AndrewJin

ELITE MEMBER

- Joined

- Feb 23, 2015

- Messages

- 14,904

- Reaction score

- 23

- Country

- Location

China's big four

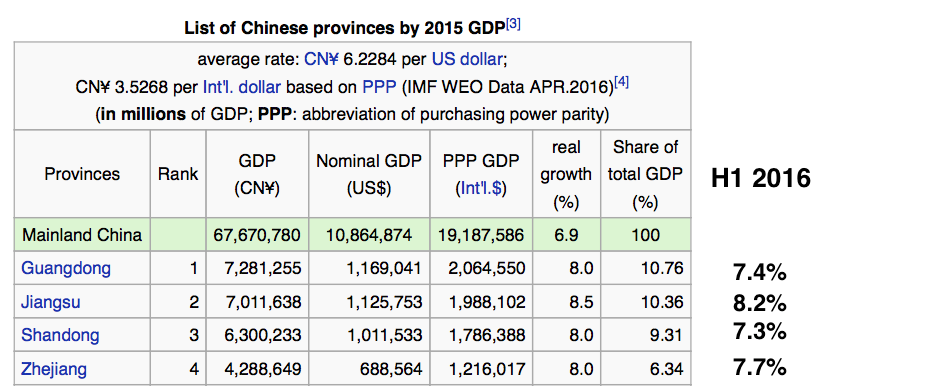

Guangdong, Jiangsu, Shandong and Zhejiang

It's very hard to gauge China's economy at regional levels. China is simple big and diverse.

There are a couple of provinces with temporary difficulties, basically Northeast China and some provinces that mainly rely on heavy industry and mining, such as Shanxi Province, Hebei Province and Inner Mongolia.

There are also the underdeveloped Central China and Western China, both are 2 trillion dollars economy but with much higher than average growth. 2 trillion + 2 trillion seem big, but considering their population, the potential is still huge. (see China's interior: a 5 trillion dollars economy, the new spotlight )

Overall, the primary growth engine of Chinese economy is by large the big four provinces. The GDP of these big four all together is on par with Japan's GDP figure in 2015 (4 trillion US dollars). It's very stupid to say, they have reached some sort of maturity in terms of economic development. If we refer to the economic figures of H1 2016 and 2015, it's rational to say, their economies are steady, vigorous, and better than ever, especially in terms of high value-added industries and service sector. Nearly all emerging Chinese brands are more and less based on these big four (and of course with independent municipalities and numerous regional mega cities), including Huawei, BYD, Haier, Alibaba, DJI, Gree, CRRC, etc.

(mind that Q4 accounts for 1/3 of the entire year in China)

Having said that the GDP of big 4 provinces is on par with Japan, we must clearly understand that the big 4 has more than 330 million people (and on the rise) while the population of Japan is merely 126 million (and shrinking). But the big 4 provinces, as the economic model of China and the primary origin of innovation, should have bigger goals. The booming economy of the big 4 is also critical to the economy of China's interior. The economic tie between Central China's Hubei/Hunan Province and Guangdong Province is so tight that the high-speed railway services every 5-10 minutes on Wuhan-Changsha-Guangzhou HSR are always full of passengers.

As the host city of the upcoming G20 summit, Hangzhou, the capital city of Zhejiang Province (the smallest one of big 4, but with higher GDP per capita than Guangdong and Shandong) provides a perfect example of a high-tech oriented and internet-focused development, with holding the headquarter of Alibaba and numerous innovative companies.

There is a long way to go.

Keep working and never feel content.

@Yizhi @Shotgunner51 @TaiShang @Stranagor @cirr @Keel @Jlaw @Place Of Space @FairAndUnbiased @zeronet @Raphael @sweetgrape @Edison Chen @Chinese Bamboo @Chinese-Dragon @cnleio @+4vsgorillas-Apebane @onebyone @yusheng @Kyle Sun @dy1022 @Beast @YoucanYouup @terranMarine @ahojunk @kuge@Economic superpower @Beidou2020 @cirr @JSCh @jkroo @Pangu @ChineseTiger1986 @powastick @onebyone @kankan326 @badguy2000 @TianyaTaiwan @ahtan_china @ChineseTiger1986 @powastick @empirefighter @hexagonsnow @xuxu1457 @sword1947 @tranquilium@55100864 @Sommer @HongWu002 @Speeder 2 @Dungeness @utp45 @StarCraft_ZT2 @Martian2 @Jguo @Arryn @rott @TheTruth @Dungeness @immortalsoul @beijingwalker @xunzi @Obambam @ahtan_china @bolo @bobsm @Abacin @Tom99 @Genesis @GS Zhou @Sinopakfriend @djsjs @Daniel808 @Nan Yang @70U63 ]@CAPRICORN-88 @XiaoYaoZi @Hu Songshan @theniubt @LTE-TDD @faithfulguy @Mista @Tiqiu @long_ @Three_Kingdoms et al

Guangdong, Jiangsu, Shandong and Zhejiang

It's very hard to gauge China's economy at regional levels. China is simple big and diverse.

There are a couple of provinces with temporary difficulties, basically Northeast China and some provinces that mainly rely on heavy industry and mining, such as Shanxi Province, Hebei Province and Inner Mongolia.

There are also the underdeveloped Central China and Western China, both are 2 trillion dollars economy but with much higher than average growth. 2 trillion + 2 trillion seem big, but considering their population, the potential is still huge. (see China's interior: a 5 trillion dollars economy, the new spotlight )

Overall, the primary growth engine of Chinese economy is by large the big four provinces. The GDP of these big four all together is on par with Japan's GDP figure in 2015 (4 trillion US dollars). It's very stupid to say, they have reached some sort of maturity in terms of economic development. If we refer to the economic figures of H1 2016 and 2015, it's rational to say, their economies are steady, vigorous, and better than ever, especially in terms of high value-added industries and service sector. Nearly all emerging Chinese brands are more and less based on these big four (and of course with independent municipalities and numerous regional mega cities), including Huawei, BYD, Haier, Alibaba, DJI, Gree, CRRC, etc.

(mind that Q4 accounts for 1/3 of the entire year in China)

Having said that the GDP of big 4 provinces is on par with Japan, we must clearly understand that the big 4 has more than 330 million people (and on the rise) while the population of Japan is merely 126 million (and shrinking). But the big 4 provinces, as the economic model of China and the primary origin of innovation, should have bigger goals. The booming economy of the big 4 is also critical to the economy of China's interior. The economic tie between Central China's Hubei/Hunan Province and Guangdong Province is so tight that the high-speed railway services every 5-10 minutes on Wuhan-Changsha-Guangzhou HSR are always full of passengers.

As the host city of the upcoming G20 summit, Hangzhou, the capital city of Zhejiang Province (the smallest one of big 4, but with higher GDP per capita than Guangdong and Shandong) provides a perfect example of a high-tech oriented and internet-focused development, with holding the headquarter of Alibaba and numerous innovative companies.

There is a long way to go.

Keep working and never feel content.

@Yizhi @Shotgunner51 @TaiShang @Stranagor @cirr @Keel @Jlaw @Place Of Space @FairAndUnbiased @zeronet @Raphael @sweetgrape @Edison Chen @Chinese Bamboo @Chinese-Dragon @cnleio @+4vsgorillas-Apebane @onebyone @yusheng @Kyle Sun @dy1022 @Beast @YoucanYouup @terranMarine @ahojunk @kuge@Economic superpower @Beidou2020 @cirr @JSCh @jkroo @Pangu @ChineseTiger1986 @powastick @onebyone @kankan326 @badguy2000 @TianyaTaiwan @ahtan_china @ChineseTiger1986 @powastick @empirefighter @hexagonsnow @xuxu1457 @sword1947 @tranquilium@55100864 @Sommer @HongWu002 @Speeder 2 @Dungeness @utp45 @StarCraft_ZT2 @Martian2 @Jguo @Arryn @rott @TheTruth @Dungeness @immortalsoul @beijingwalker @xunzi @Obambam @ahtan_china @bolo @bobsm @Abacin @Tom99 @Genesis @GS Zhou @Sinopakfriend @djsjs @Daniel808 @Nan Yang @70U63 ]@CAPRICORN-88 @XiaoYaoZi @Hu Songshan @theniubt @LTE-TDD @faithfulguy @Mista @Tiqiu @long_ @Three_Kingdoms et al

Last edited: