Aero India 2013: The Indian defence story

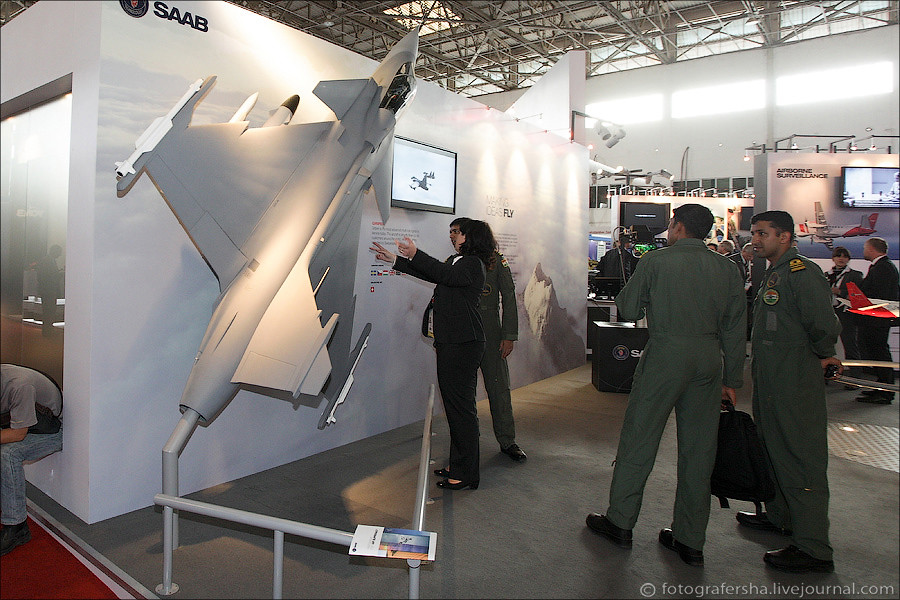

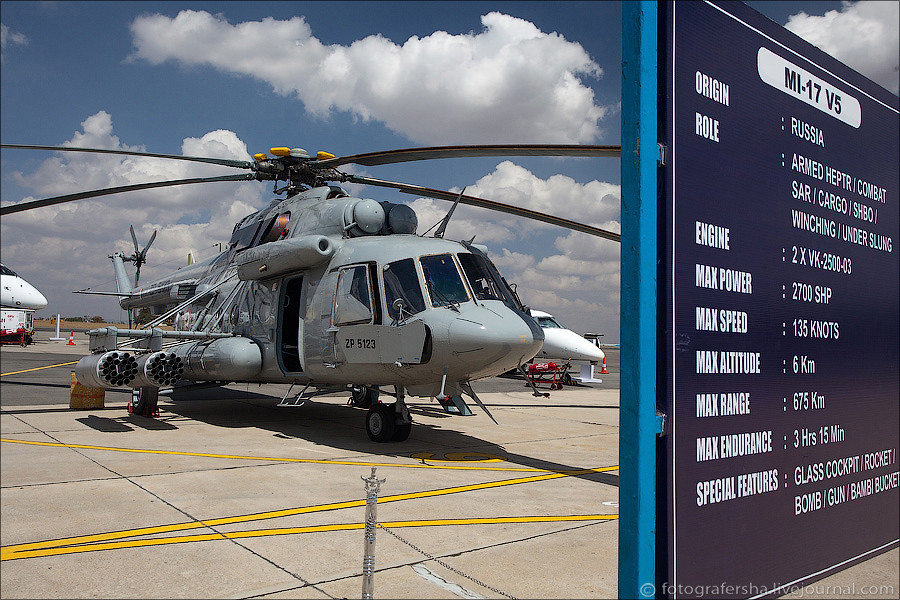

The five-day aviation extravaganza, Aero India 2013, which ended on Sunday was not only about display of aerobatic skills and the paraphernalia usually accompanying such events, but also about potential business tie-ups and networking, given the Rs 1.42 lakh crore defence budget (2009-10), Indian aerospace and defence (A&D) sector is eyed by every Indian and global firm.

The questions that arise are, are Indian firms positioned well to leverage the opportunity and what are the challenges for them and for global firms? To start with, the offset policy that aims at higher involvement of Indian firms and a gradual shift towards indigenisation of weapons, needs to get going in right earnest, said Wing Commander (retd) Neelu Khatri, who heads the Defence and Security Advisory Services at KPMG India. “The policy is good in intention, now the Ministry of Defence (MoD) should operationalise it, so that it really takes off.” A well-trained staff, comprehensive IT infrastructure and higher levels of engagement with the industry, in other words, according to her.

When one talks of defence procurements, the first thing that strikes is controversy, thanks to the Bofors deal, that brought kickbacks in defence deals to the centre stage in the late 1980s and made Bofors a byword for corruption. Elimination of opaqueness in procurement is the best panacea, said Neelu. “If there is a clear policy in place and a stipulated time frame for these procurements that is strictly adhered to, then most of these concerns will automatically go out.”

Another issue that is perceived as a roadblock to the successful implementation of the offset policy is the 26 per cent limit on FDI in joint ventures in the A&D sector. KPMG Partner (Global International Corporate Tax) Gaurav Mehndiratta, said, “The investments in defence tend to be huge and for an Indian promoter to invest 74 per cent in a venture not knowing what the returns are going to be, is going to be very difficult.” If the FDI ceiling is raised, global manufacturers will be confident of transferring technology, he added.

The absence of a level playing field, given that defence public sector undertakings have some tax advantages over their private sector counterparts, is another dampener, he said.

But are Indian companies geared up for a bigger role, presuming these concerns are taken care of? They don’t have the mind-frame of aerospace, as of now, said Neelu. “They are still going through the learning curve that ranges from three to eight years, depending on the complexity of the technology,” she said. It also calls for a stiff programme management and adherence to the highest standards the A&D sector is known for. The notion of India offering cost advantage is misplaced, according to her. “We need to have adequate, trained engineers in aerospace. On ground if I see today, they don’t exist.”

Aero India 2013: The Indian defence story | idrw.org