@Mage @monitor @Dubious @CHACHA"G" @PakSword @Joe Shearer

2.1. Pre-independence Revenue Sharing (Niemeyer Award) Prior to independence, Niemeyer Award (under the 1935 Act) was followed to distribute the resources between federal and provincial governments of the British India. Under this award sales tax was a provincial subject while income tax collections to be redistributed were prescribed as 50 percent of the total collection. Even after the creation of Pakistan, till March 1952, same award was followed although with some adjustment in railway budget, sharing of income and sales tax [Pakistan (1991)]. In addition Sindh and NWFP were given annual grants of Rs 10 million and Rs 10.5 million, respectively. However when the financial position of Sindh improved, these grants were used to settle its federal debt thus it was virtually getting no grants at the time of independence.

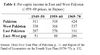

2.2. Post-independence Revenue Sharing (Raisman Award) After the independence, Sir Jeremy Raisman was assigned to formulate a feasible revenue sharing formula between federation and federating units of the country. Thus Raisman formula was presented in December, 1947 [Pakistan (1991) and Jaffery and Sadaqat (2006)] and subsequently adopted on April 1, 1952. In that formula, to overcome the poor financial situation arising from partition federal government was given 50 percent ad hoc share of sales tax to cope with its financial crises under Raisman award. Out of the proceeds of 50 percent income tax East Pakistan government got 45 percent of the federal divisible pool while West Pakistan got the remaining share. This share was distributed as 27, 12, 8, 4, 0.6, 0.6, and 2.8 percent amongst provinces of Punjab, Sindh, NWFP and Bhawalpur, Khairpur, Balochistan states union and residual1, respectively [Pakistan (1991)]. Under this award the subvention to NWFP was Rs 12.5 million.

2.3. Revenue Sharing under One Unit Four provinces NWFP, Sindh, Punjab, and Balochistan of West Pakistan were declared as one unit during 1955. Earlier, these provinces were considered as separate identities as of East Pakistan. Therefore, after these arrangements there were only two units namely East and West Pakistan. Two awards for year 1961 and 1964 were announced during that period. At that time the resources were distributed only amongst East Pakistan and West Pakistan.

2.3.1. The 1961 Award Under the award, out of the divisible pool (70 percent of sales tax plus other taxes), East Pakistan and West Pakistan got 54 and 46 percent share,

respectively. 30 percent of sales tax was specified to the provinces on the bases of collection in their respective areas. While the remaining duties on agricultural land and capital value tax on immovable property were given to the units as per their collection [Pakistan (1991)].

2.3.2. The 1964 Award The 1964 National Finance Commission was set up under article 144 of the 1962 constitution. The divisible pool consisted of collection from income tax, sales tax, excise duty and export duty. However 30 percent of sales tax was distributed in accordance with its collection in each province. The respective share out of divisible pool between centre and provinces were 35:65 percent. The share of East Pakistan and West Pakistan remained unchanged at 54 percent and 46 percent. However, on 1st July 1970 the West Pakistan was disband into Punjab, Sindh, NWFP and Balochistan, thus its share of 46 percent was distributed as 56.5, 23.5, 15.5 and 4.5 percent respectively among the new provinces [Pakistan (1991)].

2.3.3. National Finance Committee 1970 A committee2 was set up to recommend for the inter-governmental resource sharing under the Federal Finance Minister on April 1970. The divisible pool remained unchanged, however the share of the federal and provincial governments in the divisible pool was considered to be 20:80 percent respectively. Out of the provincial share 54 percent was given to East Pakistan, while the remaining 46 percent was distributed among the rest of the provinces

http://pide.org.pk/pdf/Working Paper/WorkingPaper-33.pdf