Happy to comment, but I will steal a bit from my previous posts on this issue. As you say, shale oil is not going to be easy to kill. From the article:

Oil has dropped 38 percent this year and, in theory, production can continue to flow until prices fall below the day-to-day costs at existing wells. Stevens said some U.S. shale producers may break even at $40 a barrel or less. The International Energy Agencyestimates most drilling in the Bakken formation -- the shale producers that OPEC seeks to drive out of business -- return cash at $42 a barrel.

And with the diversity of shale fields we have, there will be many, many more places where $40 remains viable for drilling:

The U.S. Energy Information Administration estimated in 2009 that the U.S. had 1,722 trillion cubic feet of recoverable natural gas in six key shale formations, including the Marcellus in the northeastern U.S. EIA projected that identified natural gas deposits in the shale plays was enough to supply the country's needs for 90 years at then-current production rates. Other estimates of shale gas reserves extend the supply to 116 years.

Also, as you mentioned and has been said before, fracking technology continues to improve, thus improving productivity and bringing down the break-even price for drilling. Examples are new materials being injected into the rock that increase flow (such as Schlumberger's HIWAY, which adds fibers to the grain solution; more sophisticated pipe fittings that can target specific pockets of oil and gas, which cuts down on the need for water and time; and improved blast technology to break further into the rock to widen the funnel (and increase flow).

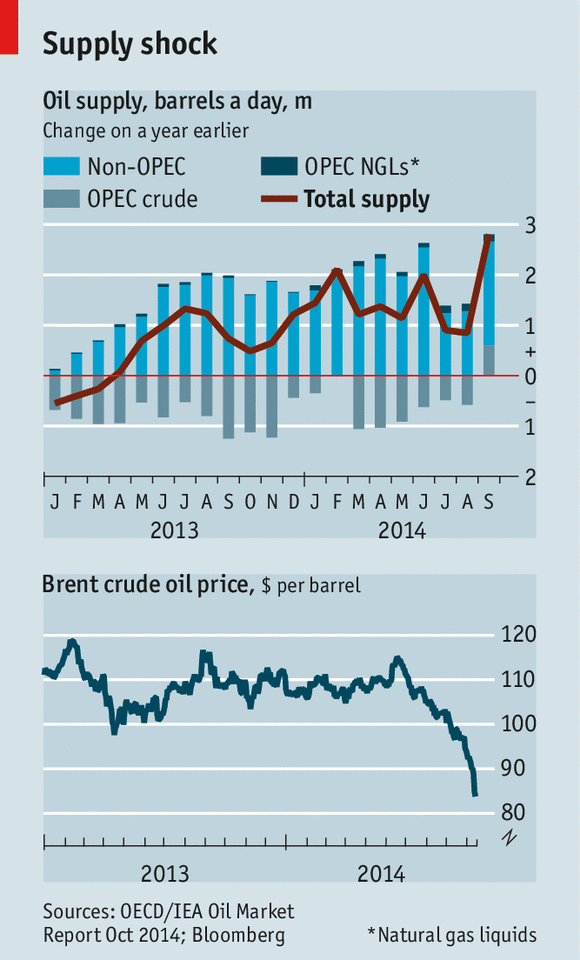

Unlike the OPEC members, who basically just had to stick a straw in the ground, fracking is a highly innovative and fast-moving industry. It's not sitting still, to OPEC's great misfortune, and gets harder to kill with each passing month. And between fracking and non-OPEC oil production, we can see that OPEC has been easily eclipsed. Look at this chart, showing the dominance of non-OPEC suppliers (light blue) dwarfing the contribution of OPEC (grey). Those negative grey bars are OPEC trying to cut supply to maintain the oil price, but they are getting swamped by the non-OPEC increases in production. Saudi Arabia finally threw in the towel and decided to join the party in order to protect its market share, which is why the grey bars (OPEC) turned positive. Now everyone is supplying oil:

We know that prices are determined by supply and demand. That's the supply side: fracking plus high output at OPEC. But demand is also weakening:

Europe, Japan, China, and even Russia have weaker oil demand than forecast, so the gap between production and consumption is growing faster than anticipated. As you can see, inventories (the blue bars) are starting to build rapidly, which is putting tremendous pressure on prices. Even as the US increases production rapidly, our demand is flat or declining:

(I guess the EPA fuel efficiency standards are good for something, after all).

The best part is that this low price range will probably last a long, long time. Even if demand picks up, it's unlikely OPEC will have the discipline to cut supply to the degree necessary to raise prices:

(OPEC consistently produces above its self-declared quotas).

Gentlemen, enjoy the windfall. For the oil importers, this will cut their import bills and boost GDP, providing a stimulus of several hundred billion dollars for the world economy. And the icing on the cake is that while the good guys win, the bad guys (Venezuela, Russia, Saudi Arabia, Iran, etc.) lose. Hopefully we'll see a knock-on effect where the mysterious money-and-weapons flow (where do all the Russian weapons and funding come from? No one knows, wink wink nod nod) to terrorist groups dries up. I'm sure it will be pure coincidence that the fiscal squeeze on the bad guys leads to a fiscal squeeze on the terrorist groups, right? Pure coincidence.