ziaulislam

ELITE MEMBER

- Joined

- Apr 22, 2010

- Messages

- 23,617

- Reaction score

- 9

- Country

- Location

Guy is baised since he was humilated by us

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

The perception that China does not do development and aid is untrue.I agree with you. Think of USA. Post WW2 USA literally lifted most of Europe by providing masive aid, market access and US companies investing. The total amount by todays measure would be far more than $250 billiion.

America probably has poured that much, if not more in tiny Greece which has population only slightly larger than Lahore city. Had USA not done that, Greece would have fallen apart or turned in Syria.

However. Underlying this massive US investment lay something else. A strong convergence within those societies to America. That is they were prepared to count themselves as Western, either explicitly or implicitly.

Even countries not strictly speaking part of the Christian European civilzation like Turkey or Japan co-opted into the West and America. Thus they become honorary Western nations.

Think of Turkey which also has been beneficiary of US largesse. Paks think of Turkey as 'brother'. Truth is Turkey is more brother of America as opposed to a having a distant acquaintenace with Pakistan.

What is real litmus test of a realtionship? If a friend stands by you in your hour of need. Well Turks go one step further. Turks are prepared [even under Sultan Erdogan] to send their young boys to die for America under NATO.

Would Turks be prepared to enter such a treaty of mutual defence with Pakistan? like balls.

I guess what I am saying you can't have such close economic, military ties unless you also have similiar cultural, political, social ties.

Now ask yourself what convergence does Pakistani society have with Chinese. We are poles apart. One of Chinese favourite food is snorting pork. They also are rabidly athiest and have no time for religion which they look down as preserve of backward people. With such vast differances in societies China and Pakistan can only have transactional relatiionship.

Which is what we have despite all the silly rhetoric you hear about mountains and oceans.

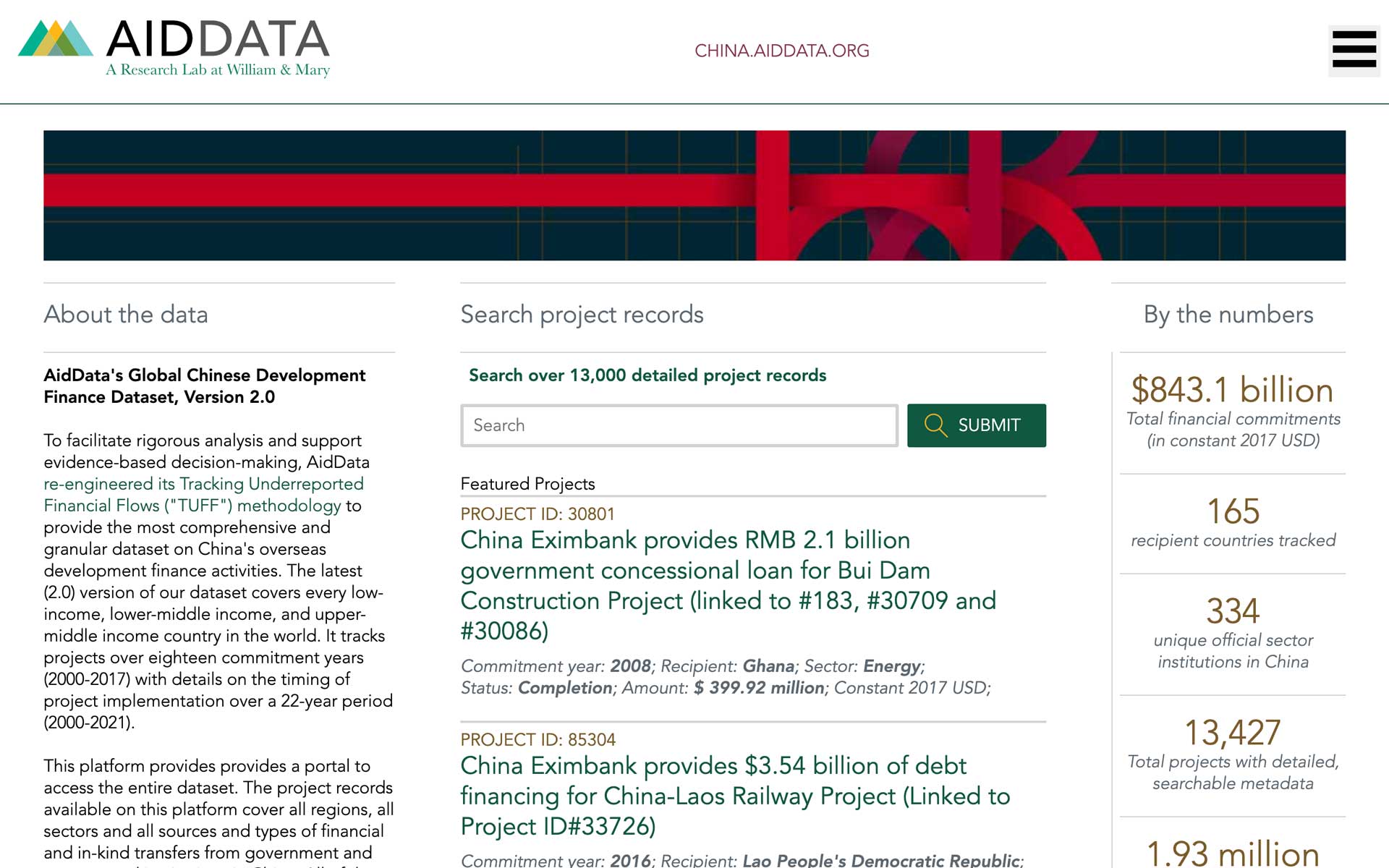

Colombo Port City Project- China Development BankThe China lead infrastructure projects in Sri Lanka are not financed by Chinese commercial banks, rather they were funded by EXIM Bank of China, which is a state owned banks. Commercial banks in China cannot purchase foreign government bond or participate foreign financing project.

Below is a disclosure back in 2018 from SL government about concessional loan from EXIM China to finance infrastructure projects in SL.

Three Concessional Loans of USD 492 mn from the EXIM bank of China for Infrastructure Development of Sri Lanka

Department of External Resourceswww.erd.gov.lk

Sri Lanka’s economic problem was not driven by infrastructure projects but was driven by financial mismanagement, fragile economical structure, and the large amount of foreign debt. As of 2021, more than 80% of Sri Lanka’s foreign debt was owned by US and European Financial institutions, as well as ADB and India. China has only about 10% of SL’s foreign debt, which is not a major driver of SL debt problem. Below is a summary of Sri Lanka’s foreign debt holding from DW (a German state broadcaster).

View attachment 864309

China Development Bank is not commercial bank, it is a state owned development bank that specializes in overseas development projects. Do you know the difference between commercial bank and state development bank?Colombo Port City Project- China Development Bank

Valachchenai Water Supply Project and Banadarawela, Diyathalawa and Haputhale Water Supply Project- China Development Bank

Katana Water Supply Project- China Development Bank

Thambuttegama Water Supply Project- China Development Bank

Moragahakanda Development Project- China Development Bank

Broadlands Hydropower Project- Industrial and Commercial Bank of China

Etc etc.

You want more? I can provide you more.

Why don't you shut up and go learn something. If you don't know the difference between an Exim bank and any XYZ bank, you just need to look at their respective shareholding pattern.China Development Bank is not commercial bank, it is a state owned development bank that specializes in overseas development projects. Do you know the difference between commercial bank and state development bank?

No, for Broadlands Hydropower Project, 85% of the project funded by credit line with Chinese government. The rest is a loan by local Hatton National Bank.

The China Development Bank (CDB) (simplified Chinese: 国家开发银行) is a development bank in the People's Republic of China (PRC), led by a cabinet minister at the Governor level, under the direct jurisdiction of the State Council. As one of three policy banks in China, it is responsible for raising funds for large-scale infrastructure projects.Why don't you shut up and go learn something. If you don't know the difference between an Exim bank and any XYZ bank, you just need to look at their respective shareholding pattern.

Chinese development bank is a commercial bank, Chinese government having a stake in it or not doesn't make any difference.

My bad, I thought you are Pakistani.The China Development Bank (CDB) (simplified Chinese: 国家开发银行) is a development bank in the People's Republic of China (PRC), led by a cabinet minister at the Governor level, under the direct jurisdiction of the State Council. As one of three policy banks in China, it is responsible for raising funds for large-scale infrastructure projects.

China Development Bank - Wikipedia

en.m.wikipedia.org

When you tell lies concerning China, it is my responsibility to expose them. It is as simple as that.

You are wrong again. That 47% market borrowing in the form of sovereign bond are held by major Western fund management firms. The top firms are:My bad, I thought you are Pakistani.

I don't wanna waste my time on low IQ Chinese on the forum, you are so stupid to think that Wiki link proves anything.

As far as loans in SL go, China holding 10% of total external debt DO NOT include loans by CDB and other Chinese banks, they are included in that big fat 47%+. Get it in your thick skull.

Sri Lanka has ISBs worth $12.55B.You are wrong again. That 47% market borrowing in the form of sovereign bond are held by major Western fund management firms. The top firms are:

* Pacific Investment Management

* BlackRock

* T Rowe Price Group

* AllianceBernstein LP

* Wellington Management Group

* Ashmore

It is Ok if you don’t know, the link of the reports from Bloomberg and Reuters are here:

Pimco Among Firms Set to Start Debt Talks With Sri Lanka

A group representing Sri Lanka’s creditors has expanded to about 20 firms, people with knowledge of the matter said, with the defaulting country expected to start readying an advisory team soon.www.bloomberg.com

EXCLUSIVE BlackRock, Ashmore part of Sri Lanka's creditor group ahead of debt talks

Asset managers Blackrock Inc. and Ashmore Group Plc. are among the top holders of Sri Lanka's international bonds that form part of a creditor group as markets prepare for a potential debt restructuring, a source said on Wednesday.www.reuters.com

Chinese commercial banks cannot purchase foreign sovereign bond or provide direct finance to foreign infrastructure projects.

You are wrong or simply lying again. Sri Lanka’s total foreign debt was around $35B, of which 47% or 16B was market borrowing from fund management firms. The data is from Sri Lanka’s Department of External Resource.Sri Lanka has ISBs worth $12.55B.

Sri Lanka default rumours "totally unsubstantiated," says central bank

Sri Lanka's central bank said on Wednesday the country was committed to honouring all forthcoming debt obligations, adding that the island nation was not on the verge of a sovereign default.www.reuters.com

(47% of $51B) -12.55 =?

Chinese commercial banks finance "foreign" infrastructure projects regularly, I think you should have your social credits cut for spewing nonsense.

You are wrong or simply lying again. Sri Lanka’s total foreign debt was around $35B, of which 47% or 16B was market borrowing from fund management firms. The data is from Sri Lanka’s Department of External Resource.

View attachment 864684

That’s the latest data published by SL government and should be fairly close to their current position. It is much better than the numbers you invented from your imagination.1) "By the end of April 2021, total outstanding external debt of the Government was US$ 35.1billion."

2) February 9, 2022 : "Sri Lanka has outstanding sovereign bonds amounting to $12.55 billion, with $1 billion of the bonds maturing in July."

Sri Lanka default rumours "totally unsubstantiated," says central bank

Sri Lanka's central bank said on Wednesday the country was committed to honouring all forthcoming debt obligations, adding that the island nation was not on the verge of a sovereign default.www.reuters.com

Chinese are frauds, liars and cheat!