Africa’s debt dance with China in creating the Belt Road Initiative

By

Harry G. Broadman

Posted on April 21, 2021 11:14

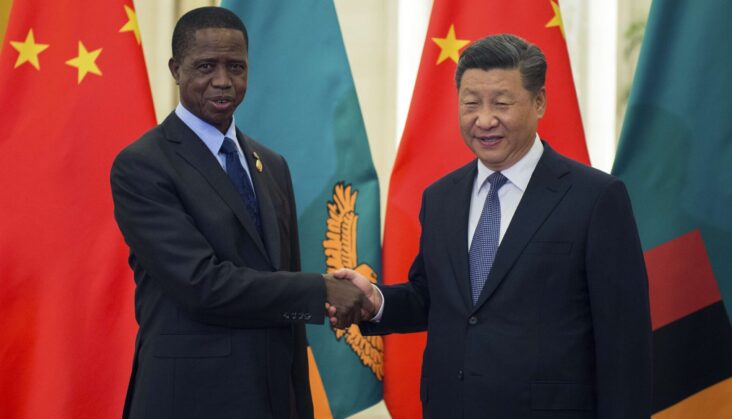

Zambia’s President Edgar Lungu, left, shake hands with China’s President Xi Jinping, in Beijing, China, Saturday, Sept. 1, 2018. (Nicolas Asfouri/Pool Photo via AP)

With more than half of the 60-plus recipient countries under China’s Belt Road Initiative (BRI) located in Africa, it’s hard to not commend the Chinese for their willingness to make significant investments to develop infrastructure on the continent.

After all, many advanced countries still have yet to fully grasp both the imperative to

help African countries grow through such investments and that substantial risk-adjusted returns can be earned from helping the continent close its long-standing “infrastructure gap.”

How financing works

However, that China’s financing of its BRI projects across Africa (as in the other emerging markets where the programme is underway), is

mostly comprised of loans to governments that are both very large and conditioned by signatories’ commitments to not fully disclose their terms, is cause for deep concern. The headlines in the past few months about Zambia’s struggle to repay its debt burden to China highlights just the most recent case in point.

READ MORE Zambia: IMF debt talks unlikely to stop Lungu from trying to pawn copper to China

Whether you applaud or are critical of China’s BRI in Africa or elsewhere, especially its impacts on recipient countries’ debt burdens, it is critical to assess the motives and conduct of both sides of these

sovereign-to-sovereign financial transactions: the lender, Beijing, and the borrowing government. Doing so will expose the questionable public policy judgments by leaders on the African continent who choose to sign on to carry such debt. As the old adage goes:

“it takes two to tango.”

Indeed, in many African states (as in other emerging markets), there are significant public governance gaps – a disjuncture between the incentives of the governing elites and those of society writ large. These pre-existing conditions need to be taken into account in assessing the roots, the effects, and potential solutions of Africa’s emerging BRI debt crisis.

READ MORE Is China weaponizing ports built along the Belt Road Initiative?

There should be no illusion that BRI’s projects in Africa are wholly altruistic. To some degree, that characteristic is not unlike other countries’ earlier initiatives to foster the economic development of nations – although largely outside emerging markets – whose economies have been ravaged by wars. Think the

US Marshall Plan.

Who stands to gain more?

There are key elements of the BRI that stand out starkly as having only the most rudimentary of camouflages for Beijing’s pursuit of unspoken (but not hard to guess) motives, including those that serve to benefit China more than the recipient countries.

The BRI is China’s vehicle by which it exports the excess capacity of, and the workers employed by the Communist Party’s lumbering state-owned enterprises (SOEs), to which

the Party is holding on for dear life. It is also what enables Beijing to gain access to raw materials abroad to fuel the Chinese economy.

Africa Insights

Wake up to the essential with the Editor's picks.

Sign up

Also receive offers from The Africa Report

Also receive offers from The Africa Report's partners

At the same time, China’s ruler, Xi Jinping has been obtuse about BRI’s implementation, exposing the program’s glaring contradictions. The most salient of these is rolling out the projects in an across-the-board fashion in many countries at once. This is at variance with

the way China engaged in its economic reforms since 1978: incrementally, collaboratively and through experimentation. These are the key ingredients utilized by Beijing over the decades to encourage its own population to believe in and support reforms. In effect, Mr Xi’s political ambitions for the

BRI are lacking “Chinese characteristics.”

The evidence of Mr Xi’s tin ear on this score is arguably most evident in Africa. At last count, BRI programs exist in 36 (or two-thirds of) African states. This points to the fact that through the BRI, China is laser-focused on trying to shape Africa’s economic development in its own image.

What do Africans think?

Many Africans with whom I have interacted on the continent over the last couple of decades, do appreciate China’s willingness to invest there. But the

true motives behind the BRI are now being questioned by a large share of them. They are not buying the notion that the initiative is simply a vehicle for Beijing’s exercise of “soft-power.’’

An increasingly large swath of the Africans deeply resent that decisions regarding project selection and design, the configuration of workers employed, and financing terms for Chinese projects, cater only to the interests of the continent’s political elite. They thus correctly view the

BRI as exacerbating deep pre-existing domestic social and political stratification on the continent.

It is the debt financing terms between the African governments and the Chinese government that are seen as particularly egregious. At present, the countries in Africa with the largest Chinese debt are Angola ($25bn), Ethiopia ($13.5bn), Zambia ($7.4bn), the Republic of Congo ($7.3bn), and Sudan (6.4bn).

The negative effects of China’s economic presence

It is bad enough that China’s lending entities, which are government-owned, do not disclose the terms of their lending to African countries.

It is even worse that African government leaders also agree to this. After all, terms of loans made to African countries by the IMF, the World Bank and the African Development Bank – all of which are also non-commercial institutions – are routinely made public.

READ MORE IMF/Georgieva: After austerity, it’s ‘spend, spend, spend’ at the Fund

I mention this because many writers mistakenly refer to the Chinese entities who make these loans to African and other emerging market governments – Beijing’s policy banks, the China Development Bank and the Export-Import Bank – as “private” creditors.

These entities are about as far away from the global private commercial banks as can be. Arguably they should be seen as “official” creditors.

Even worse is when China’s presence affords—even seemingly energises—local elites in Africa to veer away from the rule of law and renege on pre-existing contracts with incumbent foreign investors to Beijing’s advantage.

This not only results in massive and expensive investment disputes, but also has a lasting effect on souring the reputation and investment climate in the country to attract capital investment from other nations.

Djibouti is the poster child here.

It has

flouted the rules of international arbitration for an investment dispute settlement by unilaterally abrogating the 30-year port concession agreement for the Doraleh Container Terminal it had signed in 2006 with UAE’s DP World (DPW) and ceded control of DPW’s share to China Merchants.

READ MORE Djibouti is doing fine without DP World

After losing several cases on the matter, including before a tribunal comprised of members chosen jointly by the parties under the auspices of the London Court of International Arbitration, Djibouti is now bringing the case to a local court, contending that under domestic law the concession’s stipulations regarding international arbitration are illegal in Djibouti.

Bottom line

Around the world, government officials who are most revered by their populations, hugely successful in ushering in reforms that spur their country’s economic growth, and leave in their wake enviable legacies as great government leaders, are those who are always on the lookout for opportunities to instil confidence by engaging in transparent conduct.

Any African official therefore would do well to tell Chinese official lenders that it is on this basis that they will do business with them under the BRI.

To be clear, I am not naïve to think it will be a rare leader of an African country – or of many emerging markets – who is willing to do this. Many European or American businesspeople are also naïve or too timid to not push back against unreasonable commercial conditions imposed or supra-competitive prices charged (sometimes in the form of demand for bribes) by foreign governments – China’s or any other.

Still,

the dirty little secret of the BRI is that Beijing is far more desperate for it to succeed than are the potential recipients. African government leaders – as well as each country’s broader group of stakeholders – therefore, rather than behaving as supplicants should not be shy in voicing their concerns and negotiate in earnest with the Chinese on BRI’s terms and objectives.

Who knows, perhaps the BRI may well be able to help them move forward with their economic development objectives and dreams.

African leaders should try to be more vocal in negotiating China’s Belt Road Initiative financing terms, which at the moment do more for the financer.

www.theafricareport.com