mehboobkz

SENIOR MEMBER

- Joined

- Aug 27, 2010

- Messages

- 2,462

- Reaction score

- -6

- Country

- Location

In the late 1980s, Presidency College, Calcutta, flaunted one of the finest economics departments in the world. We were 'advised' to read a book, which wasn't part of the syllabus.

Our professors, each a titan in their field, kept their stature well hidden, as befitted their bhadralok status.

We were assumed intellectual goats, foraging on whatever we found nearby.

One of the least appetising morsels thrown our way was a book by Richard and Giovanna Stone, with the bestselling title of National Income and Expenditure.

Calculated Numbers

Stone and Stone hung around our necks for a few months, while we hoped it wouldn't drag us into the crocodile marshes of the Sundarbans .

Then, we were rid of it. Several years earlier, Richard Stone had won the Nobel Prize for economics for figuring out the way to calculate a nation's wealth, poverty and growth.

So, this sorry tale would have ended — were it not for Simon Kuznets, born in Belarus, 1901. In 1971, he got the Nobel Prize — yes, economics — for a lifetime spent crunching data without a spreadsheet or computer. At the age of 17, he had the misfortune to learn economics, statistics, history and mathematics in Kharkiv, present-day Ukraine, after which the Russian civil war of 1920-21 drove him west.There, Kuznets landed his first degree, a BSc, in 1923, Columbia University, followed one year later by a master's degree, followed in 1926 by a PhD: on the economics of Joseph Schumpeter, who told the world about creative destruction.

Thereafter, blah-blah, till he pops up to tell Americans in the 1930s that there's a way to measure everything, including how much money the nation is making and where it can hope to go in the near future. Enter data and the cult of the growth rate.

So, two people have already won Nobel Prizes in economics, Kuznets in 1971 and Stone in 1984, for the tools to measure national income and — just possibly — growth rate. We now have a new star on the horizon: T C A Anant, chief statistician of India. TCA , when he had a moustache and taught us in a haphazard way at the Delhi School of Economics in the early 1990s, has suddenly told us India grew 7.9% through January to March.

That translates to 7.6% in a year, which makes us the fastest-growing economy in the world. This is not just bad manners, like passing wind at a family dinner, but an obscenity.

For the last two years, TCA's numbers have been in doubt, questioned by analysts and economists the world over. Reserve Bank of India governor Raghuram Rajan threw his hands up at his magic numbers long ago.

But this new 7.9% growth is something else: a crazy statistical fudge, a delight for emperors in need of clothes, spikes in the hearts of Kuznets, Stone turning in their graves from TCA's earlier myths. Here is why.

The bulk of the country's growth has apparently materialised from Rs 1,40,000 crore — try wrapping your mind around that number — of 'discrepancies' in our balance-sheets. To remind you, the number was less than Rs 30,000 crore a year ago.

TCA has conjured up a more than fourfold jump in 'discrepancies' and padded it to the GDP number.

Private consumption is also supposed to have grown: by an astronomical Rs 1,27,000 crore in one year. I do not know a single person whose consumption has recently rocketed up. Maybe TCA, or his boss Arun Jaitley , or his boss' boss Narendra Modi has friends like that.

Damn Lies & Statistics

Here is the embarrassing footnote: it is easy to bump up consumption (largely informal, hence poorly measured) numbers or 'discrepancies' to boost growth. It's tough to hide actual figures. The most frightening is a Rs 17,000 crore-plus drop in investment, which reflects a lack of confidence in Modi's India. Take away the rubbish in data, our actual growth rate is around 4%, about half of what is being claimed.

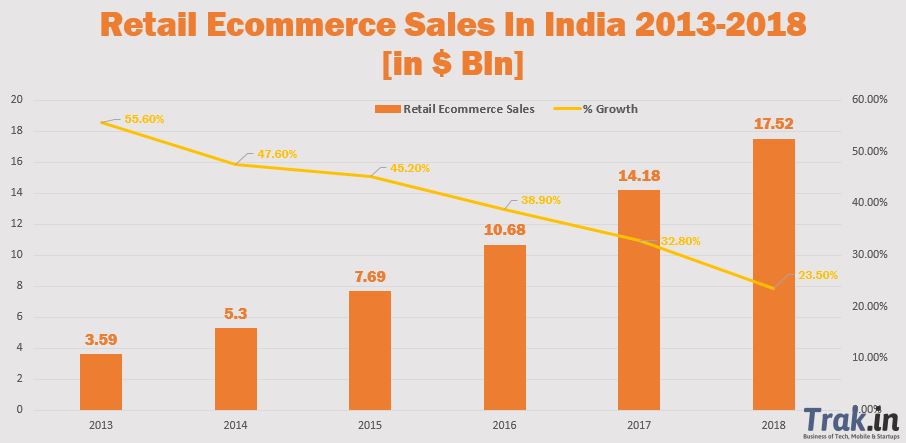

Real life disproves TCA's numbers. On Thursday, The Times of India reported that students in IITs and IIMs are on hunger strike because job offers have fallen through for nearly a year. If these guys — talented, go-ahead children — can't get a white-collar job, what is Modi peddling? If we are clocking near-8% growth, and consumption is shooting up, why has the valuation of Flipkart, the largest e-commerce firm, been knocked down several times by investors?

This company cannot hire on campus because its pockets are empty. Its peers aren't doing any better. At the other end of the spectrum, the IT arm of L&T, India's largest infrastructure company, has reneged on 1,500 job offers made on campuses.

Meanwhile, all state-owned banks are drowning in red: Bank of India lost more than Rs 6,000 crore in a year, tiny Canara Bank is nearly Rs 4,000 crore in the red. Our largest bank, state-owned SBI, saw profits sliding 66%. So, here is India, shining on bombast, propped up by numerical mistruths. Ronald Coase, another Nobel laureate, said, "If you torture data long enough, it will confess to anything." Under TCA, it sang like the proverbial canary.

http://economictimes.indiatimes.com...the-best-data-fudger/articleshow/52565724.cms

Our professors, each a titan in their field, kept their stature well hidden, as befitted their bhadralok status.

We were assumed intellectual goats, foraging on whatever we found nearby.

One of the least appetising morsels thrown our way was a book by Richard and Giovanna Stone, with the bestselling title of National Income and Expenditure.

Calculated Numbers

Stone and Stone hung around our necks for a few months, while we hoped it wouldn't drag us into the crocodile marshes of the Sundarbans .

Then, we were rid of it. Several years earlier, Richard Stone had won the Nobel Prize for economics for figuring out the way to calculate a nation's wealth, poverty and growth.

So, this sorry tale would have ended — were it not for Simon Kuznets, born in Belarus, 1901. In 1971, he got the Nobel Prize — yes, economics — for a lifetime spent crunching data without a spreadsheet or computer. At the age of 17, he had the misfortune to learn economics, statistics, history and mathematics in Kharkiv, present-day Ukraine, after which the Russian civil war of 1920-21 drove him west.There, Kuznets landed his first degree, a BSc, in 1923, Columbia University, followed one year later by a master's degree, followed in 1926 by a PhD: on the economics of Joseph Schumpeter, who told the world about creative destruction.

Thereafter, blah-blah, till he pops up to tell Americans in the 1930s that there's a way to measure everything, including how much money the nation is making and where it can hope to go in the near future. Enter data and the cult of the growth rate.

So, two people have already won Nobel Prizes in economics, Kuznets in 1971 and Stone in 1984, for the tools to measure national income and — just possibly — growth rate. We now have a new star on the horizon: T C A Anant, chief statistician of India. TCA , when he had a moustache and taught us in a haphazard way at the Delhi School of Economics in the early 1990s, has suddenly told us India grew 7.9% through January to March.

That translates to 7.6% in a year, which makes us the fastest-growing economy in the world. This is not just bad manners, like passing wind at a family dinner, but an obscenity.

For the last two years, TCA's numbers have been in doubt, questioned by analysts and economists the world over. Reserve Bank of India governor Raghuram Rajan threw his hands up at his magic numbers long ago.

But this new 7.9% growth is something else: a crazy statistical fudge, a delight for emperors in need of clothes, spikes in the hearts of Kuznets, Stone turning in their graves from TCA's earlier myths. Here is why.

The bulk of the country's growth has apparently materialised from Rs 1,40,000 crore — try wrapping your mind around that number — of 'discrepancies' in our balance-sheets. To remind you, the number was less than Rs 30,000 crore a year ago.

TCA has conjured up a more than fourfold jump in 'discrepancies' and padded it to the GDP number.

Private consumption is also supposed to have grown: by an astronomical Rs 1,27,000 crore in one year. I do not know a single person whose consumption has recently rocketed up. Maybe TCA, or his boss Arun Jaitley , or his boss' boss Narendra Modi has friends like that.

Damn Lies & Statistics

Here is the embarrassing footnote: it is easy to bump up consumption (largely informal, hence poorly measured) numbers or 'discrepancies' to boost growth. It's tough to hide actual figures. The most frightening is a Rs 17,000 crore-plus drop in investment, which reflects a lack of confidence in Modi's India. Take away the rubbish in data, our actual growth rate is around 4%, about half of what is being claimed.

Real life disproves TCA's numbers. On Thursday, The Times of India reported that students in IITs and IIMs are on hunger strike because job offers have fallen through for nearly a year. If these guys — talented, go-ahead children — can't get a white-collar job, what is Modi peddling? If we are clocking near-8% growth, and consumption is shooting up, why has the valuation of Flipkart, the largest e-commerce firm, been knocked down several times by investors?

This company cannot hire on campus because its pockets are empty. Its peers aren't doing any better. At the other end of the spectrum, the IT arm of L&T, India's largest infrastructure company, has reneged on 1,500 job offers made on campuses.

Meanwhile, all state-owned banks are drowning in red: Bank of India lost more than Rs 6,000 crore in a year, tiny Canara Bank is nearly Rs 4,000 crore in the red. Our largest bank, state-owned SBI, saw profits sliding 66%. So, here is India, shining on bombast, propped up by numerical mistruths. Ronald Coase, another Nobel laureate, said, "If you torture data long enough, it will confess to anything." Under TCA, it sang like the proverbial canary.

http://economictimes.indiatimes.com...the-best-data-fudger/articleshow/52565724.cms

Last edited: