China's “Semiconductor Theranos”: HSMC

Kevin Xu

China’s semiconductor ambition just had its first ponzi scheme fully exposed:

Wuhan Hongxin Semiconductor Manufacturing (HSMC).

The HSMC ponzi scheme was led by a trio of characters, who have zero expertise in semiconductor (or anything tech related), but are experts in manipulating local government subsidies, construction contractors, a renowned but gullible former TSMC executive, and China’s desperate need for homegrown chips to pull of a heist so large it makes Theranos look amateur.

Details of this scheme,

documented and exposed in this 36Kr article (in Chinese; hat tip: Jordan Schneider), illuminates a bigger structural problem in China, where the central government’s desires, and the local governments’ desire to satisfy

those desires, can produce to ripe opportunities to scammers to steal and profit on a monumental scale.

(Note: during the course of writing this article this week, the 36Kr report was deleted.)

The Heist

Let’s first summarize the major elements of the HSMC heist that unfolded between late 2017 and early 2021 (which may read like a movie script, not real life):

Part I -- the Trap:

- Throughout 2017, a man by the name of Cao Shan traveled across China looking for a local government to invest in his semiconductor scheme. (“Cao Shan” is actually a fake name this person uses, because his real name is already tainted by the scams he used to do back in his hometown.)

- Cao eventually found an accomplice, Mr. Long Wei, who worked his connections to get the City of Wuhan’s East-West Lake District Government to provide land and investment.

- Long brought another close friend into the fold: Ms. Li Xueyan, a small business owner who has opened restaurants and sold Chinese rice liquor.

- The trio -- Cao, Long, Li -- formed the board of directors of what became HSMC.

Part II -- the Money:

- Throughout 2018, the trio worked to secure two sources of “income”: direct subsidies from the East-West Lake District Government (aka taxpayer money) and deposits from construction contractors who want to build the HSMC factory.

- Sourcing both government subsidies and contractor deposits is a strategy for scam factory projects to increase the amount of money to be scammed.

- The East-West Lake District Government decided to invest in HSMC partly because of its jealousy of a local rival district, which attracted and incubated a successful flash storage manufacturer.

- To make themselves look important and powerful, the trio would spread false rumors about their personal background. Long was rumored to be the grandson of some high-level official, while Li would pretend to be the sister of some other political figure.

- By May 2019, HSMC has received 6.5 billion RMB (~$1 billion USD) of investment from the district government. Cao and Long have quit the board, giving Li and her cronies full control. Cao began going to other provinces to set up similar ponzi schemes.

Part III -- Chiang Shang-Yi, TSMC, and ASML:

- By June 2019, the trio targeted and successfully persuaded Chiang Shang-Yi, the legendary founding CTO of TSMC, to join HSMC as its CEO.

- To convince Chiang, HSMC spread false rumors publicly that it has already attracted 100 billion RMB (~$15 billion USD) of investments. They also took advantage of Chiang’s gullibility and professional insecurities. (At the time, Chiang was a consultant at SMIC, China’s largest chip foundry, with relatively little influence.)

- Using Chiang’s aura, HSMC started aggressively poaching engineers from TSMC with salary packages worth 2 to 2.5x more than what they were earning.

- Chiang also used his industry reputation to convince ASML, the Dutch company and world’s leading manufacturer of lithography equipment, to sell one DUV equipment to HSMC. (DUV is not the most advanced equipment, but this is still a huge coup given heavy US pressure at the time on the Dutch government to not sell to China.)

- By December 2019, the ASML equipment was delivered to HSMC amidst huge fanfare. The company also secured more investment due to this accomplishment from the district government, totaling 15.3 billion RMB (~$2.4 billion USD).

- One month later, the same equipment was offered as collateral to a local Wuhan commercial bank for a 580 million RMB loan (~$90 million USD) -- another new source of “income” for the heist.

Part IV -- HSMC Collapses, Heist Completed:

- During the first half of 2020, while Wuhan was ravaged by the coronavirus, the trio began siphoning HSMC money away.

- One of its primary methods was conducting employee training programs with a company run by Li’s younger brother.

- HSMC also refused to pay its construction contractors money, owing tens of millions of dollars.

- By July 2020, it became clear that HSMC was a scam. Chiang left the company. The Wuhan city government started leaking news that HSMC is running out of money.

- By November 2020, Li was pushed out of the company and the East-West Lake District Government took full ownership of HSMC.

- By January 2021, Chiang rejoined SMIC. HSMC furloughed all its employees for 40 days and reduced salaries across the board.

This is a timeline (in Chinese) of the major events put together by the 36Kr team:

Central and Local

While the HSMC saga may read like a movie script and an isolated incident, it’s a symptom of a structural problem. This symptom is amplified by the high-profile nature of China’s need to produce its own semiconductors.

From the outside, a common stereotype and myth about China is that Beijing’s central government is omnipresent and omnipotent. In reality, the dynamic is more of a call-and-response; the central government calls with directives, local governments respond with implementation plans.

I described the importance of understanding this dynamic last year in

Part II of my “Open Source in China” series. I emphasized the role that provincial governments play in aligning and allocating resources according to the central government’s desires, in order to compete for star projects and build new companies.

Local officials are motivated to deliver results for political advancement.

In a recent piece by

Matt Sheehan of the think tank MarcoPolo, he also illustrated this relationship when analyzing China’s plans around “5G+ Industrial Internet.” Four months after the central government issued its “5G+ Industrial Internet” guidance, the Guangdong provincial government issued its implementation plan, and the city of Huizhou in the Guangdong province soon issued

its own plan to align with the provincial government’s plan. What tangibly resulted was Guangdong (the province) offering a 30% public cloud discount to push businesses to move to the cloud, while Huizhou (the city)

pledging 100 million yuan (~$14 million USD) in subsidies to attract so-called “intelligent manufacturing projects” to set up shop there.

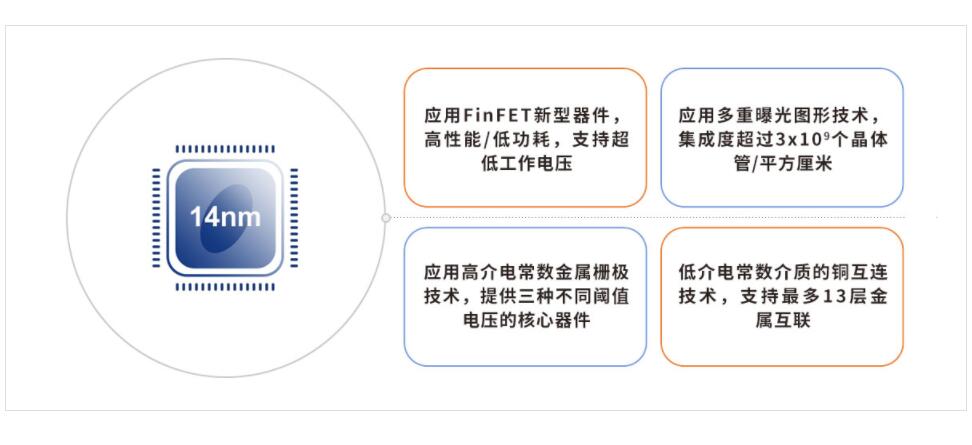

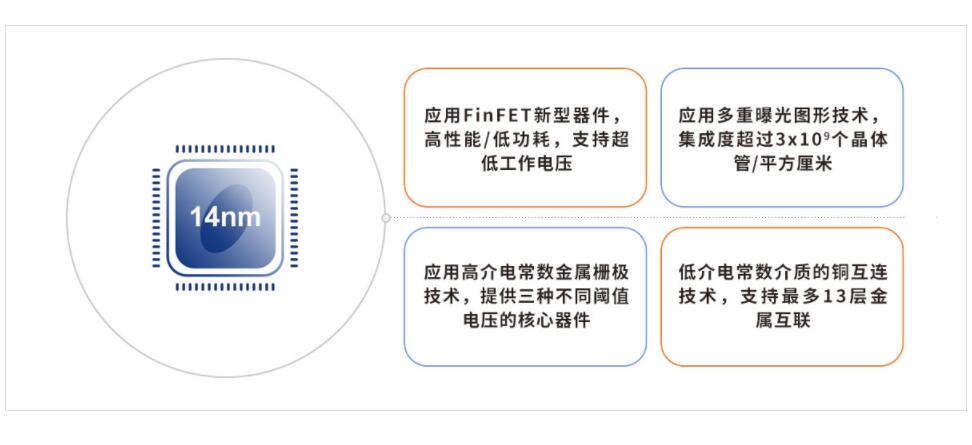

HSMC is the archetypal child of this system -- a new shiny company with a rockstar legendary CEO that would’ve done wonders for the political future of officials in Wuhan and the East-West Lake District, if it had succeeded. The allure was so strong that no one from the district government bothered to scrutinize the outlandish promise that Cao pitched -- HSMC will start producing 14nm chips right away, then quickly advance to 7nm chips and compete directly with TSMC and Samsung. (A more realistic timeline would be to start with 65nm chips, move to 40nm, and then progressively to denser chips; a process that could take at least a decade.) Cao knew nothing about semiconductor production, but he did know that the smaller the chip, the more advanced it is, and the more investment he could scam by promising it.

Herein lies a more vexing problem.

The same reasons that make semiconductor manufacturing hard also make it easy to scam. Few people have the knowledge to oversee and pinpoint why a project failed, which party should be responsible, and how to prevent similar failures. This ignorance extends all the way to the top. When the National Development and Reform Commission, the central government regulator, learned of HSMC’s failing, its official response was “谁支持,谁负责” (whoever supported the project is responsible). There’s not much more it could do.

Furthermore, such a failure in the high-profiled semiconductor space is so embarrassing publicly for the local government that there’s no incentive to litigate the truth, because an honest investigation would inevitably uncover gross incompetence by local officials. As a case in point, according to 36Kr’s report (now deleted), after the district government took over ownership of HSMC, it did not spend time inspecting wrongdoings, but instead traveled to Shanghai and other places to try to sell what remains of HSMC to salvage this failed investment (so far without any success).

For professional scammers like Cao, Long, and Li, semiconductor projects are ripe targets -- low risk, high reward, too complicated for most people to understand, and too embarrassing to investigate if projects fail.

That’s why Cao, instead of sitting in jail, has formed several other “semiconductor factory projects” in cities like Jinan and Zhuhai. He is still out there, trying to replicate other HSMC’s.

Shooting Yourself in the Foot

Last October, I wrote a column “

What Can $1.4 Trillion Buy” for The Wire China, where I identified the two main chokepoints to China’s semiconductor ambition: access to advanced equipment, hiring technical talent. The greed of the “HSMC trio” has managed to shoot China in the foot in both areas, permanently damaging the prospect of other semiconductor upstarts that may actually be trying to make chips.

Regarding advanced equipment access, by luring Chiang and using his reputation to buy ASML’s DUV equipment (only to loan it off for more cash), ASML may never sell to another Chinese semiconductor startup, with or without sanctions. ASML’s reputation is damaged by this transaction. It doesn’t sell to any company that has the money to buy; it evaluates the buyer’s technical capabilities first to make sure the buyer can make proper use of its product. ASML toured HSMC prior to agreeing to sell its equipment, and lauded HSMC’s team as the best it has seen in Mainland China, mostly on the strength of Chiang’s reputation and the engineers he was able to attract. ASML now must feel like a fool. But the bigger fool here is China. ASML had a record 2020, selling 258 lithography equipment, primarily to TSMC. ASML doesn’t need the Mainland China market; China urgently needs ASML’s products.

Regarding hiring technical talent, a chilling effect will permeate the industry, where experienced engineers from Taiwan will think twice about joining a mainland startup, since even the reputation and judgment of Chiang cannot protect you from scam artists. This situation cuts off the best and most obvious source of talent, given the cultural and language similarities between Mainland China and Taiwan. Poaching talent from South Korea and the United States would be much harder. And training domestic talent will take much (much) longer.

HSMC isn’t the only semiconductor startup that failed in 2020. Last May, a startup in Chengdu failed after two years of operation and supposedly attracted $10 billion USD in investment. Last July, another startup based in Nanjing filed for bankruptcy after four years of operation, with a supposed investment size of $3 billion USD. We don’t know yet

why these startups failed.

And that’s the key question: why?

According to

a report from Caixin (in Chinese), in just the last three years, the number of semiconductor startups in China have increased by more than 50%. Moreover, the amount of investment has increased 6-times, from $946 million USD in 2018 to $6.16 billion USD in 2019. For the first half of 2020, investment has reached $8.46 billion USD.

Source:

https://finance.sina.com.cn/tech/2021-01-04/doc-iiznezxt0546437.shtml

Undoubtedly, not all of these investors know what they are investing in; most of them don’t. Similarly, not all of these startups will succeed; most of them won’t.

Failures are inevitable for something as hard as semiconductor manufacturing. Learning about why failures happen is an important necessity to a new industry’s growth and maturity. But what did China’s fledgling semiconductor industry learn from the HSMC experience?

Based on 36Kr’s calculation, the “HSMC trio” stole in total 12.4 billion RMB (~$2 billion USD) in three years from the three-course meal of district government investment, contractor deposits, and bank loans. (In comparison, Theranos evaporated roughly $1.4 billion USD of its gullible investors’ money in about 15 years.)

The HSMC heist has managed to make Theranos look somewhat benign. If HSMC isn’t treated as a criminal act (

like Theranos) but as just another failed startup in a frothy market, it will likely not be China’s only “semiconductor Theranos.”

(The audio version of this post can be found on the Interconnected YouTube channel [https://www.youtube.com/c/Interconnected_newsletter]): China’s semiconductor ambition just had its first ponzi scheme fully exposed: Wuhan Hongxin Semiconductor Manufacturing [http://en.hsmc.com/] (HSMC). The...

interconnected.blog