FDI came in a lot of sectors, ranging from telecommunications to manufacturing.

Several mobile phone service operators built networks worth billions of dollars,, new cement plants met growing demand that doubled per capita cement consumption, FMCG sector took off to meet demand from growing middle class, car and motorcycle production jumped several fold

News, analysis and opinions about India, Pakistan, US, Canada, Europe, Mid East, South Asia, Silicon Valley, High Technology, Economy, Politics, World

www.riazhaq.com

News, analysis and opinions about India, Pakistan, US, Canada, Europe, Mid East, South Asia, Silicon Valley, High Technology, Economy, Politics, World

www.riazhaq.com

News, analysis and opinions about India, Pakistan, US, Canada, Europe, Mid East, South Asia, Silicon Valley, High Technology, Economy, Politics, World

www.riazhaq.com

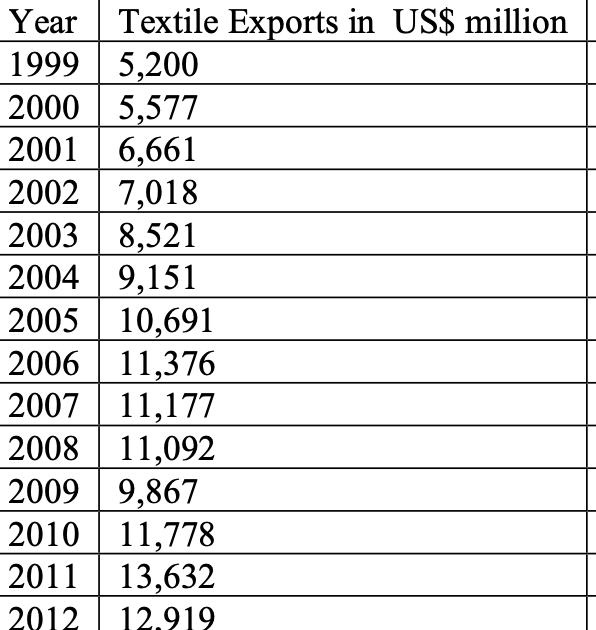

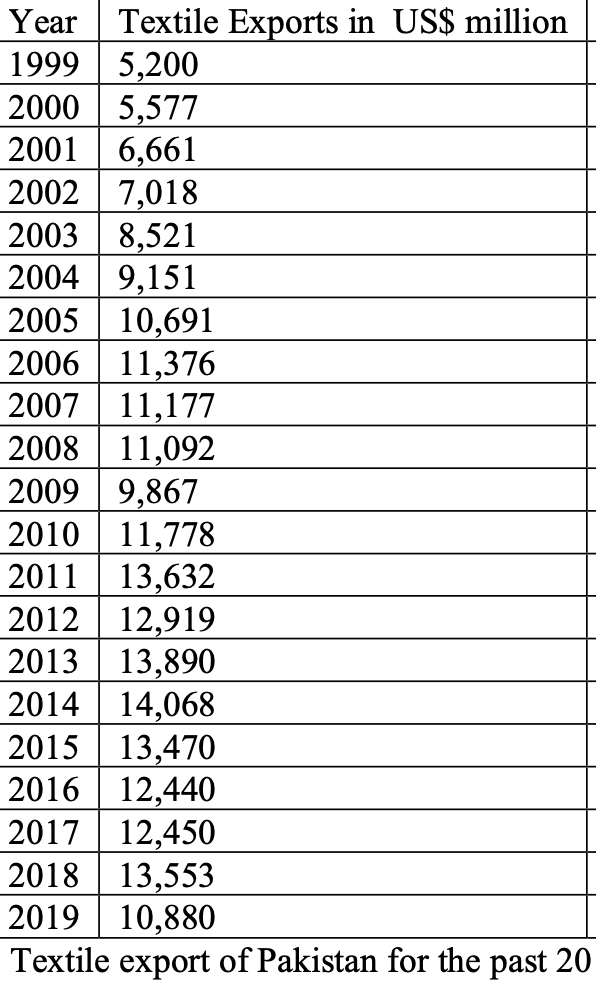

Textile exports more than doubled

News, analysis and opinions about India, Pakistan, US, Canada, Europe, Mid East, South Asia, Silicon Valley, High Technology, Economy, Politics, World

www.riazhaq.com

---------------

The government has identified telecoms as a key sector for attracting overseas investment. Mobilink, owned by Egypt’s Orascom, has uncovered a vast pool of mobile phone users, with the number of customers soaring from one million to 3.7 million in the past 18 months.

“We will have invested $775m in Pakistan by the end of the year and we now control 64% of the market,” says Mobilink’s chairman Zouhair Khaliq. “We are now in the process of raising $200m from export agencies to help fund our $400m investment programme for next year. Our network now covers 350 towns across the country, some without running water or metalled roads.”

This is one business sector in which foreign operators have been piling into the market. Norway’s Telenor and UAE-owned Warid Telecom were recently awarded GSM licences and two Luxembourg-based groups, Instafone and Paktel, are competing along with state-owned Ufone, which holds a 25% market share.

www.fdiintelligence.com