How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Arab World and China Cooperation and News.

- Thread starter al-Hasani

- Start date

Saif al-Arab

BANNED

- Joined

- Mar 26, 2015

- Messages

- 8,873

- Reaction score

- 5

- Country

- Location

China and Saudi Arabia to cooperate on lunar explore. MOU for Chang E-4 lunar mission was signed between CNSA and KACST on 16 Mar.

Big news.

Big news.

Saif al-Arab

BANNED

- Joined

- Mar 26, 2015

- Messages

- 8,873

- Reaction score

- 5

- Country

- Location

People's Daily, China

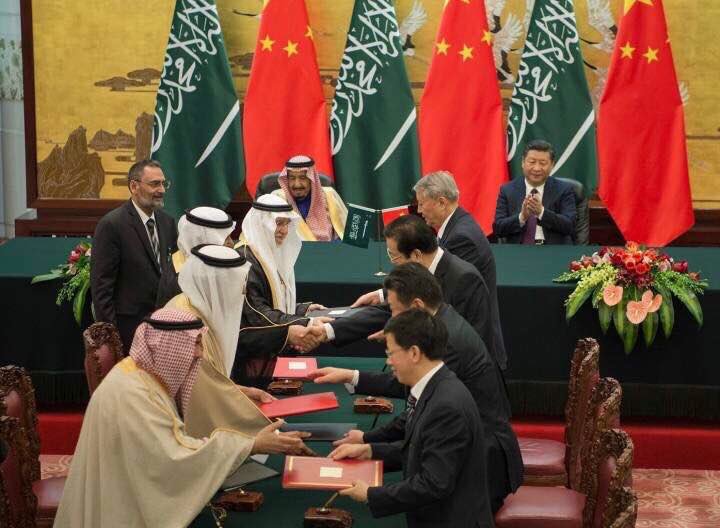

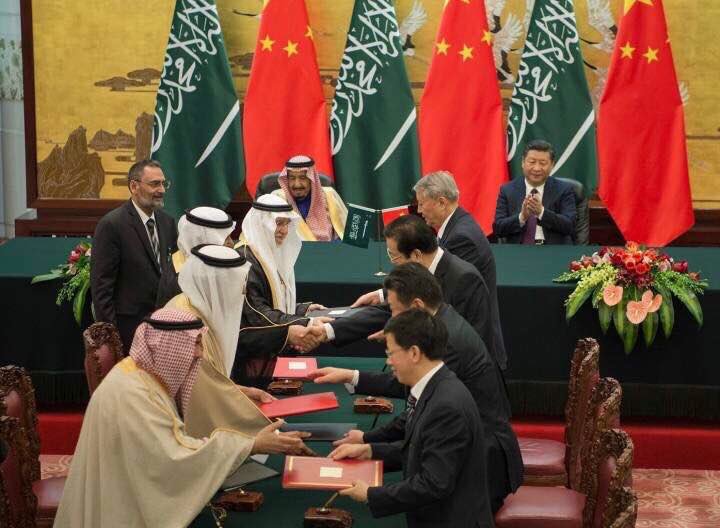

President Xi and Saudi #KingSalman oversee signing of deals worth US$65 billion

Chinese President #XiJinping held a welcoming ceremony for King Salman bin Abdulaziz Al Saud of Saudi Arabia at the Great Hall of the People in #Beijing on Thursday. The two heads of state oversaw the signing of deals worth potentially 65 billion US dollars.

China and Saudi Arabia signed 14 cooperative agreements during a visit by Saudi King Salman bin Abdulaziz Al Saud, said Chinese Vice Foreign Minister Zhang Ming on Thursday.

Those agreements covered a wide range of cooperation areas, said Zhang, noting that a memorandum of understanding on production capacity and investment cooperation between the two governments worth about 65 billion U.S. dollars involves 35 cooperative projects.

Very cordial as usual.

Saudi Arabia signs 21 MoUs with China, grants trading licenses for two companies

The key focus on the latest meeting on Thursday was to find further opportunities for Chinese investments in coordination with by Saudi Vision 2030 initiatives in multiple fields. (SPA)

Staff writer, Al Arabiya English

Thursday, 16 March 2017

At least 21 Memorandums of Understandings were signed in the latest Saudi-China Business Forum meeting that was attended by Saudi King Salman.

The key focus on the latest meeting on Thursday was to find further opportunities for Chinese investments in coordination with by Saudi Vision 2030 initiatives in multiple fields.

Also on Thursday, two Chinese companies – Shandong Tiangong Mechanical & Electrical Equipment Limited Company and ZTE – were granted licenses to invest and trade in Saudi Arabia.

Deputy Chinese Foreign Minister Zhang Ming said the agreements involved investment, energy, space and other areas.

King Salman, who has overseen the launch of an ambitious economic reform plan since his accession two years ago, is on a month-long Asian tour.

Boost of trade relations between East and West

Saudi King Salman Chinese President Xi Jinping also attended in Beijing the conclusion ceremony of Roads of Arabia Expo at China National Museum.

The King and the Chinese President toured the Expo containing ancient and rare artifacts which represent the long history of the Arabian Peninsula and introduce the civilizational dimensions of the Arabian Peninsula and the cultural heritage of the Kingdom of Saudi Arabia.

The artifacts displayed in the Expo cover the period extends from the Old Stone Age (one million years Before Christ (BC) since prehistoric times, and the establishment of the Saudi state until the reign of late King Abdulaziz, the founder of modern Saudi state.

China's efforts and Kingdom's participation in building the economic belt of Silk Road and Maritime Silk Road come to boost trade relations between the East and the West and increase the interaction between civilizations.

Last Update: Thursday, 16 March 2017 KSA 16:30 - GMT 13:30

https://english.alarabiya.net/en/bu...rabia-sign-agreements-worth-about-65-bln.html

President Xi and Saudi #KingSalman oversee signing of deals worth US$65 billion

Chinese President #XiJinping held a welcoming ceremony for King Salman bin Abdulaziz Al Saud of Saudi Arabia at the Great Hall of the People in #Beijing on Thursday. The two heads of state oversaw the signing of deals worth potentially 65 billion US dollars.

China and Saudi Arabia signed 14 cooperative agreements during a visit by Saudi King Salman bin Abdulaziz Al Saud, said Chinese Vice Foreign Minister Zhang Ming on Thursday.

Those agreements covered a wide range of cooperation areas, said Zhang, noting that a memorandum of understanding on production capacity and investment cooperation between the two governments worth about 65 billion U.S. dollars involves 35 cooperative projects.

Very cordial as usual.

Saudi Arabia signs 21 MoUs with China, grants trading licenses for two companies

The key focus on the latest meeting on Thursday was to find further opportunities for Chinese investments in coordination with by Saudi Vision 2030 initiatives in multiple fields. (SPA)

Staff writer, Al Arabiya English

Thursday, 16 March 2017

At least 21 Memorandums of Understandings were signed in the latest Saudi-China Business Forum meeting that was attended by Saudi King Salman.

The key focus on the latest meeting on Thursday was to find further opportunities for Chinese investments in coordination with by Saudi Vision 2030 initiatives in multiple fields.

Also on Thursday, two Chinese companies – Shandong Tiangong Mechanical & Electrical Equipment Limited Company and ZTE – were granted licenses to invest and trade in Saudi Arabia.

Deputy Chinese Foreign Minister Zhang Ming said the agreements involved investment, energy, space and other areas.

King Salman, who has overseen the launch of an ambitious economic reform plan since his accession two years ago, is on a month-long Asian tour.

Boost of trade relations between East and West

Saudi King Salman Chinese President Xi Jinping also attended in Beijing the conclusion ceremony of Roads of Arabia Expo at China National Museum.

The King and the Chinese President toured the Expo containing ancient and rare artifacts which represent the long history of the Arabian Peninsula and introduce the civilizational dimensions of the Arabian Peninsula and the cultural heritage of the Kingdom of Saudi Arabia.

The artifacts displayed in the Expo cover the period extends from the Old Stone Age (one million years Before Christ (BC) since prehistoric times, and the establishment of the Saudi state until the reign of late King Abdulaziz, the founder of modern Saudi state.

China's efforts and Kingdom's participation in building the economic belt of Silk Road and Maritime Silk Road come to boost trade relations between the East and the West and increase the interaction between civilizations.

Last Update: Thursday, 16 March 2017 KSA 16:30 - GMT 13:30

https://english.alarabiya.net/en/bu...rabia-sign-agreements-worth-about-65-bln.html

AZADPAKISTAN2009

ELITE MEMBER

- Joined

- Sep 8, 2009

- Messages

- 37,662

- Reaction score

- 68

- Country

- Location

Great diplomatic effort to expand business ties , the experience shows

Wow cooperation on Lunar Space mission , tremendous news for both countries did not see that coming so quickly

Wow cooperation on Lunar Space mission , tremendous news for both countries did not see that coming so quickly

Saif al-Arab

BANNED

- Joined

- Mar 26, 2015

- Messages

- 8,873

- Reaction score

- 5

- Country

- Location

People to people relations (Arab-East Asian/South East Asian relations)

Arab-Indonesian mix: (Nabila Syakieb)

https://id.wikipedia.org/wiki/Nabila_Syakieb

Fera Feriska (half Yemeni and half Chinese)

There are quite a lot of half Saudi and half Filipino/Malaysian/Indonesian children in KSA. Usually due to you know what. What is striking is that the Asian part is dominating although you can see that such people are mostly mixtures and what is better they turn out really beautiful in general. The women that is.

Miss Universe Philippines from 2015 was half Arab (Saudi) and half Filipino.

Half Arab (mostly Yemeni and Hijazi as almost all Arab Indonesians and Arab Malaysians are from Arabia originally) half Indonesian/Malaysian (Chinese origin)

Faith Alqahtani (half Saudi and half Filipino)

Her Instagram

https://www.instagram.com/faithalqahtani/

There have actually been quite a few Arab-Chinese intermarriages in the GCC, mainly UAE, of late due to the big Chinese diaspora in the UAE.

https://en.wikipedia.org/wiki/Chinese_people_in_the_United_Arab_Emirates

Also there are at least 200.000 people in KSA of Han Chinese origin (Hui mainly) who are citizens and expats. One of our generals is a Hui Chinese.

In Ta'if there is a whole neighborhood called Chinatown due to the many people of Chinese origin. Not many people know but now those who see this post will know.

Chinese cyclist visiting the Chinese Saudi Arabian community.

A well-known Chinese restaurant in Ta'if (one out of numerous) that is very good.

Ta'if is a beautiful Hijazi mountain town located almost 2000 meters above sea level. The climate is pleasant all year round.

https://en.wikipedia.org/wiki/Ta'if

Arab-Indonesian mix: (Nabila Syakieb)

https://id.wikipedia.org/wiki/Nabila_Syakieb

Fera Feriska (half Yemeni and half Chinese)

There are quite a lot of half Saudi and half Filipino/Malaysian/Indonesian children in KSA. Usually due to you know what. What is striking is that the Asian part is dominating although you can see that such people are mostly mixtures and what is better they turn out really beautiful in general. The women that is.

Miss Universe Philippines from 2015 was half Arab (Saudi) and half Filipino.

Half Arab (mostly Yemeni and Hijazi as almost all Arab Indonesians and Arab Malaysians are from Arabia originally) half Indonesian/Malaysian (Chinese origin)

Faith Alqahtani (half Saudi and half Filipino)

Her Instagram

https://www.instagram.com/faithalqahtani/

There have actually been quite a few Arab-Chinese intermarriages in the GCC, mainly UAE, of late due to the big Chinese diaspora in the UAE.

https://en.wikipedia.org/wiki/Chinese_people_in_the_United_Arab_Emirates

Also there are at least 200.000 people in KSA of Han Chinese origin (Hui mainly) who are citizens and expats. One of our generals is a Hui Chinese.

In Ta'if there is a whole neighborhood called Chinatown due to the many people of Chinese origin. Not many people know but now those who see this post will know.

Chinese cyclist visiting the Chinese Saudi Arabian community.

A well-known Chinese restaurant in Ta'if (one out of numerous) that is very good.

Ta'if is a beautiful Hijazi mountain town located almost 2000 meters above sea level. The climate is pleasant all year round.

https://en.wikipedia.org/wiki/Ta'if

Saif al-Arab

BANNED

- Joined

- Mar 26, 2015

- Messages

- 8,873

- Reaction score

- 5

- Country

- Location

A friendly remainder of what has been signed in the past 6 months and what has occurred between KSA and China.

MOHAMMED RASOOLDEEN | ARAB NEWS STAFF | Published — Tuesday 8 November 2016

KACTS President Prince Turki bin Saud bin Mohammed Al Saud and Wan Gang, Chinese minister of science and technology, in Beijing after their meeting on Sunday.

Prince Turki's statement was sent to Arab News from Beijing, where he attended the G-20 Science, Technology and Innovation Ministers’ Meeting this week.

The meeting was a follow-up to one held by Deputy Crown Prince Mohammed bin Salman, second deputy premier and minister of defense, in Beijing in September.

In his speech as head of the delegation, the prince said that the Kingdom views innovation as a key to develop talent, technology, infrastructure, investment, institutions and programs needed to take the country forward in a balanced manner.

Such features, he said, could promote innovative projects, enhance patent and marketing programs, set up incubators, produce accelerators for ownership programs for small and medium enterprises and help set up industrial centers.

During his meeting with Wan Gang, Chinese minister of science and technology, the prince stressed the importance of boosting cooperation between the two countries in various promising areas such as water, energy and materials, biotechnology, space and aviation technologies, and the need to expand this cooperation significantly to include the areas of innovation, technology incubators, and the creation of small- and medium-sized enterprises in the two countries.

KACST recently set up the Saudi-Chinese Center for technology transfer to promote small- and medium-sized enterprises in accordance with the Kingdom’s Vision 2030 and the National Program 2020.

Earlier this year, Chinese President Xi Jinping visited Saudi Arabia and signed several bilateral agreements to launch a new phase in relations between the two countries. Fourteen cooperation agreements were signed in different fields, including the economic belt and Silk Road, nuclear and renewable energy, combating terrorism and culture and industry.

China and the Kingdom agree on the principle of noninterference in the internal affairs of other countries and are aligned in their positions on major international and regional issues.

Saudi Arabia is the world’s largest oil exporter and the largest trading partner of China among Arab and Muslim countries, while China is also the largest trading partner of the Kingdom.

http://www.arabnews.com/node/1007821/saudi-arabia

Saudi Arabia and China have increased bilateral cooperation in recent months [Getty]

Date of publication: 7 November, 2016

Saudi Arabia and China have agreed to increase cooperation on security and counter-terrorism issues, following talks in Riyadh on Sunday between the two countries' leaders.

A five-year plan for security cooperation was signed between the two nations following talks involving King Salman al-Saud, Crown Prince Mohammed bin Naif and Deputy Crown Prince Mohammed bin Salman with Chinese President Xi Jinping.

This follows a deal struck between the two nations in August, when Mohammed bin Salman visited Beijing. This resulted in 15 preliminary agreements on areas ranging from housing to energy.

Saudi media outlets are touting the visit as part of the kingdom's economic overhaul which aims to reduce its reliance on oil experts.

To this end, Riyadh hopes that such visits will present the oil-rich kingdom as a hub for business and investment opportunities.

Last month, China and Saudi Arabia held their first joint military drills as part of Beijing's latest effort to strengthen ties with the Middle East.

China said it faces a growing threat from terrorism as its global footprint expands, as well as its diplomatic involvement in Middle Eastern affairs.

Members of each side's special forces took part in a fortnight of training focusing on combat skills and tactics near China's southwestern city of Chongqing.

https://www.alaraby.co.uk/english/news/2016/11/7/saudi-arabia-and-china-sign-security-pact

FOUZIA KHAN | Published — Thursday 17 November 2016

A delegation from the Chinese Consulate headed by the Chinese Commercial Consul Lee Chiang visited the Jeddah Chamber of Commerce and Industry on Monday.

JEDDAH: Saudi Arabia is a major partner in the Gulf and Middle East for China, and China is keen to raise economic ties and strategic relations between the two countries.

A delegation from the Chinese Consulate visited the Jeddah Chamber of Commerce (JCCI) for the promotion of International Trade, headed by the Chinese Commercial Consul Lee Chiang on Monday.

The delegates met with the acting Secretary-General Hassan bin Ibrahim Dahlan where they discussed aspects of the partnership, the development of investments, and economic and trade relations between the two countries at all levels.

China is willing to maintain the momentum of high-level exchanges, and synergize the One Belt, One Road Initiative with Saudi Arabia’s Vision 2030, said Lee.

Lee explained that there are a number of investment opportunities and aspects of joint cooperation. He expressed his country’s desire to establish a number of joint projects to strengthen the bonds of economic relations and be part of the efforts in confronting the economic challenges facing the region.

Chiang said China is looking forward to working with Saudi Arabia and boosting coordination in international and regional affairs, and wants to meet the aspirations of the leaderships and peoples of both countries, especially in light of the economic recovery experienced by the Kingdom and China.

He said China is one of the economic players in the international market; major Chinese companies and businesses are seeking cooperation with their counterparts in the Kingdom, especially in the areas of petrochemicals, natural gas, electricity generation, water desalination, transportation, telecommunications, and electronics.

He praised the qualitative leap made by Saudi-Chinese relations, as China ranked as first partner in trade and economic exchanges with Saudi Arabia in the Arab world.

He also pointed out that China’s economic and industrial momentum is diverse in the Asian market, and the Kingdom with its natural, industrial and economic resources is a leading partner for China.

Dahlan said Saudi-Chinese economic relations, and joint projects between the two countries are results of the comprehensive strategic partnership between the two countries.

He said the visit and meetings of officials in the private sector from both the countries, and the holding of exhibitions and exchanges of economic delegations, are important and necessary for development and mutual cooperation. Saudi and Chinese cooperation is fostered by the leadership of the two countries who are looking forward to increasing trade exchange.

He confirmed the readiness of the JCCI in the consolidation of commercial and industrial cooperation relations among Saudi business owners and their Chinese counterparts, and to provide everything that would expand the circle of this cooperation, and introduce investment opportunities available in the Kingdom, in general, and Jeddah in particular, and promote and attract local and international investors. The Kingdom has enormous available trade and investment opportunities in various regions of the Kingdom.

http://www.arabnews.com/node/1011826/saudi-arabia

Nov 7, 2016

Crown Prince Muhammad Bin Naif, deputy premier and minister of interior, hosts working luncheon with Special Envoy of Chinese President Meng Jianzhu. — SPA

Saudi Gazette report

RIYADH — A five-year action plan for cooperation in the field of security training between Saudi Arabia and China was signed here on Sunday.

The agreement was signed during a meeting between Crown Prince Muhammad Bin Naif, Deputy Premier and Minister of Interior, and Meng Jianzhu, member of the Politburo of the Central Committee, secretary of the Central Political Legal Committee, special envoy of the Chinese President.

http://saudigazette.com.sa/saudi-arabia/saudi-arabia-china-sign-security-cooperation-pact/

Nov 7, 2016

Custodian of the Two Holy Mosques King Salman received at Al-Yamama Palace in Riyadh on Sunday Meng Jianzhu, who is Member of the Politburo of the Communist Party of China, secretary of Central Political and Legal Affairs Commission and special envoy of the Chinese president.

Meng conveyed to the King the greetings of President Xi Jinping. In a separate meeting, King Salman received an invitation from Sheikh Mohammed Bin Zayed Al Nahyan, Crown Prince of Abu Dhabi and Deputy Supreme Commander of Armed Forces of United Arab Emirates.

The invitation was conveyed to the King by Ambassador of United Arab Emirates to the Kingdom Mohammed Saeed Al-Dhahiri. — SPA

http://saudigazette.com.sa/saudi-arabia/king-receives-special-envoy-chinese-president/

A lot has been happening in the past 2 months alone.

A few recent examples out of many:

ARAB NEWS | Published — Thursday 1 September 2016

ROBUST DEFENSE: Wing Loong drones will enhance Saudi forces’ capability to monitor borders.

JEDDAH: Saudi Arabia has signed a contract with China for the purchase of an unspecified number of pterodactyl planes, also known as Wing Loong or medium-altitude long-endurance unmanned drones, according to a report in Al-Watan newspaper.

The Chinese unmanned drones are modeled after MQ-1 Predator; they have surveillance capabilities and are able to carry two air-to-ground missiles.

According to the Global Times, the Kingdom is the first Arab country to obtain such types of drones, which were developed by Chengdu Aircraft Industry Group.

According to a press statement from the company last year, its drones are sold to four countries, including an unnamed country in Central Asia, while a series of negotiations are still going on with other potential clients.

The pterodactyl flies more than 4,000 km in 20 hours, and has a total payload capacity of up to 200 kg. It is equipped with laser-guided sensors.

http://www.arabnews.com/node/978446/saudi-arabia

Joint anti-terrorism drills held in China:

Arabic caligraphy and Chinese calligraphy is well-known across the world and also unique. Here is a wonderful video that blends those two unique styles.

https://en.wikipedia.org/wiki/Chinese_calligraphy

https://en.wikipedia.org/wiki/Arabic_calligraphy

https://en.wikipedia.org/wiki/Islamic_calligraphy

Made in China:

MOHAMMED RASOOLDEEN | ARAB NEWS STAFF | Published — Tuesday 8 November 2016

KACTS President Prince Turki bin Saud bin Mohammed Al Saud and Wan Gang, Chinese minister of science and technology, in Beijing after their meeting on Sunday.

Prince Turki's statement was sent to Arab News from Beijing, where he attended the G-20 Science, Technology and Innovation Ministers’ Meeting this week.

The meeting was a follow-up to one held by Deputy Crown Prince Mohammed bin Salman, second deputy premier and minister of defense, in Beijing in September.

In his speech as head of the delegation, the prince said that the Kingdom views innovation as a key to develop talent, technology, infrastructure, investment, institutions and programs needed to take the country forward in a balanced manner.

Such features, he said, could promote innovative projects, enhance patent and marketing programs, set up incubators, produce accelerators for ownership programs for small and medium enterprises and help set up industrial centers.

During his meeting with Wan Gang, Chinese minister of science and technology, the prince stressed the importance of boosting cooperation between the two countries in various promising areas such as water, energy and materials, biotechnology, space and aviation technologies, and the need to expand this cooperation significantly to include the areas of innovation, technology incubators, and the creation of small- and medium-sized enterprises in the two countries.

KACST recently set up the Saudi-Chinese Center for technology transfer to promote small- and medium-sized enterprises in accordance with the Kingdom’s Vision 2030 and the National Program 2020.

Earlier this year, Chinese President Xi Jinping visited Saudi Arabia and signed several bilateral agreements to launch a new phase in relations between the two countries. Fourteen cooperation agreements were signed in different fields, including the economic belt and Silk Road, nuclear and renewable energy, combating terrorism and culture and industry.

China and the Kingdom agree on the principle of noninterference in the internal affairs of other countries and are aligned in their positions on major international and regional issues.

Saudi Arabia is the world’s largest oil exporter and the largest trading partner of China among Arab and Muslim countries, while China is also the largest trading partner of the Kingdom.

http://www.arabnews.com/node/1007821/saudi-arabia

Saudi Arabia and China have increased bilateral cooperation in recent months [Getty]

Date of publication: 7 November, 2016

Saudi Arabia and China have agreed to increase cooperation on security and counter-terrorism issues, following talks in Riyadh on Sunday between the two countries' leaders.

A five-year plan for security cooperation was signed between the two nations following talks involving King Salman al-Saud, Crown Prince Mohammed bin Naif and Deputy Crown Prince Mohammed bin Salman with Chinese President Xi Jinping.

This follows a deal struck between the two nations in August, when Mohammed bin Salman visited Beijing. This resulted in 15 preliminary agreements on areas ranging from housing to energy.

Saudi media outlets are touting the visit as part of the kingdom's economic overhaul which aims to reduce its reliance on oil experts.

To this end, Riyadh hopes that such visits will present the oil-rich kingdom as a hub for business and investment opportunities.

Last month, China and Saudi Arabia held their first joint military drills as part of Beijing's latest effort to strengthen ties with the Middle East.

China said it faces a growing threat from terrorism as its global footprint expands, as well as its diplomatic involvement in Middle Eastern affairs.

Members of each side's special forces took part in a fortnight of training focusing on combat skills and tactics near China's southwestern city of Chongqing.

https://www.alaraby.co.uk/english/news/2016/11/7/saudi-arabia-and-china-sign-security-pact

FOUZIA KHAN | Published — Thursday 17 November 2016

A delegation from the Chinese Consulate headed by the Chinese Commercial Consul Lee Chiang visited the Jeddah Chamber of Commerce and Industry on Monday.

JEDDAH: Saudi Arabia is a major partner in the Gulf and Middle East for China, and China is keen to raise economic ties and strategic relations between the two countries.

A delegation from the Chinese Consulate visited the Jeddah Chamber of Commerce (JCCI) for the promotion of International Trade, headed by the Chinese Commercial Consul Lee Chiang on Monday.

The delegates met with the acting Secretary-General Hassan bin Ibrahim Dahlan where they discussed aspects of the partnership, the development of investments, and economic and trade relations between the two countries at all levels.

China is willing to maintain the momentum of high-level exchanges, and synergize the One Belt, One Road Initiative with Saudi Arabia’s Vision 2030, said Lee.

Lee explained that there are a number of investment opportunities and aspects of joint cooperation. He expressed his country’s desire to establish a number of joint projects to strengthen the bonds of economic relations and be part of the efforts in confronting the economic challenges facing the region.

Chiang said China is looking forward to working with Saudi Arabia and boosting coordination in international and regional affairs, and wants to meet the aspirations of the leaderships and peoples of both countries, especially in light of the economic recovery experienced by the Kingdom and China.

He said China is one of the economic players in the international market; major Chinese companies and businesses are seeking cooperation with their counterparts in the Kingdom, especially in the areas of petrochemicals, natural gas, electricity generation, water desalination, transportation, telecommunications, and electronics.

He praised the qualitative leap made by Saudi-Chinese relations, as China ranked as first partner in trade and economic exchanges with Saudi Arabia in the Arab world.

He also pointed out that China’s economic and industrial momentum is diverse in the Asian market, and the Kingdom with its natural, industrial and economic resources is a leading partner for China.

Dahlan said Saudi-Chinese economic relations, and joint projects between the two countries are results of the comprehensive strategic partnership between the two countries.

He said the visit and meetings of officials in the private sector from both the countries, and the holding of exhibitions and exchanges of economic delegations, are important and necessary for development and mutual cooperation. Saudi and Chinese cooperation is fostered by the leadership of the two countries who are looking forward to increasing trade exchange.

He confirmed the readiness of the JCCI in the consolidation of commercial and industrial cooperation relations among Saudi business owners and their Chinese counterparts, and to provide everything that would expand the circle of this cooperation, and introduce investment opportunities available in the Kingdom, in general, and Jeddah in particular, and promote and attract local and international investors. The Kingdom has enormous available trade and investment opportunities in various regions of the Kingdom.

http://www.arabnews.com/node/1011826/saudi-arabia

Nov 7, 2016

Crown Prince Muhammad Bin Naif, deputy premier and minister of interior, hosts working luncheon with Special Envoy of Chinese President Meng Jianzhu. — SPA

Saudi Gazette report

RIYADH — A five-year action plan for cooperation in the field of security training between Saudi Arabia and China was signed here on Sunday.

The agreement was signed during a meeting between Crown Prince Muhammad Bin Naif, Deputy Premier and Minister of Interior, and Meng Jianzhu, member of the Politburo of the Central Committee, secretary of the Central Political Legal Committee, special envoy of the Chinese President.

http://saudigazette.com.sa/saudi-arabia/saudi-arabia-china-sign-security-cooperation-pact/

King receives special envoy of Chinese president

Nov 7, 2016

Custodian of the Two Holy Mosques King Salman received at Al-Yamama Palace in Riyadh on Sunday Meng Jianzhu, who is Member of the Politburo of the Communist Party of China, secretary of Central Political and Legal Affairs Commission and special envoy of the Chinese president.

Meng conveyed to the King the greetings of President Xi Jinping. In a separate meeting, King Salman received an invitation from Sheikh Mohammed Bin Zayed Al Nahyan, Crown Prince of Abu Dhabi and Deputy Supreme Commander of Armed Forces of United Arab Emirates.

The invitation was conveyed to the King by Ambassador of United Arab Emirates to the Kingdom Mohammed Saeed Al-Dhahiri. — SPA

http://saudigazette.com.sa/saudi-arabia/king-receives-special-envoy-chinese-president/

A lot has been happening in the past 2 months alone.

A few recent examples out of many:

ARAB NEWS | Published — Thursday 1 September 2016

ROBUST DEFENSE: Wing Loong drones will enhance Saudi forces’ capability to monitor borders.

JEDDAH: Saudi Arabia has signed a contract with China for the purchase of an unspecified number of pterodactyl planes, also known as Wing Loong or medium-altitude long-endurance unmanned drones, according to a report in Al-Watan newspaper.

The Chinese unmanned drones are modeled after MQ-1 Predator; they have surveillance capabilities and are able to carry two air-to-ground missiles.

According to the Global Times, the Kingdom is the first Arab country to obtain such types of drones, which were developed by Chengdu Aircraft Industry Group.

According to a press statement from the company last year, its drones are sold to four countries, including an unnamed country in Central Asia, while a series of negotiations are still going on with other potential clients.

The pterodactyl flies more than 4,000 km in 20 hours, and has a total payload capacity of up to 200 kg. It is equipped with laser-guided sensors.

http://www.arabnews.com/node/978446/saudi-arabia

Joint anti-terrorism drills held in China:

Arabic caligraphy and Chinese calligraphy is well-known across the world and also unique. Here is a wonderful video that blends those two unique styles.

https://en.wikipedia.org/wiki/Chinese_calligraphy

https://en.wikipedia.org/wiki/Arabic_calligraphy

https://en.wikipedia.org/wiki/Islamic_calligraphy

Made in China:

Saif al-Arab

BANNED

- Joined

- Mar 26, 2015

- Messages

- 8,873

- Reaction score

- 5

- Country

- Location

SAUDI ARABIA

Saudi Vision 2030 provides mutual opportunity, says Chinese envoy

ARAB NEWS | Published — Friday 19 January 2018

Chinese ambassador to Saudi Arabia, Li Huaxin

RIYADH: The Chinese ambassador to Saudi Arabia, Li Huaxin, has said that his country considers Vision 2030 an opportunity for integration between the two countries, and that China’s Belt and Road Initiative (BRI) is compatible with it.

In a press statement, Li said that a visit to China by the Saudi justice minister and chairman of the Supreme Judicial Council, Walid Al-Samaani, represented a new round in consolidating bilateral relation.

“The two sides discussed a draft agreement for civil and commercial judicial cooperation between the two countries. This agreement is co-welcomed because the Kingdom’s Vision 2030 and its programs represent a great opportunity to deepen partnerships and commercial exchanges,” Li said.

The ambassador added that legal measures taken by the Saudi government against corruption were part of an ambitious initiative to clean up the investment environment for the benefit of all partners, including Chinese companies.

“The new steps taken by the Ministry of Justice in launching commercial courts in different regions reflect tangible evidence that the Kingdom is a state of law, and sends a message to the world that it is working to establish rights and justice in order to support the investment environment in the Kingdom,” he said.

In 2016, bilateral trade reached $43 billion.

In the cultural field, Li said that the two sides had agreed to translate 50 Saudi books into Chinese and 50 Chinese books into Arabic.

http://www.arabnews.com/node/1228841/saudi-arabia

Uranium mining in KSA (KSA is rumored to have one of the largest uranium reserves in the world) have begun in KSA with Chinese partners.

https://mobile.sabq.org/nYgFcv

Nuclear Power Saudi Arabia’ Uranium Mining began

Saudi Arabia and South Korea has agreement between them to develop the world's smallest nuclear power plant with output of 100mw.

By

admin

December 17, 2017

Saudi Arabia starts Uranium mining project

ONGOING NUCLEAR POWER TUSSLE BETWEEN COUNTRIES IN THE MIDDLE EAST IS EXPANDING WITH SAUDI ARABIA JOINING IN THE LIST.

Saudi Arabian Kingdom recently inaugurated Uranium excavation project with the help of China.

In January this year Saudi Arabia hinted at development of Uranium mining projects initiatives as part of National Transformation Project by 2030. The Arabian Kingdom already finalized Uranium mining projects in several locations.

Plan is to mine Uranium and make Saudi Arabia a self sufficient nuclear power. Saudi Arabia and South Korea has agreement between them to develop the world’s smallest nuclear power plant with output of 100mw. These one of a kind power plants can be installed in several parts of the Saudi Kingdom.

For Self reliance Saudi Arabia identified several locations in many regions of Saudi Arabia. Saudi Arabia also worked out a clear regulation systems that could control all the future nuclear power plants. As per some reports available with Defence Network team the initial goal is to achieve 80 GW of electricity generation per year as soon as possible. Later reach their ultimate goal of producing 100GW of electricity by 2030.

Saudi Electricity Company owns majority of power generation of the kingdom. Plan is in place to divide the SEC in to several companies.

KA Care – The King Abdullah Center for Atomic and Renewable Energy was intended to bring all renewable and nuclear power plant under single entity which will be responsible mega projects for the future power generations such as solar power plants and Nuclear reactors.

But it is still unclear which company will take over nuclear power generation.

Nuclear Atomic reactors requires enriched Uranium of around 5% purity. But with this same process by enriching heavy metals can produce enough material for weapons.

This is seen as a grave concern by western countries as religion enemies Iran and Saudi Arabia joining nuclear elite make matters even worse than it is today’s. But with signing of nuclear agreements with Iran and western countries, Iran agreed to put an hold on their work towards nuclear power for the next 15 years. As per the agreement Iran can enrich Uranium of below 4% purity which is enough for commercial power generation.

With this new thrust on mining Uranium Saudi Arabia will be the second country with nuclear power in the region UAE. But soon it is expected that many other countries will join the list starting from United Arab Emirates. UAE set to start its first nuclear reactors built by South Korean company. Reactor will start its operation in late 2018. UAE on its part committed itself not to enrich Uranium or reprocess the spent fuel to make them weapon grade.

Saudi Arabian Kingdom is planning to build 17 to 19 nuclear power plants by 2030. Opening up nuclear power plant manufacturing sectors to crowd king’s palaces for lucrative deals.

As per preliminary investigation reports states that Saudi Arabia has consists Uranium ore deposits of 60,000 Tones.

Why nuclear power plant?

Kingdom believes that nuclear power generations are cost effective, greener in futuristic point of view. Saudi Arabia is one of the world’s largest exporter of petroleum products. Tapping on nuclear energy or Atomic power generation is a move to diversifying its energy procurement. It is expected that Saudi Arabia will sign its first contract for two nuclear power plant by 2018. Mining of Uranium ore is seen as initiative to become self sufficient in nuclear fuel production to power their nuclear plants without any hindrance from western countries.

https://www.defencenet.in/nuclear-power-saudi-arabia-uranium-mining-began/

Old news from September 2017 but not covered in this thread;

China says its bilateral relations with Saudi Arabia have entered a new era.

Chinese Vice Premier Zhang Gaoli made a three-day visit to Saudi Arabia from August 23 to August 25. During his visit, China and Saudi signed a series of deals worth nearly $70 billion. Zhang said that China-Saudi Arabia cooperation was going to enter a new, more robust, sustainable, and fruitful era.

China and Saudi Arabia’s relationship is getting significantly warmer recently. Days Before Zhang’ visit, Saudi Minister of Energy, Industry, and Mineral Resources Khalid Al-Faleh had just visited Beijing and met with Zhang on August 18. In the meeting, both sides vowed to strengthen economic ties.

Soon, Zhang met Khalid Al-Faleh again in Jeddah on August 24. During the meeting, Al-Faleh revealed that China and the Kingdom had signed 60 various agreements and memoranda of understanding worth nearly $70 billion, according to Saudi Arabian news agency SPA. China’s news agency Xinhua said the agreements covered investment, trade, energy, postal service, communications, and media.

Enjoying this article? Click here to subscribe for full access. Just $5 a month.

Besides Al-Faleh, the two most important figures Zhang met were Saudi King Salman bin Abdulaziz Al Saud and Saudi Crown Prince Mohammed bin Salman.

The meeting with the crown prince is particularly noteworthy. As King Salman’s favorite son, Mohammed was just appointed crown prince in June 2017. As first deputy prime minister, minister of defense, and president of the Council for Economic and Development Affairs, the crown prince, 31, is the de facto person in charge of Saudi foreign policy, security and the oil industry—the country’s main source of wealth. He is also known for his ambition, or—from perspective of his critics—aggression.

Showing his ambition for the country, the crown prince in 2016 initiated a national strategy called “Vision for 2030,” aiming to make the Kingdom a global investment powerhouse and the heart of the Arab and Islamic world while also diversifying the country’s economy, which is heavily dependent on oil.

His vision seems to match well with China’s Belt and Road Initiative, which was put forward by Chinese President Xi Jinping in 2013.

Since 2016, the crown prince has started to pave the road to cooperating with China. In August 2016, he led a committee to Beijing, met President Xi Jinping and signed 15 agreements with his Chinese counterpart. The trip was seen as the start of a closer relationship between China and Saudi Arabia.

Thediplomat

Related thread;

https://defence.pk/pdf/threads/chin...ys-its-bilateral-relations-with-ksa-h.516410/

President praises 'friends' at Arab expo

By Wu Yunhe and Guo Shaoyu in Yinchuan | China Daily | Updated: 2017-09-07 09:00

President Xi Jinping called the Arab states "good friends" and important partners in constructing the Belt and Road in his letter of congratulations to the 2017 China-Arab States Expo.

The expo, which brings together Chinese and Arab business leaders to cooperate on science, finance, energy, agriculture, healthcare, tourism and culture, opened on Wednesday in Yinchuan, capital of the Ningxia Hui autonomous region.

The president also hailed the cooperation and achievements between the two sides.

http://www.chinadaily.com.cn/cndy/2017-09/07/content_31669637.htm

Interview: China-Saudi Arabia ties rapidly developing: Chinese Ambassador

Source: Xinhua| 2017-08-23 09:50:29|Editor: Yang Yi

by Xinhua writers Xia Yuanyi, Wang Bo

RIYADH, Aug. 23 (Xinhua) -- The Chinese Embassy in Saudi Arabia is often a hub of activity with diplomatic missions and events, evidence of ties warming up between the two countries, said Li Huaxin, Chinese Ambassador to Saudi Arabia.

"In January, 2016, President Xi (Jinping) visited Saudi Arabia and announced the lifting of bilateral ties to a comprehensive strategic partnership in a joint communique with Saudi King Salman bin Abdulaziz Al Saud. From then on, our relations have quickly developed," the ambassador said in a recent interview with Xinhua.

The West Asian country has been China's top crude oil supplier for many years straight. Meanwhile, the latter is the former's biggest business partner, with bilateral trade reaching 42.36 billion U.S. dollars in 2016, according to Chinese official figures.

After more than 140 Chinese enterprises began tapping Saudi Arabia's markets, including in the energy, housing, construction and telecommunication industries, the "1+2+3" model has taken shape, said Li.

Specifically, the model refers to the energy industry as the core of business ties, with two supporting industries, namely infrastructure, and trade and investment, and three emerging, cutting-edge trade areas, mainly nuclear power, aerospace and renewable energy rounding out the center.

The ambassador also said that in the four years since the Belt and Road Initiative was put forward by China in 2013, Saudi Arabia has emerged as an important player along its route.

"The two partners bilaterally cooperate not only on economic and trade, but also on culture and education," Li said.

In 2013, Saudi Arabia hosted the Janadriyah Heritage Festival at the Janadriyah town, 45 miles (72.4 km) away from the capital Riyadh, in which China, as that year's "guest of honor," exhibited more than 30 traditional arts and 600-plus exquisite articles, attracting a sea of local residents.

Three years later, an exhibition titled "The Arab Road" displaying Saudi Arab's cultural relics was held at the National Museum of China, with 466 pieces of treasures on show, among which were several "Made-in-China" ceramics, tokens of the once bustling ancient Silk Road.

In March, King Salman attended the opening ceremony of the Peking University Branch of the King Abdul-Aziz Public Library during his state visit to China. The following month, China displayed some of its intangible cultural heritage in Saudi Arabia.

"The next step for the two great civilizations is to organize a Chinese Cultural Week together in Riyadh and Jeddah to promote mutual understanding through more performances and exchange visits," the ambassador said.

He added that in a bid to facilitate some young people in Saudi Arabia to learn the Chinese language and culture, the China National Office for Teaching Chinese as a Foreign Language is in talks with King Saud University about offering Chinese language classes. The university is the largest in the country.

Li says the first team of Chinese teachers will soon come to Saudi Arabia as cultural go-betweens.

"Because top leaders from both sides value bilateral ties and we are facing significant historical opportunities for development, bilateral cooperation will only go further," Li said, adding "both peoples will benefit from this progress."

http://news.xinhuanet.com/english/2017-08/23/c_136548057.htm

China, Saudi Arabia agree to build energy cooperation mechanisms

Xinhua | Updated: 2017-08-25 14:20

JEDDAH - China and Saudi Arabia agreed on Thursday to set up a package of bilateral energy cooperation mechanisms.

The agreement was reached when Chinese Vice-Premier Zhang Gaoli met with Saudi Crown Prince Mohammed bin Salman in the Saudi Red Sea resort of Jeddah during Zhang's visit to the Gulf Arab country.

Also during the talks, the two compared notes and reached broad consensus on bilateral cooperation in the fields of energy, finance and industrial capacity, among others.

They vowed to push forward a sea water desalination project using high temperature gas-cooled reactors, as well as a Chinese industry park in Saudi Arabia's southern border region of Jizan, and support the construction of a power plant in the western Saudi coastal town of Rabigh.

The two sides also agreed to promote cooperation over petrochemical projects and security matters, and enhance international coordination so as to further boost their bilateral comprehensive strategic partnership.

Also on Thursday, Zhang and Mohammed co-chaired the second meeting of a high-level steering committee, a regular meeting mechanism set up during Chinese President Xi Jinping's state visit to the Gulf Arab country last year.

The two co-hosted the first meeting of the committee in Beijing last August.

At the second meeting, the two sides agreed that the two countries have maintained close high-level exchanges, noting that Saudi King Salman bin Abdulaziz Al Saud visited China while a number of Chinese leaders have visited Saudi Arabia.

They also agreed that the two countries have made smooth progress in key projects, and signed 30 major projects over industrial capacity and investment cooperation.

Two-way trade has developed soundly with Saudi Arabia being China's largest trading partner in the region of West Asia and North Africa over the past 15 years.

Both sides pledged to strengthen coordination and communication on such multilateral platforms as the UN and the Group of 20 gatherings on major issues that concern the world system and order as well as the rights and interests of developing countries in a bid to cement strategic trust.

Beijing and Riyadh also vowed to further synergize their development strategies, and promote practical cooperation and cultural and people-to-people exchanges for shared benefits and win-win results.

They were also committed to stronger cooperation and exchanges in the fields of culture, education, health, technology, tourism and journalism.

After the meeting, the two sides signed the minutes of the meeting, and the two leaders witnessed the signing of a host of cooperation agreements involving investment, trade, energy, postal service, communications and media.

Earlier in the day, the Chinese vice-premier met with King Salman.

Saudi Arabia is the second leg of Zhang's four-nation tour which has already taken him to Kuwait. He will also travel to Sudan and Namibia.

http://www.chinadaily.com.cn/business/2017-08/25/content_31099957.htm

Wonderful news.

Over 250 deals signed at China-Arab States Expo

Source: Xinhua| 2017-09-08 14:28:25|Editor: Yang Yi

YINCHUAN, Sept. 8 (Xinhua) -- A total of 253 deals worth about 186.05 billion yuan (around 28 billion U.S. dollars) had been signed so far at the third China-Arab States Expo in northwest China's Ningxia Hui Autonomous Region.

The agreements involve agriculture and food processing, new materials, equipment manufacturing, bio-pharmaceuticals, chemical industry, textiles, industrial park construction and modern services.

The new cooperation is expected to forge closer ties between China and Arab states, and add momentum to the Belt and Road Initiative.

The expo, which kicked off Wednesday in Ningxia's capital Yinchuan and will run until Saturday, is sponsored by the Ministry of Commerce, the China Council for the Promotion of International Trade and the regional government of Ningxia.

http://news.xinhuanet.com/english/2017-09/08/c_136594315.htm

Economic Watch: China-Arab industrial cooperation gathers steam

Source: Xinhua| 2017-09-08 13:38:03|Editor: Yang Yi

YINCHUAN, Sept. 8 (Xinhua) -- Yahya Jabri, chairman of a China-Oman industrial park, is briefing investors on Oman's sound business environment at a trade and investment expo in northwest China.

"As a WTO member, we have rolled out a string of favorable policies for investment. Besides oil, we enjoy an advantageous location, a good deepwater port, and complete ship-repairing facility," Jabri says. "Goods transported via Duqm will reach 22 million tonnes in the next decade ... The country will be the gate of North Africa." Oman welcomes more Chinese entrepreneurs to set up joint ventures or solely foreign-owned businesses, he says.

Although still under construction, Jabri's industrial zone is expected to be an exemplary project in China-Arab industrial cooperation. With the foundation stone laid in April, it is designed to develop into a logistics center, commercial harbor and tourist site for the Arabian Sea, covering an area of nearly 1,200 hectares in coastal Duqm.

Investment agreements worth 3.8 billion U.S. dollars were signed between companies of the two sides.

"Total capital poured in will amount to 11 billion dollars in 10 years, and 12,000 jobs will be created for local people," Jabri says.

From the Gulf of Suez in Egypt to Jazan of Saudi Arabia, similar projects were sprouting in Arab countries. After years of stable trade in crude and other goods, the two sides have moved to channel more energy into capacity and technology transfers to forge closer economic ties and reap bigger mutual benefits.

"With huge market potential and unique natural resources, Arab economies are complementary to China," says Chen Zhou, vice president of the China Council for the Promotion of International Trade. "The new cooperation not only allows China to give full play to its competitive industries but helps Arab countries improve infrastructure and build a more sophisticated economic structure."

Abdulrahman al-Saleh, adviser to the Minister of Housing of Saudi Arabia, said he backed such cooperation as it met the needs of the country to transform the economy. Saudi Arabia released an ambitious plan last year to wean off reliance on oil, and to develop education, the arms industry, real estate and tourism.

At the ongoing China-Arab States Expo held in Yinchuan, capital of Ningxia Hui Autonomous Region, 22 contracts on industrial capacity cooperation were signed to pour 17.1 billion yuan (more than 2.5 billion U.S. dollars) into projects ranging from infrastructure to textile and food processing in countries including Oman, United Arab Emirates and Iraq.

Besides traditional projects on energy and resources, Chinese and Arab businesses have started to explore more sectors, such as chemical industry, telecommunication and manufacturing, says Li Shaotong, an official of the Ministry of Commerce.

The global drive of China's high tech sectors, including equipment manufacturing and clean energy, is promising, Chen says.

Driven by robust industrial cooperation, China-Arab investment is surging. A total of 1.1 billion U.S. dollars of non-financial direct investment was made by Chinese companies in Arab states in 2016, up 74.9 percent year on year.

China has signed agreements on industrial capacity cooperation with 37 countries around the world, including Arab countries, says Liu Xia, an official of the National Development and Reform Commission.

By the end of 2016, two Chinese policy banks had issued loans worth 110 billion U.S. dollars for overseas corporate investment along the Belt and Road, and Chinese banks had set up 62 branches in 26 countries.

Running until Saturday, the four-day biennial expo is a significant platform for China and Arab countries to bolster ties.

http://news.xinhuanet.com/english/2017-09/08/c_136594176.htm

Economic Watch: China-Arab economic ties get B&R boost

Source: Xinhua| 2017-09-07 01:18:37|Editor: Liu

YINCHUAN, Sept. 6 (Xinhua) -- According to Abdulrahman Al-Basri, very few Chinese companies worked on contract in Saudi Arabia 10 years ago. Today, Chinese workers are everywhere.

From skyscrapers to oil rigs, Chinese companies in Saudi Arabia work swiftly and cost-effectively.

"We would welcome more engineering companies from China, as well as IT and others," Al-Basri, vice president of SABIC, a Riyadh-based chemical company, said Wednesday at the business session of the ongoing China-Arab States Expo in northwest China.

The corporate executive is far from the only one encouraged by closer China-Arab ties at the gathering in Yinchuan, capital of Ningxia Hui Autonomous Region.

Running till Saturday, the four-day expo has assembled executives from over 1,000 companies and nearly 5,000 exhibitors from 31 industries ranging from transportation to big data, along with government representatives and academics. The event has been held three times since 2013, the year the Belt and Road Initiative was proposed.

Economic ties between the two sides were steady, but the Belt and Road Initiative shifted cooperation into another gear.

The expo is important to expanding cooperation, Kamal Hassan Ali, assistant secretary general for economic affairs of the Arab League, told the opening gathering.

A total of 321 deals in science and technology, finance, energy, agriculture, health, tourism, culture and education were made during previous events, with total contract worth tens of billions of U.S. dollars.

China-Arab trade reached 171 billion U.S. dollars in 2016, and agreements on projects worth 40 billion dollars were signed between the two sides, up 40.8 percent from 2015. China's non-financial direct investment in Arab countries surged 74.9 percent.

At the junction of the Belt and Road that spans across Eurasia, Arab countries are eager to revitalize ancient trade routes, Egyptian Trade and Industry Minister Tarek Kabil said.

Six Arab states signed agreements with China on the Belt and Road and seven are founding members of the Asian Infrastructure Investment Bank. Joint infrastructure projects were worth 46 billion U.S. dollars last year.

"The Belt and Road has created new opportunities and offers a better business environment for both Chinese and Arab companies," said Ding Hongxiang, vice president of China National Machinery Industry Corporation (Sinomach), a Fortune 500 company.

Entering Arab markets more than 30 years ago, Sinomach has a solid presence there, with infrastructure projects ranging from power plants to schools and hospitals. Projects valued at 3.8 billion U.S. dollars are still in progress.

Chinese firms have channeled investment and production capacity that is badly needed for the industrialization of Middle East, Kabil said.

"We hope to attract Chinese businesses to build industrial parks... to help the development of textile, furniture, electronics and chemical industries," Kabil said, promising favorable measures including tax breaks and shortened approval procedures.

http://news.xinhuanet.com/english/2017-09/07/c_136589764.htm

Xi sends letter of congratulations to China-Arab States Expo

Source: Xinhua| 2017-09-06 14:27:15|Editor: Yang Yi

YINCHUAN, Sept. 6 (Xinhua) -- Chinese President Xi Jinping has sent a letter of congratulations to the China-Arab States Expo, which opened Wednesday in Yinchuan, capital of northwest China's Ningxia Hui Autonomous Region.

Noting that China and the Arab states are "good friends," Xi said the two sides had become important partners in the construction of the Belt and Road.

He also hailed the ever broader cooperation and achievements between the two sides.

Xi said the Arab world actively responded to and widely supported his proposal that the Belt and Road should be built as a road of peace, prosperity, opening up as well as innovation, and one that connects different civilizations, during the Belt and Road Forum for International Cooperation, which was held in Beijing this May.

The expo is an important platform for China and Arab countries to expand cooperation, he said.

During the construction of the Belt and Road, China is willing to promote shared opportunities with other countries, including the Arab states, and jointly promote peace with them, Xi added.

http://news.xinhuanet.com/english/2017-09/06/c_136588545.htm

Why China sets an example for Saudi’s MSCI inclusion

China’s inclusion in MSCI’s main indices can provide lessons for Saudi Arabia

Finance

Investors across the Middle East are trying to figure out how many billions of dollars will flow to Saudi Arabia’s traded companies if it is eventually included in the MSCI Emerging Markets index, following MSCI’s recent move to add the kingdom to its watch list for a potential upgrade in 2018.

Earlier this year, Arqaam Capital estimated inflows of approximately $10.6bn into the Saudi market as a result of MSCI inclusion. Globally, more than $1.5 trillion in assets are benchmarked by money managers to the MSCI Emerging Markets Index family.

A good direction to look for indicative results is further east. MSCI’s decision to include mainland China shares in its main indices in the same review earlier this year is a minor tremor in the global investment landscape, but bigger seismic activity could come later.

Chinese domestic equities – A shares – will account for just over 0.7 per cent of the MSCI Emerging Market stock index when they enter the benchmark in the middle of next year.

In the near term, that doesn’t add up to a dramatic shift in global equity portfolios. But over the long run, it could be that the decision proves as transformative for the international capital markets as China’s 2011 inclusion in the World Trade Organisation (WTO).

In endorsing Beijing’s efforts to open up China’s securities to foreign investors, the MSCI could facilitate the country’s climb to the top tier of global financial markets in a number of ways.

For one thing, market reforms in the world’s second largest economy can now be expected to gather pace. The recent launch of a direct trading link between Shenzhen and Hong Kong exchanges and a reduction in trading suspensions are the beginning of what we believe will be a much deeper financial and regulatory overhaul.

What’s more, the emergence of an open and efficient stock market could help put the Chinese economy on a more sustainable footing by encouraging domestic firms to use equity as a source of finance rather than debt. As things stand, corporate borrowing amounts to an eye-watering 156 per cent of GDP in China. This ought to give international investors even greater confidence in Chinese securities.

In Saudi Arabia, a similar story is unfolding. The government is already undertaking dramatic privatisation efforts to wean the Kingdom off oil, spearheaded by the Saudi Vision 2030 economic plan, and characterised by the upcoming listing of Saudi Aramco – expected to be the world’s largest IPO.

Inclusion of the kingdom’s stock exchange – the Tadawal – to the MSCI would further improve financial regulatory standards and give international investors greater confidence in Saudi securities.

Saudi Arabia is already making quick progress. In September 2016, a new version of rules supporting an increase in Qualified Foreign investors was implemented. This was followed by a series of progressive new legislation in 2017 including spinning off the central securities depositary to a new independent wholly owned subsidiary, and launching a public consultation on the proposed new market operating model.

There are, of course, no guarantees when it comes to reform.

China’s change programme is ambitious yet complex and unlikely to progress smoothly. Currently, around two thirds of Chinese listed companies are part owned by the state in some shape or form, while governance standards do not compare favourably with those of developed economies.

Similarly in Saudi Arabia, such a ‘promotion’ would require the government to further relax its control on the market and significantly improve governance levels. This move may be tricky since many of the country’s largest companies, and particularly Saudi Aramco, are closely integrated with the state.

It would, however, boost Saudi Arabia’s global economic stature, placing it in good stead to achieve its Vision 2030. It may even attract investor interest to markets across the Middle East and North Africa ahead of the planned share sale of Saudi Aramco.

James Kenney is senior investment manager at Pictet Asset Management

http://gulfbusiness.com/china-sets-example-saudis-msci-inclusion/

Saudi, Chinese firms bag contract for final phase of Dubai solar park

Visitors look at screens displaying images of the Mohammed bin Rashid Al-Maktoum Solar Park on March 20, 2017, at the solar plant in Dubai. (AFP)

AFP, Dubai Saturday, 16 September 2017

Dubai on Saturday announced the award of a $3.8-billion contract for the final phase of a solar park aimed at generating 5,000 megawatts of electricity by 2030.

The local government said the contract for the fourth and final phase went to Chinese conglomerate Shanghai Electric and ACWA Powerof Saudi Arabia.

The solar park named after Dubai’s ruler, Sheikh Mohammed bin Rashed Al-Maktoum, went online in 2013 and the final phase is to be launched in stages from 2020, bringing the overall cost to $13.6 billion.

Dubai, which has dwindling oil reserves unlike Abu Dhabi, a fellow member of the United Arab Emirates, has set a target of 2050 to produce 75 percent of its electricity needs from renewable energy sources.

Abu Dhabi, the UAE capital, is building four nuclear power plants, each with a 1,400-megawatt capacity, the first of which is scheduled to launch operations in 2018. The overall costs are put at more than $25 billion.

The UAE has announced it plans to invest a total of $163 billion in projects aimed at supplying the country with almost half of its energy needs from renewable sources.

Last Update: Saturday, 16 September 2017 KSA 17:45 - GMT 14:45

https://english.alarabiya.net/en/bu...-contract-for-final-phase-of-solar-park-.html

Saudi and Chinese businesses join forces on Egyptian solar projects

Anmar Frangoul

Published 7:07 AM ET Wed, 17 Jan 2018 CNBC.com

Kazzaz Photography | Moment | Getty Images

Saudi Arabia's ACWA Power has awarded an engineering, procurement and construction contract to China's Chint Group for three solar photovoltaic power plants in southern Egypt.

ACWA Power, which develops both power and water desalination projects, said that the total investment value of the projects was $190 million, and that they would have a total capacity of 165.5 megawatts. The contract for the deal was signed Tuesday at the World Future Energy Summit in Abu Dhabi.

ACWA Power President and CEO Paddy Padmanathan said the deal represented the company's first investment in Egypt.

The projects' construction will begin in the first quarter of 2018, with operations slated to commence in the fourth quarter. ACWA Power said that the facilities would power 80,000 homes and save 156,000 tons of carbon dioxide annually.

Chint Solar CEO Chuan Lu described Egypt as a "growing market where significant change is happening in the renewables industry."

China seems to be forging an ever-closer relationship with renewable energy in Egypt. Last September, for example, the Beijing-headquartered Asian Infrastructure Investment Bank announced as much as $210 million in debt financing in order to "tap" the renewable energy potential of the country.

https://www.cnbc.com/2018/01/17/sau...s-join-forces-on-egyptian-solar-projects.html

Saudi Vision 2030 provides mutual opportunity, says Chinese envoy

ARAB NEWS | Published — Friday 19 January 2018

Chinese ambassador to Saudi Arabia, Li Huaxin

RIYADH: The Chinese ambassador to Saudi Arabia, Li Huaxin, has said that his country considers Vision 2030 an opportunity for integration between the two countries, and that China’s Belt and Road Initiative (BRI) is compatible with it.

In a press statement, Li said that a visit to China by the Saudi justice minister and chairman of the Supreme Judicial Council, Walid Al-Samaani, represented a new round in consolidating bilateral relation.

“The two sides discussed a draft agreement for civil and commercial judicial cooperation between the two countries. This agreement is co-welcomed because the Kingdom’s Vision 2030 and its programs represent a great opportunity to deepen partnerships and commercial exchanges,” Li said.

The ambassador added that legal measures taken by the Saudi government against corruption were part of an ambitious initiative to clean up the investment environment for the benefit of all partners, including Chinese companies.

“The new steps taken by the Ministry of Justice in launching commercial courts in different regions reflect tangible evidence that the Kingdom is a state of law, and sends a message to the world that it is working to establish rights and justice in order to support the investment environment in the Kingdom,” he said.

In 2016, bilateral trade reached $43 billion.

In the cultural field, Li said that the two sides had agreed to translate 50 Saudi books into Chinese and 50 Chinese books into Arabic.

http://www.arabnews.com/node/1228841/saudi-arabia

Uranium mining in KSA (KSA is rumored to have one of the largest uranium reserves in the world) have begun in KSA with Chinese partners.

https://mobile.sabq.org/nYgFcv

Nuclear Power Saudi Arabia’ Uranium Mining began

Saudi Arabia and South Korea has agreement between them to develop the world's smallest nuclear power plant with output of 100mw.

By

admin

December 17, 2017

Saudi Arabia starts Uranium mining project

ONGOING NUCLEAR POWER TUSSLE BETWEEN COUNTRIES IN THE MIDDLE EAST IS EXPANDING WITH SAUDI ARABIA JOINING IN THE LIST.

Saudi Arabian Kingdom recently inaugurated Uranium excavation project with the help of China.

In January this year Saudi Arabia hinted at development of Uranium mining projects initiatives as part of National Transformation Project by 2030. The Arabian Kingdom already finalized Uranium mining projects in several locations.

Plan is to mine Uranium and make Saudi Arabia a self sufficient nuclear power. Saudi Arabia and South Korea has agreement between them to develop the world’s smallest nuclear power plant with output of 100mw. These one of a kind power plants can be installed in several parts of the Saudi Kingdom.

For Self reliance Saudi Arabia identified several locations in many regions of Saudi Arabia. Saudi Arabia also worked out a clear regulation systems that could control all the future nuclear power plants. As per some reports available with Defence Network team the initial goal is to achieve 80 GW of electricity generation per year as soon as possible. Later reach their ultimate goal of producing 100GW of electricity by 2030.

Saudi Electricity Company owns majority of power generation of the kingdom. Plan is in place to divide the SEC in to several companies.

KA Care – The King Abdullah Center for Atomic and Renewable Energy was intended to bring all renewable and nuclear power plant under single entity which will be responsible mega projects for the future power generations such as solar power plants and Nuclear reactors.

But it is still unclear which company will take over nuclear power generation.

Nuclear Atomic reactors requires enriched Uranium of around 5% purity. But with this same process by enriching heavy metals can produce enough material for weapons.

This is seen as a grave concern by western countries as religion enemies Iran and Saudi Arabia joining nuclear elite make matters even worse than it is today’s. But with signing of nuclear agreements with Iran and western countries, Iran agreed to put an hold on their work towards nuclear power for the next 15 years. As per the agreement Iran can enrich Uranium of below 4% purity which is enough for commercial power generation.

With this new thrust on mining Uranium Saudi Arabia will be the second country with nuclear power in the region UAE. But soon it is expected that many other countries will join the list starting from United Arab Emirates. UAE set to start its first nuclear reactors built by South Korean company. Reactor will start its operation in late 2018. UAE on its part committed itself not to enrich Uranium or reprocess the spent fuel to make them weapon grade.

Saudi Arabian Kingdom is planning to build 17 to 19 nuclear power plants by 2030. Opening up nuclear power plant manufacturing sectors to crowd king’s palaces for lucrative deals.

As per preliminary investigation reports states that Saudi Arabia has consists Uranium ore deposits of 60,000 Tones.

Why nuclear power plant?

Kingdom believes that nuclear power generations are cost effective, greener in futuristic point of view. Saudi Arabia is one of the world’s largest exporter of petroleum products. Tapping on nuclear energy or Atomic power generation is a move to diversifying its energy procurement. It is expected that Saudi Arabia will sign its first contract for two nuclear power plant by 2018. Mining of Uranium ore is seen as initiative to become self sufficient in nuclear fuel production to power their nuclear plants without any hindrance from western countries.

https://www.defencenet.in/nuclear-power-saudi-arabia-uranium-mining-began/

Old news from September 2017 but not covered in this thread;

China says its bilateral relations with Saudi Arabia have entered a new era.

Chinese Vice Premier Zhang Gaoli made a three-day visit to Saudi Arabia from August 23 to August 25. During his visit, China and Saudi signed a series of deals worth nearly $70 billion. Zhang said that China-Saudi Arabia cooperation was going to enter a new, more robust, sustainable, and fruitful era.

China and Saudi Arabia’s relationship is getting significantly warmer recently. Days Before Zhang’ visit, Saudi Minister of Energy, Industry, and Mineral Resources Khalid Al-Faleh had just visited Beijing and met with Zhang on August 18. In the meeting, both sides vowed to strengthen economic ties.

Soon, Zhang met Khalid Al-Faleh again in Jeddah on August 24. During the meeting, Al-Faleh revealed that China and the Kingdom had signed 60 various agreements and memoranda of understanding worth nearly $70 billion, according to Saudi Arabian news agency SPA. China’s news agency Xinhua said the agreements covered investment, trade, energy, postal service, communications, and media.

Enjoying this article? Click here to subscribe for full access. Just $5 a month.

Besides Al-Faleh, the two most important figures Zhang met were Saudi King Salman bin Abdulaziz Al Saud and Saudi Crown Prince Mohammed bin Salman.

The meeting with the crown prince is particularly noteworthy. As King Salman’s favorite son, Mohammed was just appointed crown prince in June 2017. As first deputy prime minister, minister of defense, and president of the Council for Economic and Development Affairs, the crown prince, 31, is the de facto person in charge of Saudi foreign policy, security and the oil industry—the country’s main source of wealth. He is also known for his ambition, or—from perspective of his critics—aggression.

Showing his ambition for the country, the crown prince in 2016 initiated a national strategy called “Vision for 2030,” aiming to make the Kingdom a global investment powerhouse and the heart of the Arab and Islamic world while also diversifying the country’s economy, which is heavily dependent on oil.

His vision seems to match well with China’s Belt and Road Initiative, which was put forward by Chinese President Xi Jinping in 2013.

Since 2016, the crown prince has started to pave the road to cooperating with China. In August 2016, he led a committee to Beijing, met President Xi Jinping and signed 15 agreements with his Chinese counterpart. The trip was seen as the start of a closer relationship between China and Saudi Arabia.

Thediplomat

Related thread;

https://defence.pk/pdf/threads/chin...ys-its-bilateral-relations-with-ksa-h.516410/

President praises 'friends' at Arab expo

By Wu Yunhe and Guo Shaoyu in Yinchuan | China Daily | Updated: 2017-09-07 09:00

President Xi Jinping called the Arab states "good friends" and important partners in constructing the Belt and Road in his letter of congratulations to the 2017 China-Arab States Expo.

The expo, which brings together Chinese and Arab business leaders to cooperate on science, finance, energy, agriculture, healthcare, tourism and culture, opened on Wednesday in Yinchuan, capital of the Ningxia Hui autonomous region.

The president also hailed the cooperation and achievements between the two sides.

http://www.chinadaily.com.cn/cndy/2017-09/07/content_31669637.htm

Interview: China-Saudi Arabia ties rapidly developing: Chinese Ambassador

Source: Xinhua| 2017-08-23 09:50:29|Editor: Yang Yi

by Xinhua writers Xia Yuanyi, Wang Bo

RIYADH, Aug. 23 (Xinhua) -- The Chinese Embassy in Saudi Arabia is often a hub of activity with diplomatic missions and events, evidence of ties warming up between the two countries, said Li Huaxin, Chinese Ambassador to Saudi Arabia.

"In January, 2016, President Xi (Jinping) visited Saudi Arabia and announced the lifting of bilateral ties to a comprehensive strategic partnership in a joint communique with Saudi King Salman bin Abdulaziz Al Saud. From then on, our relations have quickly developed," the ambassador said in a recent interview with Xinhua.

The West Asian country has been China's top crude oil supplier for many years straight. Meanwhile, the latter is the former's biggest business partner, with bilateral trade reaching 42.36 billion U.S. dollars in 2016, according to Chinese official figures.

After more than 140 Chinese enterprises began tapping Saudi Arabia's markets, including in the energy, housing, construction and telecommunication industries, the "1+2+3" model has taken shape, said Li.

Specifically, the model refers to the energy industry as the core of business ties, with two supporting industries, namely infrastructure, and trade and investment, and three emerging, cutting-edge trade areas, mainly nuclear power, aerospace and renewable energy rounding out the center.

The ambassador also said that in the four years since the Belt and Road Initiative was put forward by China in 2013, Saudi Arabia has emerged as an important player along its route.

"The two partners bilaterally cooperate not only on economic and trade, but also on culture and education," Li said.

In 2013, Saudi Arabia hosted the Janadriyah Heritage Festival at the Janadriyah town, 45 miles (72.4 km) away from the capital Riyadh, in which China, as that year's "guest of honor," exhibited more than 30 traditional arts and 600-plus exquisite articles, attracting a sea of local residents.

Three years later, an exhibition titled "The Arab Road" displaying Saudi Arab's cultural relics was held at the National Museum of China, with 466 pieces of treasures on show, among which were several "Made-in-China" ceramics, tokens of the once bustling ancient Silk Road.

In March, King Salman attended the opening ceremony of the Peking University Branch of the King Abdul-Aziz Public Library during his state visit to China. The following month, China displayed some of its intangible cultural heritage in Saudi Arabia.

"The next step for the two great civilizations is to organize a Chinese Cultural Week together in Riyadh and Jeddah to promote mutual understanding through more performances and exchange visits," the ambassador said.

He added that in a bid to facilitate some young people in Saudi Arabia to learn the Chinese language and culture, the China National Office for Teaching Chinese as a Foreign Language is in talks with King Saud University about offering Chinese language classes. The university is the largest in the country.

Li says the first team of Chinese teachers will soon come to Saudi Arabia as cultural go-betweens.

"Because top leaders from both sides value bilateral ties and we are facing significant historical opportunities for development, bilateral cooperation will only go further," Li said, adding "both peoples will benefit from this progress."

http://news.xinhuanet.com/english/2017-08/23/c_136548057.htm

China, Saudi Arabia agree to build energy cooperation mechanisms

Xinhua | Updated: 2017-08-25 14:20