onebyone

SENIOR MEMBER

- Joined

- Jul 2, 2014

- Messages

- 7,550

- Reaction score

- -6

- Country

- Location

Bloomberg News

Fri, October 27, 2023 at 3:50 PM GMT+7·3 min read

1 / 2

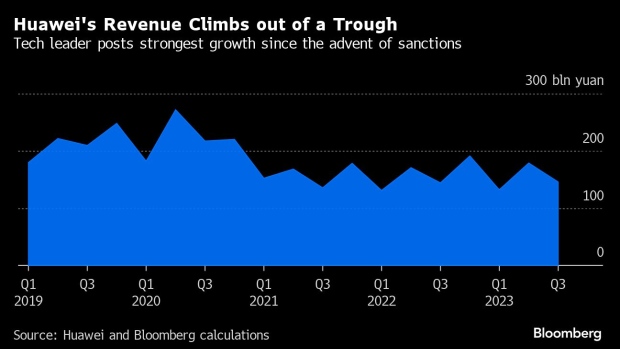

(Bloomberg) -- Huawei Technologies Co.’s profit more than doubled during the quarter it revealed its biggest achievement in chip technology, adding to signs the Chinese tech leader is steadying a business rocked by US sanctions.

Most Read from Bloomberg

The Shenzhen company reported a 118% surge in net profit to 26.4 billion yuan ($3.6 billion) in the September quarter, and a slight rise in sales to 145.7 billion yuan, according to Bloomberg News calculations from nine-month results released Friday. Those numbers included initial sales of the vastly popular Mate 60 Pro, which began shipping in late August.

Huawei, written off as a top smartphone player after the US cut it off from overseas suppliers in 2019, is mounting a comeback. It electrified the chip industry by unveiling the Mate 60 Pro housing a 7nm processor made by Semiconductor Manufacturing International Corp. That surprise revelation triggered celebration across China and accusations in the US that a campaign to contain the country’s technological ascent had failed.

The gadget sold out almost instantly, spurring expectations it could rejuvenate Huawei’s fortunes and potentially cut into Apple Inc.’s lead in China, given signs of a disappointing debut for the iPhone 15. Analysts including Haitong International Securities’s Jeff Pu have estimated Huawei could build as many as 70 million smartphones using its own Kirin chips in 2024 — not insignificant compared to the roughly 220 million iPhones that Apple ships annually.

The US won’t be able to stop Huawei and SMIC from making progress in chip technology, Burn J. Lin, a former Taiwan Semiconductor Manufacturing Co. vice president, told Bloomberg News. SMIC should be able to advance to the next generation at 5 nanometers with machines from ASML Holding NV that it already operates, said Lin, who at TSMC championed the lithography technology that transformed chipmaking.

In the run-up to the Mate 60 Pro’s debut, Huawei shored up its margins through a series of cost-cutting efforts. It also booked one-off gains from sales of the Honor smartphone business and a server unit in 2020 and 2021, it has said.

“We continue to optimize our management systems, improve the efficiency and quality of our operations, and refine our sales strategy and product mix,” Huawei said in a statement. “These actions have had a very positive impact on our profit margin.”

A resurgent Huawei would pose problems not just for Apple but also local brands from Xiaomi Corp. to Oppo and Vivo, all of which are fighting for sales in a shrinking market. Chinese smartphone shipments fell 6.3% in the third quarter led by local vendors, according to research firm IDC.

But the market could be bottoming out.

“The Chinese market is expected to see its first year-on-year growth in the fourth quarter after more than two years, mainly driven by more intense competition and a low comparison base,” said IDC analyst Will Wong.

(Updates with industry expert’s comment in the fifth paragraph)

Most Read from Bloomberg Businessweek

finance.yahoo.com

finance.yahoo.com

Fri, October 27, 2023 at 3:50 PM GMT+7·3 min read

1 / 2

Huawei’s Profit Doubles With Made-in-China Chip Breakthrough

(Bloomberg) -- Huawei Technologies Co.’s profit more than doubled during the quarter it revealed its biggest achievement in chip technology, adding to signs the Chinese tech leader is steadying a business rocked by US sanctions.

Most Read from Bloomberg

The Shenzhen company reported a 118% surge in net profit to 26.4 billion yuan ($3.6 billion) in the September quarter, and a slight rise in sales to 145.7 billion yuan, according to Bloomberg News calculations from nine-month results released Friday. Those numbers included initial sales of the vastly popular Mate 60 Pro, which began shipping in late August.

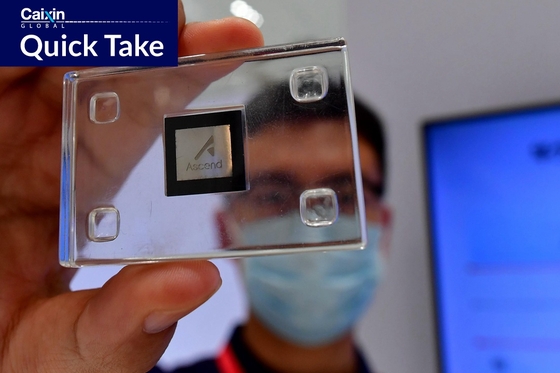

Huawei, written off as a top smartphone player after the US cut it off from overseas suppliers in 2019, is mounting a comeback. It electrified the chip industry by unveiling the Mate 60 Pro housing a 7nm processor made by Semiconductor Manufacturing International Corp. That surprise revelation triggered celebration across China and accusations in the US that a campaign to contain the country’s technological ascent had failed.

The gadget sold out almost instantly, spurring expectations it could rejuvenate Huawei’s fortunes and potentially cut into Apple Inc.’s lead in China, given signs of a disappointing debut for the iPhone 15. Analysts including Haitong International Securities’s Jeff Pu have estimated Huawei could build as many as 70 million smartphones using its own Kirin chips in 2024 — not insignificant compared to the roughly 220 million iPhones that Apple ships annually.

The US won’t be able to stop Huawei and SMIC from making progress in chip technology, Burn J. Lin, a former Taiwan Semiconductor Manufacturing Co. vice president, told Bloomberg News. SMIC should be able to advance to the next generation at 5 nanometers with machines from ASML Holding NV that it already operates, said Lin, who at TSMC championed the lithography technology that transformed chipmaking.

In the run-up to the Mate 60 Pro’s debut, Huawei shored up its margins through a series of cost-cutting efforts. It also booked one-off gains from sales of the Honor smartphone business and a server unit in 2020 and 2021, it has said.

“We continue to optimize our management systems, improve the efficiency and quality of our operations, and refine our sales strategy and product mix,” Huawei said in a statement. “These actions have had a very positive impact on our profit margin.”

A resurgent Huawei would pose problems not just for Apple but also local brands from Xiaomi Corp. to Oppo and Vivo, all of which are fighting for sales in a shrinking market. Chinese smartphone shipments fell 6.3% in the third quarter led by local vendors, according to research firm IDC.

But the market could be bottoming out.

“The Chinese market is expected to see its first year-on-year growth in the fourth quarter after more than two years, mainly driven by more intense competition and a low comparison base,” said IDC analyst Will Wong.

(Updates with industry expert’s comment in the fifth paragraph)

Most Read from Bloomberg Businessweek

Huawei’s Profit Doubles With Made-in-China Chip Breakthrough

(Bloomberg) -- Huawei Technologies Co.’s profit more than doubled during the quarter it revealed its biggest achievement in chip technology, adding to signs the Chinese tech leader is steadying a business rocked by US sanctions. Most Read from BloombergHouse Speaker Mike Johnson’s First Big Bill...