Haq's Musings: Tight Gas Production Begins in Pakistan

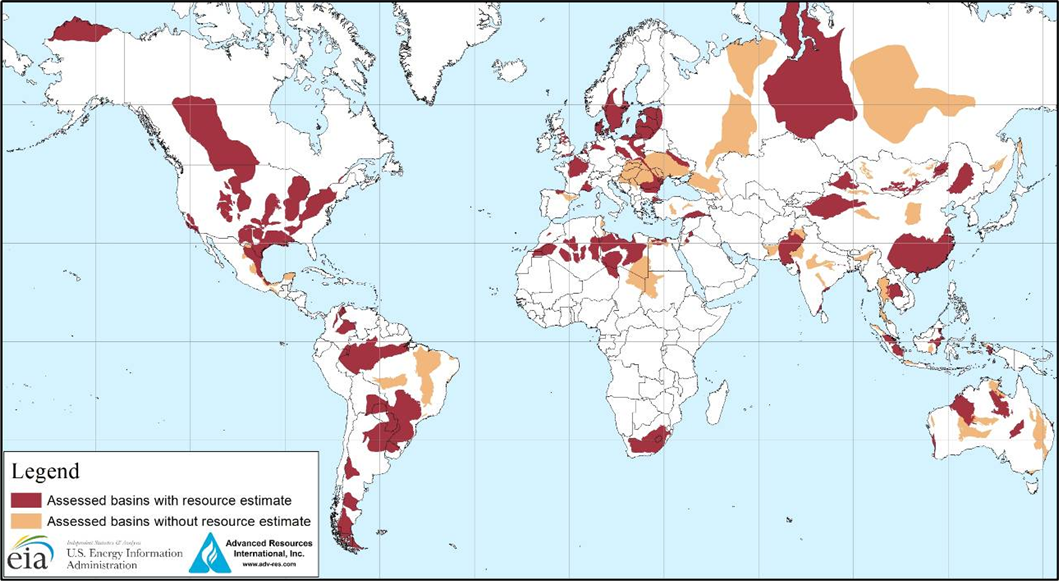

First tight gas well producing 15 million cubic feet per day of natural gas is on line at Sajawal gas field in Kirthar block in Sindh province, according to a report in Express Tribune. It is located 110 km south east of Karachi, Pakistan. It puts Pakistan in an exclusive club of just a few nations producing unconventional natural gas.

The tight gas well in Kirthar belt is being operated jointly by Poland's Polskie Gornictwo Naftowe i Gazownictwo (PGNiG) and Pakistan Petroleum Limited (PPL).

The state-owned Sui Southern Gas Company (SSGC) is buying gas from the joint venture at $6 per million BTUs (half the price agreed for Iranian gas) for distribution through its network in southern Pakistan. SSGC is laying a 52-kilometre-long pipeline at an estimated cost of Rs 325 million, carrying gas from the Suleman Range to the Nooriabad industrial estate.

First tight gas production launch in Sajawal is a very significant milestone for Pakistan. It augurs well for the future of both tight and gas production in the country because there are similarities in how both are extracted. Pakistan is endowed with huge deposits of both---105 trillion cubic feet (TCF) of shale gas and at least 33 trillion cubic feet of tight gas. In addition, Pakistan is also blessed with 9.1 billion barrels of shale oil which is also extracted in a similar way.

Pakistan's current demand for natural gas is about 1.6 trillion cubic feet per year. Even if triples to 5 trillion cubic feet per year, the current known reserves of over 150 trillion cubic feet of conventional and unconventional gas are sufficient for over 30 years.

Wells for both of these unconventional resources (tight and shale) must be "hydraulically fractured" (fracked) in order to produce commercial amounts of gas. Operator challenges and objectives to be accomplished during each phase of the Asset Life Cycle (Exploration, Appraisal, Development, Production, and Rejuvenation) of both shale gas and tight gas are similar, according to a paper on this subject. Drilling, well design, completion methods and hydraulic fracturing are somewhat similar; but formation evaluation, reservoir analysis, and some of the production techniques are quite different.

The current technology known as hydraulic fracturing or fracking was developed in the United States and it has spawned shale oil and gas revolution increasing supplies and reducing gas prices. The Chinese are now working on further cutting costs to make the equipment and technology more affordable.

Like the shale gas revolution in the United States, tight gas is transforming China's gas production - accounting for a third of total output in 2012 -- and will form the backbone of the country's push to expand so-called "unconventional" gas production nearly seven-fold by 2030, according to Reuters. The speed and size of the boom has exceeded forecasts and has been led by local firms developing low-cost technology and techniques, already being rolled out by Chinese companies in similar gas fields outside of China. Pakistan can benefit from the Chinese in its efforts to increase tight and shale gas and oil production.

Haq's Musings: Tight Gas Production Begins in Pakistan

First tight gas well producing 15 million cubic feet per day of natural gas is on line at Sajawal gas field in Kirthar block in Sindh province, according to a report in Express Tribune. It is located 110 km south east of Karachi, Pakistan. It puts Pakistan in an exclusive club of just a few nations producing unconventional natural gas.

The tight gas well in Kirthar belt is being operated jointly by Poland's Polskie Gornictwo Naftowe i Gazownictwo (PGNiG) and Pakistan Petroleum Limited (PPL).

The state-owned Sui Southern Gas Company (SSGC) is buying gas from the joint venture at $6 per million BTUs (half the price agreed for Iranian gas) for distribution through its network in southern Pakistan. SSGC is laying a 52-kilometre-long pipeline at an estimated cost of Rs 325 million, carrying gas from the Suleman Range to the Nooriabad industrial estate.

First tight gas production launch in Sajawal is a very significant milestone for Pakistan. It augurs well for the future of both tight and gas production in the country because there are similarities in how both are extracted. Pakistan is endowed with huge deposits of both---105 trillion cubic feet (TCF) of shale gas and at least 33 trillion cubic feet of tight gas. In addition, Pakistan is also blessed with 9.1 billion barrels of shale oil which is also extracted in a similar way.

Pakistan's current demand for natural gas is about 1.6 trillion cubic feet per year. Even if triples to 5 trillion cubic feet per year, the current known reserves of over 150 trillion cubic feet of conventional and unconventional gas are sufficient for over 30 years.

Wells for both of these unconventional resources (tight and shale) must be "hydraulically fractured" (fracked) in order to produce commercial amounts of gas. Operator challenges and objectives to be accomplished during each phase of the Asset Life Cycle (Exploration, Appraisal, Development, Production, and Rejuvenation) of both shale gas and tight gas are similar, according to a paper on this subject. Drilling, well design, completion methods and hydraulic fracturing are somewhat similar; but formation evaluation, reservoir analysis, and some of the production techniques are quite different.

The current technology known as hydraulic fracturing or fracking was developed in the United States and it has spawned shale oil and gas revolution increasing supplies and reducing gas prices. The Chinese are now working on further cutting costs to make the equipment and technology more affordable.

Like the shale gas revolution in the United States, tight gas is transforming China's gas production - accounting for a third of total output in 2012 -- and will form the backbone of the country's push to expand so-called "unconventional" gas production nearly seven-fold by 2030, according to Reuters. The speed and size of the boom has exceeded forecasts and has been led by local firms developing low-cost technology and techniques, already being rolled out by Chinese companies in similar gas fields outside of China. Pakistan can benefit from the Chinese in its efforts to increase tight and shale gas and oil production.

Haq's Musings: Tight Gas Production Begins in Pakistan