.,.,.,

Huge resource transfers caused by implicit taxes have adversely affected farmers’ income.

In Pakistan, many economic circles have continuously been demanding to improve agricultural income tax (AIT) collection, in line with the much-cherished principle of horizontal and vertical equity in taxation.

The sector contributes around 23 per cent to the national GDP (FY21). However, the total AIT collection in Pakistan is around Rs3 billion — a mere 0.02pc of the agricultural GDP of the country. Several studies have estimated that the AIT potential is around Rs10bn to Rs200bn, based on various land-based and income-based tax options.

In Pakistan, AIT is a provincial subject. Undeniably, the tax rate on agricultural income is lower than the federal tax rate applicable to income derived from other sources. The highest slab on agricultural income stands at just 15pc in Sindh and Punjab provinces.

However, farmers are required to pay — whichever is higher — either a fixed amount based on landholding or an amount based on annual agricultural income, with varying limits and rates.

In 1996-1997, Pakistan’s land revenue (land tax) collection stood at Rs1.4bn. Soon after, Agricultural Income Tax Act 1997 was promulgated in Punjab and subsequently in other provinces. Effectively, Rs1.4bn is far greater than the current Rs3bn, in view of the current size of agricultural GDP and Pakistan’s total tax revenues. There are several underlying causes of such abysmal performance.

Agricultural income tax is around Rs3bn, a mere 0.02pc of the agricultural GDP when it has been estimated around Rs10bn to Rs200bn, based on various tax options

First, the agriculture sector has been paying a variety of indirect taxes, explicit as well as implicit taxes (indirect costs that result from government policies. For instance, last year, the government announced the procurement price of the wheat crop at Rs2,200 per 40-kilogram, which was less than the average international price, which hovered around Rs2,750. This price difference alone resulted in a Rs200bn transfer from rural to urban areas.

Many studies point out that such implicit taxation on the agriculture sector has led to large inter-sectoral resource transfers to the tune of $1-2bn per year during the previous decades. Unfortunately, this transfer stands greater than all the subsidies provided to the agriculture sector.

Such huge resource transfers have adversely affected the farmers’ income and, in turn, farm investments, which are deemed crucial for the agricultural development of a country.

Second, a good tax policy always aims at the effective administration of taxes, ensuring minimum tax evasion and rent-seeking, along with an inexpensive tax collection system.

Unfortunately, the current hybrid AIT system, based on land-based tax and income-based tax, empowers tax collectors to direct even a small farmer to file an AIT return if the collector presumes (without having details of personal revenue/expense/investment) that a farmer’s income exceeds the maximum limit of AIT exemption, which is Rs400,000 in Punjab and Khyber Pakhtunkhwa, and Rs1.2 million in Sindh. Such income-based AIT collection has opened a new floodgate to corruption for farmers, especially who own 12-50 acres of land.

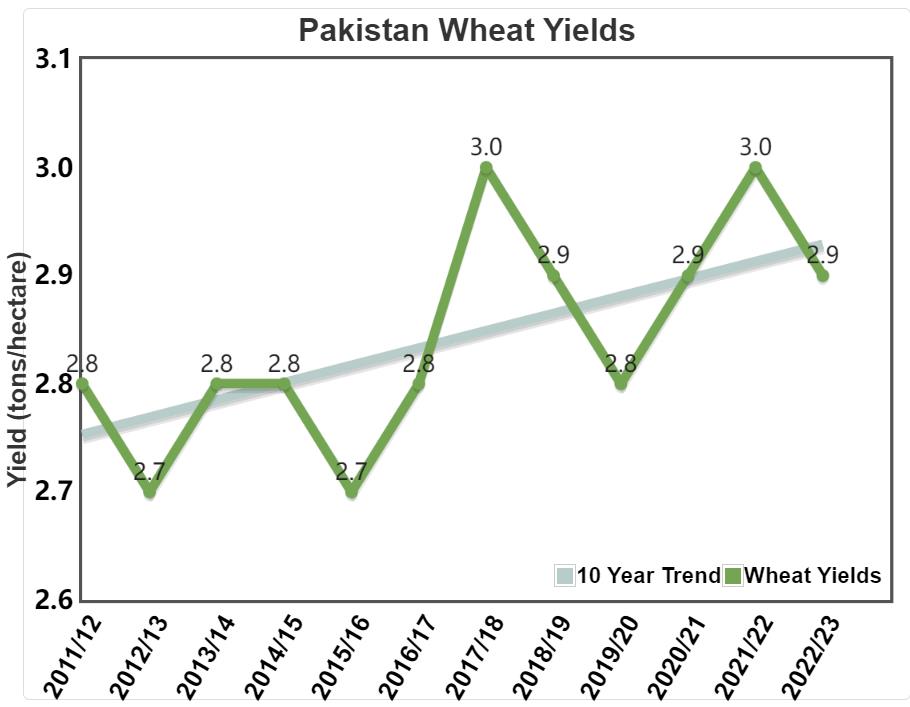

Third, agriculture is an inherently risky business, given its high dependency on weather conditions and volatile prices of crops. On top of all these uncontrolled factors, climate change is a new menace that is further escalating this production risk, leading to variation in production from year to year.

In addition, there are great dissimilarities in the agricultural income generated from the same size of land depending upon crops, soil type, availability of agricultural inputs, farming practices, crop sowing time, cropping intensity, and weather conditions.

Our tax authorities are usually not accustomed to such wide variations in yields, cost of production, commodity prices, and in turn, net agricultural incomes and tax assessment thereof.

Fourth, income-based tax collection is, in many ways, out of sync with the current social readiness level of rural areas, farm management practices, and the educational and social profile of farmers (with the exception of large farmers).

Four options for agricultural tax are prevalent in different countries. These are based on the land area, rental value of land, actual income from land, and presumptive income from land using some proxies.

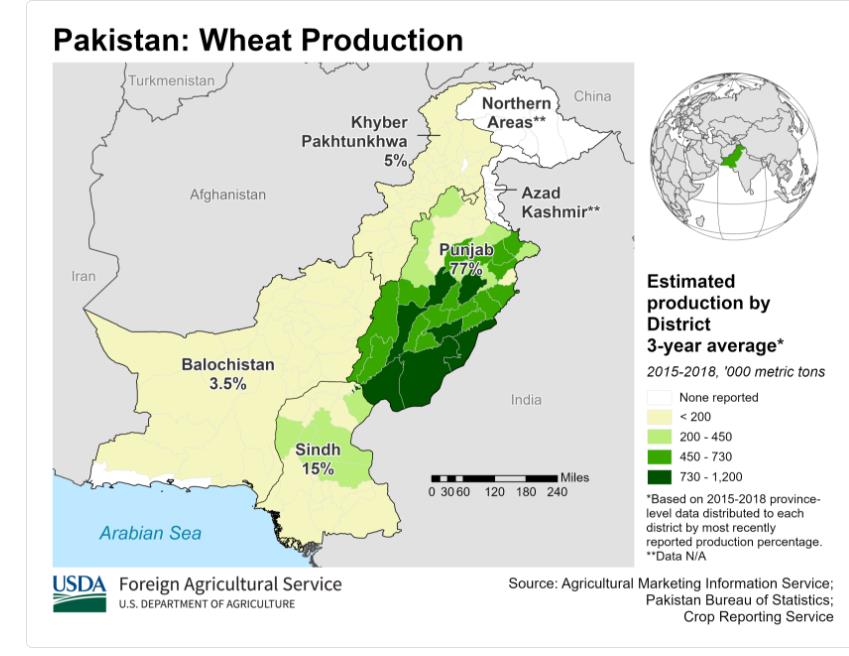

Land area-based taxation has been by far the most common practice in developing countries. Farm sizes in Pakistan are shrinking due to rapid population growth and land division among family members over successive generations.

Since farms less than 12 acres (irrigated) in Punjab and four acres (irrigated) in Sindh are exempt from agricultural tax, land-based tax collection is doomed to decline in the future unless the tax rate (per acre) is increased, which is possible only up to a certain level.

Furthermore, in Pakistan, there are only two categories of land used for tax purposes: irrigated and non-irrigated. Therefore, under the prevailing criterion, the least productive land has the highest tax burden as a percentage of land value.

The rental value of land is changing rapidly in rural areas. Imposing a tax based on it may require undertaking a full-fledged village survey at regular intervals. Because several other factors influence rent, the rental value of land does not always reflect the true productive capacity of agricultural land.

As already discussed, in practice, there are several challenges in assessing actual farm income. This is because land productivity varies from area to area, year to year, and even from farmer to farmer.

Moreover, an income-based AIT assessment of 0.86m farmers, who own 12 or more acres of land and cumulatively 52pc of Pakistan’s total farm area (Agricultural Census 2010), seems beyond the human and institutional capacity of provincial revenue departments and would also be too expensive a task.

It is pertinent to mention that the Federal Board of Revenue (FBR) manages 3.5m active taxpayers (including salaried persons) with a huge institutional setup and budget. Therefore, income-based AIT may have to wait for some time.

Hence, the most viable option is to tax this sector based on presumed income (presumptive taxation), using a predetermined proxy — Produce Index Unit (PIU) of land, which measures the productive capacity of agricultural land considering soil type, mode of irrigation, and agro-climatic zone.

PIU was used for the land revenue (tax) system in the 1970s and 1990s. Banks also used PIU to advance loans to farmers. This option has an inbuilt mechanism to take into account land productivity and the tax-paying ability of each farmer.

Such presumptive tax should be progressive — whereby large farmers are required to pay higher rates. Moreover, the exemption for farmers up to 12 acres is too generous, considering current cropping intensity, crop yields, and crop prices.

This direct tax can be collected in a very cost-effective manner, like the e-Abiana (irrigation tax) system, prevalent in Punjab, with a mechanism in place for sharing information about PIUs and paid taxes with FBR to plug tax evasion and tax sheltering.

However, to implement PIU-based AIT, a revision of the outdated number of PIUs (per acre) is required in line with the current productive capacity of land. For such revision, already necessary resources and information are within the capacity of the Land Revenue Departments and Agriculture Departments.