beijingwalker

ELITE MEMBER

- Joined

- Nov 4, 2011

- Messages

- 65,191

- Reaction score

- -55

- Country

- Location

Why America Is Losing the Tech War with China

It is simply too late to try to suppress China. The United States must either spend seriously on research and development, along with industrial policy, or it will lose the race for twenty-first-century technological supremacy.by David P. Goldman

July 23, 2023

Western media, for the most part, has ignored a remarkable array of Chinese pilot products in industrial automation, executed primarily by Huawei, the world’s largest maker of telecommunications infrastructure and the target of a global suppression campaign by the United States. Fully automated factories, mines, ports, and warehouses already are in operation, and the first commercial autonomous taxi service is starting up in Beijing. Huawei officials say the company has 10,000 contracts for private 5G networks in China, including 6,000 in factories. Huawei’s cloud division has just launched a software platform designed to help Chinese businesses build proprietary AI systems using their own data.

There’s no indication that the Biden administration’s restrictions on high-end chips and the software and machines that make them have slowed China’s drive for dominance in the so-called Fourth Industrial Revolution—the application of AI to manufacturing, mining, farming, and logistics. Although the fog of tech war makes it hard to evaluate China’s progress with precision, available information points to surprisingly rapid progress in China’s efforts to work around technology restrictions.

The Three Potential Outcomes

China’s single-minded goal is to lead the next wave of industrial technology. Former World Bank Chief Economist Justin Yifu Lin, now a professor at Peking University and a councilor of China’s State Council, wrote in a 2021 book:

China’s 5G technology has become the world leader in the new industrial revolution. In the past few years, the US has repeated its old tricks and suppressed Chinese companies with groundless accusations, using all of its national resources. If the US succeeds in suppressing China by means of a blockade in the new industrial revolution, China will not be able to achieve its second centennial goal. How can China break through the US blockade? It can only do this by working hard to lead the new industrial revolution.

China is leading in the application of AI and high-speed broadband to business productivity. This can have one of three outcomes:

1. The United States and its allies make a concerted effort to leapfrog China and reclaim technological leadership in industry;

2. America and Europe adopt Chinese industrial technology and become followers, as China was a follower of developed markets a generation ago;

3. America continues to lose market share in industry and increases its import dependency, following the United Kingdom’s path of industrial decline.

The first option would require an industrial policy of some kind. America has turned towards such through the CHIPS Act, which has motivated $200 billion in projected investment in semiconductor production, according to the Semiconductor Industry Association. How effective the research and development (R&D) component of the CHIPS Act will be remains to be seen. Whatever the merits and flaws of the legislation, building chip fabs in the United States is justifiable on national security grounds but does not necessarily contribute to the productivity of other industries. On the contrary: the same quality (and even better) chips can be imported at a lower cost from Taiwan and South Korea; TSMC reportedly will sell chips made in the United States at a price 30 percent higher than the same product made in Taiwan. And beyond chips, the United States has not begun to consider a broader industrial policy, let alone begin to put such a policy into place.

To some extent, the second option—adopting Chinese technology—already is taking hold in increments. As noted below, only American companies that already have large-scale manufacturing operations in China have adopted AI/5G applications, entirely in the auto and related sectors.

The third alternative, continued deindustrialization, is unacceptable.

China’s Chip Dominance and the Failure of U.S. Tech Controls

Western analysts have overestimated the impact of technology controls on China, and underestimated China’s ability to work around them. There is a great deal of confusion about the importance of the latest generation of computer chips, whose narrow gate width allows more transistors to be packed into a single chip. The newest iPhones run on chips with 13 billion transistors; for reference, the computer that took the Apollo capsule to the moon in 1969 had about 64,000. The faster speed and energy efficiency of the newest chips are indispensable for 5G handsets. The graphics processing units (GPUs) produced by Nvidia and AMD make tractable the enormous datasets required for large language models (LLMs), like ChatGPT. But older chips, alone or working in parallel, can handle most business AI applications. More important than raw chip speed is the availability of the right data, the ability to transmit it quickly and conveniently, and the overall system architecture.

After the Trump administration banned sales of high-end U.S. semiconductors to Huawei in 2020, Western media predicted that China’s 5G rollout would grind to a halt. The Nikkei Asian Review wrote, for example: “Huawei Technologies and ZTE, China’s two largest telecoms equipment providers, have slowed down their 5G base station installation in the country, the Nikkei Asian Review has learned, a sign that Washington’s escalating efforts to curb Beijing's tech ambitions are having an effect.”

On the contrary: the number of 5G base stations in China doubled in 2021 to 1.43 million, and rose to 2.31 million in 2022, out of a world total of 3 million. Huawei simply built the 5G base stations with mature chips (with a 28-nanometer gate width rather than the 7-nanometer chips banned by Washington). Energy consumption was higher than optimal, but the system worked. Without access to the newer chips, Huawei’s handset business, the world’s largest in the second quarter of 2020, shrank drastically, because 5G handsets need powerful, energy-efficient processors.

Now it appears that Huawei can design its own high-end chips and manufacture them in China. Chinese research firms report that Huawei will reenter the 5G handset market in the second half of 2023. Reuters reported on July 12 that, “Huawei should be able to procure 5G chips domestically using its own advances in semiconductor design tools along with chipmaking from Semiconductor Manufacturing International Co (SMIC), three third-party technology research firms covering China’s smartphone sector told Reuters.” Caixin Global Daily reported in March that Huawei had co-developed Electronic Design Automation software with local firms for older 14-nanometer chips. It isn't clear whether SMIC can make enough 7-nanometer chips to meet Huawei's requirements, or whether the reported new 5G chips use another technology, for example, “stacking” two 14-nanometer chips in a “chiplet” to achieve 7-nanometer performance.

Consumer technology like handsets, though, is a subplot. The decisive issue is business productivity. Huawei and other Chinese companies now offer cloud-based AI services along with training and consulting to propagate the new technology to thousands of firms.

Huawei Cloud CEO Zhang Pingan July 7 rolled out a business-centered AI system before the 6th World Artificial Intelligence Conference in Shanghai, with a dismissive nod to ChatGPT: “The Pangu model does not compose poetry, nor does it have time to compose poetry, because its job is to go deep into all walks of life, and help AI add value to all walks of life.” Unlike OpenAI’s LLM, Huawei’s entry will train AI systems for customers in manufacturing, pharmaceutical R&D, mining, railways, finance, and other industries, Zhang said. The platform is powered by Huawei’s own Kunpeng and Ascend AI accelerator chips. Like the American LLMs, Pangu writes computer code, according to Huawei. But “it was designed for industry, and will be dedicated to industry,” Zhang added.

Most of these are embryonic, but with the Pangu system, Huawei Cloud offers its customers “large-scale industry development kits. Through secondary training on customer-owned data, customers can have their own exclusive industry large models,” the company said.

Zhang Pingan added that Huawei has built an AI cloud platform based on its own Kunpeng and Ascend processors, supporting a suite of AI software. Although “Nvidia’s V100 and A100 GPUs remain the most popular GPUs for training Chinese large-scale models,” a recent study notes, “Huawei used its own Ascend 910 processors” to train the Pangu model. Second, China appears able to produce proprietary AI chips like Ascend, although U.S. sanctions continue to prevent it from fabricating its Kirin smartphone chipset in Taiwan. Chinese chipmakers are keeping their cards close to their vests about fabrication capability.

The overriding issue is that industrial systems rarely require the complexity and computing power that ChatGPT applies to composing school essays and Valentine’s Day poems. China can’t import the fastest and most efficient chips with gateways of 7 nanometers or less, let alone the equipment to manufacture them. But it can make 7-nanometer chips with a costlier process, or approximate the performance of the fastest chip by stacking older chips into so-called chiplets, or jerry-rig older chips to approximate the performance of newer ones through clever system architecture.

Think of the railroad in the nineteenth century, which made it profitable to grow large crops far from water transport. This unleashed ripple effects that made the U.S. economy the world’s largest. Whether the train traveled at 40 or 80 miles an hour made a small difference to its impact on the broader economy—what mattered is that the distance could be crossed. The combination of AI and high-speed broadband creates a data highway that will transform the way most businesses run.

The United States and China approach AI differently. The trillion-dollar valuations of the great American technology companies mainly come from consumer entertainment. China, as Huawei’s Zhang said, has no time for poetry. Rather than guess when the machines will become sentient or when AI will replace human beings, China has focused on the automation of drudge work: inspecting parts on a factory conveyor belt, checking the bins near the coal face for foreign objects, detecting anomalies in machines, picking containers out of ships and placing them on autonomous trucks, and so forth.

China’s plan to assert leadership in the Fourth Industrial Revolution—the application of AI to production, logistics, and services—appears to be on track.

Except for large manufacturers who already maintain large-scale operations in China, American manufacturers have shown little commitment to Fourth Industrial Revolution technology. To my knowledge, the only U.S. manufacturing firms that have installed private 5G networks to support factory automation are General Motors (which made 2.3 million cars in China in 2022), Ford (which made 500,000 cars in China in 2022), and John Deere (which rolled its 70,000th Chinese-made tractor in February). These firms have joint ventures with Chinese manufacturers and can be considered auxiliaries of Chinese industry.

The trouble is that what is left of American manufacturing after the great decline of the 2000s often does not have the scale to realize the benefits of AI applications. The installation of private 5G networks does not coincide completely with AI applications; wifi and fiber optic cables can transmit information just as well in certain factory environments. But 5G has obvious advantages over cable-based communications in environments with fast-moving heavy machinery, especially in robot-intensive manufacturing, mines, ports, and warehouses.

According to a count by the European 5G Observatory, about sixty factories, ports, and airports have built private 5G networks, prominently including automakers like Volkswagen, Porsche, Saab, and Toyota. Again, most of the manufacturing and transport firms applying this Industry 4.0 technology have a major presence in China.

As a Western consumer technology, 5G has been a disappointment. As the Wall Street Journal headlined a January 2023 report: “It’s Not Just You: 5G is a Big Letdown.” With download speeds of about 150 mbps per second, moreover, American 5G networks are half as fast as China’s. And some U.S. 5G networks have higher latency than the 4G networks that preceded them, making them less useful for applications like autonomous vehicles. Reduced spending on 5G infrastructure pushed Ericsson into a loss during the second quarter of 2023.

China, by contrast, views 5G as an industrial technology, and expects 5G2B (5G to business) to drive sales. The relative stock price performance of Western vs. Chinese companies contains some forward-looking information. Huawei, the largest provider of telecom infrastructure, is a private (employee-owned company) and has no listed stock price, so no insight can be gleaned there. But China’s number two telecom company, ZTE, provides a rough proxy for Huawei. Its stock price has doubled over the past five years, while the second and third-ranked global firms, Ericsson and Nokia, have lost about 30 percent of their market value (price performance calculated in U.S. dollars). That is noteworthy considering that the broad European market rose 23 percent between July 2018 and July 2023 while the Chinese market (CSI 300) is almost unchanged. American pressure has excluded the Chinese firms from the U.S. market and many European markets as well, but the Chinese firms dominate their home market and most of the Global South.

China thus has a distinct advantage in 5G broadband, a critical element in business automation. Transmitting large amounts of data (for example, thousands of photos of a factory conveyor belt per minute or real-time video of underground mining operations) is more of a bottleneck than chip speed. Last month, China was the first country to allocate spectrum in the 6GHZ band to 5G and 6G services, to promote “global or regional division of 5G/6G spectrum resources” and provide the groundwork to “promote mobile communications and industrial developments at home.”

U.S. spectrum allocation favors wifi over mobile broadband, allocating virtually all of the 6GHz band to “unlicensed use,” that is, Wi-Fi. As the industry website Lightreading observed, “the ruling represented a win for the cable industry and other Wi-Fi proponents ranging from Apple to Cisco. But for 5G network operators – which continue to argue they don’t have enough spectrum for high-bandwidth services like fixed wireless – the FCC’s ruling came as a setback.”

In other words, U.S. policies continue to favor consumer-oriented Big Tech over industry applications.

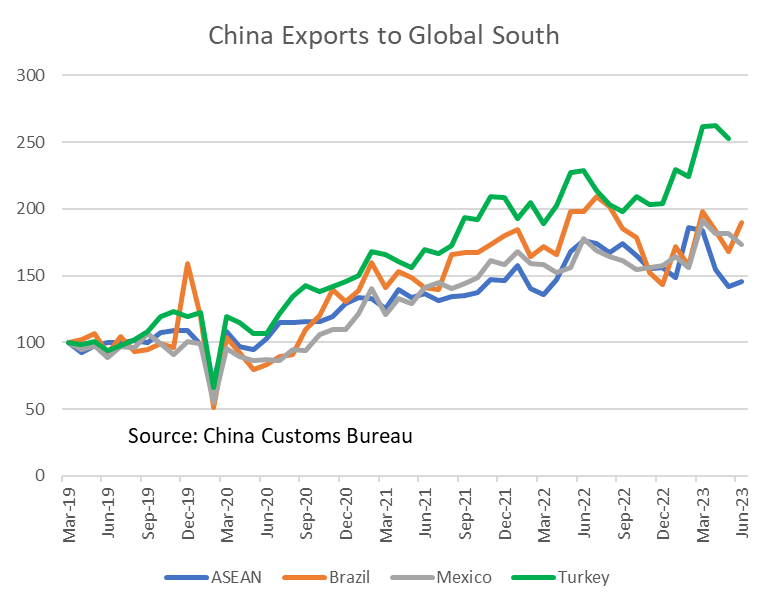

Telecom infrastructure and related applications have also buoyed China’s exports to the Global South, which have risen 50 percent since 2019 in ASEAN, nearly 100 percent in Brazil, and 250 percent in Turkey. Broadband has a transformational impact on countries with a high proportion of informal employment. It puts payment systems onto smartphones and opens banking and credit to previously marginalized people, and provides information and sales opportunities to entrepreneurs. It reduces the cost of delivery of services, including education and healthcare, and fosters new industries.

Because of all of these efforts, China in 2023 became the world’s leader in the largest manufacturing industry, automobiles, with $3 billion in global sales. High-tech manufacturing and economies of scale are likely to increase China’s edge. In 1908, Henry Ford defined an era of mass ownership of personal cars by pricing the Model T at $800, then America’s per capita GDP. China now produces electric vehicles with adequate range and power at around $11,000, just below China’s per capita GDP. China’s cheap but full-featured electric cars may dominate the low end of Europe’s auto market. Once China’s best-selling brand, Volkswagen’s market share has fallen, with annual sales down to 3.2 million units in 2022 from 4.2 million before the coronavirus pandemic. The benefits of 5G2B and artificial intelligence are thus tangible and visible: Cheaper industrial products, more efficient ports, deployment of automated vehicles, and so forth.

Meanwhile, in the West, how LLMs will drive profitability is less clear. Generative AI may find more lucrative uses in the future, especially in the automation of software, but how the existing technology justifies the trillions of dollars of additional equity valuation inspired by ChatGPT remains something of a mystery. OpenAI’s ChatGPT model meanwhile appears to have peaked as an object of popular curiosity, with a 10 percent decline in website visits in June.

As for present usage and estimates, the picture is sanguine. An Asia Times study noted that replacing every help desk employee in the United States with a chatbot would save a mere $1.6 billion a year, while replacing the bottom 25 percent of computer programmers by earnings would save just $2.5 billion.

Why Have U.S. Tech Sanctions Failed?

For several reasons, U.S. sanctions are ineffective in constraining AI development in China.

First, as noted, China’s home designs are competitive in industry applications, which typically require less computing power than LLMs and may already offer performance equivalent to the Nvidia and AMD offerings

Second, China’s SMIC can produce 7-nanometer chips, albeit with much higher costs and lower efficiency. It can certainly meet the requirements of China's military for 7-nanometer chips. These are probably quite small; existing military systems overwhelmingly use older chips, which are more robust and easier to harden, as the RAND Corporation explained in a 2022 study.

Third, Nvidia’s fastest AI chips are readily available in China through third-party sellers although at higher prices. Slower versions designed by Nvidia to stay within U.S. guidelines are still sold to China, although Washington reportedly may ban these as well.

Stopping Chinese firms from using American AI computing power via cloud services won’t accomplish much, according to US industry leaders. Amazon CEO Andy Jassy was asked by CNBC July 6: “One of the things the administration has floated is the idea that Chinese companies wouldn’t have access to kind of AI-grade cloud computing resources through hyper scalers, through cloud providers, like Amazon. Do you have a sense of how that would affect Amazon if Chinese companies couldn’t access AI scale computing on [Amazon Web Services]?” Jassy replied: “Well, the reality is that there are some very strong cloud providers who are Chinese cloud providers in China. So Chinese companies in China are going to have access to AI capabilities, whether they come from U.S. companies, European companies, or Chinese companies.”

Compete Seriously or Perish

U.S. limits on technology exports to China do not appear to have stopped or even slowed the rollout of the AI applications that have the greatest strategic impact. At the same time, restrictions on sales to China reduce the revenues of U.S. semiconductor companies and endanger their R&D budgets. In December 2019, the Defense Department vetoed a Trump administration plan to ban the export of high-end chips to Huawei on the grounds that the loss of Huawei as a customer would impinge on chipmakers’ ability to sustain R&D. President Donald Trump initially backed the Pentagon position, but reversed this later in 2020 after the coronavirus epidemic hit with full force.

The semiconductor industry is unique in the scale of its R&D requirements. It budgeted $200 billion for R&D on $600 billion in 2021 sales (the actual total will be $160 billion or less due to market softness). No other industry devotes a third of revenue to R&D. The world’s largest industry, automobiles, spends about one-fourteenth of its revenue in R&D. For companies like Qualcomm, which earns a third of its revenue in China, or Nvidia, which earns one-fifth of revenue, the support available under the CHIPS act will not compensate for revenues lost due to federal regulation. These companies are lobbying the Biden administration to relax controls on China, and they have a good case—in fact, the same case the Pentagon made in December 2019.

Restrictions on technology exports to China at best are a stopgap. Eventually, China, which graduates more engineers each year than the rest of the world combined, will develop its own substitutes, as ASML, the world’s premier maker of chip lithography equipment, avers. Even as a stopgap, though, the controls are failing. They impose high costs on China in several ways but have not impeded the Fourth Industrial Revolution. On the contrary: the limited adoption of Fourth Industrial Revolution technologies by American industry is concentrated in firms that have major commitments to China.

Whatever its merits, the CHIPS Act is not a substitute for the kind of effort the United States made under the Apollo program, or during the late 1970s and early 1980s, when DARPA funded the invention of the digital economy. In 1983 the United States devoted 1.2 percent of GDP and 5 percent of the U.S. budget to federal R&D. Today we spend only 0.6 percent of GDP on federal R&D and barely 2 percent of the federal budget.

To maintain a technological edge over China, we will have to spend an additional several hundred billions of dollars, train a highly-skilled workforce, educate or import more scientists and engineers, and provide broader incentives to manufacturing. It is simply too late to try to suppress China. That is no longer within our power. What remains within our power is to restore American pre-eminence.

Why America Is Losing the Tech War with China

It is simply too late to try to suppress China. The United States must either spend seriously on research and development, along with industrial policy, or it will lose the race for twenty-first-century technological supremacy.