gambit

PROFESSIONAL

- Joined

- Apr 28, 2009

- Messages

- 28,569

- Reaction score

- 148

- Country

- Location

Considering how China returned to US, may be we do not need Japan and the EU. But when the euro finally collapses, good luck to China on finding an alternative.Says someone who knows ZILCH about economic and thinks Japan and the EU will snap up your debt should China decides to throw them out. I guess this "military alliance" thing has lodged into that mind of yours a bit too deeply.

If merely printing money qualifies as 'currency manipulation' then all countries are guilty of it. But then if the question is why would a country print money when it already has an established economy in world standing, then it is a different issue. So if out of your great love for international economic stability and prosperity...You have to becareful with your choice of words here. Quantitative Easing was irresponsibly used as a tool by America to drive down long term interest rates by mass printing the dollars and flooding the market with it. This resulted in a deliberate devaluation of the dollars (currency manipulation). It was America's desperate attempt to undermine the competitiveness of China as well as its other trading partners. "was very much internally targeted against domestic problems." you say?

...You have a problem with US printing money as a response to internal economic issues, then you should have even greater grief when China print money for BOTH internal economic issues and currency manipulation...

...You have a problem with US printing money as a response to internal economic issues, then you should have even greater grief when China print money for BOTH internal economic issues and currency manipulation...China's Money-Printing Addiction Could Spell Disaster - Business Insider

In the past 30 years, we have used excessive money supply to rapidly advance our economy, said Wu Xiaoling, vice chairman of the Financial and Economic Affairs Committee of Chinas National Peoples Congress.

China has not only been the country that prints money at the fastest rate but also been the country with the largest money supply in the world in the past decade, according to the Chinese-language Southern Weekly.

Furthermore, China continued to be the largest money-supplying country in 2010 as its M2, a broad measure of money supply, was up 19.46% at the end of November from a year earlier, said the weekly.

China's Money Supply "Unprecedented in History": Report

Here is where you ended up looking the fool as you lectures others about economics...China has not only been the country that prints money at the fastest rate but also been the country with the largest money supply in the world in the past decade, according to the Chinese-language Southern Weekly.

"In the past 30 years, we have used excessive money supply to rapidly advance our economy," said Wu Xiaoling, vice chairman of the Financial and Economic Affairs Committee of China's National People's Congress.

China has no choice but to print more money in the face of its massive foreign exchange reserves, said the Southern Weekly, adding that the excessive money supply that has resulted is a phenomenon unprecedented in the history of the world economy.

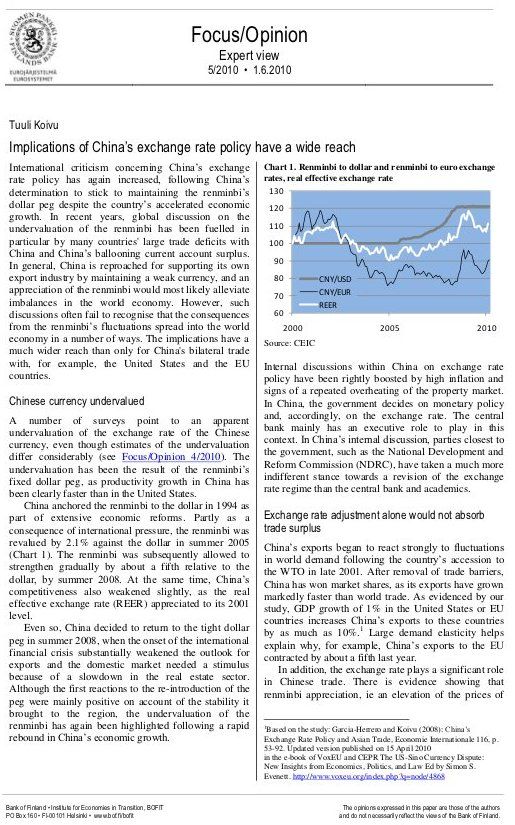

As highlighted, China's currency manipulation PREDATED the US quantitative easing measures. We do not need China to grow our economy while China need ours, in 1994 when China need US consumers to bootstrap China out of that communist inspired economic hellhole, then in 2008 when China needed to return to the dollar peg to support Chinese economy from the consequences of Chinese currency manipulations.A number of surveys point to an apparent undervaluation of the exchange rate of the Chinese currency, even though estimates of the undervaluation differ considerably (see Focus/Opinion 4/2010). The undervaluation has been the result of the renminbis fixed dollar peg, as productivity growth in China has been clearly faster than in the United States. China anchored the renminbi to the dollar in 1994 as part of extensive economic reforms. Partly as a consequence of international pressure, the renminbi was revalued by 2.1% against the dollar in summer 2005 (Chart 1). The renminbi was subsequently allowed to strengthen gradually by about a fifth relative to the dollar, by summer 2008. At the same time, Chinas competitiveness also weakened slightly, as the real effective exchange rate (REER) appreciated to its 2001 level. Even so, China decided to return to the tight dollar peg in summer 2008, when the onset of the international financial crisis substantially weakened the outlook for exports and the domestic market needed a stimulus because of a slowdown in the real estate sector. Although the first reactions to the re-introduction of the peg were mainly positive on account of the stability it brought to the region, the undervaluation of the renminbi has again been highlighted following a rapid rebound in Chinas economic growth.

This is why no one can legitimately criticize US for being a 'currency manipulator' in the current economic environment. They can criticize US for creating consequences outside of our borders but then again, NO ONE forces anyone to use the dollar in their international trade. Just as no one forced China to peg the yawn against the dollar so if the yawn and China's economy has to take a hit because of our internal economic problems, that is a consequence of the dollar-RMB alliance that China created.

You mean like this...Funny how the world cared less about China's so called "Currency Manipulation" than America...erm I mean Gambit.

America have (Yet again, what a surprise) refused to label us as a currency manipulator. Regardless of how much you spin it, that day never came. Instead, America went on and accused Japan of manipulating its currency. I guess with them being the third largest economy and accepting bilateral trade to be conducted in their own currencies have greatly upset your country.

America must have been frustrated beyond belief!

I'd like to see them accuse the Koreans too of their Won, of course, the Americans love their Samsungs and LG's too much to do so.

Korean Currency Manipulation Threatens U.S. Economy | Economy In Crisis

The U.S. Treasury Department has only ever named three nations to its list of currency manipulators, China, Taiwan and Korea. Future financial black magic could make a deal already disadvantageous to the American economy even worse.

Chapter 13 of the agreement specifically focuses on banning the regulation or restriction of any form of financial activity, whether it be buying dollars and U.S. debt to undervalue a currency, or even issuing derivatives, credit default swaps and other financial instruments that caused the market collapse in the U.S. in 2008.

No. China is our largest FOREIGN creditor. And a damn willing one at that and that is what make YOUR stomach churns. The American people is America's largest creditor. The euro is on life support and many are willing to 'pull the plug'. That leave China with no options other than US to sustain and grow China's economy.Fact of the matter that China is your biggest creditor and supplier of common goods makes it so much harder for you to stomach.

Now that is a laugh. If you claimed anything in this forum about being 'in finance' then you have just destroyed it all. By most metrics, the US as a manufacturer is still a force, especially when it comes to productivity and compared against Chinese workers, ours outperforms...Manufacturing jobs will not return to the states regardless and it will not be able to compete with China in the things that we produce and export. When China no longer rely so heavily on the secondary sector (already happening), it will simply move on to countries such as India or Indonesia (Have fun labeling them too in the future)

You can blame American capitalist "fook-ups" for that. America destroyed its own manufacturing industry and racked up a mountain of debt, is exporting inflation and is trying very hard to be funny by lecturing the world on stage that China is the cause of America's downfall.

Thanks to your country's poor economic planning that your country is now going down the pan. Keep arguing and blaming Bush, Obama, China, Rest of the world and what not. Those are the typical symptoms of a failed democracy

China vs. US: Manufacturing comparison - Manufacturing Digital

...By about 10-1. Before my current company, I have been to my current competitors' semicon facilities in China and Taiwan. The automation processes are at least one generation behind ten years ago and little gain since then. The Chinese workers are not as well educated as attested by vendors like Advantest and Agilent, who has to, sorry to say it but, 'dumb down' their manuals and instructions considerably. This is because of the constant influx of rural workers who are far less educated than their urban cousins, many of the latter moved to Si or the US for better opportunities.However, productivity is still a massive issue. IHS's Head of World Industry Services Mark Killon points out: The US has a huge productivity advantage in that it produced only slightly less than Chinas manufacturing output in 2010 but with 11.5 million workers compared to the 100 million employed in the same sector in China.

So please...Spare US all the hyperboles about US decline in manufacturing. We got problems, yes, but China's are far worse and far more precipitous to a collapse should we impose a tariff.

Why not? If China can peg the yawn against the dollar and/or print massive amount of currency to buy huge dollar reserves in order to manipulate the value of the [iyawn[/i], why is China immune from criticisms?For America perhaps (just you wait for them to unleash a new round of QE). The effects the last wave of QE has on the global economy is not so short term to say the least. Just look at the Euro zone, America's currency manipulation clearly did not help the likes of Greece, Italy, Iceland, Spain or Portugal. Nobody knows for sure when this economic crisis will be over, in fact more are anticipating a double dip recession, and not so optimistic of their road to recovery. Of course America would love to blame China out of convenience and shy away from developed symptoms of its poorly structured economy. Heck why not do something about Japan and South Korea too? I'd love to see how everyday Americans afford to pay for their goods as the value of the dollar declines and when faced by effects of hyperinflation.

We can see that it has been the Chinese, both government and people, who are the true 'spinmeisters' here.America hired you to play its role as the spin doctor now?

See sources above. But of course, China can always let the yawn appreciate the way the market would do so appreciate. We can see who is the true coward here.A low Yuan benefits ones who imports from China, providing America stops manipulating its currency by devaluating it and increasing inflating the prices of everyday commodities. It is clear that America has done the world economy a lot of harm and is too coward to admit it.

The fact that America was the only one who came to the summit wagging its fingers at China about the so called "currency manipulation" issue. America was also the only one sitting there defending and tried in vain to justify its role in currency manipulation from all 19 members says otherwise.

It turned out that the G20 is not as gullible as you are and took America's word with a truck load of salt, of course they too refused to label America as a currency manipulator "out of political considerations".

The sources I provided, previous and now, said otherwise when it comes to gullibility. China is guilty of currency manipulation, first to raise its economy out of a communist inspired hellhole, then to sustain its growth. The evidences are aplenty.

The sources I provided, previous and now, said otherwise when it comes to gullibility. China is guilty of currency manipulation, first to raise its economy out of a communist inspired hellhole, then to sustain its growth. The evidences are aplenty.No clue? Spoken by someone who does not know China has been printing money all this time?Wrong, more like a text book fail from YOU.

It's hard trying to play economist when you have no clue how the society and economy works doesn't it?

You are correct. My apologies about the mix-ups. I have been negligent in keeping track of the Chinese cowards living in comfort in various parts of the world while defending China based upon some dubious racial ties.I have no issues defending where I come from and the fact that I have a house there which I go back to annually is enough to put your cowardice to shame.

And who told you that I live in Canada? It appears that YOU have not only failed in Economics, but in Geography too!

You mean the Brits were kind to the Chinese? The Brits whose country you are living in comfort amongst while defending China out of some dubious racial ties? You may have a house back in China, but the fact that you continues to live in comfort in the UK is no more meaningful than I could go back to Viet Nam and live with my relatives and friends. But at least I am honest to tell everyone, here on this forum and the people in Viet Nam, that I do not want to live in Viet Nam because of its government and its economy.You have a reason to leave Vietnam and a reason to serve the ones who brutalized the place you came from and are now too afraid to live under.