ashok321

ELITE MEMBER

- Joined

- Nov 1, 2010

- Messages

- 17,942

- Reaction score

- 4

- Country

- Location

World’s largest train maker, CRRC, on uphill climb

As CRRC, the Chinese train manufacturer, confronts slower growth in a maturing market at home, the state-owned company is setting course on a new track. “We are shifting our overseas strategy from zouchuqu [go abroad] to rongjinqu [melt inside],” Liu Hualong, chairman of CRRC and of state-owned enterprise CRRC Group, said in an interview with the Nikkei Asian Review.

CRRC Group owns more than 50 per cent of the Hong Kong- and Shanghai-listed core company, CRRC. The group and the listed company have “put an emphasis on the great principle advocated by President Xi Jinping of ‘doing business together, making things together and sharing profits,’ in order for our overseas operations to coexist and co-prosper with local economies”, Mr Liu said on the sidelines of the 19th Communist Party Congress in Beijing on October 20.

He served as a delegate to the congress and was selected as one of the 133 members of the Central Commission for Discipline Inspection. The term zouchuqu refers to the long-running government policy of encouraging Chinese companies to expand their businesses beyond the country’s borders, which embraces the purchase of external assets and the conventional model of manufacturing low-cost products at home for export to overseas markets.

Rongjinqu, meanwhile, promotes the strategy of companies seeking to localise their overseas operations by integrating them with local economies where they have operations. In an effort to court foreign railway operators that purchase CRRC’s trains, the company aims at “local production of railway cars, local procurement of parts, employment of locals as plant workers and localisation of management”, Mr Liu said, adding that the company was working to build relationships with foreign customers and to become a “good neighbour” in local communities. CRRC was created in June 2015 through a merger of two state-owned peers, CSR and CNR, with the goal of creating a synergy of “one plus one equals more than two”.

It is the world’s largest manufacturer of railway trains, or rolling stock. But the Beijing-based company is facing challenges. It is expected to see drops in both revenue and net income in 2017, which would mark two consecutive years of declines. As growth in China’s domestic railway investment stalls following a decade of rapid expansion in high-speed railways, CRRC is setting its sights on growth abroad, by increasing its proportion of overseas sales to 25 per cent from 8 per cent in 2016.

CRRC chairman Liu Hualong © Shunsuke Tabeta “We still have plenty of room for growth outside China,” Mr Liu said. One stumbling block for Chinese overseas high-speed rail projects could be the deep dissatisfaction toward China’s ambition to export its technology in the sector, which does not translate into the distribution of profits to local communities. Share this graphic That is because Chinese companies have a history of bringing in their own workers and importing raw materials from China to carry out overseas projects.

CRRC’s strategy now is to show its foreign customers that it is willing to contribute to local communities by setting up its manufacturing facilities and creating jobs there. CRRC already has begun its localisation strategy in Malaysia. After winning an order in 2010 for 30 train cars for an intercity railway there, the company set up a maintenance centre in Kuala Lumpur the following year. As orders in Malaysia grew, CRRC built an assembly plant in the country for train cars in 2015.

The plant has an annual production capacity of 200 cars, and it employs about 170 workers, more than 80 per cent of whom are Malaysian, Mr Liu said. The facility in Malaysia has sent several employees to a CRRC plant in China for training, in a bid to improve the technological level of the Malaysian factory. The company also has enrolled two Malaysian plant executive candidates in a masters course at Tongji University in Shanghai, with the company shouldering the academic costs.

This article is from the Nikkei Asian Review, a global publication with a uniquely Asian perspective on politics, the economy, business and international affairs. Our own correspondents and outside commentators from around the world share their perspectives on Asia, while our Asia300 section provides in-depth coverage of 300 of the biggest and fastest-growing listed companies from 11 economies outside Japan. Subscribe | Group subscriptions Mr Liu noted that CRRC “has operations in more than 70 locations in some 20 countries, and 13 research-and-development bases outside China”, vowing to step up efforts to support Mr Xi’s pet project, the Belt and Road Initiative across Eurasia. “We are moving forward with internationalisation in line with the localisation policy, with both the number of overseas employees and overseas assets expanding 10-fold since 2012,” Mr Liu said.

According to CRRC’s annual report and Chinese news media, the company has set up research centres jointly with the University of Southampton, the University of Birmingham, TU Dresden, Ruhr University Bochum and Czech Technical University in Europe, as well as the University of Illinois, the University of Michigan and Virginia Polytechnic Institute and State University in the US CRRC also has built plants for electric-machinery products in India, according to state-owned news agency Xinhua, in addition to its existing factories in Malaysia, Turkey and South Africa.

But CRRC has attached the greatest importance to its overseas facilities in the US, and Mr Liu described the “three highs” of entering that market. “The demand for product quality is high, and if a product is accepted by the US market, it means we get the hallmark of world-level quality,” he said. “The second is a high-level of demand toward Chinese suppliers. We face strong demand for local production and the hiring of local workers,” he said. “The third is a high level of demand for technological standards.

If you can build a sufficient track record in the US market, that will make it easier to enter other Western markets.” CRRC’s efforts to gain access to the US market have been aggressive. After it won a $560m contract from Boston’s subway system for 284 train cars in 2014, the company decided to build its first US production plant in nearby Springfield, Massachusetts. The contract requires the $60m plant — which is scheduled to open in 2018 and begin deliveries the following year — to meet a local-content ratio of at least 60 per cent.

Share this graphic CRRC has also said it will employ 150 local workers. With the Springfield facility already under construction, CRRC in April received an order for another 120 train cars valued at $250m for the Boston subway. The company has landed a $1.3bn contract for 846 subway train cars in Chicago, and a $647m order for 282 train cars for the Los Angeles subway. In Chicago, the company plans to build an assembly plant at a cost of $100m, with the aim of putting it into operation next year. In an effort to demonstrate CRRC’s commitment to localisation, the company this year sent more than 30 locally hired employees at the Springfield plant for three-month training at the company’s production base in Changchun, Jilin Province, to ensure a smooth start in Massachusetts.

As a dominant company in the sector, CRRC has been a significant beneficiary of China’s expanding high-speed railway network. “We anticipate opening a new high-speed railway line every year,” He Lifeng, chairman of the National Development and Reform Commission, said during the party congress. But as the total operating distance reaches 22,000km, the pace of construction will probably plateau and demand for new train cars could be nearing its peak.

Share this graphic Indeed, state-run railway operator China Railway has said that its capital spending in 2016 fell 3 per cent from the previous year to 801.5bn renminbi ($120bn). Some 80 per cent of the company’s annual capital spending is used to construct railways and 15-20 per cent to purchase train cars. A securities analyst covering the country’s railway sector pointed out that “China’s domestic demand for train cars will not decline substantially but not increase considerably either.”

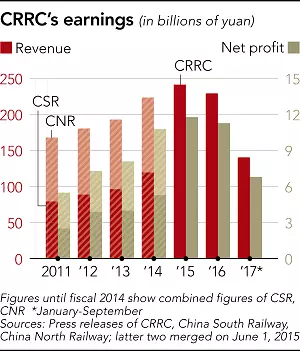

Share this graphic After a record performance in 2015, CRRC reported a 6 per cent decline in revenue and a 4 per cent slide in net profit in 2016. In the first nine months of this year, it saw sales fall another 4 per cent compared with a year earlier to HK$140.6bn ($18bn), and its net profit dropped 9 per cent to HK$6.8bn. Its stock price has also been weak. Shares of CRRC traded in Hong Kong stood at HK$7.69 at the end of October, down from a 2017 high of HK$7.99 in March, and about a third of what they were around the time of the merger in April 2015.

Kelvin Lau of Daiwa Capital Markets in Hong Kong reinstated a “hold” rating on October 27, after the company reported its third-quarter earnings. “Overall, we think CRRC lacks [a] solid growth driver,” he noted in a report, pointing to a risk of “worse than expected orders and deliveries.” Since downgrading its stock ratings in August, he maintains a target price of HK$7.10.

CRRC appears to have little choice but to pursue high-growth opportunities overseas, while seeking slow-but-steady earnings growth in the mature domestic market. Even so, its overseas expansion strategy has already hit a snag. For example, Mexico in 2014 abruptly cancelled a contract awarded for the CRRC-led consortium of Chinese and Mexican companies to build a high-speed rail system in the Latin American country.

The project was postponed indefinitely after an allegation that one of the Mexican companies in the consortium gifted a luxury house to the wife of Enrique Pena Nieto, the country’s president. In June 2016, XpressWest, a US passenger-rail venture, terminated its joint-venture activities with Chinese companies to build a high-speed rail link between Los Angeles and Las Vegas. According to a press release from XpressWest, the decision was “based primarily upon difficulties associated with timely performance” and “challenges in obtaining required authority to proceed with required development activities”.

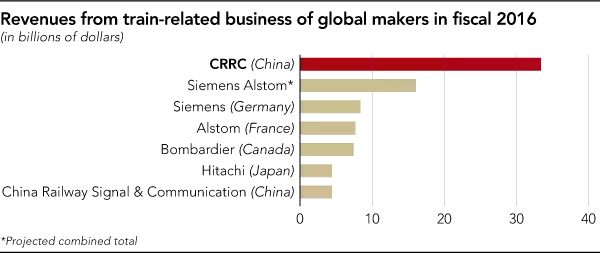

The agreement, which was signed just days before Mr Xi’s visit to the US in September 2015, was seen as a centrepiece of US-Chinese co-operation. Meanwhile, Thailand scaled back plans in 2016 for a long-distance railway due to disagreements with China over financing. CRRC also faces increasing competition in the global railway industry. German industrial group Siemens and French rival Alstom agreed in September to merge their rail operations. Although CRRC is by far the largest supplier of rail transit equipment in the world, the combined sales of Siemens and Alstom are equal to almost half of the Chinese company’s revenue.

Meanwhile, Hitachi of Japan announced plans to boost sales from its railway operations to between ¥700bn and ¥800bn ($6.19bn and $7.07bn) by the fiscal year ending March 2022, up 50 per cent from present levels. Share this graphic Hitachi has improved its business performance mainly in the European market.

In July, through its Italian subsidiary, the Japanese company was awarded a large-scale contract to provide rail cars and a train control system for the Baltimore Metro SubwayLink in the US, and also in 2018 it will begin shipping high-speed trains from Italy to the U.K. “Italy now accounts for 40 per cent of the Hitachi group’s rolling-stock production globally,” Toshiaki Higashihara, Hitachi president, told the NAR. “[As industry realignment accelerates on a global scale], we will face a much tougher business environment,” Mr Higashihara said. “Rolling stock has a relatively small profit margin, so greater scale will not directly translate into high growth.” For his part, Mr Liu takes a philosophical approach toward CRRC’s future.

“As merger and realignment become a major global trend, industry reorganisation that leads to development and technological progress is regarded as perfectly normal,” Mr Liu said. “The corporate acquisitions that we envision are long-term strategies aimed at developing high-end products and promoting internationalisation. Mergers and acquisitions are something like a romance and require agreement from both sides. “There is no point in unrequited feelings. Although we are aggressively seeking M&A opportunities, we should proceed cautiously with them in an orderly manner.”

Nikkei staff writer Tetsuya Abe in Tokyo contributed to this story.

As CRRC, the Chinese train manufacturer, confronts slower growth in a maturing market at home, the state-owned company is setting course on a new track. “We are shifting our overseas strategy from zouchuqu [go abroad] to rongjinqu [melt inside],” Liu Hualong, chairman of CRRC and of state-owned enterprise CRRC Group, said in an interview with the Nikkei Asian Review.

CRRC Group owns more than 50 per cent of the Hong Kong- and Shanghai-listed core company, CRRC. The group and the listed company have “put an emphasis on the great principle advocated by President Xi Jinping of ‘doing business together, making things together and sharing profits,’ in order for our overseas operations to coexist and co-prosper with local economies”, Mr Liu said on the sidelines of the 19th Communist Party Congress in Beijing on October 20.

He served as a delegate to the congress and was selected as one of the 133 members of the Central Commission for Discipline Inspection. The term zouchuqu refers to the long-running government policy of encouraging Chinese companies to expand their businesses beyond the country’s borders, which embraces the purchase of external assets and the conventional model of manufacturing low-cost products at home for export to overseas markets.

Rongjinqu, meanwhile, promotes the strategy of companies seeking to localise their overseas operations by integrating them with local economies where they have operations. In an effort to court foreign railway operators that purchase CRRC’s trains, the company aims at “local production of railway cars, local procurement of parts, employment of locals as plant workers and localisation of management”, Mr Liu said, adding that the company was working to build relationships with foreign customers and to become a “good neighbour” in local communities. CRRC was created in June 2015 through a merger of two state-owned peers, CSR and CNR, with the goal of creating a synergy of “one plus one equals more than two”.

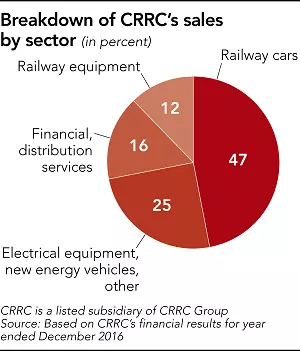

It is the world’s largest manufacturer of railway trains, or rolling stock. But the Beijing-based company is facing challenges. It is expected to see drops in both revenue and net income in 2017, which would mark two consecutive years of declines. As growth in China’s domestic railway investment stalls following a decade of rapid expansion in high-speed railways, CRRC is setting its sights on growth abroad, by increasing its proportion of overseas sales to 25 per cent from 8 per cent in 2016.

CRRC chairman Liu Hualong © Shunsuke Tabeta “We still have plenty of room for growth outside China,” Mr Liu said. One stumbling block for Chinese overseas high-speed rail projects could be the deep dissatisfaction toward China’s ambition to export its technology in the sector, which does not translate into the distribution of profits to local communities. Share this graphic That is because Chinese companies have a history of bringing in their own workers and importing raw materials from China to carry out overseas projects.

CRRC’s strategy now is to show its foreign customers that it is willing to contribute to local communities by setting up its manufacturing facilities and creating jobs there. CRRC already has begun its localisation strategy in Malaysia. After winning an order in 2010 for 30 train cars for an intercity railway there, the company set up a maintenance centre in Kuala Lumpur the following year. As orders in Malaysia grew, CRRC built an assembly plant in the country for train cars in 2015.

The plant has an annual production capacity of 200 cars, and it employs about 170 workers, more than 80 per cent of whom are Malaysian, Mr Liu said. The facility in Malaysia has sent several employees to a CRRC plant in China for training, in a bid to improve the technological level of the Malaysian factory. The company also has enrolled two Malaysian plant executive candidates in a masters course at Tongji University in Shanghai, with the company shouldering the academic costs.

This article is from the Nikkei Asian Review, a global publication with a uniquely Asian perspective on politics, the economy, business and international affairs. Our own correspondents and outside commentators from around the world share their perspectives on Asia, while our Asia300 section provides in-depth coverage of 300 of the biggest and fastest-growing listed companies from 11 economies outside Japan. Subscribe | Group subscriptions Mr Liu noted that CRRC “has operations in more than 70 locations in some 20 countries, and 13 research-and-development bases outside China”, vowing to step up efforts to support Mr Xi’s pet project, the Belt and Road Initiative across Eurasia. “We are moving forward with internationalisation in line with the localisation policy, with both the number of overseas employees and overseas assets expanding 10-fold since 2012,” Mr Liu said.

According to CRRC’s annual report and Chinese news media, the company has set up research centres jointly with the University of Southampton, the University of Birmingham, TU Dresden, Ruhr University Bochum and Czech Technical University in Europe, as well as the University of Illinois, the University of Michigan and Virginia Polytechnic Institute and State University in the US CRRC also has built plants for electric-machinery products in India, according to state-owned news agency Xinhua, in addition to its existing factories in Malaysia, Turkey and South Africa.

But CRRC has attached the greatest importance to its overseas facilities in the US, and Mr Liu described the “three highs” of entering that market. “The demand for product quality is high, and if a product is accepted by the US market, it means we get the hallmark of world-level quality,” he said. “The second is a high-level of demand toward Chinese suppliers. We face strong demand for local production and the hiring of local workers,” he said. “The third is a high level of demand for technological standards.

If you can build a sufficient track record in the US market, that will make it easier to enter other Western markets.” CRRC’s efforts to gain access to the US market have been aggressive. After it won a $560m contract from Boston’s subway system for 284 train cars in 2014, the company decided to build its first US production plant in nearby Springfield, Massachusetts. The contract requires the $60m plant — which is scheduled to open in 2018 and begin deliveries the following year — to meet a local-content ratio of at least 60 per cent.

Share this graphic CRRC has also said it will employ 150 local workers. With the Springfield facility already under construction, CRRC in April received an order for another 120 train cars valued at $250m for the Boston subway. The company has landed a $1.3bn contract for 846 subway train cars in Chicago, and a $647m order for 282 train cars for the Los Angeles subway. In Chicago, the company plans to build an assembly plant at a cost of $100m, with the aim of putting it into operation next year. In an effort to demonstrate CRRC’s commitment to localisation, the company this year sent more than 30 locally hired employees at the Springfield plant for three-month training at the company’s production base in Changchun, Jilin Province, to ensure a smooth start in Massachusetts.

As a dominant company in the sector, CRRC has been a significant beneficiary of China’s expanding high-speed railway network. “We anticipate opening a new high-speed railway line every year,” He Lifeng, chairman of the National Development and Reform Commission, said during the party congress. But as the total operating distance reaches 22,000km, the pace of construction will probably plateau and demand for new train cars could be nearing its peak.

Share this graphic Indeed, state-run railway operator China Railway has said that its capital spending in 2016 fell 3 per cent from the previous year to 801.5bn renminbi ($120bn). Some 80 per cent of the company’s annual capital spending is used to construct railways and 15-20 per cent to purchase train cars. A securities analyst covering the country’s railway sector pointed out that “China’s domestic demand for train cars will not decline substantially but not increase considerably either.”

Share this graphic After a record performance in 2015, CRRC reported a 6 per cent decline in revenue and a 4 per cent slide in net profit in 2016. In the first nine months of this year, it saw sales fall another 4 per cent compared with a year earlier to HK$140.6bn ($18bn), and its net profit dropped 9 per cent to HK$6.8bn. Its stock price has also been weak. Shares of CRRC traded in Hong Kong stood at HK$7.69 at the end of October, down from a 2017 high of HK$7.99 in March, and about a third of what they were around the time of the merger in April 2015.

Kelvin Lau of Daiwa Capital Markets in Hong Kong reinstated a “hold” rating on October 27, after the company reported its third-quarter earnings. “Overall, we think CRRC lacks [a] solid growth driver,” he noted in a report, pointing to a risk of “worse than expected orders and deliveries.” Since downgrading its stock ratings in August, he maintains a target price of HK$7.10.

CRRC appears to have little choice but to pursue high-growth opportunities overseas, while seeking slow-but-steady earnings growth in the mature domestic market. Even so, its overseas expansion strategy has already hit a snag. For example, Mexico in 2014 abruptly cancelled a contract awarded for the CRRC-led consortium of Chinese and Mexican companies to build a high-speed rail system in the Latin American country.

The project was postponed indefinitely after an allegation that one of the Mexican companies in the consortium gifted a luxury house to the wife of Enrique Pena Nieto, the country’s president. In June 2016, XpressWest, a US passenger-rail venture, terminated its joint-venture activities with Chinese companies to build a high-speed rail link between Los Angeles and Las Vegas. According to a press release from XpressWest, the decision was “based primarily upon difficulties associated with timely performance” and “challenges in obtaining required authority to proceed with required development activities”.

The agreement, which was signed just days before Mr Xi’s visit to the US in September 2015, was seen as a centrepiece of US-Chinese co-operation. Meanwhile, Thailand scaled back plans in 2016 for a long-distance railway due to disagreements with China over financing. CRRC also faces increasing competition in the global railway industry. German industrial group Siemens and French rival Alstom agreed in September to merge their rail operations. Although CRRC is by far the largest supplier of rail transit equipment in the world, the combined sales of Siemens and Alstom are equal to almost half of the Chinese company’s revenue.

Meanwhile, Hitachi of Japan announced plans to boost sales from its railway operations to between ¥700bn and ¥800bn ($6.19bn and $7.07bn) by the fiscal year ending March 2022, up 50 per cent from present levels. Share this graphic Hitachi has improved its business performance mainly in the European market.

In July, through its Italian subsidiary, the Japanese company was awarded a large-scale contract to provide rail cars and a train control system for the Baltimore Metro SubwayLink in the US, and also in 2018 it will begin shipping high-speed trains from Italy to the U.K. “Italy now accounts for 40 per cent of the Hitachi group’s rolling-stock production globally,” Toshiaki Higashihara, Hitachi president, told the NAR. “[As industry realignment accelerates on a global scale], we will face a much tougher business environment,” Mr Higashihara said. “Rolling stock has a relatively small profit margin, so greater scale will not directly translate into high growth.” For his part, Mr Liu takes a philosophical approach toward CRRC’s future.

“As merger and realignment become a major global trend, industry reorganisation that leads to development and technological progress is regarded as perfectly normal,” Mr Liu said. “The corporate acquisitions that we envision are long-term strategies aimed at developing high-end products and promoting internationalisation. Mergers and acquisitions are something like a romance and require agreement from both sides. “There is no point in unrequited feelings. Although we are aggressively seeking M&A opportunities, we should proceed cautiously with them in an orderly manner.”

Nikkei staff writer Tetsuya Abe in Tokyo contributed to this story.