Progress Continues....Update on CPEC and OBOR from The Wall Street Journal:

‘New Silk Road’ projects keep the spirit of globalization alive: Globalization to increase travel and commerce between 65 countries in Eurasia.

The first freight train service linking Xi'an, capital of northwest China's Shaanxi Province, with Moscow via Kazakhstan, departs Xi'an in December. PHOTO: XINHUA/ZUMA PRESS

By : MARK MAGNIER

Jan. 16, 2017

BEIJING—As the U.S., U.K. and others hit pause on globalization,

China is flexing its economic muscle with an ambitious infrastructure-building spree that would connect up to a third of the world’s people.

In recent years, Beijing has set up a range of institutions and groupings that are being mobilized to promote China’s interests—from the Asian Infrastructure Investment Bank to separate regional development investment forums from Latin America and the Middle East to Central and Eastern Europe.

Chinese President Xi Jinping, who has pushed a more forward-leaning foreign policy than his recent predecessors, has used recent global summits to call for freer trade and urge against protectionism.

He is expected to reiterate the message in a keynote speech Tuesday at the World Economic Forum.

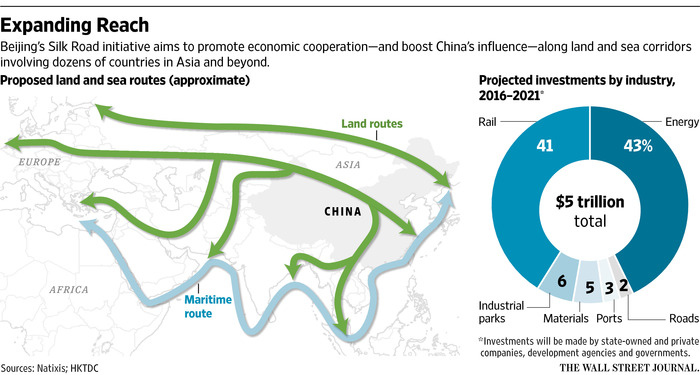

Mr. Xi’s—and China’s—biggest calling card is the mega-infrastructure Silk Road initiative, also known in

China as One Belt, One Road, which envisions building railways, ports, roads, dams, pipelines and industrial corridors across dozens of countries in Asia, Europe and Africa.

Billions of tons of cement and steel, hundreds of thousands of workers and tens of thousands of cranes and diggers could be involved in the effort, according to a report by BNP Paribas Investment Partners.

The initiative offers China a way to boost its flagging economy, push development into its western regions, open new markets, strengthen links with resource-rich countries and extend China’s political clout. Many countries likely to be on the receiving end of investment have signed on.

Foreign engineering and equipment companies such as Caterpillar Inc., ABB Group and Vermeer Corp. said they are hoping for a slice of future projects, working with Chinese state-owned companies.

Less clear, however, is whether Beijing can avoid pitfalls such as wasting investment, exacerbating corruption, driving up indebtedness and arousing suspicion about Chinese intentions in many of the countries. An earlier surge into Africa and Latin America brought accusations that Chinese companies disregarded environmental standards, fanned graft and displayed limited concern for local communities or industries.

“China’s making a pretty concerted effort to improve its image,” said Tom Miller, author of a coming book on the new Silk Road initiative. “But it has a long way to go.”

Pakistan Prime Minister Nawaz Sharif, in vest, in November celebrated the arrival of a Chinese trade convoy at Gwadar port, a key part of the planned $46 billion China-Pakistan Economic Corridor. PHOTO: METIN AKTAS/ANADOLU AGENCY/GETTY IMAGES

In Kazakhstan, where Mr. Xi unveiled the infrastructure plan in 2013, more than 50 projects have been signed, at a price tag of over $20 billion. Some regional rail projects have moved ahead, but the Western Europe-Western China Expressway road project has foundered. China’s part of the road corridor, which aims to connect the Yellow Sea with Russia’s St. Petersburg, is largely done. And Kazakhstan’s portion of the 5,000-mile project is partly done, but Russia’s languishes.

China is stepping up at a time when the incoming Trump administration is rethinking trade commitments and promising to focus on U.S. interests, and the European Union is finding its position in the world tested by Britain’s vote to leave the group and political shifts in other members.

China can concentrate considerable resources in support of its vision. Beijing is backing the $100 billion, China-led Asian Infrastructure Investment Bank; its own $40 billion Silk Road Fund; and the $100 billion New Development Bank, created by the Brics group of emerging economies. The infrastructure bank’s capital alone could generate $1.3 trillion in financing, though that is still shy of the trillions in estimated infrastructure demand.

In the past two years, China reported pouring nearly $30 billion in direct investment into more than 50 countries along the overland and maritime routes that make up the updated Silk Road. Some of this money went into longstanding projects—such as the Eurasian Land Bridge rail project connecting China with Europe and the Bangladesh-China-India-Myanmar transport corridor—that have been repackaged as part of the updated initiative.

A cargo vessel is moored at Gwadar, Pakistan, in November, as the port, marked its first export of a large number of containers to overseas destinations. PHOTO: LIU TIAN/XINHUA/ZUMA PRESS

Even so, Beijing has set a daunting task, especially for the state-owned companies it expects to join the effort. In a 2015 Deloitte Touche Tohmatsu Ltd. survey of state-owned companies likely to spearhead Beijing’s One Belt, One Road vision, 10% reported having no overseas business department. Those companies will need to build up oversight and legal expertise to avoid potential pitfalls of operating abroad.

Some companies, including

Shaanxi Construction Machinery Co., a Shanghai listed state-owned maker of road-building equipment, say they will focus initially on more familiar markets in Southeast Asia.

“You can lose money very quickly if you’re not careful,” said Peking University professor Zha Daojiong. “How industry programs take root locally in these landlocked, poor and small economies is a big question.”

—Pei Li contributed to this article.

Write to Mark Magnier at

mark.magnier@wsj.com