I agree it does not work that well for india. But it is fairly accurate in east asia. Services are indeed undervalued there because of govt policy. In say singapore - the water quality, air quality, infra structure is on par with any country in the world but restaurant food is incredibly cheap.View attachment 1030726

A good explanation on why nominal GDP is the only measure to assess relative strength of countries economies.

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

China’s rise is reversing

- Thread starter F-22Raptor

- Start date

StraightEdge

SENIOR MEMBER

- Joined

- Jan 21, 2021

- Messages

- 2,261

- Reaction score

- -6

- Country

- Location

A booming US economy and a Chinese crash? Think again

- China is using its downturn to deflate bubbles and raise productivity while the US is doing the opposite – feeding the Bernanke bubble and hoping for an AI cure for falling productivity

Published: 7:00pm, 21 Nov, 2023

China’s economy is more sustainable precisely because it is deflating its bubbles, while a US economy that continues to rely on an expanding debt bubble can only be headed for a cliff.

For the first three quarters of this year, China’s growth of 5.2 per cent came from improving efficiency on the supply side; in the US, growth came on the back of its fiscal deficit increasing sharply as a proportion of its gross domestic product.

Yet there is manufactured consensus in the West that China’s economy is crashing and the US economy is booming. For China, its deflating property bubble and high youth unemployment rate are cited as evidence. As I have said before, when an economy enters a downturn for the right reasons, it is an opportunity for renewal. And China appears to be making all the right decisions.

China’s economy has been plagued by “twin cancers”: a property bubble and shadow banking system rife with Ponzi schemes. A bunch of very destructive people screamed “GDP!” and “jobs!” to get the government to print money. China was marching to the cliff. But the government stopped feeding the beasts two years ago.

Chinese workers are among the world’s most competitive. As long as China’s economic system is not too obstructive and the global market remains open, China will boom. Prosperity happens naturally in peacetime China. Only endemic government corruption and a mass speculative frenzy can bring China down. These destructive forces are in check for now, so China’s immediate future looks good.

Dealing with the twin cancers will take a long time and the economic pain is just beginning. The losses embedded in the shadow banking system, for instance, are estimated to be in the trillions of yuan – and the psychological blow from these losses has yet to sink in fully.

But as the bubbles deflate, Chinese businesses are focusing more on productive, but less glamorous, activities such as becoming better at making things. The breakout success of China’s electric vehicle sector is probably the most important one. The automobile sector is a major chunk of global manufacturing and much bigger than the smartphone market. China’s transition towards electric vehicles was inevitable.

Chinese companies are not just leading, they are also innovating faster than their competitors and can dominate the global auto sector in the coming decade. Countries competitive in automotive-making have traditionally become high-income economies. China may well go down that path.

But while there are bright spots in the Chinese economy, they cannot completely offset the drag from its property sector. The surge in domestic tourism made up for some of the downward pressure – but it won’t be able to do the same next year.

As China holds the line against reviving its bubbles, productivity growth will eventually boost the economy again. In particular, the virtuous economic circle linking China and the rest of the Global South will provide a powerful lift.

China is supplying renewable technology and infrastructure across the Global South at affordable prices. This will increase productivity across the region and lift the purchasing power of billions of people.

The United States, on the other hand, is stuck with the legacy of the bubble engineered by former Federal Reserve chairman Ben Bernanke in 2008, in response to the subprime mortgage crisis that triggered a global financial crisis. When the market is trying to flush out destructive people, the government should not step in to save them.

When it does, they come back to haunt you. In the US, there are those who were bailed out who went on to help create a bigger bubble, which now hangs around the neck of the US economy. This is why the Federal Reserve cannot shrink its balance sheet in a timely manner. This is why the government must run ever bigger deficits to keep the economy afloat.

Meanwhile, despite a boom in demand, US labour productivity has been going nowhere for the last three years. It fell to 1.6 per cent the decade before, down from 2.7 per cent in the previous decade.

The US seems to be pinning its hopes on artificial intelligence and its promise of revolutionising productivity. But I wouldn’t bet the farm on that. Rounds of AI hype have come and gone: the latest caught the mass imagination only because ChatGPT appears to be able to talk to people.

But it is too early to say if it is just a version of a more sophisticated deepfake or real intelligence. The latest developments in generative AI are based on massive data and computing power. But how confident are we that intelligence boils down to data and computing power?

Remember self-driving cars? For at least a decade, we were promised that the miracle of autonomous driving was very nearly here – but it will probably be another decade before it is ready. And this is task-specific AI.

There is talk in the market of a recession coming to the US once the Federal Reserve starts cutting interest rates again soon. Don’t hold your breath. The US government is spending borrowed money like a drunken sailor chasing alcohol. Lower interest rates just means cheaper alcohol.

How can an economy go into recession when more money is available to be spent? This story will stop only when the US bond market crashes. But that is another story.

Opinion | A booming US economy and a Chinese crash? Think again

China is using its downturn to deflate bubbles and raise productivity while the US is doing the opposite – feeding the Bernanke bubble and hoping for an AI cure for falling productivitywww.scmp.com

The US government is spending borrowed money like a drunken sailor chasing alcohol. Lower interest rates just means cheaper alcohol.

-- That's all you need to know.

Total US debt is close to $100 trillion now.

There's massive unemployment in USA.

A lot of people are unable to pay the rent and buy food.

Do you have any numbers or data to backup this ? I live in USA. We have trouble hiring qualified people.

US life expectancy is free falling for a reason

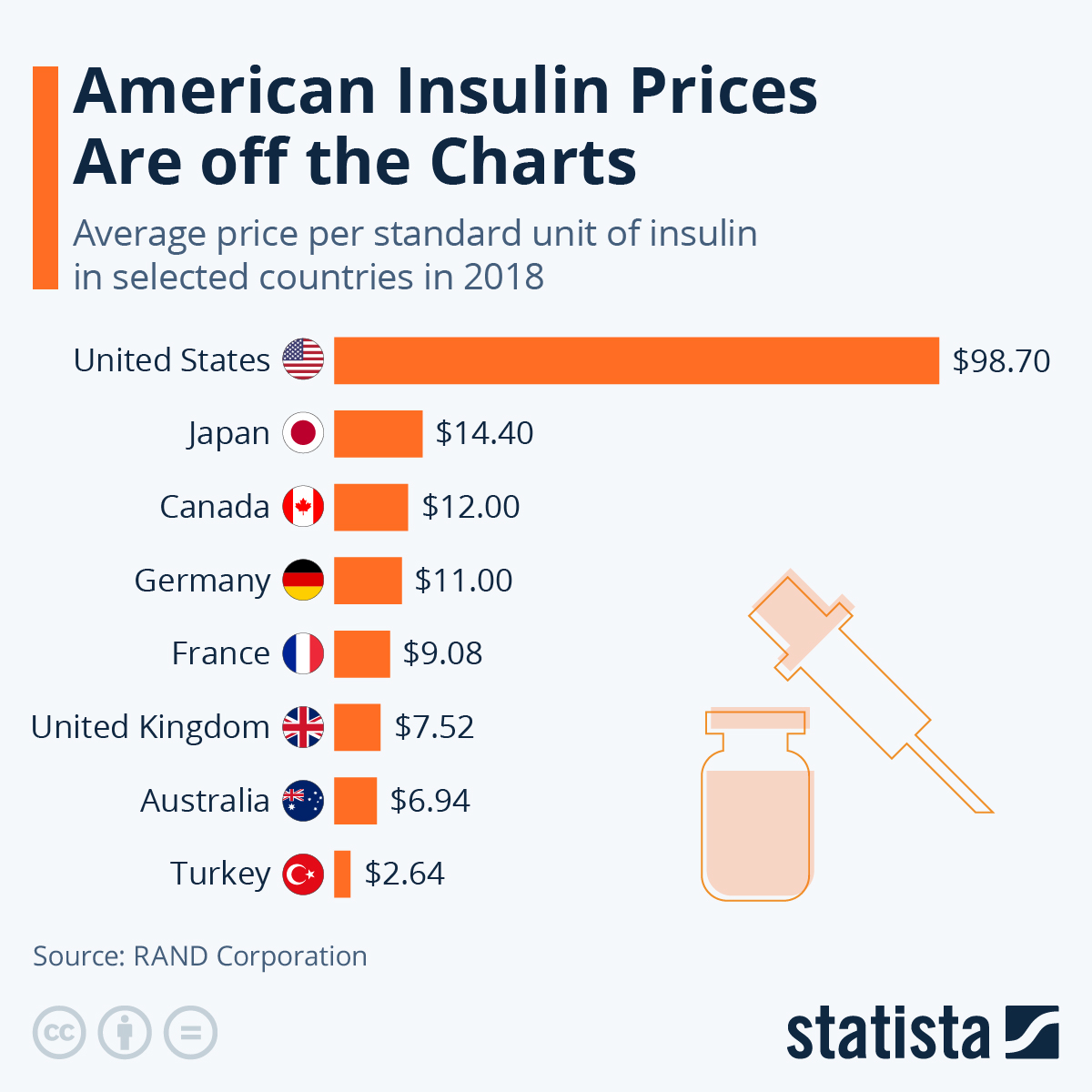

1.3 million Americans ration insulin amid high drug prices in US, study shows

David Himmelstein, a researcher of the study, told FOX Television Stations he is “greatly alarmed” by their findings.www.foxla.com

American Insulin Prices Are off the Charts

Why quote Rand Corporation ?

Insulin Coverage

Find out if insulin coverage is included in your current plan. Medicare Part D includes insulin, certain medical supplies used to inject insulin.

Manidabest

SENIOR MEMBER

- Joined

- Nov 9, 2015

- Messages

- 2,205

- Reaction score

- 0

- Country

- Location

Chinese are changing their financial system

View attachment 1030726

A good explanation on why nominal GDP is the only measure to assess relative strength of countries economies.

Wrong example -- India has 11 times more people than Japan and 16 times more people than Germany. Even with a living standard 1/10th of those countries it will exceed the GDP of those countries. the living standards in India are way crappier than Japan and Germany.

@F-22Raptor

ST1976

FULL MEMBER

- Joined

- Jul 25, 2006

- Messages

- 955

- Reaction score

- 0

- Country

- Location

countries like India have 'undocumented' part of GDP. the ratio of economy we don't document.Wrong example -- India has 11 times more people than Japan and 16 times more people than Germany. Even with a living standard 1/10th of those countries it will exceed the GDP of those countries. the living standards in India are way crappier than Japan and Germany.

@F-22Raptor

we also have news, US's economy on PPP is below to half of Indian economy on PPP

(when we adjust 'bubble' of US economy.)

ST1976

FULL MEMBER

- Joined

- Jul 25, 2006

- Messages

- 955

- Reaction score

- 0

- Country

- Location

Wrong example -- India has 11 times more people than Japan and 16 times more people than Germany. Even with a living standard 1/10th of those countries it will exceed the GDP of those countries. the living standards in India are way crappier than Japan and Germany.

@F-22Raptor

I don't see your argument having ground realities......

Japan and Germany are having lesser future prospects than India. Life in PPP measure matters..... The OECD economies are struggling with what they are. India has brighter future than Japan and Germany

.

=>

List of countries by GDP (PPP) - Wikipedia

Last edited:

ST1976

FULL MEMBER

- Joined

- Jul 25, 2006

- Messages

- 955

- Reaction score

- 0

- Country

- Location

Wrong example -- India has 11 times more people than Japan and 16 times more people than Germany. Even with a living standard 1/10th of those countries it will exceed the GDP of those countries. the living standards in India are way crappier than Japan and Germany.

@F-22Raptor

we know Living standard of Japanese also. here, is it right to say them have 10 times living standard than India, is it enough?

the GDP on PPP also matters as below:

List of countries by GDP (PPP) - Wikipedia

while its still not enough, developing economies have large share of 'undocumented' part of GDP. the ratio of GDP which can't be documented.....

in sum, i would say that Japanese and German would be having living standard close to the 31% population of India as below:

.

=>

- The middle class now represents 31% of India’s population.

- It is projected to hit 38% by 2031 and 60% by 2047.

Is the World Ready to Meet the Indian Middle Class?

Set aside the fact that India’s population has surpassed China’s. The real growth driver for the travel industry is its surging middle class.

skift.com

skift.com

Last edited:

ST1976

FULL MEMBER

- Joined

- Jul 25, 2006

- Messages

- 955

- Reaction score

- 0

- Country

- Location

Wrong example -- India has 11 times more people than Japan and 16 times more people than Germany. Even with a living standard 1/10th of those countries it will exceed the GDP of those countries. the living standards in India are way crappier than Japan and Germany.

@F-22Raptor

along with last post#68, we have list of Billionaires of India as below:-

How Japanese would be compared to Indians in this field?

.

==>

India’s ultra wealthy population to grow by 58.4% in next five years, Knight Frank

India’s ultra-high-net-worth individuals (UHNWI) with net worth over $30 million is estimated to rise by 58.4% in the next five years to 19,119 individuals in 2027 from 12,069 in 2022. India’s billionaire population is expected to move up to 195 individuals in 2027 from 161 individuals in 2022, showed a Knight Frank India report.

India’s ultra wealthy population to grow by 58.4% in next five years, Knight Frank

The Knight Frank India report estimates that the number of ultra-high-net-worth individuals (UHNWIs) in India will rise by 58.4% in the next five years to 19,119 individuals in 2027 from 12,069 in 2022. The Indian high-net-worth-individual (HNI) population, with asset value of $1 million and...

Similar threads

- Replies

- 0

- Views

- 703

- Replies

- 0

- Views

- 235

- Replies

- 0

- Views

- 553

Latest posts

-

-

India launches missile attacks on Multiple locations in Pakistan,

- Latest: ProudThamizhan

-

-

Pakistan Affairs Latest Posts

-

-

India launches missile attacks on Multiple locations in Pakistan,

- Latest: ProudThamizhan

-

-

PAF provides evidence of shooting down Indian Rafales

- Latest: ProudThamizhan