kinds of same route China tookOkok. I accept this. But 40% tax is crazy. This is protectionism.

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

India slashes solar imports from China as domestic manufacturing thrives

- Thread starter NG Missile Vessels

- Start date

Puffin

FULL MEMBER

- Joined

- May 27, 2023

- Messages

- 586

- Reaction score

- 0

- Country

- Location

China owns all rare earth metals in China, Africa and South America.

China controls the whole market and the supply chian through BRI.

Silicon ingots are made of Silicon. Sand in other words. Does China own all the sand in the world ?

India is still buying Chinese cells for packing into modules. Even Africans can do that. The hard part is the foundry.

Adani becomes India’s sole producer of large monocrystalline silicon ingots

Adani Solar has started producing large monocrystalline silicon ingots for M10 and G12 wafers. It is targeting 2 GW of ingot and wafer capacity by the end of 2023 and 10 GW by 2025.DECEMBER 22, 2022 UMA GUPTA

Adani Solar's factory in Gujarat, India

Image: Adani Solar

Share

From pv magazine India

Adani Solar, the photovoltaics unit of Adani Group, has become India’s sole producer of large-sized monocrystalline silicon ingots for M10 and G12 wafers.

Gautam Adani, the chairman of Adani, recently unveiled the new ingots at the group's Mundra facility. The company said the monocrystalline ingots will drive the production of renewable electricity from silicon-based PV modules, with efficiencies ranging from 21% to 24%.

Adani Solar is a part of Adani New Industries Ltd. (ANIL), which is trying to develop the world’s largest green hydrogen ecosystem. It completed the backward integration of the ingot line infrastructure in about seven months.

Last edited:

Puffin

FULL MEMBER

- Joined

- May 27, 2023

- Messages

- 586

- Reaction score

- 0

- Country

- Location

Reliance manufacturing solar cells using the latest technologies

SEPTEMBER 25, 2021 UMA GUPTA

Adani Solar manufacturing line

Image: Adani Solar

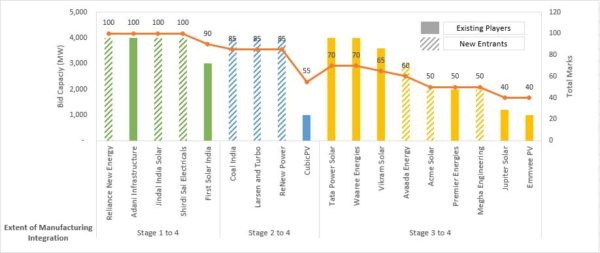

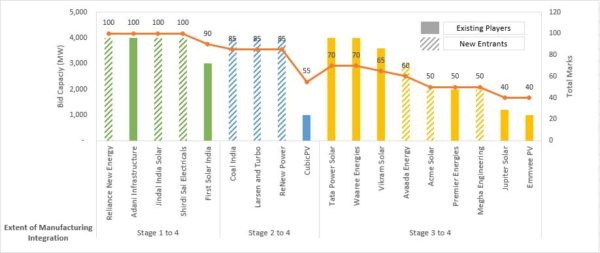

The government’s production-linked incentives scheme for gigawatt-scale manufacturing of high-efficiency solar modules has received bids for an overwhelming 54.8 GW of capacity with participation from existing manufacturers and new players alike. Out of the total 18 bidders, half are new to solar manufacturing.

In the shortlist, Adani Infrastructure, Jindal India Solar, Reliance New Energy, and Shirdi Sai Electricals are the highest scorers with each of them winning 100 marks—owing to the fact they offered full extent of integration up to polysilicon manufacturing stage (50 marks) and a maximum capacity of 4 GW each (another 50 marks). USA-based thin-film module First Solar is also a strong contender with 90 marks (50 marks awarded for full integration plus 40 marks for 3 GW proposed capacity).

Also on the shortlist are Coal India Limited, CubicPV, Larsen and Toubro, and ReNew Power, which submitted bids for module fabs integrated up to ingots-wafers manufacturing from outsourced polysilicon. And Avaada Energy, Acme Solar, Emmvee PV, Jupiter Solar, Megha Engineering, Premier Energies, Tata Power Solar, Vikram Solar, and Waaree Energies as bidders for cell and module manufacturing (please see the below chart released by JMK Research).

Bid Capacities and Total Marks Assigned under Solar Manufacturing PLI Scheme

Bid Capacities and Total Marks Assigned under Solar Manufacturing PLI Scheme

JMK Research

“The bidder/manufacturer getting higher marks will get preference in the allocation of manufacturing capacity under the PLI scheme. In case of equal marks, the bidder/manufacturer quoting the least total PLI amount for five years’ period, followed by a higher ‘Extent of integration’ followed by higher ‘Manufacturing Capacity,’ will get priority in the selection,” as per the PLI bid document.

The shortlisted applicants will lodge bids based on the level of PLI funding they will require for five years after their planned factories are commissioned.

The maximum incentive to a single manufacturer will be tied to 2 GW of its annual production capacity or half of the planned output of its facility, whichever is lower. That cap will ensure at least three solar manufacturers can benefit from the INR4,500 crore pot.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: [email protected].

More articles from Uma Gupta

[email protected]

Adani and Reliance to set up solar gigafabs under PLI Scheme

Adani and Reliance New Energy, along with Jindal India Solar and Shirdi Sai Electricals, are the top scorers in the shortlist released for the production-linked incentives (PLI) scheme for high-efficiency module manufacturing. The list also includes 14 other companies vying for the incentives. The PLI requirement quoted by the shortlisted applicants will decide the beneficiaries.SEPTEMBER 25, 2021 UMA GUPTA

Adani Solar manufacturing line

Image: Adani Solar

Share

The government’s production-linked incentives scheme for gigawatt-scale manufacturing of high-efficiency solar modules has received bids for an overwhelming 54.8 GW of capacity with participation from existing manufacturers and new players alike. Out of the total 18 bidders, half are new to solar manufacturing.

In the shortlist, Adani Infrastructure, Jindal India Solar, Reliance New Energy, and Shirdi Sai Electricals are the highest scorers with each of them winning 100 marks—owing to the fact they offered full extent of integration up to polysilicon manufacturing stage (50 marks) and a maximum capacity of 4 GW each (another 50 marks). USA-based thin-film module First Solar is also a strong contender with 90 marks (50 marks awarded for full integration plus 40 marks for 3 GW proposed capacity).

Also on the shortlist are Coal India Limited, CubicPV, Larsen and Toubro, and ReNew Power, which submitted bids for module fabs integrated up to ingots-wafers manufacturing from outsourced polysilicon. And Avaada Energy, Acme Solar, Emmvee PV, Jupiter Solar, Megha Engineering, Premier Energies, Tata Power Solar, Vikram Solar, and Waaree Energies as bidders for cell and module manufacturing (please see the below chart released by JMK Research).

JMK Research

“The bidder/manufacturer getting higher marks will get preference in the allocation of manufacturing capacity under the PLI scheme. In case of equal marks, the bidder/manufacturer quoting the least total PLI amount for five years’ period, followed by a higher ‘Extent of integration’ followed by higher ‘Manufacturing Capacity,’ will get priority in the selection,” as per the PLI bid document.

The shortlisted applicants will lodge bids based on the level of PLI funding they will require for five years after their planned factories are commissioned.

The maximum incentive to a single manufacturer will be tied to 2 GW of its annual production capacity or half of the planned output of its facility, whichever is lower. That cap will ensure at least three solar manufacturers can benefit from the INR4,500 crore pot.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: [email protected].

Share

UMA GUPTA

Based in New Delhi, Uma reports on the latest PV market trends and projects in India. After gaining an MSc Physics (Electronics) and an MBA, she has gone on to accrue over a decade of experience in technology journalism.More articles from Uma Gupta

[email protected]

Han Patriot

ELITE MEMBER

- Joined

- Mar 23, 2011

- Messages

- 13,534

- Reaction score

- -36

- Country

- Location

I didn't recall we ever impose 40% on solar panels mate.kinds of same route China took

It seems you do not do research before spouting off your behind.View attachment 953587

View attachment 953588

View attachment 953589View attachment 953590

For high end there is absolute basic chinese contribution of parts, most expensive(and hence most value addition) parts are the ICs, Battery cell, camera module, screen, the Chinaman doesn't have state of the art capabilities for any of these.

What the chinaman does is assembly

He will import the battery cell from Korea and assemble it in a ceramic or other casing with the leads etc attached

He will import various ICs, but do the OSAT on it where the IC is sealed in ceramic packaging and attached to the leads

He will import the core display panel, LCD, OLED whatever and assemble it into a screen.

He will import the camera module IC, stick it on a PCB and add the imported camera lense setup to it.

And so all these products are "Made in China" per the shipping labels or little labels on the packaging, but the core is in white masta's hands, or in his Confucian vassals like Korea, Japan or Taiwan.

The West has milked the Chinese cow well without having a critical dependency on them which they cannot fix given enough time.

Indeed, even the ubiquity of Chinese shit in the markets of the world is a blessing of the white master, Huawei is simply a trailer, as they have shown with Russia they can go much further, utteraly cut off market access for these chinese and for all DuAL CirCuLaTiOn cope of 11, Jinping, their economy is still heavily export dependent and not on domestic consumption only like he hopes.

Samsung gets more iPhone 15 OLED orders as Chinese firm BOE fails quality test

Apple was reportedly forced to buy more OLED panels for iPhones from Samsung Display as Chinese firm BOE's OLED panels failed quality tests.www.sammobile.com

Huawei now using Kunlun Glass.

My Huawei phone with Harmony Os dropped few times with not even a scratch. Best phone I ever had.

Is Huawei Kunlun Glass Unbreakable? Watch This Video to Find Out

Huawei's "unbreakable" Kunlun glass survived a concrete drop test, outperforming other smartphone glass. Here are the details...

Putting “Unbreakable” Huawei Kunlun Glass to the Test: The Results May Surprise You (video)

.NG Missile Vessels

FULL MEMBER

- Joined

- Apr 9, 2023

- Messages

- 1,600

- Reaction score

- 0

- Country

- Location

Similar threads

- Replies

- 0

- Views

- 424

- Replies

- 0

- Views

- 204

- Replies

- 0

- Views

- 633

Latest posts

-

-

-

Cabinet approves COAS Gen Asim Munir's promotion to field marshal

- Latest: FourMikeEcho

Pakistan Defence Latest Posts

-

-

Cabinet approves COAS Gen Asim Munir's promotion to field marshal

- Latest: FourMikeEcho

-

-

Why Pakistan’s JF-17 Thunder Is Outshining India’s Tejas on the World Stage

- Latest: FourMikeEcho

Pakistan Affairs Latest Posts

-

Russia Has Delivered MI-35M Assault Helicopters To Pakistan

- Latest: Defense Reader

-

India launches missile attacks on Multiple locations in Pakistan,

- Latest: RaktimChandra