Stranagor

SENIOR MEMBER

- Joined

- May 11, 2014

- Messages

- 2,187

- Reaction score

- -8

- Country

- Location

It is difficult to replicate China's experience.

Many people only see the development of China in the last 30 years.

Some Africans complain that what they study in China is Western economics and politics, so what is the point of coming to China? They want to study Chinese politics.

This involves the issue of ideological export, which China does not want to do.

Perhaps it is even not to good thing to replicate it verbatim.

***

China's Great Leap Backward: So much for the next dominant superpower

The Chinese century is over. Facing upside-down demographic and economic trends, China is heading off the cliff

After all the prognostications, projections and proclamations of the past 20 years asserting that China would soon overtake the U.S. as the world's dominant superpower, the People's Republic is now facing twin perpetual headwinds, and has no realistic options for countering either of them.

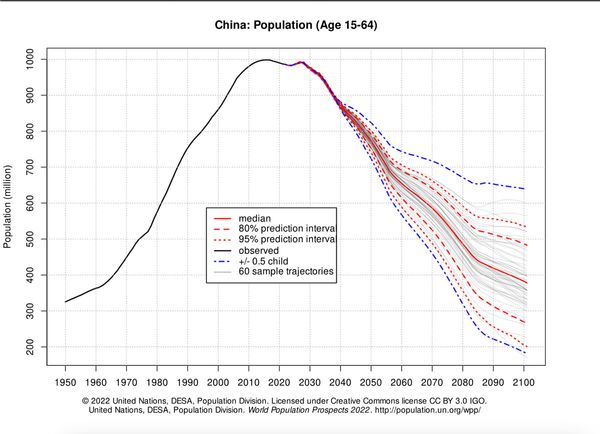

The first could accurately be described as the strongest long-term force driving the fates of all great powers: demographics. What was, for many previous decades,China's ultimate advantage — its never-ending supply of working-age laborers — peaked at almost exactly one billion people in 2010, according to the Chinese census. The next census, in 2020, revealed that for the first time since China's economic liberalization in the 1970s, the working-age cohort had shrunk, decreasing by more than 30 million. The U.N. estimates that this group will continue to contract, dropping to 773 million by 2050. (In other words, between now and then China is likely to lose a number of workers larger than the entire population of Brazil.) The under-14 population will also fall in that same period, from just over 250 million in 2020 to a median projection of 150 million in 2050. Not only will the workers be disappearing, but nobody is expected to replace them.

Advertisement:

Related

Is war with China inevitable? The answer to that question will determine our future

Advertisement:

In Japan, economic stagnation produced a period that was called the "Lost Decade." That stagnation eventually persisted so long that some began to refer to it as the "Lost Generation." In China, an even more ominous buzz-phrase has become popular online: The "Last Generation."

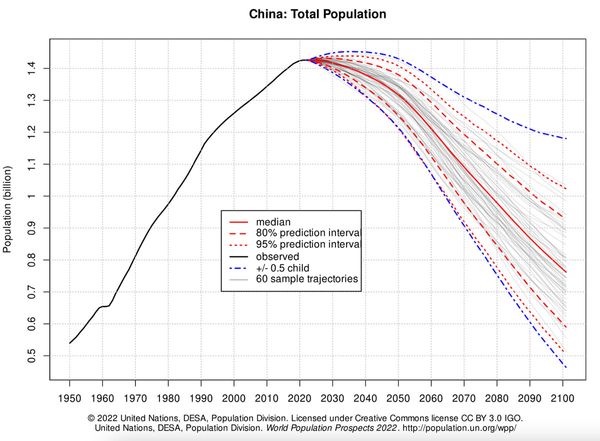

Much has been made of the difficulties China will face in attempting to manage a rapidly-shrinking workforce against a rapidly-growing retirement age population, which is projected to double by 2050. But that issue may actually be preferable to what is likely to happen afterward, or perhaps sooner if some of China's older population doesn't wind up living as long as expected. Here are the UN estimates for China's total population between now and 2100:

Advertisement:

To make matters worse, if that seems possible, all these numbers rely on official Chinese statistics, and the government has likely been overstating them. According to an extensive examination of different sets of books by University of Wisconsin Prof. Yi Fuxian, it's possible to find the "fudging" effects by comparing local and provincial data to that published at the national level.

If you think China has ghost cities now, imagine that vast nation with barely one-third of the population it has today. What will happen to property values in a country where between 50 and 70 percent of its people have disappeared?

"For the official statisticians," Yi explains, "the primary school enrolment data should be reliable because public education covers every Chinese child. They were wrong, however, because primary school enrolment data in China is often inflated so that local authorities can claim more education subsidies from Beijing. … According to a report by CCTV on January 7, 2012, the Jieshou city in Anhui province reported 51,586 primary school students, when the actual number was only 36,234, allowing them to extract an additional 10.63 million yuan (about $1.54 million) in state funding. On June 4, 2012, China Youth Daily reported that a middle school in Yangxin county, Hubei province reported 3,000 students, while the actual number was only 700."

Advertisement:

In a country as large as China, what do these figures look like when aggregated to a national scale? According to Yi, government data "showed that China had 366 million new births" between 1991 and 2010, "but the group aged 0-19 in the 2010 census was only 321 million." In other words, either 45 million of those children had died between birth and the census, or they never really existed in the first place.

That was just one cohort, in one census, but it's hardly the only example. "In 2010, the population aged 3-14 was only 169 million, according to the 2010 household registration database, and 176 million, according to the 2010 census," Yi continued. "Yet, according to the Chinese statistics bureau, there were 210 million births in the 1996-2007 period." Again, either China has secretly experienced the greatest wave of mass child deaths that the world has ever seen, or the birth-rate numbers were always grossly exaggerated.

China's demographic headwinds, therefore, may be hurricane-strength. To be fair, most major nations in the West also face declining birth rates and aging citizens. The enormous difference in projected demographics, at least in many of those cases, comes down to immigration. Even with a current fertility rate of only 1.6, the U.S. population projects to reach roughly 400 million by the end of the century, according to the U.N.'s median estimate. East Asian countries tend to have much more restrictive immigration policies, but nowhere is this as true as in the People's Republic. Since 1950, which is as far back as the data goes, China has never experienced a single year of net positive migration. Ever.

Advertisement:

As previously mentioned, Beijing faces not one but two enormous burdens going forward. The second should not come as much of a surprise, as it was intertwined with China's population burst during all the good years: the economy.

Yes, the mighty Chinese economy, the boomiest boom that's ever boomed… is going to become a big, big problem. Much of this problem will, of course, be caused by the enormity of the demographic crunch. But there are specific details that will amplify the impact of that crunch. A whopping 70 percent of Chinese household wealth is held in real estate. Seventy. Percent. (The comparable number in the U.S. is less than half that.) The demand for investment properties has been so high that China's construction eruption simply cannot be reasonably compared to those that have occurred in any other major economy, even ones that have experienced giant housing bubbles of their own. As this graphic from the Reserve Bank of Australia shows, "residential gross fixed capital" as a proportion of GDP is close to 20% in China — the comparable proportions in Australia, Japan, South Korea and the U.S. are all around 5% or less.

Advertisement:

Keep in mind that China's population is shrinking, and will continue to do so with increasing velocity. According to the World Bank, home price-to-income ratios in Beijing, Shanghai, and Shenzhen exceed "a multiple of 40;" the same figure is "only" 22 in London and 12 in New York, two notoriously expensive cities in the West.

It is likely impossible to overemphasize the potential economic damage that will likely ensue when previous decades of population growth, urbanization and the frenzied real estate investment that has accompanied them run into the brick wall of new decades with consistently fewer buyers — and that doesn't mean "fewer buyers" in the normal sense of a bubble popping, but the literal absence of hundreds of millions of buyers over time. What will happen as those aforementioned ghost cities begin to multiply? And perhaps the more important question: How can China possibly make its all-important transition to a consumer-based economy when consumers as a whole have shoved so much of their wealth into properties that will often end up being worthless? How in the world is this supposed to work? How could it work?

Advertisement:

We need your help to stay independent

Subscribe today to support Salon's progressive journalism

That consumer transition becomes more necessary every day, because China has no other realistic option for productive growth moving forward. For years, Beijing has obsessively pushed economic activity toward investment, which sounds appealing at first simply because of the connotations of the word. But the Middle Kingdom long ago started running up against the law of diminishing returns when it comes to endlessly increasing investment. As Carnegie's China scholar Michael Pettis explained earlier this year, "China has the highest investment share of GDP in the world. It also has among the fastest growing debt burdens in history. These are not unrelated. With growing amounts of investment directed into projects whose economic benefits are less than their economic costs, the surge in China's debt burden is a direct consequence of this very high investment share."

Advertisement:

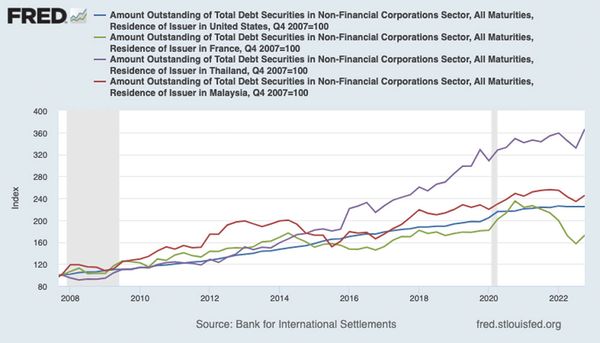

Pettis is not strictly talking about central government debt here, but rather total debt within the economy. Given the prodigious real estate boom in the People's Republic, one could be forgiven for assuming that's mainly what Pettis is describing, and such data surely factors into the next two charts. But there are many other sectors that do as well. Below is a graph of the increase in all outstanding non-financial corporate debt in four nations — the U.S., France, Thailand and Malaysia — since the global financial crisis. For simplicity's sake, the debt level in each country was set to a value of 100 in the final quarter of 2007, and the data goes through the final quarter of 2022:

That's admittedly not the easiest visual aid to digest, so here's a summary: The total amount of such debt in the U.S. increased over those 15 years to a level of 220, or slightly more than double the amount that existed in 2007. Malaysia, which has posted the fastest average growth of the four countries in that time, wound up with almost the same relative amount of internal debt growth. France and Thailand, which have both had economic struggles in the post-crisis period, took very different paths and ended up at the bottom and top of the chart, respectively.

Advertisement:

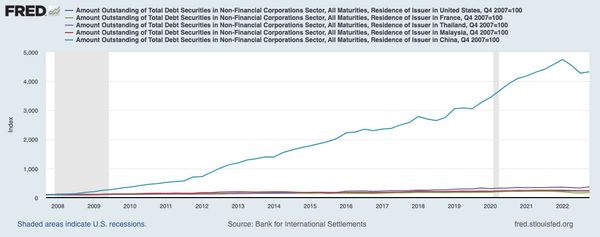

Here's why the comparison is worth digesting. Below is the same exact chart, except with China added:

Most nations tabulate their economic activities and eventually spit out a number that is recorded as GDP. In China, the central government determines what GDP shall be for the quarter, and then it's up to officials to hit their numbers.

Advertisement:

There is likely no economist on the planet who would advocate multiplying any significant category of debt 50 times over, no matter what the reason. But this is as much the result of political pressure to hit government GDP targets as anything else. To go back to Pettis, he explains the Chinese view by saying that for Beijing, GDP is an input, whereas virtually every other country understands it as an output. In other words, most nations tabulate their economic activities and eventually spit out a number that is recorded as GDP. Many arguments are fought over exactly how to go about that calculation and what it means, but the basic premise is pretty much the same. In China, the central government determines what GDP shall be for the quarter, and then it's up to provincial and local officials to do whatever is necessary to hit their numbers, regardless of the actual necessity or utility of the projects. (Furthermore, if those officials can't even reach their goals by incessantly building bridges to nowhere, they may simply lie and claim success anyway.)

Want a daily wrap-up of all the news and commentary Salon has to offer? Subscribe to our morning newsletter, Crash Course.

Advertisement:

Local governments are forbidden from directly borrowing money, so their administrators do what any local government apparatchiks worth their salt around the world do when they need money they're technically not supposed to have: They find a loophole and exploit it relentlessly. In China's case, that means forming "independent" corporations known as "Local Government Financing Vehicles," which are somewhat-inexplicably allowed to be the equivalent of Clark Kent putting on a pair of glasses to fool everyone into thinking that he's not Superman. The LGFVs can borrow money that local governments can't. So that's what they do. Especially when the alternative is to displease the Politburo.

As you might imagine, this type of policy-making does not tend to result in more money allocated to things like expanding sick leave, pension reform, parental leave, debt reduction or anything else that fails to artificially goose GDP. Instead, funds are dumped into watermelon museums that nobody needs and endless Skynet (they seriously call it that) "internal security" cameras that people need even less.

Advertisement:

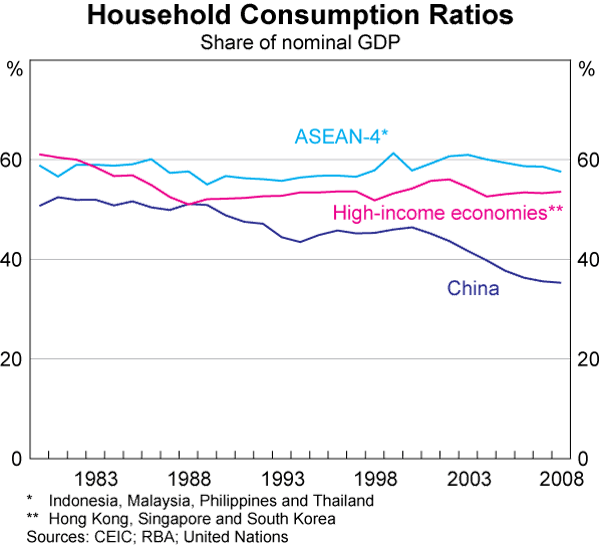

The ironic lack of social safety nets in an ostensibly Communist country, combined with a seemingly unstoppable regime of compulsive over-investment, has for many years resulted in the exact opposite of what China needs — consumers have felt and still feel it necessary to have some of the highest savings rates in the world, which means they aren't becoming a larger part of the economy but rather a smaller part of it. Here's a graph published by Reuters, which shows that private consumption as a share of Chinese GDP has been falling for decades. A similar chart from the Reserve Bank of Australia compares household consumption in China to other major Asian economies:

Advertisement:

"The next few decades" is probably generous. The Chinese economy, if measured by anything remotely approaching the slightest degree of accuracy, won't surpass America's because it can't. The structural forces that have allowed it to grow at breakneck speed for half a century are now the same forces preventing it from continuing to do so. Chinese labor costs today are significantly higher than costs for the same amount of labor in both its Asian neighbors and Latin America, including Mexico, where manufacturing for the American market is much more convenient despite the overhanging power of the cartels. In fact, Mexico became the largest overall U.S. trading partner in the first quarter of this year, after surpassing China to become the biggest trade partner specifically for manufactured goods last year.

The Chinese economy won't surpass America's because it can't. The same structural forces that allowed it to grow at breakneck speed for half a century are now preventing it from continuing to do so.

Advertisement:

China's "factory of the world" status is slowly evaporating because cheaper workers can now be found elsewhere, which often come without problems like blatant IP theft across countless industries or figuring out whether any given supply chain involves Uyghur forced labor camps. The Chinese population is shrinking, meaning that domestic labor costs will continue to surge upward even as overall GDP growth falls. The government in Beijing is worried about "South Park" and Winnie the Pooh. China is no longer a place where capitalist dreams go to succeed, and indeed the fact that it ever was reflects one of the biggest mistakes the Western world has made since the fall of the Iron Curtain.

President Xi Jinping probably won't be happy with the way the rest of the "Chinese century" is likely to turn out. If it's any consolation, he should be happier right now than he will be in the years ahead.