ST1976

FULL MEMBER

- Joined

- Jul 25, 2006

- Messages

- 955

- Reaction score

- 0

- Country

- Location

Low-income Americans face a ‘hunger cliff’ as Snap benefits are cut

Gina Melton is facing a dilemma. Like millions of other Americans, Melton and her family relied on food assistance benefits boosted by Congress to help them through the pandemic. Now that extra cash is gone.The reduction has hit them hard. Three of her family members are disabled and one of her daughters works to take care of them through an agency. They had already relied on credit cards to pay for medical equipment that wasn’t covered by the federal health insurance schemes Medicare or Medicaid but have had to stop paying a couple of them in order to afford food.

“When you have to choose between feeding your family and paying a credit card bill, you have to choose food,” said Melton, 62.

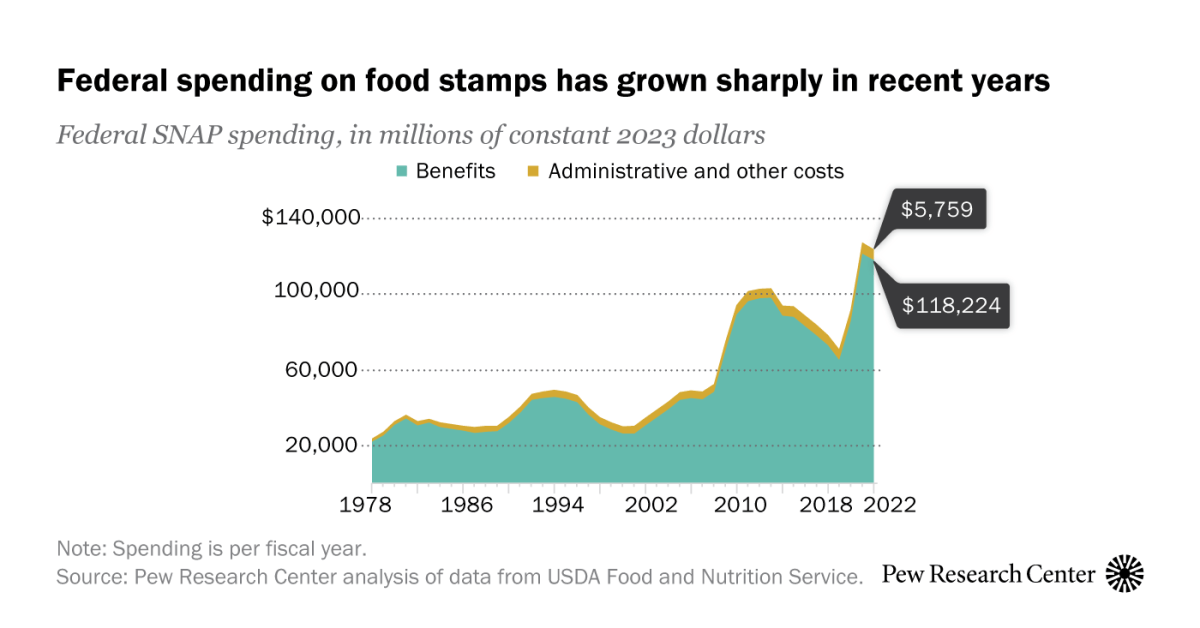

Around 42 million Americans are currently enrolled in Supplemental Nutrition Assistance Program (Snap) benefits. Congress increased Snap benefits in response to the Covid-19 pandemic in March 2020. The last extra payments went out at the end of February in the remaining 32 states that were still issuing them, in addition to the District of Columbia, Guam and the US Virgin Islands.

The emergency allotments were authorized in tandem with the Covid-19 emergency declaration in March 2022, but in December 2022, Congress passed a law to end the allotments.

The lapse in the additional benefits will reduce Snap allotments for the average recipient by $90 a month, with some households losing $250 a month or more. Older adults at the minimum benefit level will see their monthly Snap benefits drop from $281 a month to $23.

Though Melton’s husband, a diabetic, is still recovering from a recent surgery, he has been considering going back to work part time at the age of 65 as the family struggles to afford basic necessities, including healthy food. They’ve cut back on food purchases and buy what’s on sale or in reduced-price bins.

“The extra food allotment was helping us a lot,” said Melton. “We’ve started shopping at lower-priced stores that don’t bag your groceries, but for a disabled person like myself, that requires me to go with a helper. We’ve also cut back on some more expensive necessities and are relying on the local food pantry more.”

The end of the expanded benefits comes at a time when US consumer debt has been on the rise, with 20.5 million Americans currently behind on their utility payments and nearly 25 million behind on credit card, auto loan or personal loan payments, the highest number since 2009. Low-wage workers in the US, who make less than $20 an hour, have experienced drops in wage growth compared with other workers in recent months.

Food prices have risen and are expected to continue to rise significantly in 2023 as well. The US Department of Agriculture estimated that all food prices will increase by 7.9% in 2023 – and they were already 9.5% higher in February 2023 compared with February 2022.

With so many Americans receiving Snap benefits because of low wages, unemployment and underemployment, the sudden end of the emergency allotment has been characterized as a “hunger cliff”.

Ellen Vollinger, Snap director for the nonprofit Food Research and Action Center, said: “The cliff is aptly named because this a very abrupt change in what people are going to have in their food budget and it’s affecting tens of millions of people.

“When the federal government doesn’t provide as much support for food, it doesn’t mean that hungry people all of a sudden are better off, or no longer need assistance, or they go away. The hunger is still there, people are still there, the need is there, but the federal government is too abrupt in shifting the burden and costs of dealing with that downstream, to states [and] localities, and puts a greater burden on charities.”

Vollinger noted that the end of emergency allotments leaves low-income families facing difficult choices around food, from forgoing meals and purchasing less to buying cheaper food.

“There’s a lot of stress, that’s why we call it a hunger cliff. It’s very precipitous,” she added.

Food banks have been bracing for a surge in demand as the expanded Snap benefits expire, with state agencies directing recipients to food pantries to help cope with the reduction in benefits.

Studies have shown that the extra payments worked. The Urban Institute found that the increased Snap benefits during the Covid-19 pandemic kept 4.2 million Americans out of poverty in the fourth quarter of 2021, reducing poverty by 9.6% and child poverty by 14% in states with emergency allotments. They also have a wider economic benefit. Every $1 invested in Snap benefits yields between $1.50 and $1.80 in economic activity during economic downturns.

A 2022 survey conducted by Propel found that among Snap recipients, there was a significant level of higher food insecurity in states where emergency allotments were cut off. In a January 2023 survey, there was an increase in the number of Snap recipients who reported skipping meals, eating less, visiting food pantries or relying on family or friends for meals compared with December 2022.

The end of the emergency Snap allotments also coincides with a push from Republicans in Congress to cut regular Snap benefits this year, despite the majority of Americans having favorable views of the benefits. A January 2023 survey conducted by Purdue University found that seven out of 10 respondents supported permanent expansions of the Snap program.

But an expansion looks very unlikely in the current Congress. In the meantime, recipients are facing tough choices.

“I just received the last one last week,” said Patricia Ameral, 67, of Massachusetts, referring to the Covid emergency benefits. “I am certain it will mean the difference between consuming less fresh produce and less meat, fresh or frozen.”

Low-income Americans face a ‘hunger cliff’ as Snap benefits are cut

The US food assistance program offered expanded benefits during the Covid emergency, but they ended last month