ghazi52

PDF THINK TANK: ANALYST

- Joined

- Mar 21, 2007

- Messages

- 101,794

- Reaction score

- 106

- Country

- Location

Remittances jump to $2.71b in July 2021

Modest receipts will tackle rising imports, help govt achieve economic growth target

Salman Siddiqui

August 11, 2021

KARACHI: Pakistan has received the third largest workers’ remittances amounting to $2.71 billion in July, the first month of current fiscal year, making the much-needed finances available to pay for increasing imports which is a must to achieve the planned higher economic growth.

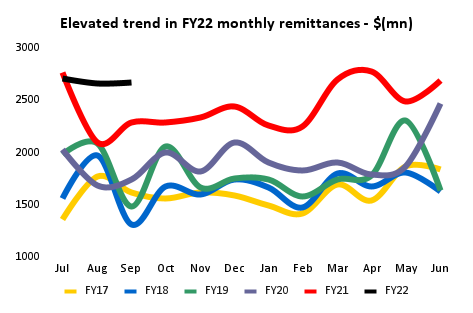

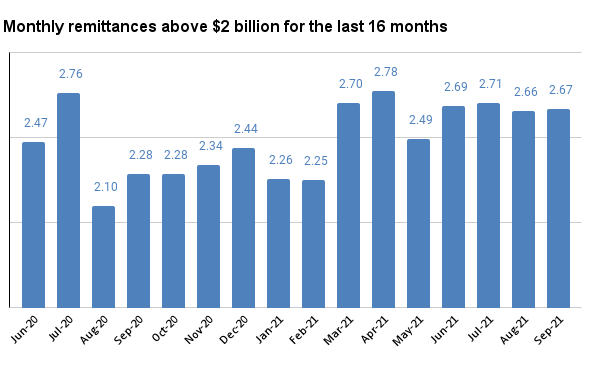

This was the sixth month in the past 13 months when the inflows of remittances sent home by overseas Pakistanis remained over $2.5 billion. Moreover, July was the fourteenth successive month in which the receipts remained above the threshold of $2 billion, according to the State Bank of Pakistan’s (SBP) data.

The remittances in July, however, dropped slightly by 2.1% compared to $2.76 billion received a year ago in July 2021. They stood almost 1% (0.7%) higher compared to $2.69 billion in the previous month of June 2021.

“This marginal year-on-year decline (of 2.1%) was largely on account of Eidul Azha, which resulted in fewer working days in July 2021 compared to last year,” Pakistan’s central bank said in a statement on remittances.

“This (the third largest remittances in a month in July) is a positive surprise. This is a good start of the (fiscal) year,” BMA Capital Director Research Saad Hashmey said while talking to The Express Tribune.

The strong remittances would tackle rising imports and help the government achieve the economic growth target of 4.8% for the current fiscal year 2021-22, he said.

Pakistan heavily relies on imports to sustain higher economic growth. The necessary imports of the country include basic raw materials for many sectors of the economy, expensive energy (oil and gas) and foods like wheat, sugar and cooking oil to develop strategic reserves in a bid to counter food inflation in the country.

In addition to this, the country is set to increase import of plant and machinery for setting up new industrial units or expending the existing ones under the subsidised Temporary Economic Refinance Finance (TERF) scheme this year. Commercial banks have approved loans worth Rs436 billion under the temporary refinance scheme which ended on March 31, 2021. The central bank had introduced the facility to nullify impact of Covid-19 on investment ecosystem and ensure growth. The country’s economy grew 4% in FY21 compared to a negative growth of 0.5% in the prior fiscal year 2019-20 owing to lockdown imposed to contain spread of the infection.

“The increased remittances are seemingly sustainable, considering the amount of inflows has risen over $2.5 billion a month in recent months compared to $2 billion a month witnessed mostly in initial months following the outbreak of pandemic,” Hashmey said.

The workers’ remittances surged by a strong 27% to an all-time high of $29.4 billion in FY21, surpassing the previous record high of $23.1 billion received in FY20.

“The additional inflows of over $6 billion in workers’ remittances in FY21 compared to FY20 are equivalent to the amount of ongoing IMF loan for Pakistan,” the BMA official said.

Remittance inflows during July 2021 were mainly sourced from Saudi Arabia ($641 million), United Arab Emirates ($531 million), United Kingdom ($393 million) and the United States ($312 million), SBP said.

“Proactive policy measures by the government and SBP to incentivise the use of formal channels and curtailed cross-border travel in the face of Covid-19 have positively contributed towards the sustained improvement in remittance inflows since last year,” the SBP said.

It added that altruistic transfers to Pakistan amid the pandemic and orderly foreign exchange market conditions lent further support.

The central bank expects remittances to remain strong and improve in the current fiscal year 2022.

The inflows of remittances are not only utilised to partially pay for increasing imports but also used to repay foreign debt. Therefore, they help finance twin trade and current account deficits.

Pakistan achieved 10-year low current account deficit of 0.6% in FY21 amid strong remittances compared to 1.7% in FY20. The deficit is, however, projected to increase to 2-3% amid rising imports which are must to achieve higher economic growth, the central bank said the other day.

Pakistan saw robust growth in workers’ remittances in the wake of Covid-19, as full or partial suspension of international travelling to contain the disease also encouraged overseas Pakistanis to send remittances through banking channels.

Previously, few non-resident Pakistanis used to send money home through illegal channels of hundi-hawala operators, as they paid comparatively better exchange rate in Pakistani rupee in the country.

Published in The Express Tribune, August 11th, 2021.

tribune.com.pk

tribune.com.pk

Modest receipts will tackle rising imports, help govt achieve economic growth target

Salman Siddiqui

August 11, 2021

KARACHI: Pakistan has received the third largest workers’ remittances amounting to $2.71 billion in July, the first month of current fiscal year, making the much-needed finances available to pay for increasing imports which is a must to achieve the planned higher economic growth.

This was the sixth month in the past 13 months when the inflows of remittances sent home by overseas Pakistanis remained over $2.5 billion. Moreover, July was the fourteenth successive month in which the receipts remained above the threshold of $2 billion, according to the State Bank of Pakistan’s (SBP) data.

The remittances in July, however, dropped slightly by 2.1% compared to $2.76 billion received a year ago in July 2021. They stood almost 1% (0.7%) higher compared to $2.69 billion in the previous month of June 2021.

“This marginal year-on-year decline (of 2.1%) was largely on account of Eidul Azha, which resulted in fewer working days in July 2021 compared to last year,” Pakistan’s central bank said in a statement on remittances.

“This (the third largest remittances in a month in July) is a positive surprise. This is a good start of the (fiscal) year,” BMA Capital Director Research Saad Hashmey said while talking to The Express Tribune.

The strong remittances would tackle rising imports and help the government achieve the economic growth target of 4.8% for the current fiscal year 2021-22, he said.

Pakistan heavily relies on imports to sustain higher economic growth. The necessary imports of the country include basic raw materials for many sectors of the economy, expensive energy (oil and gas) and foods like wheat, sugar and cooking oil to develop strategic reserves in a bid to counter food inflation in the country.

In addition to this, the country is set to increase import of plant and machinery for setting up new industrial units or expending the existing ones under the subsidised Temporary Economic Refinance Finance (TERF) scheme this year. Commercial banks have approved loans worth Rs436 billion under the temporary refinance scheme which ended on March 31, 2021. The central bank had introduced the facility to nullify impact of Covid-19 on investment ecosystem and ensure growth. The country’s economy grew 4% in FY21 compared to a negative growth of 0.5% in the prior fiscal year 2019-20 owing to lockdown imposed to contain spread of the infection.

“The increased remittances are seemingly sustainable, considering the amount of inflows has risen over $2.5 billion a month in recent months compared to $2 billion a month witnessed mostly in initial months following the outbreak of pandemic,” Hashmey said.

The workers’ remittances surged by a strong 27% to an all-time high of $29.4 billion in FY21, surpassing the previous record high of $23.1 billion received in FY20.

“The additional inflows of over $6 billion in workers’ remittances in FY21 compared to FY20 are equivalent to the amount of ongoing IMF loan for Pakistan,” the BMA official said.

Remittance inflows during July 2021 were mainly sourced from Saudi Arabia ($641 million), United Arab Emirates ($531 million), United Kingdom ($393 million) and the United States ($312 million), SBP said.

“Proactive policy measures by the government and SBP to incentivise the use of formal channels and curtailed cross-border travel in the face of Covid-19 have positively contributed towards the sustained improvement in remittance inflows since last year,” the SBP said.

It added that altruistic transfers to Pakistan amid the pandemic and orderly foreign exchange market conditions lent further support.

The central bank expects remittances to remain strong and improve in the current fiscal year 2022.

The inflows of remittances are not only utilised to partially pay for increasing imports but also used to repay foreign debt. Therefore, they help finance twin trade and current account deficits.

Pakistan achieved 10-year low current account deficit of 0.6% in FY21 amid strong remittances compared to 1.7% in FY20. The deficit is, however, projected to increase to 2-3% amid rising imports which are must to achieve higher economic growth, the central bank said the other day.

Pakistan saw robust growth in workers’ remittances in the wake of Covid-19, as full or partial suspension of international travelling to contain the disease also encouraged overseas Pakistanis to send remittances through banking channels.

Previously, few non-resident Pakistanis used to send money home through illegal channels of hundi-hawala operators, as they paid comparatively better exchange rate in Pakistani rupee in the country.

Published in The Express Tribune, August 11th, 2021.

Remittances jump to $2.71b in July | The Express Tribune

Pakistan received the third largest workers’ remittances amounting to $2.71b in July, making the much-needed finances available to pay for increasing imports.