Shotgunner51

RETIRED INTL MOD

- Joined

- Jan 6, 2015

- Messages

- 7,165

- Reaction score

- 48

- Country

- Location

China’s Investors Target Brazil in Hunt for Growth

Beijing’s shift from pure resources sparks $11.9bn of deals spanning food to tech

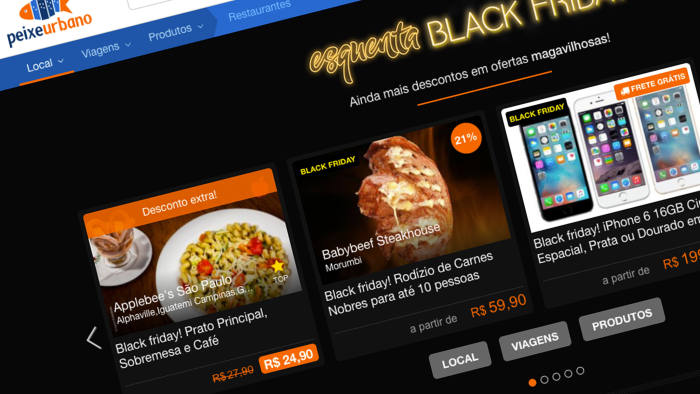

Monashees put Brazilian tech on Beijing’s map when it sold a local daily deal site,

Peixe Urbano, to Chinese internet giant Baidu in 2014

Yesterday by: Lucy Hornby in Beijing and Joe Leahy in São Paulo

Every year, Brazilian venture capital firm Monashees takes entrepreneurs from its portfolio companies on an overseas discovery tour. This year, instead of Silicon Valley, the firm headed to the Yangtze Valley, in a clear sign of a new front opening for Chinese investment in Latin America.

China is seeking to expand lending and investment in Brazil and elsewhere on the continent, as it shifts from its traditional resource focus to manufacturing, logistics and even technology. The switch comes amid a prolonged slump in energy prices and an economic meltdown in Venezuela, which had dominated China’s push into the region.

China is turning into an international financial investor, looking elsewhere for returns on investment as profit margins at home turn thin. That means considering a broader range of industries than it has been targeting.

Mergers and acquisitions tell part of the story. So far in 2016, Chinese companies have spent $11.9bn acquiring Brazilian counterparts, the highest since 2010, when Brazil was at the height of its commodity-driven economic boom, according to figures from Dealogic, the data company. Deals this year have been concentrated in utilities but span sectors ranging from food and beverage to transport.

Monashees put Brazilian tech on Beijing’s map when it sold a local daily deal site, Peixe Urbano, to Chinese internet giant Baidu in 2014 for an undisclosed amount. In leading a group of 60 entrepreneurs to China, Monashees is hoping to replicate that success.

The Brazilian group met all the biggest Chinese tech companies, from Baidu to Alibaba and Tencent, focusing on areas such as software as a service, fintech, e-health and education, said co-founder Eric Acher. The group started 10 years ago and invests in Argentina, Colombia and Silicon Valley, in addition to its main focus, Brazil.

China’s recent advances in innovation and technology were more tangible for Brazilian entrepreneurs, Mr Acher said: “We can learn a lot from what happened in the last 15 years in China as an emerging market, the second-largest tech ecosystem in the world today.”

Beijing’s shift away from pure resources is important to maintaining investment flows into Latin America. In the downturn since 2012, World Bank lending to the region halved, Inter-American Development Bank lending stayed roughly even but Chinese lending soared, according to data from the OECD.

“China is acting as the countercyclical lender, the stabiliser,” says Angel Melguizo, head of the Latin American and Caribbean development centre under the OECD.

Much of that money has flowed into Brazilian energy and infrastructure. But while earlier investment was into state-controlled infrastructure, replicating the Chinese model, new flows are “basically market investments”, said Marcos Caramuru de Paiva, Brazil’s ambassador in Beijing. “It’s very much a demonstration of how dynamic the relations are.”

China and Brazil are finalising details of a $20bn Sino-Brazilian bilateral investment fund, first announced last year, to which China will contribute $15bn. The new fund falls under the umbrella of the China-Latin America Industrial Cooperation Investment Fund (CLAI), adding to its existing $30bn investment mandate.

Han Deping, president of the CLAI fund, said future targets include renewable energy such as solar power; logistics and high-end manufacturing. “Latin America wants to move away from commodity exports, get into value-added processing,” he said.

Brazilian companies have had far less success in China, with mining giant Vale repeatedly rebuffed in attempts to invest on the Chinese mainland even at the height of China’s hunger for iron ore. Monashees hopes to overcome that with an investment of its own into China, even as it seeks to attract Chinese money to its Latin American portfolio.

Another Brazilian firm to target China’s relatively closed market is BRF Global, the world’s largest poultry supplier, which is setting up poultry operations in Southeast Asia with an eye to ultimately bringing its integrated supply chain into the mainland. It already exports chicken parts, pork and beef to China.

“That’s why we are interesting. We’re trying to go in the opposite direction,” says Marcos Sawaya Jank, BRF Global’s vice-president of business development for Asia.

https://www.ft.com/content/01972f58-ae62-11e6-a37c-f4a01f1b0fa1

Last edited: