Hell hound

STAFF

- Joined

- Jun 17, 2014

- Messages

- 4,168

- Reaction score

- 2

- Country

- Location

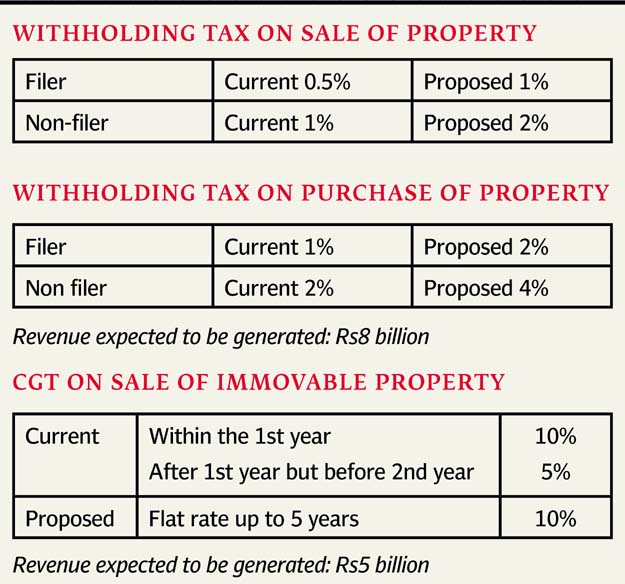

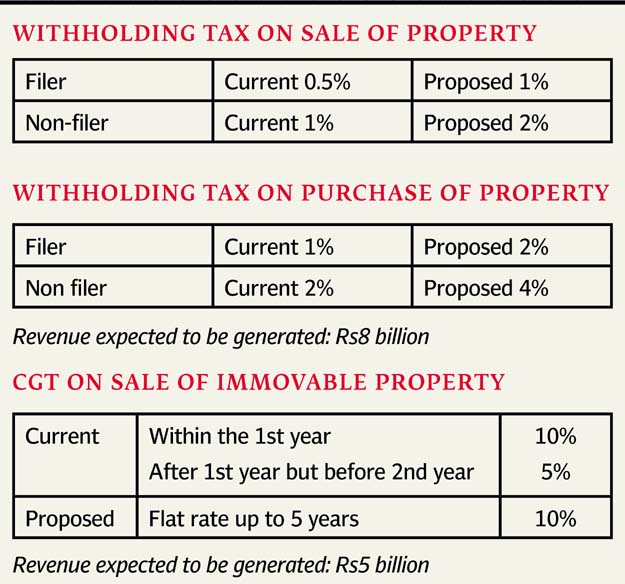

ISLAMABAD: The government may double the tax burden of sellers and purchasers on transfer of properties in addition to fixing a flat 10% tax rate on gains made on sale of properties within five years of holding period.

Sources said Finance Minister Ishaq Dar has cleared a budget proposal to increase the tax burden of both filers and non-filers of tax returns on transfer of the properties to generate Rs13 billion in revenue.

Pakistan agrees to slap billions in new taxes

If approved by Prime Minister Nawaz Sharif, the government may double withholding tax rate to 1% for those sellers who are filers of income tax returns. For sellers who are non-filers, the proposed withholding tax on transfer of properties is 2%, according to sources.

Similarly, the government may also double withholding tax rates for purchasers on transfer of properties. Currently, purchasers who file income tax returns pay 1% of the value of the property in withholding tax. According to the budget proposal, this rate will be increased to 2%. Withholding tax on non-filing purchasers will be increased to 4% from the current 2%, sources added.

However, any decision to increase taxes for filers of income tax returns in the new budget goes against Finance Minister Ishaq Dar’s commitment. While addressing a pre-budget seminar, Dar assured the government would not put extra burden on existing taxpayers in the new budget.

The Federal Board of Revenue is of the view that since market prices of immovable properties have increased manifold, these people should pay extra taxes.

Budget 2016-17: Several income tax benefits expected in budget speech

Tax authorities also argue that withholding taxes on sales and purchases are based on district collectors’ (DC) rates, which are very low when compared with market rates of these properties. DC rates vary from district to district, area-to-area, size, and location of property, buyer and seller’s position and terms of dealings.

After coming into power, the federal government had vowed to revise DC rates of property valuations in consultation with provinces. Despite the lapse of three years, the government has not yet fulfilled this promise.

CGT regime

The government may also revisit the tax regime for Capital Gains Tax (CGT) on immovable properties. Currently, there is no tax on capital gain from immovable property, if it is sold after two years of property acquisition.

However, if the property is sold within one year of acquisition, the person has to pay 10% of the gain in CGT. If the holding period is up to two years, the person has to pay 5% of the gain in taxes.

Sources said Dar has cleared a proposal to replace this regime and now a flat 10% tax will be charged, if the properties are sold within five years. The revenue impact of this proposal is about Rs5 billion.

The authorities argue that people postpone transactions beyond two years to avail CGT exemption. Secondly, brokers obtain transfers on power of attorney and execute transfer after two years to avoid the taxes.

Govt may increase tax on dividend income to 20%

The authorities have also proposed to bring family homes in the jurisdiction of the proposed new regime, which are currently exempted from CGT.

The World Bank (WB) has also asked Pakistan to withdraw CGT exemption on transfer of properties beyond two years.

Tax authorities say the lack of a mechanism for proper valuation of immovable properties is one of the major hurdles in judicious taxation of capital gains. WB has recommended Pakistan to either create an independent valuation authority or adopt the right to acquire sales like India.

However, due to presence of a strong real estate lobby in the federal cabinet, the government is reluctant to accept such proposal. The other issue is the jurisdiction, as provinces also have the right to tax properties.

The World Bank had proposed that the market value of the property should be determined without regard to the values use for different purposes by provincial governments. Sources said the federal government might adopt the WB’s recommendation to the extent of Islamabad Capital Territory (ICT) in the new budget.

Sources said Finance Minister Ishaq Dar has cleared a budget proposal to increase the tax burden of both filers and non-filers of tax returns on transfer of the properties to generate Rs13 billion in revenue.

Pakistan agrees to slap billions in new taxes

If approved by Prime Minister Nawaz Sharif, the government may double withholding tax rate to 1% for those sellers who are filers of income tax returns. For sellers who are non-filers, the proposed withholding tax on transfer of properties is 2%, according to sources.

Similarly, the government may also double withholding tax rates for purchasers on transfer of properties. Currently, purchasers who file income tax returns pay 1% of the value of the property in withholding tax. According to the budget proposal, this rate will be increased to 2%. Withholding tax on non-filing purchasers will be increased to 4% from the current 2%, sources added.

However, any decision to increase taxes for filers of income tax returns in the new budget goes against Finance Minister Ishaq Dar’s commitment. While addressing a pre-budget seminar, Dar assured the government would not put extra burden on existing taxpayers in the new budget.

The Federal Board of Revenue is of the view that since market prices of immovable properties have increased manifold, these people should pay extra taxes.

Budget 2016-17: Several income tax benefits expected in budget speech

Tax authorities also argue that withholding taxes on sales and purchases are based on district collectors’ (DC) rates, which are very low when compared with market rates of these properties. DC rates vary from district to district, area-to-area, size, and location of property, buyer and seller’s position and terms of dealings.

After coming into power, the federal government had vowed to revise DC rates of property valuations in consultation with provinces. Despite the lapse of three years, the government has not yet fulfilled this promise.

CGT regime

The government may also revisit the tax regime for Capital Gains Tax (CGT) on immovable properties. Currently, there is no tax on capital gain from immovable property, if it is sold after two years of property acquisition.

However, if the property is sold within one year of acquisition, the person has to pay 10% of the gain in CGT. If the holding period is up to two years, the person has to pay 5% of the gain in taxes.

Sources said Dar has cleared a proposal to replace this regime and now a flat 10% tax will be charged, if the properties are sold within five years. The revenue impact of this proposal is about Rs5 billion.

The authorities argue that people postpone transactions beyond two years to avail CGT exemption. Secondly, brokers obtain transfers on power of attorney and execute transfer after two years to avoid the taxes.

Govt may increase tax on dividend income to 20%

The authorities have also proposed to bring family homes in the jurisdiction of the proposed new regime, which are currently exempted from CGT.

The World Bank (WB) has also asked Pakistan to withdraw CGT exemption on transfer of properties beyond two years.

Tax authorities say the lack of a mechanism for proper valuation of immovable properties is one of the major hurdles in judicious taxation of capital gains. WB has recommended Pakistan to either create an independent valuation authority or adopt the right to acquire sales like India.

However, due to presence of a strong real estate lobby in the federal cabinet, the government is reluctant to accept such proposal. The other issue is the jurisdiction, as provinces also have the right to tax properties.

The World Bank had proposed that the market value of the property should be determined without regard to the values use for different purposes by provincial governments. Sources said the federal government might adopt the WB’s recommendation to the extent of Islamabad Capital Territory (ICT) in the new budget.

.. do such person has any moral authority to ask the same for others??? all of us want a prosperous Pakistan by paying the taxes to a govt which utilize them in a better manner.. but if some one ask me to pay the tax to these vulture... No Sir .. i dont earn money to contribute in the industrial and real estate empires of these political leaders

.. do such person has any moral authority to ask the same for others??? all of us want a prosperous Pakistan by paying the taxes to a govt which utilize them in a better manner.. but if some one ask me to pay the tax to these vulture... No Sir .. i dont earn money to contribute in the industrial and real estate empires of these political leaders