Black_cats

ELITE MEMBER

- Joined

- Dec 31, 2010

- Messages

- 10,031

- Reaction score

- -5

Bangladesh in better position than Sri Lanka, Pakistan to navigate forex crisis: UCB Asset

30 January, 2023, 09:45 am

Last modified: 30 January, 2023, 09:49 am

Infographic: TBS

Infographic: TBS

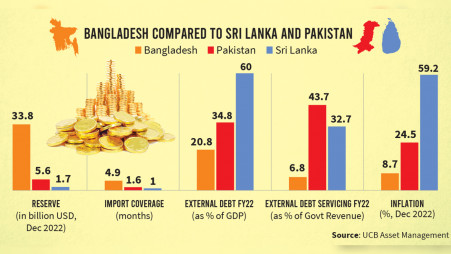

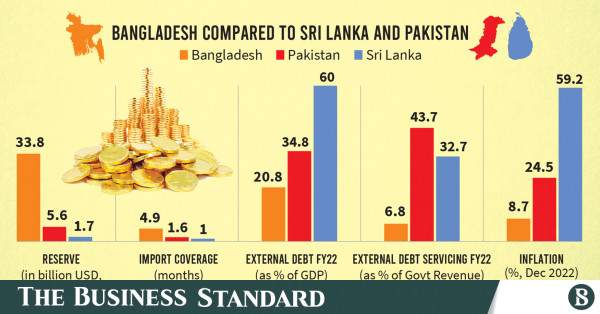

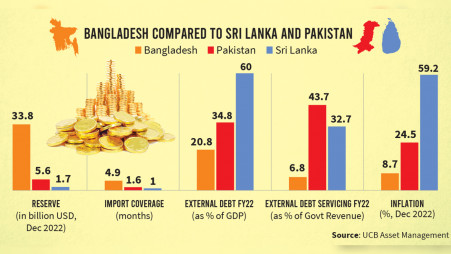

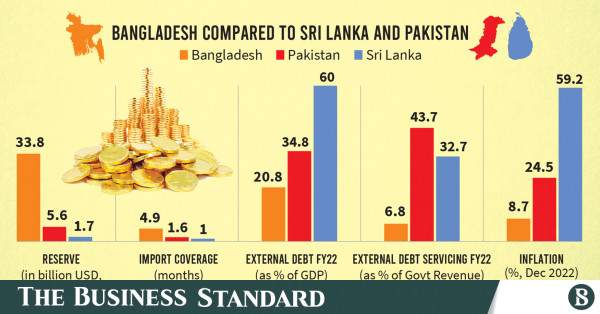

The common fear regarding whether Bangladesh is next in line for an unmanageable economic crisis like its neighbouring peers Sri Lanka and Pakistan has been cautiously busted by the analysts at UCB Asset Management.

In its latest report titled "Is Bangladesh Mirroring Sri Lanka and Pakistan?," the local asset manager said Bangladesh is in a much better position to navigate the foreign exchange crisis.

Keeping in mind the ongoing dollar austerity, the analysts estimate, Bangladesh will spend around $14.1 billion for its most essential imports of fuel and fertiliser and external debt servicing in 2023 assuming there will not be a major deviation in commodity and fertiliser prices and short-term FX debt obligation from current estimation. And, with a mere 3% annual growth the country should end the year with $22 billion in remittance inflow.

The $7.9 billion difference would help offset the trade deficit the government aims to curtail by halting nonessential imports so that the forex reserve does not drop too much from the current level of over $33 billion in gross or over $25 billion in net as of December 2022.

On the other hand, the reserves of Pakistan and Sri Lanka have already dropped to $5.6 and $1.7 billion respectively.

Bangladesh has foreign currency to pay the import bills over the 4.9 months, while import coverage for Pakistan and Sri Lanka now stands at 1.6 and 1 months respectively.

Besides the better economic indicators, and much less severity of the forex crisis, the best thing is Bangladesh had the opportunity to learn from others' mistakes and navigate accordingly with better preparation, said UCB Asset CEO Shekh Mohammad Rashedul Hasan.

The government came up with the austerity measures that should pay off in terms of forex conservation, he believes.

Bangladesh's imports dropped in December while exports grew.

"Of course, we are at risk of ending 2023 as a worse year if the global economic factors continue adversely," he expressed the analysts' caution that excludes fears of a Sri Lanka-like economic emergency where the inability to secure peoples access to food, energy, and the very essential commodities ruins it all.

"However, there is no scope for complacency," said the report adding, "Doing the right things in anticipation of a crisis is far superior to doing those things during a crisis."

"It is an opportune moment for the government to start the reforms in the financial sector," Hasan told The Business Standard.

According to the report, the intrinsic value of one dollar (on relative purchasing power parity basis) in 2022 was 533 Lankan Rupee, 226.4 Pakistani Rupee or Tk119.6, while they actually were at 367, 226.5 and 106 respectively.

The Pakistani Rupee suffered a massive depreciation in January 2023 as soon as the rates were floated.

Food sufficiency, low energy consumption per capita, some fertiliser production locally, and a bigger export earning, high remittance inflow – all are helping Bangladesh stay much ahead of the two neighbours, according to the UCB Asset report.

www.tbsnews.net

www.tbsnews.net

ECONOMY

Mahfuz Ullah Babu30 January, 2023, 09:45 am

Last modified: 30 January, 2023, 09:49 am

Infographic: TBS

Infographic: TBS

The common fear regarding whether Bangladesh is next in line for an unmanageable economic crisis like its neighbouring peers Sri Lanka and Pakistan has been cautiously busted by the analysts at UCB Asset Management.

In its latest report titled "Is Bangladesh Mirroring Sri Lanka and Pakistan?," the local asset manager said Bangladesh is in a much better position to navigate the foreign exchange crisis.

Keeping in mind the ongoing dollar austerity, the analysts estimate, Bangladesh will spend around $14.1 billion for its most essential imports of fuel and fertiliser and external debt servicing in 2023 assuming there will not be a major deviation in commodity and fertiliser prices and short-term FX debt obligation from current estimation. And, with a mere 3% annual growth the country should end the year with $22 billion in remittance inflow.

The $7.9 billion difference would help offset the trade deficit the government aims to curtail by halting nonessential imports so that the forex reserve does not drop too much from the current level of over $33 billion in gross or over $25 billion in net as of December 2022.

On the other hand, the reserves of Pakistan and Sri Lanka have already dropped to $5.6 and $1.7 billion respectively.

Bangladesh has foreign currency to pay the import bills over the 4.9 months, while import coverage for Pakistan and Sri Lanka now stands at 1.6 and 1 months respectively.

Besides the better economic indicators, and much less severity of the forex crisis, the best thing is Bangladesh had the opportunity to learn from others' mistakes and navigate accordingly with better preparation, said UCB Asset CEO Shekh Mohammad Rashedul Hasan.

The government came up with the austerity measures that should pay off in terms of forex conservation, he believes.

Bangladesh's imports dropped in December while exports grew.

"Of course, we are at risk of ending 2023 as a worse year if the global economic factors continue adversely," he expressed the analysts' caution that excludes fears of a Sri Lanka-like economic emergency where the inability to secure peoples access to food, energy, and the very essential commodities ruins it all.

"However, there is no scope for complacency," said the report adding, "Doing the right things in anticipation of a crisis is far superior to doing those things during a crisis."

"It is an opportune moment for the government to start the reforms in the financial sector," Hasan told The Business Standard.

According to the report, the intrinsic value of one dollar (on relative purchasing power parity basis) in 2022 was 533 Lankan Rupee, 226.4 Pakistani Rupee or Tk119.6, while they actually were at 367, 226.5 and 106 respectively.

The Pakistani Rupee suffered a massive depreciation in January 2023 as soon as the rates were floated.

Food sufficiency, low energy consumption per capita, some fertiliser production locally, and a bigger export earning, high remittance inflow – all are helping Bangladesh stay much ahead of the two neighbours, according to the UCB Asset report.

Bangladesh in better position than Sri Lanka, Pakistan to navigate forex crisis: UCB Asset Management

The common fear regarding if Bangladesh is next in line for an unmanageable economic crisis like its neighboring peers Sri Lanka and Pakistan, has been cautiously busted by the analysts at UCB Asset Management. In its most recent report "Is Bangladesh Mirroring Sri Lanka and Pakistan?", the...