Ranked: The Cities With the Most Bubble Risk in Their Property Markets

October 26, 2023

By

Pallavi Rao

Which Cities Have Bubble Risk in Their Property Markets?

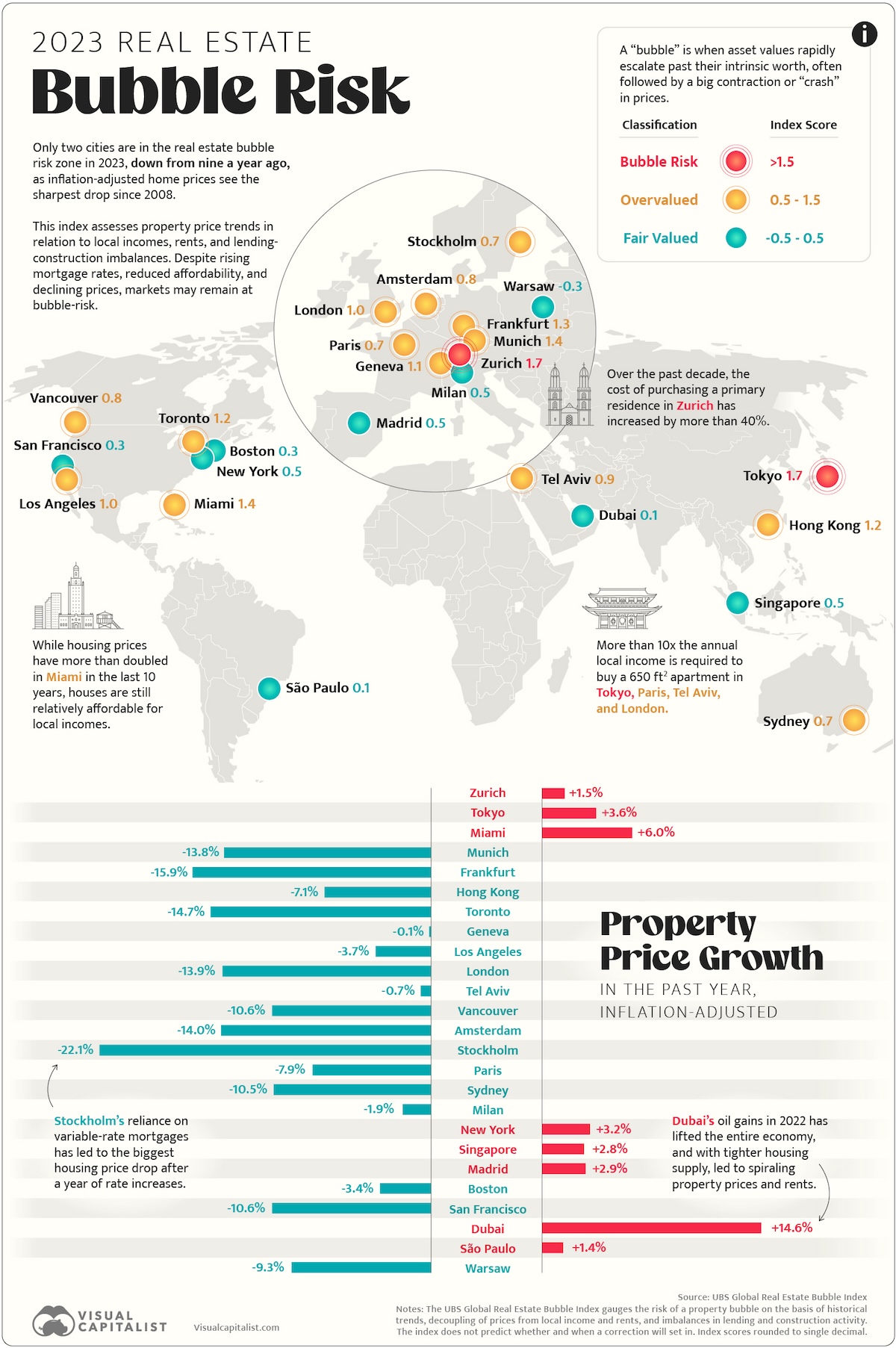

Buoyed by low interest rates for the last decade, many property markets have seen substantial

price growth since 2010. Experts warned that real estate bubbles—in which the price of assets moved up far beyond their intrinsic value—were forming.

The

UBS Global Real Estate Bubble Index analyzes the real estate market of 25 major cities across the globe and assigns them a score between -0.5 to 2.0 to convey bubble risk. The higher the score, the more imbalanced the market is, with those above 1.5 in “bubble-risk” territory.

We visualize the

data in the above map, along with charting the real property price changes in the last year.

Ranking Bubble Risk by City

At the top of UBS’ findings is Switzerland’s financial capital

Zurich, with a 1.71 score, putting the city firmly in the bubble-risk zone. With its high-income earners and the country’s low interest rates, the city has been steadily climbing the real estate

bubble-risk rankings, 5th in 2021, to 3rd in 2022, to the top spot this year.

Unlike many of its former peers in the risky territory, local prices adapted to increased mortgage rates this year, and have stayed elevated.

Here’s the full rankings for bubble risk in all 25 property markets:

View attachment 967615View attachment 967616View attachment 967617

Despite higher mortgages and sharply correcting prices, some cities’ property markets are still in bubble-risk territory.

www.visualcapitalist.com