Haq's Musings: China Deal Could Set New FDI Records, End Energy Crisis in Pakistan

Chinese state-owed banks will finance Chinese companies to invest in, build and operate $45.6 billion worth of energy and infrastructure projects in Pakistan over the next six years, according Reuters.

Major Chinese companies investing in Pakistan's energy sector will include China's Three Gorges Corp which built the world's biggest hydro power project, and China Power International Development Ltd.

Prime Minister Nawaz Sharif and President Xi Jinping

Under the agreement signed by Chinese and Pakistani leaders at a Beijing summit recently, $15.5 billion worth of coal, wind, solar and hydro energy projects will come online by 2017 and add 10,400 megawatts of energy to the national grid. An additional 6,120 megawatts will be added to the national grid at a cost of $18.2 billion by 2021.

Total Foreign Direct Investment Source: World Development Indicators

Starting in 2015, the Chinese companies will invest an average of over $7 billion a year until 2021, a figure exceeding the previous record of $5 billion foreign direct investment in 2007 in Pakistan.

FDI As Percentage of GDP. Source: World Development Indicators

With over $7 billion a year, it will still, however, barely match the prior record of 3.75% of GDP in 2007.

The biggest upside of this investment will be the generation of over 16,000 MW of additional electricity which should revitalize Pakistan's industry and significantly boost its GDP.

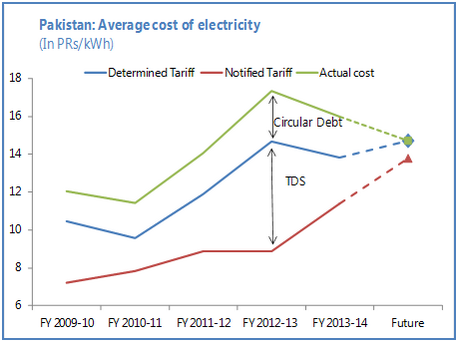

The deal can be win-win for both if the Chinese companies coming as independent power producers (IPPs) enjoy significant returns of over 17% to 27% a year on their investment while Pakistan actually alleviates its crippling electricity crisis to get its economy moving again. The assumption here is that Pakistan has learned from the prior mistakes in its existing cost-plus IPP contracts which guarantee significant profits to IPPs regardless of costs, efficiency and amount of power supplied to the grid.

Rapid increase in power generation is a well understood pre-requisite for accelerating industrialization and major improvements in productivity in this day and age. Pakistan needs sharp focus on increasing electricity availability to improve productivity and living standards of its people.

Related Links:

Haq's Musings

US-Pakistan Ties and New Silk Route

IPPs Enjoy Record Profits While Pakistan Suffers

Can Pakistan Say No to US Aid?

Obama's Pakistan Connections

Seeing Bin Laden's Death in Wider Perspective

China's Investment and Trade in South Asia

China Signs Power Plant Deals with Pakistan

Soaring Imports from China Worry India

China's Checkbook Diplomacy

Yuan to Replace Dollar in World Trade?

China Sees Opportunities Where Others See Risk

Chinese Do Good and Do Well in Developing World

Can Chimerica Rescue the World Economy?

Haq's Musings: China Deal Could Set New FDI Records, End Energy Crisis in Pakistan

Chinese state-owed banks will finance Chinese companies to invest in, build and operate $45.6 billion worth of energy and infrastructure projects in Pakistan over the next six years, according Reuters.

Major Chinese companies investing in Pakistan's energy sector will include China's Three Gorges Corp which built the world's biggest hydro power project, and China Power International Development Ltd.

Prime Minister Nawaz Sharif and President Xi Jinping

Under the agreement signed by Chinese and Pakistani leaders at a Beijing summit recently, $15.5 billion worth of coal, wind, solar and hydro energy projects will come online by 2017 and add 10,400 megawatts of energy to the national grid. An additional 6,120 megawatts will be added to the national grid at a cost of $18.2 billion by 2021.

Total Foreign Direct Investment Source: World Development Indicators

Starting in 2015, the Chinese companies will invest an average of over $7 billion a year until 2021, a figure exceeding the previous record of $5 billion foreign direct investment in 2007 in Pakistan.

FDI As Percentage of GDP. Source: World Development Indicators

With over $7 billion a year, it will still, however, barely match the prior record of 3.75% of GDP in 2007.

The biggest upside of this investment will be the generation of over 16,000 MW of additional electricity which should revitalize Pakistan's industry and significantly boost its GDP.

The deal can be win-win for both if the Chinese companies coming as independent power producers (IPPs) enjoy significant returns of over 17% to 27% a year on their investment while Pakistan actually alleviates its crippling electricity crisis to get its economy moving again. The assumption here is that Pakistan has learned from the prior mistakes in its existing cost-plus IPP contracts which guarantee significant profits to IPPs regardless of costs, efficiency and amount of power supplied to the grid.

Rapid increase in power generation is a well understood pre-requisite for accelerating industrialization and major improvements in productivity in this day and age. Pakistan needs sharp focus on increasing electricity availability to improve productivity and living standards of its people.

Related Links:

Haq's Musings

US-Pakistan Ties and New Silk Route

IPPs Enjoy Record Profits While Pakistan Suffers

Can Pakistan Say No to US Aid?

Obama's Pakistan Connections

Seeing Bin Laden's Death in Wider Perspective

China's Investment and Trade in South Asia

China Signs Power Plant Deals with Pakistan

Soaring Imports from China Worry India

China's Checkbook Diplomacy

Yuan to Replace Dollar in World Trade?

China Sees Opportunities Where Others See Risk

Chinese Do Good and Do Well in Developing World

Can Chimerica Rescue the World Economy?

Haq's Musings: China Deal Could Set New FDI Records, End Energy Crisis in Pakistan

Last edited: