Haq's Musings: Mobile Money Revolution: Pakistan Surges Ahead of India

Pakistan government is handing out Rs. 40,000 per family to nearly a million internally displaced persons (IDPs) through mobile service operator Zong's mobile SIMs. The government is attempting to ease the discomforts of displacement for such a large number of people displaced after the start of Pakistan Army's Operation ZarbeAzb to root out terrorists from North Waziristan tribal agency. Zong is one of several mobile service operators offering Easypaisa m-money service. It was pioneered by Telenor Pakistan.

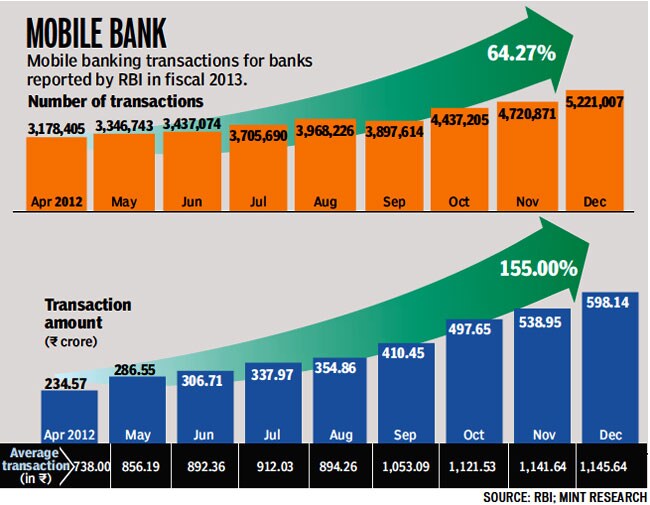

Easypaisa moved $3.5 billion in fiscal 2012-13. Bangladesh's bKash did $4 billion over the same period. These figures were well ahead of the $3.2 billion moved in comparable period by India's M-Pesa mobile money network, according to New York Times. Over the last 12 months, the m-money market volume in Pakistan has reached 153 million annual transactions worth US$ 6.2 billion, according to Asian Development Bank.

Easypaisa M-money Growth in Pakistan (Source: ADB)

Pakistan’s m-money infrastructure has grown rapidly since the launch of the first domestic initiative in October 2009. This expansion has been enabled by a liberal financial and telecommunications regulatory framework, and active private sector participation. Four out of five cellular mobile companies currently operating in Pakistan have launched m-money systems in partnership with financial institutions. The m-money market volume has reached 153 million annual transactions worth US$ 6.2 billion.

There are two ways through which m-money services are offered in Pakistan. Over 95% of m-money transactions are done through mobile banking (m-banking) agents, and the rest are processed directly through customers’ mobile-wallet (m-wallet) accounts, using mobile phones. M-banking agents (retail points) provide the basic infrastructure for Pakistan’s m-money services, whereas customers’ m-wallet accounts currently have a limited role in the m-money services market.

It is believed that the reason why India lags behind Bangladesh and Pakistan in mobile money is because its regulators require mobile operators to work with banks to provide the services. Mobile networks would prefer to have their own agents who can cash out the digital money into hard currency. Much of the infrastructure is already in place, because there are so many locations where customers can top up on airtime. But the mobile operators are not allowed to use those sales outlets as financial agents in India.

Haq's Musings: Mobile Money Revolution: Pakistan Surges Ahead of India

Pakistan government is handing out Rs. 40,000 per family to nearly a million internally displaced persons (IDPs) through mobile service operator Zong's mobile SIMs. The government is attempting to ease the discomforts of displacement for such a large number of people displaced after the start of Pakistan Army's Operation ZarbeAzb to root out terrorists from North Waziristan tribal agency. Zong is one of several mobile service operators offering Easypaisa m-money service. It was pioneered by Telenor Pakistan.

Easypaisa moved $3.5 billion in fiscal 2012-13. Bangladesh's bKash did $4 billion over the same period. These figures were well ahead of the $3.2 billion moved in comparable period by India's M-Pesa mobile money network, according to New York Times. Over the last 12 months, the m-money market volume in Pakistan has reached 153 million annual transactions worth US$ 6.2 billion, according to Asian Development Bank.

Easypaisa M-money Growth in Pakistan (Source: ADB)

Pakistan’s m-money infrastructure has grown rapidly since the launch of the first domestic initiative in October 2009. This expansion has been enabled by a liberal financial and telecommunications regulatory framework, and active private sector participation. Four out of five cellular mobile companies currently operating in Pakistan have launched m-money systems in partnership with financial institutions. The m-money market volume has reached 153 million annual transactions worth US$ 6.2 billion.

There are two ways through which m-money services are offered in Pakistan. Over 95% of m-money transactions are done through mobile banking (m-banking) agents, and the rest are processed directly through customers’ mobile-wallet (m-wallet) accounts, using mobile phones. M-banking agents (retail points) provide the basic infrastructure for Pakistan’s m-money services, whereas customers’ m-wallet accounts currently have a limited role in the m-money services market.

It is believed that the reason why India lags behind Bangladesh and Pakistan in mobile money is because its regulators require mobile operators to work with banks to provide the services. Mobile networks would prefer to have their own agents who can cash out the digital money into hard currency. Much of the infrastructure is already in place, because there are so many locations where customers can top up on airtime. But the mobile operators are not allowed to use those sales outlets as financial agents in India.

Haq's Musings: Mobile Money Revolution: Pakistan Surges Ahead of India