Skyline

SENIOR MEMBER

- Joined

- Jan 8, 2011

- Messages

- 3,640

- Reaction score

- 0

- Country

- Location

WB tips Lanka to lead South Asia’s growth; flags off key risks too

The World Bank expects Sri Lanka to lead South Asia in economic growth this year benefitting from recent rebound and enhanced capacity but the country faces many risks to the positive outlook.

“Sri Lanka would continue to grow at 7.3% this year as the economy was sustained by new capacity from infrastructure investments and rebuilding after the country’s recent conflict,” the World Bank said in its twice-a-year ‘South Asia Economic Focus’ released yesterday.

Forecast of 7.3% in 2014 for Sri Lanka is far above South Asia average of 5.2% as well as estimate for India of 5.7%, Pakistan’s 4%, Nepal’s and Maldives’ 4.5%, 5.4% of Bangladesh and 3.2% by Afghanistan.

The World Bank said the stronger momentum of activity projected for the second half of 2013 will also lead to stronger carry-over into 2014 for Sri Lanka.

“This growth is supported by an increase in capacity from new infrastructure investments and rebuilding. But a relatively protracted recovery in high-income countries and tightening of international financial conditions will constrain a more robust rebound for Sri Lanka within the forecast horizon,” the World Bank added.

It said South Asia in general appeared to have largely recovered from last year’s financial turmoil caused by changes in US Federal Reserve monetary policy. Many were rebuilding currency reserves while curbing current account deficits. But these successes on the external side were accompanied by looming problems in the domestic economy. Economic growth could be held back by unstable banking sectors, inflation, fiscal deficits and debt, and persistent shortfalls in energy and transport infrastructure across the region.

“Now that external pressures are waning, it’s time to refocus on addressing problems within the economies in South Asia so that countries can boost growth and reduce poverty,” said South Asia Chief Economist Martin Rama. “The good news is that across South Asia there is a growing momentum in support of reforms to increase growth because governments recognize this is the best way to overcome poverty.”

On Sri Lanka, the World Bank report said risks to the outlook include maintaining fiscal consolidation, the precarious financial position of CEB and CPC, weathering global commodity prices, declining exports-to-GDP and managing the economic fundamentals in the face of currency fluctuations of major trading partners. The three primary challenges to foreign direct investment in Sri Lanka, according to the World Bank are 1) policy uncertainty and inconsistency with respect to macroeconomic and trade and industrial policy 2) administrative, bureaucratic and organisational constraints and 3) relatively high production costs.

With regard to precarious financial position of CPC and CEB, the World Bank report said a drought in 2014 would increase the already-substantial losses of the CEB. Inadequate rainfall increases the cost of electricity generation because it is produced by furnace oil rather than hydropower.

The unresponsiveness of electricity tariffs to changing conditions has already undermined the viability of the CEB. As a result of its higher dependence on thermal power, the CEB’s operating loss would increase. This would trigger further below-cost provisions of furnace oil by the CPC to the CEB increasing the CPC’s losses as well.

The greater the losses of the CEB the more it undermines private-sector credit growth and by extension, investment and GDP growth. The situation could be aggravated by the Government having to transfer additional resources to bolster the balance sheets of these two State-owned corporations – a substantial fiscal cost.

Increased administered prices to cover the losses of the CPC and CEB could have temporary inflationary impact and reduce overall consumption expenditure.

World Bank also said rising global oil prices and depreciation of the rupee could put pressure on prices.

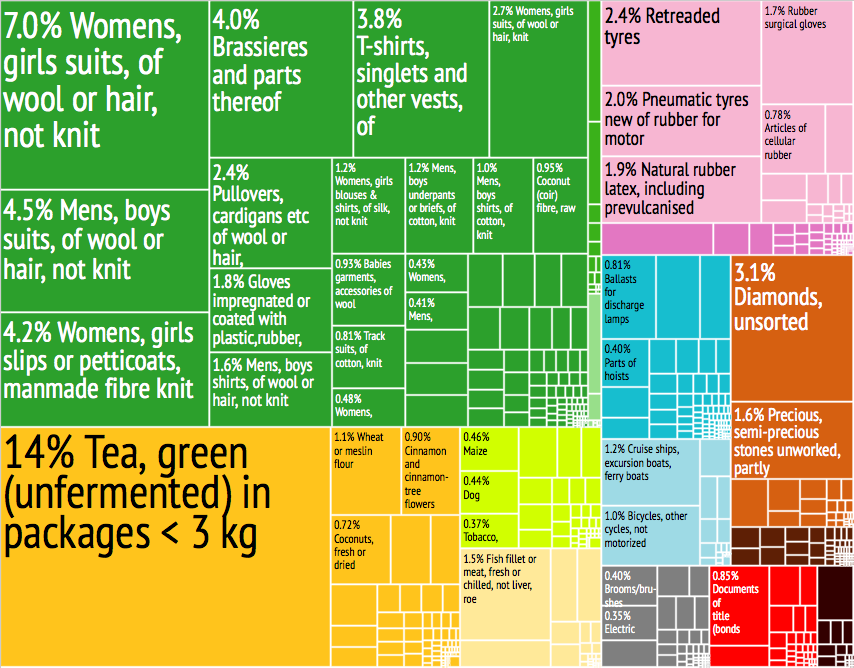

It noted that given the growth in two key export sectors – tea and apparel remains stagnant, there is a risk that there will be a continued decline in the exports to GDP ratio. “There needs to be a new thrust towards diversification of both product and export markets to ensure that the trade balance remains manageable,” the World Bank said.

Impact from the depreciation of the Indian Rupee was also highlighted. “Further depreciation of the Indian Rupee could reduce FDI inflows and tourist arrivals from India and inhibit Sri Lankan exports to India,” World Bank said.

India represents the single largest trading partner and the single largest source of tourist arrivals. India is also the single largest source of imported goods and depreciation would likely drive up imports from India thereby inflicting further deterioration in the trade balance.

WB tips Lanka to lead South Asia’s growth; flags off key risks too | DailyFT - Be Empowered

The World Bank expects Sri Lanka to lead South Asia in economic growth this year benefitting from recent rebound and enhanced capacity but the country faces many risks to the positive outlook.

“Sri Lanka would continue to grow at 7.3% this year as the economy was sustained by new capacity from infrastructure investments and rebuilding after the country’s recent conflict,” the World Bank said in its twice-a-year ‘South Asia Economic Focus’ released yesterday.

Forecast of 7.3% in 2014 for Sri Lanka is far above South Asia average of 5.2% as well as estimate for India of 5.7%, Pakistan’s 4%, Nepal’s and Maldives’ 4.5%, 5.4% of Bangladesh and 3.2% by Afghanistan.

The World Bank said the stronger momentum of activity projected for the second half of 2013 will also lead to stronger carry-over into 2014 for Sri Lanka.

“This growth is supported by an increase in capacity from new infrastructure investments and rebuilding. But a relatively protracted recovery in high-income countries and tightening of international financial conditions will constrain a more robust rebound for Sri Lanka within the forecast horizon,” the World Bank added.

It said South Asia in general appeared to have largely recovered from last year’s financial turmoil caused by changes in US Federal Reserve monetary policy. Many were rebuilding currency reserves while curbing current account deficits. But these successes on the external side were accompanied by looming problems in the domestic economy. Economic growth could be held back by unstable banking sectors, inflation, fiscal deficits and debt, and persistent shortfalls in energy and transport infrastructure across the region.

“Now that external pressures are waning, it’s time to refocus on addressing problems within the economies in South Asia so that countries can boost growth and reduce poverty,” said South Asia Chief Economist Martin Rama. “The good news is that across South Asia there is a growing momentum in support of reforms to increase growth because governments recognize this is the best way to overcome poverty.”

On Sri Lanka, the World Bank report said risks to the outlook include maintaining fiscal consolidation, the precarious financial position of CEB and CPC, weathering global commodity prices, declining exports-to-GDP and managing the economic fundamentals in the face of currency fluctuations of major trading partners. The three primary challenges to foreign direct investment in Sri Lanka, according to the World Bank are 1) policy uncertainty and inconsistency with respect to macroeconomic and trade and industrial policy 2) administrative, bureaucratic and organisational constraints and 3) relatively high production costs.

With regard to precarious financial position of CPC and CEB, the World Bank report said a drought in 2014 would increase the already-substantial losses of the CEB. Inadequate rainfall increases the cost of electricity generation because it is produced by furnace oil rather than hydropower.

The unresponsiveness of electricity tariffs to changing conditions has already undermined the viability of the CEB. As a result of its higher dependence on thermal power, the CEB’s operating loss would increase. This would trigger further below-cost provisions of furnace oil by the CPC to the CEB increasing the CPC’s losses as well.

The greater the losses of the CEB the more it undermines private-sector credit growth and by extension, investment and GDP growth. The situation could be aggravated by the Government having to transfer additional resources to bolster the balance sheets of these two State-owned corporations – a substantial fiscal cost.

Increased administered prices to cover the losses of the CPC and CEB could have temporary inflationary impact and reduce overall consumption expenditure.

World Bank also said rising global oil prices and depreciation of the rupee could put pressure on prices.

It noted that given the growth in two key export sectors – tea and apparel remains stagnant, there is a risk that there will be a continued decline in the exports to GDP ratio. “There needs to be a new thrust towards diversification of both product and export markets to ensure that the trade balance remains manageable,” the World Bank said.

Impact from the depreciation of the Indian Rupee was also highlighted. “Further depreciation of the Indian Rupee could reduce FDI inflows and tourist arrivals from India and inhibit Sri Lankan exports to India,” World Bank said.

India represents the single largest trading partner and the single largest source of tourist arrivals. India is also the single largest source of imported goods and depreciation would likely drive up imports from India thereby inflicting further deterioration in the trade balance.

WB tips Lanka to lead South Asia’s growth; flags off key risks too | DailyFT - Be Empowered