Haq's Musings: Will Pakistan Benefit From LNG Glut Pushing Prices to New Lows?

LNG spot prices hit a new low of $4 per mmBTU as the supply continue to significantly outstrip demand. It's creating opportunities for Pakistan to get access to large supply of cheap fuel for its power generation.

With softening demand from China and 130 million tons per year (mmpta) of additional LNG supply set to reach market over the next five years, gas research firm Wood Mackenzie sees continuing downward pressure on global LNG spot prices.

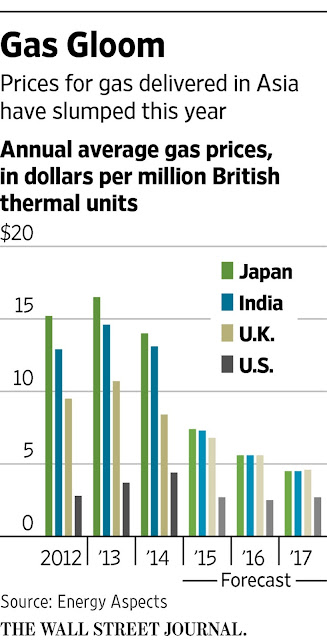

LNG Price History Source: WSJ

“The entire industry is worried because it is hard to tell when China’s demand will pick up again,” said an LNG strategist at a Malaysian energy company who attended the Wood Mackenzie conference in Singapore, according to Wall Street Journal. “Rising demand from smaller countries such as Pakistan, Egypt and Bangladesh is not enough to offset the declining demand from north Asia.”

As recently as two years ago, LNG shipped to big North Asian countries like Japan and Korea sold at around $15 to $16 a million British thermal units. This month, the price has already hit $6.65 a million BTUs, down 12% from September, according to research firm Energy Aspects. It expects prices to fall further in Asia next year, to under $6 per million BTUs, as a wave of new gas supply in countries from the U.S. to Angola to Australia comes on line, according to Wall Street Journal.

Petronet LNG Ltd, India’s biggest importer of liquefied natural gas (LNG), is saving so much money buying the commodity from the spot market that it’s willing to risk penalties for breaking long-term contracts with Qatar.

This is a great opportunity for Pakistan to take advantage of historically low LNG prices to alleviate its severe load-shedding of gas and electricity. Recently, Pakistan has launched its first LNG import terminal in Karachi and started receiving shipments from Qatar. Pakistan has also signed a $2 billion deal with Russians to build a north-south pipeline from Gwadar to Lahore. But the country needs to rapidly build up capacity to handle imports and distribution of significant volumes of LNG needed to resolve itsacute long-running energy crisis.

Related Links:

Haq's Musings

Pakistan's Twin Energy Crises of Gas and Electricity

Affordable Fuel For Pakistan's Power Generation

Pakistan Shale Oil and Gas Deposits

China-Pakistan Economic Corridor

Blackouts and Bailouts in Energy Rich Pakistan

Pakistanis Suffer Load Shedding While IPPs Profits Surge

Haq's Musings: Will Pakistan Benefit From LNG Glut Pushing Prices to New Lows?

LNG spot prices hit a new low of $4 per mmBTU as the supply continue to significantly outstrip demand. It's creating opportunities for Pakistan to get access to large supply of cheap fuel for its power generation.

With softening demand from China and 130 million tons per year (mmpta) of additional LNG supply set to reach market over the next five years, gas research firm Wood Mackenzie sees continuing downward pressure on global LNG spot prices.

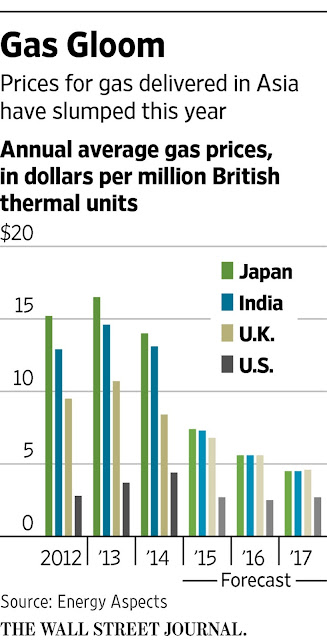

LNG Price History Source: WSJ

“The entire industry is worried because it is hard to tell when China’s demand will pick up again,” said an LNG strategist at a Malaysian energy company who attended the Wood Mackenzie conference in Singapore, according to Wall Street Journal. “Rising demand from smaller countries such as Pakistan, Egypt and Bangladesh is not enough to offset the declining demand from north Asia.”

As recently as two years ago, LNG shipped to big North Asian countries like Japan and Korea sold at around $15 to $16 a million British thermal units. This month, the price has already hit $6.65 a million BTUs, down 12% from September, according to research firm Energy Aspects. It expects prices to fall further in Asia next year, to under $6 per million BTUs, as a wave of new gas supply in countries from the U.S. to Angola to Australia comes on line, according to Wall Street Journal.

Petronet LNG Ltd, India’s biggest importer of liquefied natural gas (LNG), is saving so much money buying the commodity from the spot market that it’s willing to risk penalties for breaking long-term contracts with Qatar.

This is a great opportunity for Pakistan to take advantage of historically low LNG prices to alleviate its severe load-shedding of gas and electricity. Recently, Pakistan has launched its first LNG import terminal in Karachi and started receiving shipments from Qatar. Pakistan has also signed a $2 billion deal with Russians to build a north-south pipeline from Gwadar to Lahore. But the country needs to rapidly build up capacity to handle imports and distribution of significant volumes of LNG needed to resolve itsacute long-running energy crisis.

Related Links:

Haq's Musings

Pakistan's Twin Energy Crises of Gas and Electricity

Affordable Fuel For Pakistan's Power Generation

Pakistan Shale Oil and Gas Deposits

China-Pakistan Economic Corridor

Blackouts and Bailouts in Energy Rich Pakistan

Pakistanis Suffer Load Shedding While IPPs Profits Surge

Haq's Musings: Will Pakistan Benefit From LNG Glut Pushing Prices to New Lows?