PARIKRAMA

SENIOR MEMBER

- Joined

- Jan 5, 2014

- Messages

- 4,871

- Reaction score

- 185

- Country

- Location

Submission for Poster of the year 2016

The World in 2016 – 7 Pillars holding the Global Growth

Contents

1. Introduction

2. Overview

3. The story so far

5. Pillar 2 - The Emerging Markets

6. Pillar 3 - The Commodity Markets

7. Pillar 4 - Power of the Consumers

8. Pillar 5 - Easy Money Access - Liquidity

9. Pillar 6 - Uncertainties - Political and Institutional

10. Pillar 7 - Global Economy's hope - India

11. Conclusion

1. Introduction

Almost everyone knows why The Titanic sank, in the cold waters of the Atlantic on a starlit night in 1912. The tragedy of the Titanic was the result of ignoring risks of multiple nature. The ship was claimed to be unsinkable, which led to certain unconscious decisions on the part of people responsible for steering it, to ignore the risks and threats from sea and weather. The information on imminent risk – the icebergs – was taken too lightly. The confidence reposed in the strength of the ship – the best ship till date went to extreme lengths.

The present context is to understand and relate the how 7 pillars are holding the global growth in 2016. Have we learned anything from the story of Titanic or we are still taking every risk lightly. Are we having too much confidence on our own strength that we are ignoring every other small but important aspect emerging across the globe? Lets analyze it all here..

2. Overview

The start to 2016 was in a sense a heightened sight of fear factors. And the central theme to that is China. The start of the year news is like this

The above news items set the tone for my write up as i wish to analyse and highlight what are the 7 pillars or main support bases for a global economic story. Of course, China is a very important aspect to this story and outlook. But how much China alone matters? What about other support bases which are also risks to our global story. Are we just considering China only and re-incarnating the Titanic Saga?

3. The Story so far

3.1 The China Story -

For some time many analysts have pointed to supposedly cooling period needed for a super heated economic growth shown by China over many decades. Its economic growth and GDP expanded rapidly , industrialization zoomed ahead and debts by Corporate/Institutions ballooned to match the rapid expansion.

As in every case of growth, a stable period is needed when the expansionary growth tapers off a bit and the whole system contracts till a re-composition led transformation occurs over time. Its as simple as a human body. Suppose a man weighing 60 kgs with say 15% Body Fat and 85% Lean Body Mass decides to Bulk up and add 10 Kgs to his lean mass.. In real he has put on 15 kgs supposedly with 1/3 as fat mass and 2/3 muscle mass. Look at the table below for understanding

As you can see any expansion in this case bulking led to additional additions like Fat along with Lean Body Mass which is what he originally desired. The new re-composition needed a period of time where a process known as "CUT" was initiated to bring the fat mass back to older fat mass levels to complete the process of re-composition.

In the same manner, an economy when it gets bulked up will also add some other unwanted factors which are actually undesired "Fat Mass". Such fats needs to be cut for a completion of this re-composition. The same thing is now observed in the case of China.

So now the obvious question is whether we should all be worried about China?

The Answer - Yes and a No.

"Yes" because

As good as it gets not everything from China has penetrated into common man's lives across the globe. There are very healthy signs that China may be able to hold onto its big economic growth primarily because of

The 3 chief challenges China face today for this "CUT" Phase are

1. Currency: China needs to devaluation its own currency in order to continue being export friendly. This implies that the exchange rate and monetary policies needs adjustment. Imports will be costly and the world market will be flooded with cheaper Chinese products giving stiff competition to locally produced goods.

2. Growth rate: China does not need the big growth rate rather it needs an all inclusive growth rate. For this the new market potential within its own economy and supply side issues needs more reforms. It can very well find new market within herself in its rural economy.

3. The economy expansion or limiting question :The present situation dictates wither China tries to contain its economy as a whole and work on its intrinsic components as a complete body re-composition or continue on its ever expanding economic might with severe straining of fiscal prudence. Logically Fat burning requires China to contain its economy expansion so it needs policy actions to support such a measure.

These are important milestone for China and for the whole world. It can either attract more confidence on China or create more frenzy. In the meantime the world is undergoing change and such is the change that this year 2016 will be a roller coaster ride.

3.2 The Global Story

So we have set the tone for our next analysis.

4. Pillar 1 - Oil Prices

Three solid news upfront

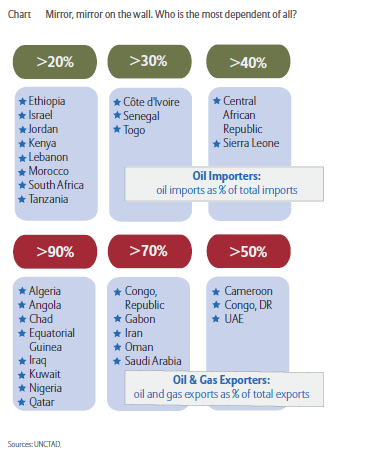

Oil prices will thus remain low for an extended period of time. This is a strong case for net oil importer nations who will get benefited but will burn oil exporting nation's economy for sure. Such economies will be effected by

weaker terms of trade, which translates into a stark deterioration of trade balance. This,will in tun, eats at their fiscal revenues. This is especially very true for a USD dollar denominated economy which virtually makes it extremely difficult to handle shocks arising out of fiscal exchange movement.

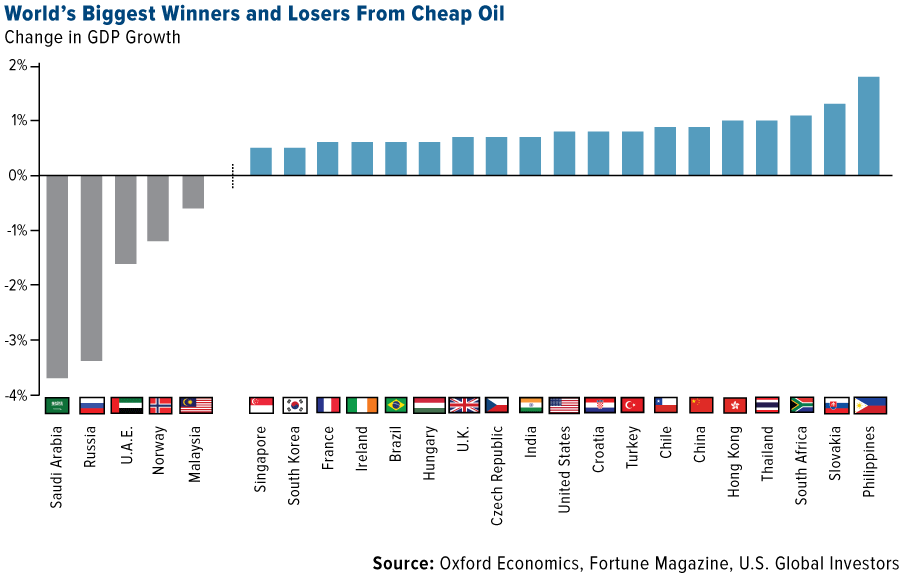

A low level commodity price should act as a trigger for demand improvement and will help tide over the deflationary scenario. This trend will be most noticeable in the Eurozone,India, Brazil with highest beneficiary being Philippines, Slovakia, South Africa, Thailand and Hong Kong. In these places,firms’ turnovers will pick up for good and economy as a whole should show solid signs of revival and growth potential. But we cannot expect a strong case of bounce back.

5. Pillar 2 - The Emerging Markets

2015 was a challenging year for emerging markets. The issues of China Slowdown and supposedly Fed Rate hike implying a stronger USD led to collapse of commodity prices and currencies. This has been very tough for most of the economies. Although these risk factors may bottom-out in 2016, some countries remain highly vulnerable.

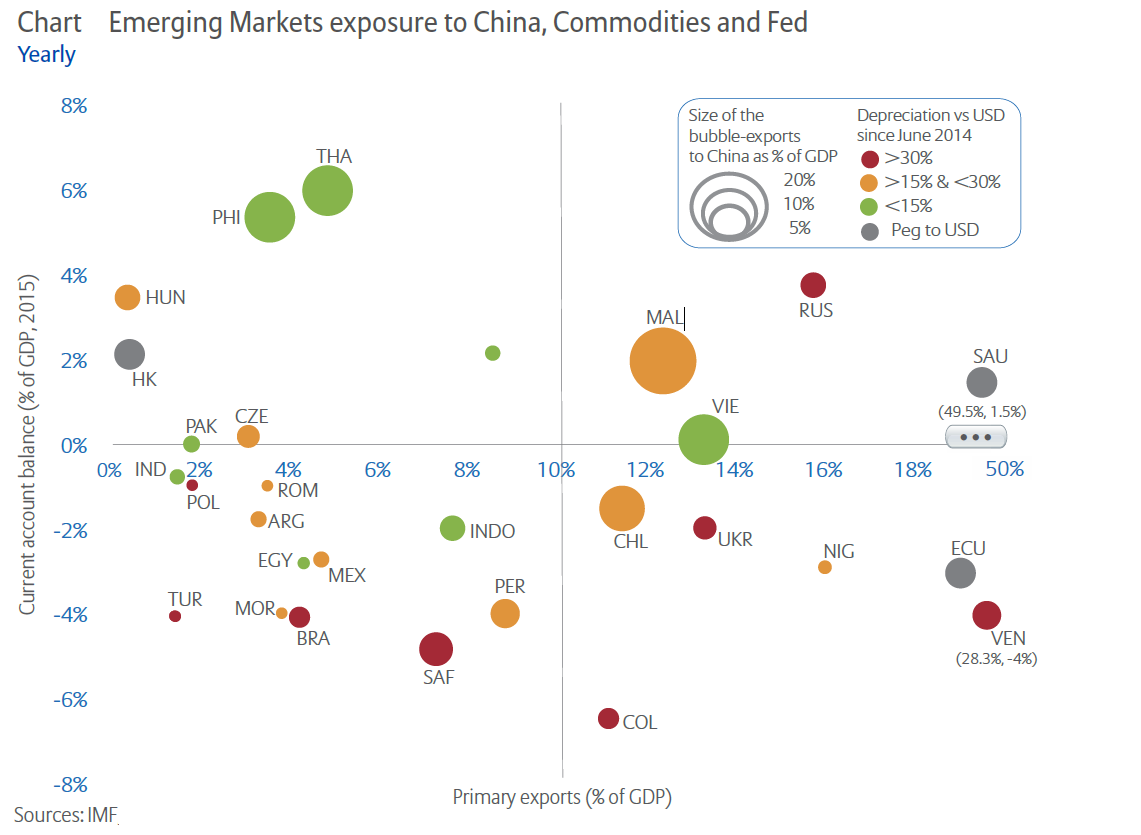

In the above Chart from IMF, we see the sensitivity of emerging countries to the three risk factors via three key metrics:

From the above based on red circles, Brazil, Russia, Colombia, Poland, Ukraine, Turkey and South Africa are the most vulnerable countries. These countries have seen a significant deterioration in their economic prospects and have little room to support growth in the short run. Both external trade and domestic demand are weak; policy support is constrained by strong macroeconomic imbalances and strong pressures on the currency. In this regard, they will remain under the volatility spotlight in 2016.

Likewise, to a lesser extent, Peru, Chile Nigeria, Morocco, Mexico, Argentina, Romania, Czech Republic, Hungary and Malaysia could also face difficult times depicted by Orange circles.

India and Pakistan denoted by Green circles are relatively much safer and are better in position to handle the risk factors defined above.

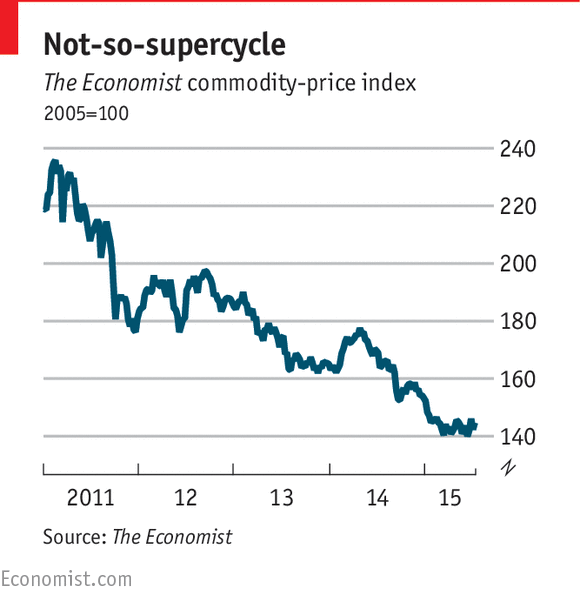

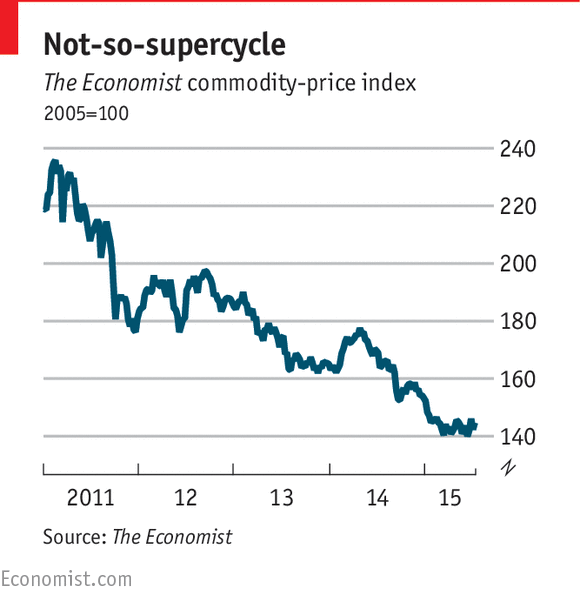

6. Pillar 3 - The Commodity Markets

Commodity markets took a beating in 2015. Indeed, oil is not the only commodity to have taken a plunge. Other commodities such as iron ore (-54%), Nickel (-53%) or Steel (-50%) have also tumbled. (Source: Euler Hermes Report). The prices should reach a bottom position known otherwise as "trough" as per any Business Cycle estimation in 2016 (Business cycle is four parts - Recession, Trough, Recovery and Peak)

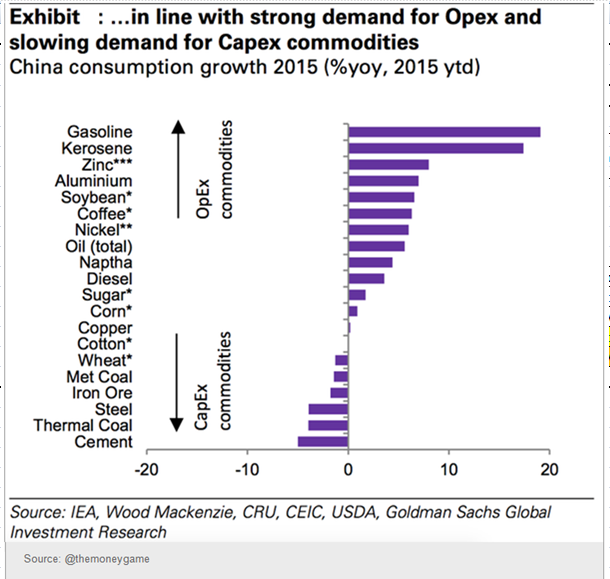

Certain Opex commodities will benefit likenickel, zinc, soybean, which are the inputs in the basic business of companies, and as such could see a limited rebound in 2016. In contrast, the outlook of “CapEx” commodities, such as iron ore, steel, copper or coal, is more challenging and their prices could fall again.

More generally, the metals complex is much more exposed to China and its re-balancing. Challenging commodity markets undoubtedly put pressure on the currencies of commodity exporters. Countries such as Indonesia, South Africa, Brazil, Chile or Peru, will once more experience downward pressures on their currencies.

7. Pillar 4 - Power of the Consumers

Consumer spending has been increasing in last few years and 2015, it did show a stable increasing trend. In advanced economies, it has shown resilience to the 'global mess' thanks to low oil prices, improving employment and easing credit conditions. In emerging economies, coupled with demand factor and increase in affordability, need and free money kept in savings for hard time has actually fueled the sentiments upwards.

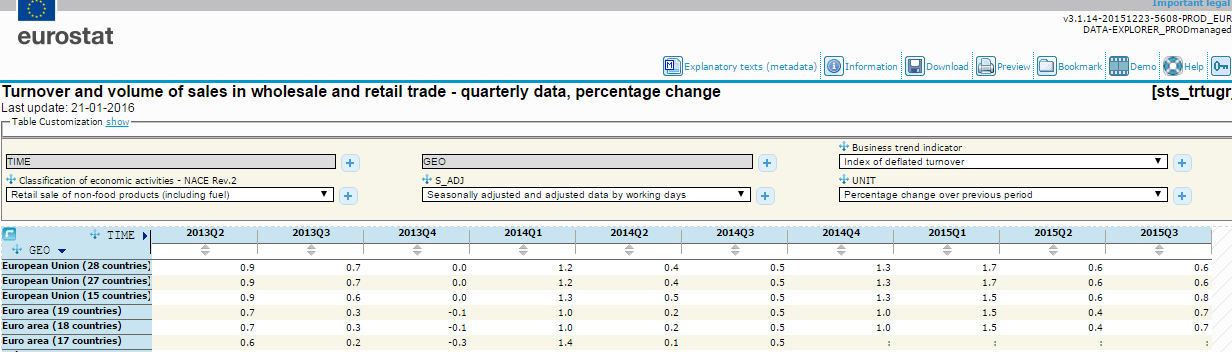

For instance, retail sales growth in the Eurozone has shot up

(Source: Turnover and volume of sales in wholesale and retail trade - quarterly data, percentage change - Eurostat

Even more importantly, consumers have been more willing to make long-term purchases, as evidenced by the rise in car sales, i.e., +8.3% y/y in the Eurozone and +6% y/y in the US. (Source Euler Hermes)

This led us to believe that future will not be having too many turmoils. Still there are strong reasons for being confident that this consumer upswing in confidence wont be a short term bubble.

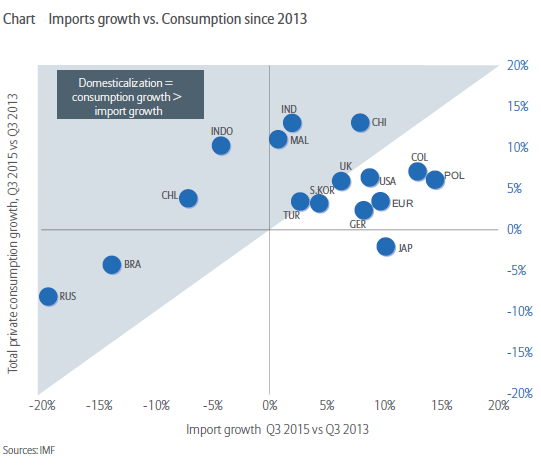

As seen from above, countries like India who are placed in the right side upper quadrant in the figure have high consumption but very limited import growths. It points to what has been described before.

8. Pillar 5 - Easy Money Access - Liquidity

The US liquidity situation is important because we all live in a dollarized world economy, where the supply of funding is jointly controlled by the Fed and wholesale money markets.Despite falling international reserves in emerging markets, global liquidity will remain abundant. Thanks to the Bank of Japan, the ECB and the PBoC, liquidity should grow in 2016

(Source: Grrrrr...owls From A (Russian) Bear | Seeking Alpha

Consider these points

9. Pillar 6 - Uncertainties - Political and Institutional

Political and institutional uncertainties could continue to pose a problem.

Lets start with first analyzing India's strengths and weakness

Strengths

The IMF projected 7.3 per cent GDP growth for India in 2015-16 and 7.5 per cent in 2016-17, levels unchanged from its outlook released in October

(source : IMF retains India’s GDP forecast for 2017 at 7.5 % - The Hindu

This outlook reflects first a base effect due to a change in methodology in Indian GDP calculation. This led to significant revisions and suggests that India enjoyed a sharp acceleration during the 2 previous years with growth now estimated at +6.9% in FY2013-14 and +5.1% in FY2012-13 which were previously estimated at just +4.7% from +4.5% under the old methodology. (Source: Euler Hermes)

More importantly, the pace is set to accelerate in the coming years due to a more favorable policy mix with less fiscal consolidation and greater monetary accommodation. Domestic demand is set to rise on the back of following chief points

While inflation is in the target range, this policy directive was followed by an interest rate cut of -125bps to present levels of 6.75%. This will likely support credit growth which has been the main Achilles' heel for growth of late. The pace of fiscal consolidation has been reduced as the government wants to increase investment in the country’s infrastructure – planned spending is over USD 11 bn to upgrade the country’s overloaded roads, railways, ports and power plants. Against this background, the government decided to delay by one year their official target to bring down the central government deficit to -3% of GDP by FY2017/18. As a result, the deficit target for the next fiscal year will be -3.9% of GDP (compared with -4.1% in FY2014/15).

Public debt will remain under control, stabilizing at around 60%. External risk is contained the current account deficit narrowed over the two past years thanks to the authorities’ responsiveness, conservative monetary policy and stringent regulation on commodity imports.

The outlook is favorable. Import pressures are also alleviated due to lower energy prices. Exports are

set to progress gradually reflecting further price competitiveness due to currency depreciation and improving demand from key partners (US and Gulf countries). Currency risk is moderate as the RBI has gained credibility and external imbalances have decreased.

11. Conclusion

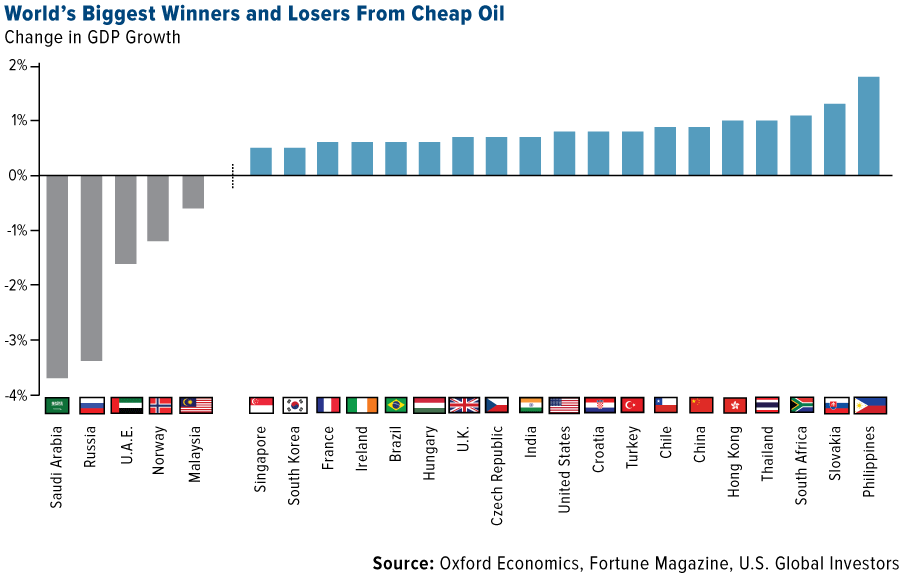

The perennial question of Oil led changes in economic conditions is best answered by the figure below

While we have already discussed in Pillar 1 about Oil, it marks a mention that Oil will play a very significant role in global growth story. Its one of the most fundamental pillar and the price per barrel moving up and down will change the fortune of global economy surely.

When it comes to China few important factors as given in overview does need mention again

China's GDP growth is set to slow in 2016 (+6.3%) and 2017 (+6%). This outlook is based on the continued efforts to re-compose the economy and clear guidance on policies. (Source IMF)

China’s authorities will probably have to set clearer priorities for the next two years and will face following challenges.

A few important points in the end are as under

The World in 2016 – 7 Pillars holding the Global Growth

Contents

1. Introduction

2. Overview

3. The story so far

3.1 The China Story

3.2 The Global Story

4. Pillar 1 - Oil Prices3.2 The Global Story

5. Pillar 2 - The Emerging Markets

6. Pillar 3 - The Commodity Markets

7. Pillar 4 - Power of the Consumers

8. Pillar 5 - Easy Money Access - Liquidity

9. Pillar 6 - Uncertainties - Political and Institutional

10. Pillar 7 - Global Economy's hope - India

11. Conclusion

1. Introduction

Almost everyone knows why The Titanic sank, in the cold waters of the Atlantic on a starlit night in 1912. The tragedy of the Titanic was the result of ignoring risks of multiple nature. The ship was claimed to be unsinkable, which led to certain unconscious decisions on the part of people responsible for steering it, to ignore the risks and threats from sea and weather. The information on imminent risk – the icebergs – was taken too lightly. The confidence reposed in the strength of the ship – the best ship till date went to extreme lengths.

The present context is to understand and relate the how 7 pillars are holding the global growth in 2016. Have we learned anything from the story of Titanic or we are still taking every risk lightly. Are we having too much confidence on our own strength that we are ignoring every other small but important aspect emerging across the globe? Lets analyze it all here..

2. Overview

The start to 2016 was in a sense a heightened sight of fear factors. And the central theme to that is China. The start of the year news is like this

- Stock exchange installed Circuit Breakers tripping leading to a massive outbreak across the globe with fall in stock markets and a fear of a deeper contagion effect.

- China's economy grew by 6.9% in 2015, compared with 7.3% a year earlier, marking its slowest growth in a quarter of a century.

- The news comes as the International Monetary Fund said it expected China's economy to grow by 6.3% in 2016 and 6% in 2017.

- Analysts believe that actual growth is much weaker than officially released data

- Analysts said any growth below 6.8% would likely fuel calls for further economic stimulus.

- Economic growth in the final quarter of 2015 edged down to 6.8%, according to the country's national bureau of statistics

The above news items set the tone for my write up as i wish to analyse and highlight what are the 7 pillars or main support bases for a global economic story. Of course, China is a very important aspect to this story and outlook. But how much China alone matters? What about other support bases which are also risks to our global story. Are we just considering China only and re-incarnating the Titanic Saga?

3. The Story so far

3.1 The China Story -

For some time many analysts have pointed to supposedly cooling period needed for a super heated economic growth shown by China over many decades. Its economic growth and GDP expanded rapidly , industrialization zoomed ahead and debts by Corporate/Institutions ballooned to match the rapid expansion.

As in every case of growth, a stable period is needed when the expansionary growth tapers off a bit and the whole system contracts till a re-composition led transformation occurs over time. Its as simple as a human body. Suppose a man weighing 60 kgs with say 15% Body Fat and 85% Lean Body Mass decides to Bulk up and add 10 Kgs to his lean mass.. In real he has put on 15 kgs supposedly with 1/3 as fat mass and 2/3 muscle mass. Look at the table below for understanding

As you can see any expansion in this case bulking led to additional additions like Fat along with Lean Body Mass which is what he originally desired. The new re-composition needed a period of time where a process known as "CUT" was initiated to bring the fat mass back to older fat mass levels to complete the process of re-composition.

In the same manner, an economy when it gets bulked up will also add some other unwanted factors which are actually undesired "Fat Mass". Such fats needs to be cut for a completion of this re-composition. The same thing is now observed in the case of China.

So now the obvious question is whether we should all be worried about China?

The Answer - Yes and a No.

"Yes" because

- Industrialization phase seems to have come to an end.

- Traditional manufacturing sectors are debt ridden a bit on a higher side of comfort zone.

- New investment and expansions wont happen for a long time as profitability has eroded and state support will not be always possible.

- The world still needs to find another consumer market like China and to a greater extent India being a potential large market has not been so attractive to change the focus of attention completely.

- This means individual countries must devise strategies to insulate themselves from a contagion effect, improving their own self efficiency and consumers worried about individual safety of money led lowering of consumption potential resulting into a turmoil filled future.

As good as it gets not everything from China has penetrated into common man's lives across the globe. There are very healthy signs that China may be able to hold onto its big economic growth primarily because of

- A large untapped population away from cosmopolitan centers primarily engaged in rural economy

- China's leadership.which can guide it out of this situation with innovative solutions

The 3 chief challenges China face today for this "CUT" Phase are

1. Currency: China needs to devaluation its own currency in order to continue being export friendly. This implies that the exchange rate and monetary policies needs adjustment. Imports will be costly and the world market will be flooded with cheaper Chinese products giving stiff competition to locally produced goods.

2. Growth rate: China does not need the big growth rate rather it needs an all inclusive growth rate. For this the new market potential within its own economy and supply side issues needs more reforms. It can very well find new market within herself in its rural economy.

3. The economy expansion or limiting question :The present situation dictates wither China tries to contain its economy as a whole and work on its intrinsic components as a complete body re-composition or continue on its ever expanding economic might with severe straining of fiscal prudence. Logically Fat burning requires China to contain its economy expansion so it needs policy actions to support such a measure.

These are important milestone for China and for the whole world. It can either attract more confidence on China or create more frenzy. In the meantime the world is undergoing change and such is the change that this year 2016 will be a roller coaster ride.

3.2 The Global Story

- Global growth, currently estimated at 3.1 percent in 2015, is projected at 3.4 percent in 2016 and 3.6 percent in 2017.

- The pickup in global activity is projected to be more gradual in emerging market and developing economies.

- In advanced economies, a modest and uneven recovery is expected to continue, with a gradual further narrowing of output gaps.

- The picture for emerging market and developing economies is diverse but in many cases challenging.

- The slowdown and re-balancing of the Chinese economy, lower commodity prices, and strains in some large emerging market economies will continue to weigh on growth prospects in 2016–17.

- The projected pickup in growth in the next two years— despite the ongoing slowdown in China—primarily reflects forecasts of a gradual improvement of growth rates in countries currently in economic distress, notably Brazil, Russia, and some countries in the Middle East, though even this projected partial recovery could be frustrated by new economic or political shocks.

- Risks to the global outlook remain tilted to the downside and relate to ongoing adjustments in the global economy: a generalized slowdown in emerging market economies, China’s re-balancing, lower commodity prices, and the gradual exit from extraordinarily accommodative monetary conditions in the United States.

- If these key challenges are not successfully managed, global growth could be derailed.

So we have set the tone for our next analysis.

4. Pillar 1 - Oil Prices

Three solid news upfront

- Oil prices have nearly halved in 2015 compared to 2014 (on average) and 2016 it started to plummet below $30 per barrel. (Souce :Oil below $30 fans wipeout fears among U.S. shale survival artists| Reuters

- Still, Russia, the US and Saudi Arabia, the three main oil producers, show no sign of cutting back their production.

- In USA Michigan, the price per Gallon of Gasoline touched less than $1 (Source: Gas Is Less Than $1 A Gallon In Michigan | The Daily Caller

Oil prices will thus remain low for an extended period of time. This is a strong case for net oil importer nations who will get benefited but will burn oil exporting nation's economy for sure. Such economies will be effected by

weaker terms of trade, which translates into a stark deterioration of trade balance. This,will in tun, eats at their fiscal revenues. This is especially very true for a USD dollar denominated economy which virtually makes it extremely difficult to handle shocks arising out of fiscal exchange movement.

A low level commodity price should act as a trigger for demand improvement and will help tide over the deflationary scenario. This trend will be most noticeable in the Eurozone,India, Brazil with highest beneficiary being Philippines, Slovakia, South Africa, Thailand and Hong Kong. In these places,firms’ turnovers will pick up for good and economy as a whole should show solid signs of revival and growth potential. But we cannot expect a strong case of bounce back.

5. Pillar 2 - The Emerging Markets

2015 was a challenging year for emerging markets. The issues of China Slowdown and supposedly Fed Rate hike implying a stronger USD led to collapse of commodity prices and currencies. This has been very tough for most of the economies. Although these risk factors may bottom-out in 2016, some countries remain highly vulnerable.

In the above Chart from IMF, we see the sensitivity of emerging countries to the three risk factors via three key metrics:

- Current-account balance, which measures a country's vulnerability to capital flows associated with the Fed rate hike;

- Exports to China as a share of GDP;

- Primary exports as a share of GDP.

From the above based on red circles, Brazil, Russia, Colombia, Poland, Ukraine, Turkey and South Africa are the most vulnerable countries. These countries have seen a significant deterioration in their economic prospects and have little room to support growth in the short run. Both external trade and domestic demand are weak; policy support is constrained by strong macroeconomic imbalances and strong pressures on the currency. In this regard, they will remain under the volatility spotlight in 2016.

Likewise, to a lesser extent, Peru, Chile Nigeria, Morocco, Mexico, Argentina, Romania, Czech Republic, Hungary and Malaysia could also face difficult times depicted by Orange circles.

India and Pakistan denoted by Green circles are relatively much safer and are better in position to handle the risk factors defined above.

6. Pillar 3 - The Commodity Markets

Commodity markets took a beating in 2015. Indeed, oil is not the only commodity to have taken a plunge. Other commodities such as iron ore (-54%), Nickel (-53%) or Steel (-50%) have also tumbled. (Source: Euler Hermes Report). The prices should reach a bottom position known otherwise as "trough" as per any Business Cycle estimation in 2016 (Business cycle is four parts - Recession, Trough, Recovery and Peak)

Certain Opex commodities will benefit likenickel, zinc, soybean, which are the inputs in the basic business of companies, and as such could see a limited rebound in 2016. In contrast, the outlook of “CapEx” commodities, such as iron ore, steel, copper or coal, is more challenging and their prices could fall again.

More generally, the metals complex is much more exposed to China and its re-balancing. Challenging commodity markets undoubtedly put pressure on the currencies of commodity exporters. Countries such as Indonesia, South Africa, Brazil, Chile or Peru, will once more experience downward pressures on their currencies.

7. Pillar 4 - Power of the Consumers

Consumer spending has been increasing in last few years and 2015, it did show a stable increasing trend. In advanced economies, it has shown resilience to the 'global mess' thanks to low oil prices, improving employment and easing credit conditions. In emerging economies, coupled with demand factor and increase in affordability, need and free money kept in savings for hard time has actually fueled the sentiments upwards.

For instance, retail sales growth in the Eurozone has shot up

(Source: Turnover and volume of sales in wholesale and retail trade - quarterly data, percentage change - Eurostat

Even more importantly, consumers have been more willing to make long-term purchases, as evidenced by the rise in car sales, i.e., +8.3% y/y in the Eurozone and +6% y/y in the US. (Source Euler Hermes)

This led us to believe that future will not be having too many turmoils. Still there are strong reasons for being confident that this consumer upswing in confidence wont be a short term bubble.

- As inflation increases whereas wages and wages in individual hands dont increase in the same proportion, the actual free money availability over time will become meager. In other words, the benefit we are seeing with low price of commodities may lose its significance owing to this free money availability.

- There is a more and renewed focus on domestic markets as there always seems to be a large untapped population available for being a large stable demand base. But such cases as seen in India for example will also lead to protectionist measures to safeguard economy and thus wont open up such avenues for other economies.

As seen from above, countries like India who are placed in the right side upper quadrant in the figure have high consumption but very limited import growths. It points to what has been described before.

8. Pillar 5 - Easy Money Access - Liquidity

The US liquidity situation is important because we all live in a dollarized world economy, where the supply of funding is jointly controlled by the Fed and wholesale money markets.Despite falling international reserves in emerging markets, global liquidity will remain abundant. Thanks to the Bank of Japan, the ECB and the PBoC, liquidity should grow in 2016

(Source: Grrrrr...owls From A (Russian) Bear | Seeking Alpha

Consider these points

- The BoJ recently fine-tuned its easing stance, notably by increasing its purchases of stocks issued by companies that are “proactively making investment in physical and human capital”.

- In China, continued low inflation & slower growth in investment suggest further easing in the short run.

- The ECB has refrained from stepping up its monthly asset purchases but still expected to do so in 2016. In any case, its QE will extend at least into 2017.

- Despite its first rate hike in 9 years, the Fed will continue to reinvest the proceeds coming from maturing assets on its balance-sheet, thus preventing a "liquidity squeeze".

- In China, a strong increase in public expenditures is helping to keep growth on track. This stance will be maintained next year as the economy continues to show signs of weakness.

- In Japan, the government continues to step up its efforts to enhance growth with an additional stimulus package worth 0.6 percentage point of GDP. New pro-growth measures were announced including a 3% rise in minimum wages and lower corporate taxes for companies.

- In the Eurozone, providing shelter and accommodations to refugees and an enhanced focus on fighting terrorism entail loosening the purse strings.

9. Pillar 6 - Uncertainties - Political and Institutional

Political and institutional uncertainties could continue to pose a problem.

- First, some legacies from the past will last throughout 2016.

- The EU announced the extension of economic sanctions against Russia until July 2016.

- Risk of conflicts remains elevated in the Middle East with the collapse of Yemen's government and political instability in Syria.

- Afghanistan Crisis still has not cooled down.

- Terror attacks from Indonesia to France to African nations to India to Pakistan

- Second, rising social tensions in some major economies is a cause of concern.

- In Brazil and South Africa, social discontent is increasing as a result of deteriorating economic prospects and increasing unemployment.

- The racial abuse of immigrants in multiple places across the globe point chaotic time fuelled by insecurity and economic turmoil.

- Third, elections will bring a slew of uncertainties.

- The US presidential election is obviously critical and can be a game changer for the longer term.

- Presidential elections in countries such as the Philippines can bring significant changes regarding the economic outlook. The current president has put the economy on better footing and the next leadership will have to maintain the pace of reforms to enhance long-term growth.

- In Taiwan, the new president Tsai Ing-wen could be a challenging event with regard to the relationship with mainland China.

- Fourth, possible institutional changes can be sources of disruptions.

- There are never-ending discussions surrounding Greece.

- Add to that the risk of a UK exit. If the UK votes in a referendum to exit the European Union, at least some EU institutions would have to be reorganized and revamped

- There are chances of rating downgrades due to falling of economic conditions which can create issues in terms of investments and possible junk ratings can fuel fear factor globally.

Lets start with first analyzing India's strengths and weakness

Strengths

- Stable democracy, with peaceful changes in government.

- Large internal market, providing some insulation from the global business cycle.

- Successful diversification into manufacturing (motor vehicles) and services (including call centres, IT and biotechnology).

- High annual GDP growth

- External debt is low relative to earnings and repayment capacity.

- Strong and Stable Foreign Exchange reserves among the emerging nations.

- Vulnerable to natural disasters (including tsunami, droughts, floods and earthquakes).

- The Kashmir region remains volatile and a source of potential conflict.

- The political system tends to engender coalition governments that lack the ability to push through economic reforms.

- Poverty remains pervasive and income distribution uneven.

- Structural weaknesses include inadequate infrastructure for a country of its status, current and fiscal account deficits and state involvement crowds out private sector initiatives in some sectors.

- Weak structural business environment.

- Despite having billion plus population Indian consumer market cannot replace directly the Chinese consumer market implying the global leaders cannot substitute India for China outright.

The IMF projected 7.3 per cent GDP growth for India in 2015-16 and 7.5 per cent in 2016-17, levels unchanged from its outlook released in October

(source : IMF retains India’s GDP forecast for 2017 at 7.5 % - The Hindu

This outlook reflects first a base effect due to a change in methodology in Indian GDP calculation. This led to significant revisions and suggests that India enjoyed a sharp acceleration during the 2 previous years with growth now estimated at +6.9% in FY2013-14 and +5.1% in FY2012-13 which were previously estimated at just +4.7% from +4.5% under the old methodology. (Source: Euler Hermes)

More importantly, the pace is set to accelerate in the coming years due to a more favorable policy mix with less fiscal consolidation and greater monetary accommodation. Domestic demand is set to rise on the back of following chief points

- Higher public and private investment for infrastructure,

- Increasing domestic consumption as lower inflationary pressures boost purchasing power.

- This will be supported further by a gradual improvement in external trade.Policy mix is supportive but under control

- Importantly the RBI operating framework has been strengthened, with government and central bank officials agreeing the adoption of a formal inflation target and creating a legal mandate for the RBI to target inflation.

While inflation is in the target range, this policy directive was followed by an interest rate cut of -125bps to present levels of 6.75%. This will likely support credit growth which has been the main Achilles' heel for growth of late. The pace of fiscal consolidation has been reduced as the government wants to increase investment in the country’s infrastructure – planned spending is over USD 11 bn to upgrade the country’s overloaded roads, railways, ports and power plants. Against this background, the government decided to delay by one year their official target to bring down the central government deficit to -3% of GDP by FY2017/18. As a result, the deficit target for the next fiscal year will be -3.9% of GDP (compared with -4.1% in FY2014/15).

Public debt will remain under control, stabilizing at around 60%. External risk is contained the current account deficit narrowed over the two past years thanks to the authorities’ responsiveness, conservative monetary policy and stringent regulation on commodity imports.

The outlook is favorable. Import pressures are also alleviated due to lower energy prices. Exports are

set to progress gradually reflecting further price competitiveness due to currency depreciation and improving demand from key partners (US and Gulf countries). Currency risk is moderate as the RBI has gained credibility and external imbalances have decreased.

11. Conclusion

The perennial question of Oil led changes in economic conditions is best answered by the figure below

While we have already discussed in Pillar 1 about Oil, it marks a mention that Oil will play a very significant role in global growth story. Its one of the most fundamental pillar and the price per barrel moving up and down will change the fortune of global economy surely.

When it comes to China few important factors as given in overview does need mention again

China's GDP growth is set to slow in 2016 (+6.3%) and 2017 (+6%). This outlook is based on the continued efforts to re-compose the economy and clear guidance on policies. (Source IMF)

China’s authorities will probably have to set clearer priorities for the next two years and will face following challenges.

- Firstly, keeping the RMB/Chinese Yuan stable could be a difficult task.

- Secondly, maintaining a solid financial base, namely high foreign exchange reserves and sound public finances, will require more selectivity in terms of expenditures. Thus, increasing both investment abroad and domestic fiscal stimulus will probable not sustainable in the longer term.

- Thirdly, “the move to quality growth” and the associated reforms will imply less ambitious growth targets.

A few important points in the end are as under

- While growth is set to decelerate in China, a modest upturn is expected in Japan, India, ASEAN-5 and Eurozone.

- Each of these upturn expectations mark them as low risk economies for the year 2016.

- Among all these nations, the highest potential is seen in India where key structural reforms can actually make it the most attractive emerging market in the world and a very solid pillar for the global economy.

- A supportive policy mix, increasing wages, solid manufacturing base and stable labor market will allow for acceleration in domestic consumption.

- A key index of performance can be gauged by PM Narendra Modi ambitious Make In India program's success

- Investment is set to gain acceleration but at a slow pace. This is due to moderate increases in market opportunities, higher costs of financing in USD terms (i.e., higher interest rates in the US) and fragile business sentiment.

- Global growth momentum will depend on China’s economic re-composition and the strength of India's rise to be the engine for fueling a global upswing in coming time.

- China economic growth slowest in 25 years - BBC News

- Recession, Cheap Oil: The World In 2016 Is Both Opportunity And Threat For India | Swarajya

- Euler Hermes Economic Outlook No 1222

- IMF World Economic Update released on In London: January 19, 2016

- Oil below $30 fans wipeout fears among U.S. shale survival artists| Reuters

- Gas Is Less Than $1 A Gallon In Michigan | The Daily Caller

- Turnover and volume of sales in wholesale and retail trade - quarterly data, percentage change - Eurostat

- Grrrrr...owls From A (Russian) Bear | Seeking Alpha

- IMF retains India’s GDP forecast for 2017 at 7.5 % - The Hindu

- India Should Review Monetary Policy Framework Cut Rates Arvind Panagariya - BW Businessworld

- Indian Country Report by Euler Hermes

Last edited:

.

.