEC oil production, we can see that OPEC has been easily eclipsed. Look at this chart, showing the dominance of non-OPEC suppliers (light blue) dwarfing the contribution of OPEC (grey). Those negative grey bars are OPEC trying to cut supply to maintain the oil price, but they are getting swamped by the non-OPEC increases in production. Saudi Arabia finally threw in the towel and decided to join the party in order to protect its market share, which is why the grey bars (OPEC) turned positive. Now everyone is supplying oil:

We know that prices are determined by supply and demand. That's the supply side: fracking plus high output at OPEC. But demand is also weakening:

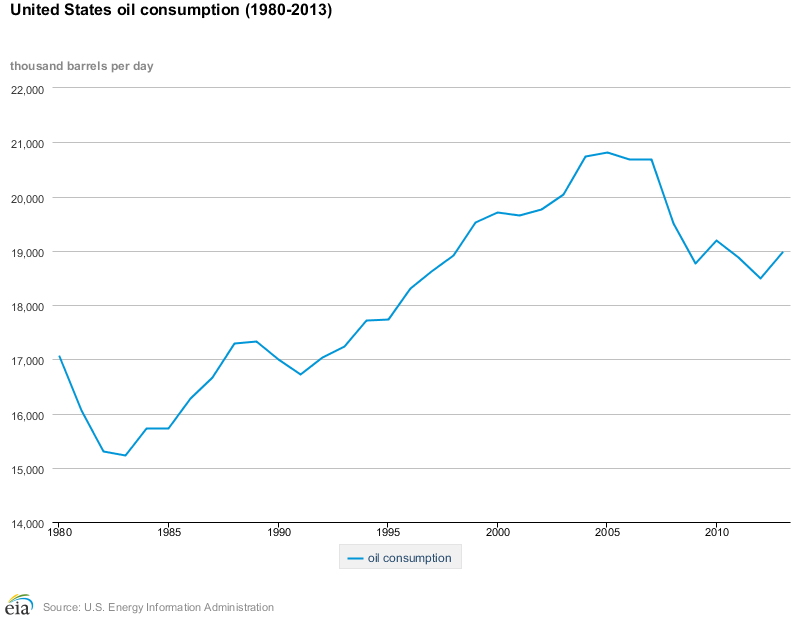

Europe, Japan, China, and even Russia have weaker oil demand than forecast, so the gap between production and consumption is growing faster than anticipated. As you can see, inventories (the blue bars) are starting to build rapidly, which is putting tremendous pressure on prices. Even as the US increases production rapidly, our demand is flat or declining:

(I guess the EPA fuel efficiency standards are good for something, after all).

The best part is that this low price range will probably last a long, long time. Even if demand picks up, it's unlikely OPEC will have the discipline to cut supply to the degree necessary to raise prices:

(OPEC consistently produces above its self-declared quotas).

Gentlemen, enjoy the windfall. For the oil importers, this will cut their import bills and boost GDP, providing a stimulus of several hundred billion dollars for the world economy. And the icing on the cake is that while the good guys win, the bad guys (Venezuela, Russia, Saudi Arabia, Iran, etc.) lose. Hopefully we'll see a knock-on effect where the mysterious money-and-weapons flow (where do all the Russian weapons and funding come from? No one knows, wink wink nod nod) to terrorist groups dries up. I'm sure it will be pure coincidence that the fiscal squeeze on the bad guys leads to a fiscal squeeze on the terrorist groups, right? Pure coincidence.

And the icing on the cake is that while the good guys win, the bad guys (Venezuela, Russia, Saudi Arabia, Iran, etc.) lose.

Levina

BANNED

- Joined

- Sep 16, 2013

- Messages

- 15,278

- Reaction score

- 59

- Country

- Location

These OIL countries 're desperate because Oil would soon become a stranded asset (trillions of dollars trapped underground).

Low oil prices 're bad news for many of these countries but then they should 've realised long back that the stone age did not finish because the stones ended, same way oil age would not end because the oil would've ended instead it would end when humanity would find a better source of energy.

Low oil prices 're bad news for many of these countries but then they should 've realised long back that the stone age did not finish because the stones ended, same way oil age would not end because the oil would've ended instead it would end when humanity would find a better source of energy.

Arya Desa

BANNED

- Joined

- Sep 23, 2012

- Messages

- 3,301

- Reaction score

- -18

- Country

- Location

@LeveragedBuyout are you an economist? I have $XXXXX sitting in a chequeing account (I know stupid as hell but I don't know what to do with my RESP). What should I invest that in?

Last edited:

raptor22

SENIOR MEMBER

- Joined

- Dec 8, 2011

- Messages

- 7,064

- Reaction score

- 9

- Country

- Location

As it seems all major oil producers which have put all their eggs in an oily basket so far have no choice but sitting and looking at their dreams fading away ... to receive the same revenue they need to sell more and that's the tragedy.

@New is there any chance to see previous prices in the market? as I see oil prices have plunged to a new low and it continues to decrease more and more on daily basis ...

@New is there any chance to see previous prices in the market? as I see oil prices have plunged to a new low and it continues to decrease more and more on daily basis ...

LeveragedBuyout

SENIOR MEMBER

- Joined

- May 16, 2014

- Messages

- 1,958

- Reaction score

- 60

- Country

- Location

@LeveragedBuyout are you an economist? I have $X sitting in a chequeing account (I know stupid as hell but I don't know what to do with my RESP). What should I invest that in?

I'm not an economist, and as far as investment advice, I would be breaking several regulations by providing advice (I don't know your risk tolerance, income, time horizon, etc.). I can only say that the most important component of investment is time, so whether it's equity, real estate, or something else, if you invest for a long enough period of time, you should be fine--as long as you can maintain your discipline and not panic should there be a pullback.

That said, don't trust what some random guy on the Internet says!

. Good luck to you.

. Good luck to you.

Last edited:

Arya Desa

BANNED

- Joined

- Sep 23, 2012

- Messages

- 3,301

- Reaction score

- -18

- Country

- Location

I'm not an economist, and as far as investment advice, I would be breaking several regulations by providing advice (I don't know your risk tolerance, income, time horizon, etc.). I can only say that the most important component of investment is time, so whether it's equity, real estate, or something else, if you invest for a long enough period of time, you should be fine--as long as you can maintain your discipline and not panic should there be a pullback.

That said, don't trust what some random guy on the Internet says!. Good luck to you.

Thank you for your response. I'm simply a student and my parents are the "buy gold" type. I'll try to figure this stuff out myself.

New

PDF THINK TANK: ANALYST

- Joined

- Jul 9, 2012

- Messages

- 2,023

- Reaction score

- 8

- Country

- Location

Ya bro, ME'erns are turning back to the part of history they belong to.As it seems all major oil producers which have put all their eggs in an oily basket so far have no choice but sitting and looking at their dreams fading away ... to receive the same revenue they need to sell more and that's the tragedy.

@New is there any chance to see previous prices in the market? as I see oil prices have plunged to a new low and it continues to decrease more and more on daily basis ...

I guess you can find it here,

Crude Oil Price History Chart | MacroTrends

The Americans are bluffing when they say their shale producers can return cash at 42 USD a barrel。

American shale producers are also supported by zero interest rate, easily available QE money financing and frenzied investors expecting big profits at $100+ per barrel of oil.

Shale oil declines at such a fast rate that it needs a constant source of cheap financing and high pricing to be economical.

Edison Chen

SENIOR MEMBER

- Joined

- Aug 21, 2013

- Messages

- 2,933

- Reaction score

- 11

- Country

- Location

Some wells can, most cannot.

Good for us and probably for China too.

We have problem of very high inflation, not deflation.

Personally I think the deflation is good for consumers in short terms, bad for both consumers and manufacturers in the long term. Deflation is due to the shortage of money in circulation, our monetary income is lower, it will cause even serious problem to consumption in the future. Two reasons lead to deflation, over-production or insufficient demand, it will inhibit industrial output from industries like energy, coal, steel. China's industrial production is only 7.2%, it failed to meet the expectation in Nov, due to the sluggish real estate market and high storage of unsold houses. Chinese banks are increasing the credit supply to stimulate the production. In 2015 I believe it will be all right.

anonymus

BANNED

- Joined

- Sep 22, 2011

- Messages

- 3,870

- Reaction score

- -7

- Country

- Location

Personally I think the deflation is good for consumers in short terms, bad for both consumers and manufacturers in the long term. Deflation is due to the shortage of money in circulation, our monetary income is lower, it will cause even serious problem to consumption in the future. Two reasons lead to deflation, over-production or insufficient demand, it will inhibit industrial output from industries like energy, coal, steel. China's industrial production is only 7.2%, it failed to meet the expectation in Nov, due to the sluggish real estate market and high storage of unsold houses. Chinese banks are increasing the credit supply to stimulate the production. In 2015 I believe it will be all right.

Deflation is not good, either for consumers or producers, even in short run.

From consumer side, it decreases value of assets for consumers. Suppose you buy a house for $100000 today, if there is a deflationary financial regime, your house would be worth less say $90000 after sometime.

From Producer side, deflationary expectations would lead to suppression in consumption as a consumer would expect prices to fall further and would postpone their spending, thus adding to deflation thus making it a vicious cycle.

The current Chinese woe is similar to subprime crisis of US, only difference that financial institutions of China are under governmental control so there would be no bubble bursting but, gradual deflation.

Whatever may be the case but China would find it hard to grow beyond 7% due to base effect coming into play.

OrionHunter

ELITE MEMBER

- Joined

- May 28, 2011

- Messages

- 13,818

- Reaction score

- -5

- Country

- Location

But it's good for oil importing nations like India which will result in lower inflation, a satisfactory balance of payments situation, lower CAD etc. These extra savings will go into developing better infrastructure resulting in huge foreign investments in the country.I think this will happen within 4 years if they dont take major decision.Russia ,Iran and some other Opec nations will severly affected by this.If they cant diversify their economy things will again begin to worse.

Edison Chen

SENIOR MEMBER

- Joined

- Aug 21, 2013

- Messages

- 2,933

- Reaction score

- 11

- Country

- Location

The current Chinese woe is similar to subprime crisis of US, only difference that financial institutions of China are under governmental control so there would be no bubble bursting but, gradual deflation.

Whatever may be the case but China would find it hard to grow beyond 7% due to base effect coming into play.

Chinese economy rely on indirect financing like the loans from banks, while the US has strong capital market so they rely on direct financing like equity financing or stock market. This cause inefficiency to Chinese economy but provide a rather safe environment. The real estate is coming to a bottle neck, the increments brought by investment cannot yield the same output as before. The new 2014 central economy work conference made it clear that China is breeding new points of growth from new industries, capital market products like asset-backed securitization and bonds will play more important roles than banks. Look at the industry of current western world, medical, advanced equipment and consumption are the main backbones, while petroleum, steel and other tradition industries are the main departments of China, they are sluggish now, less output, the more you invest on them means you are wasting money. Our president has made it clear that the current slowing growth rate is for future's persistent growth. 7% is hope to predict, a more steady growth is good for its own people and the investors's activities.

Similar threads

- Replies

- 0

- Views

- 269

- Replies

- 0

- Views

- 407

- Article

- Replies

- 1

- Views

- 427

- Replies

- 4

- Views

- 426