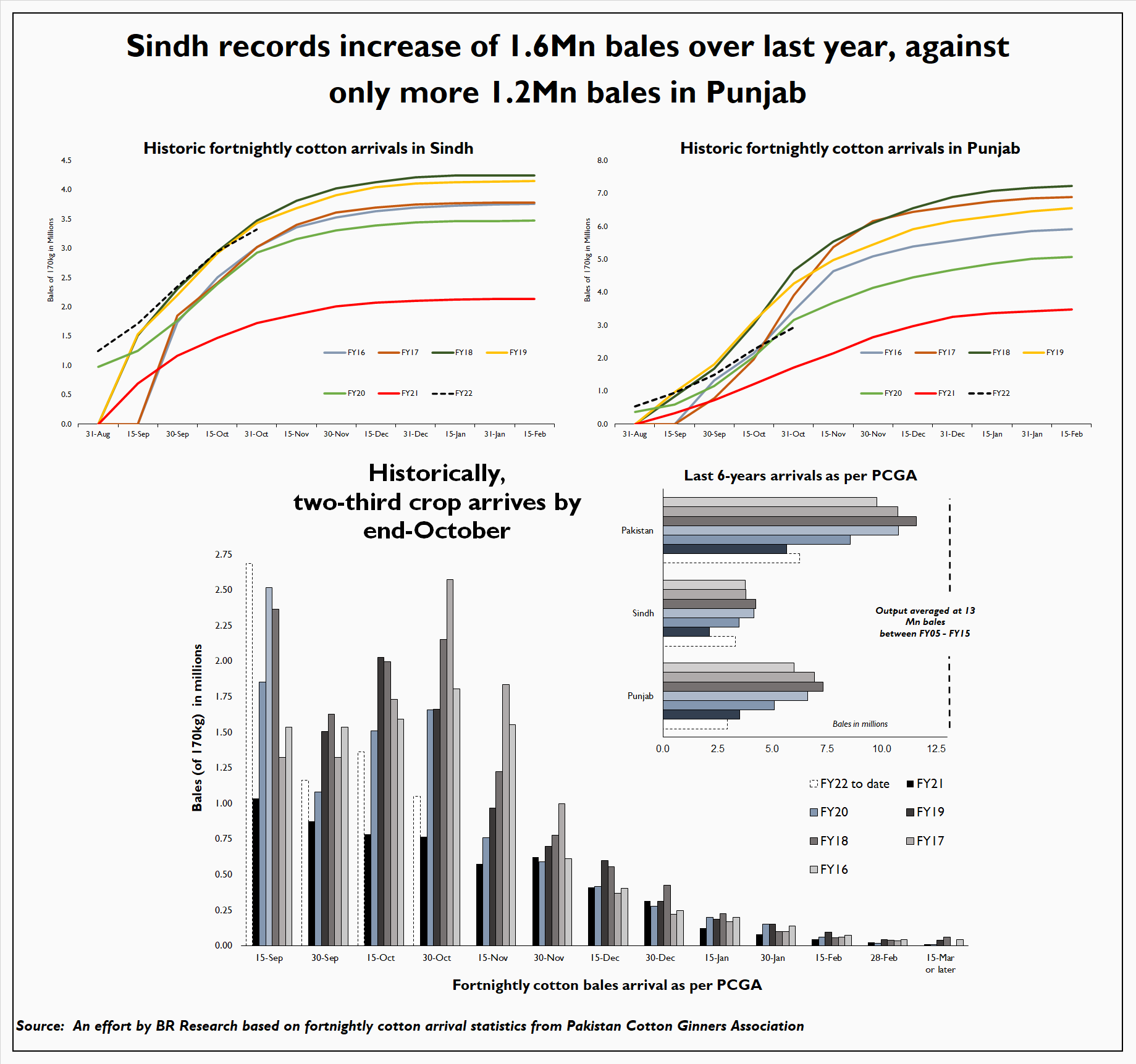

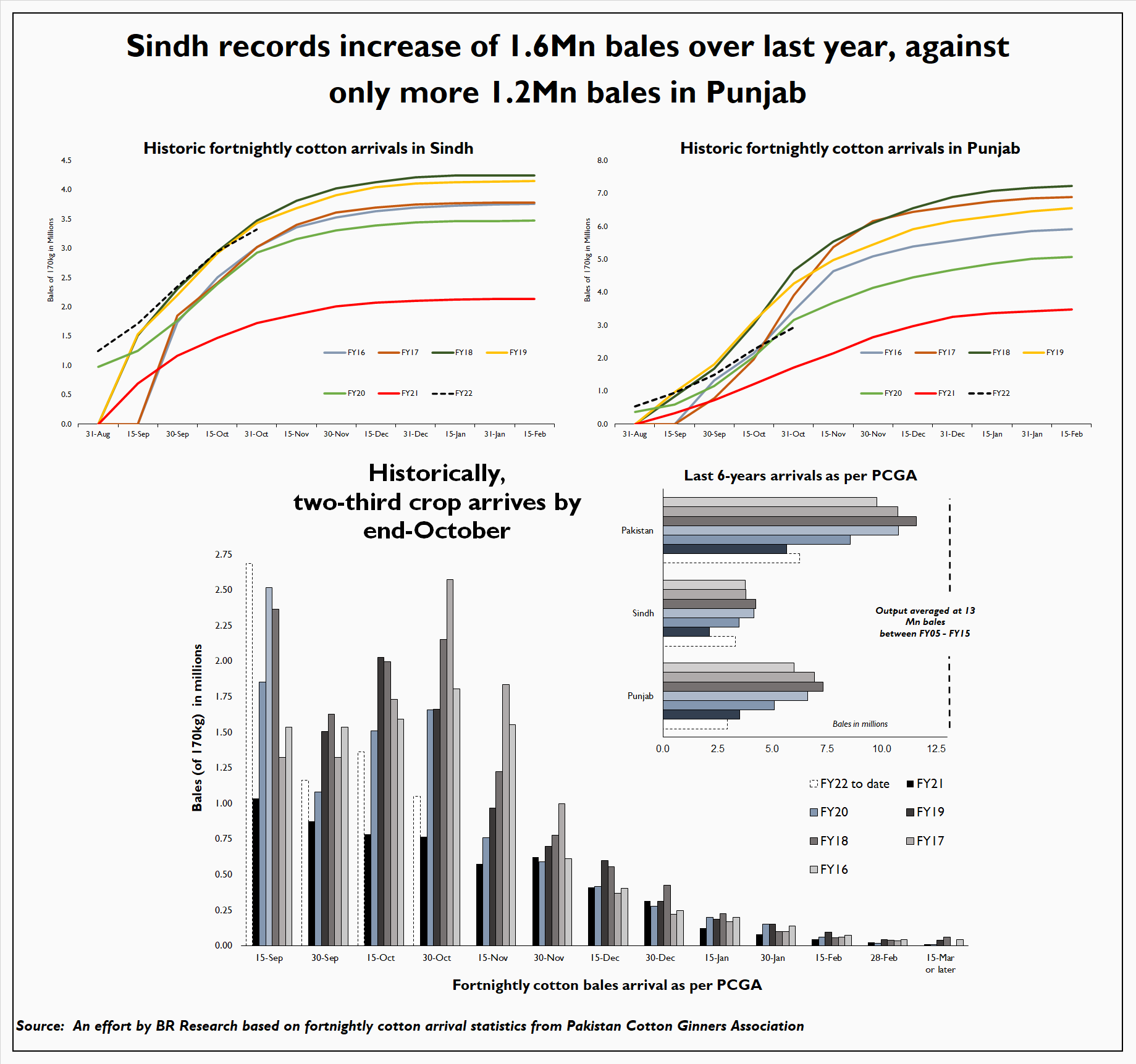

It is only the beginning of November, yet volume of cotton bale arrivals (at ginning factories) has already surpassed full year FY21’s arrivals. According to fortnightly statistics from Pakistan Cotton Ginners Association (PCGA), cumulative arrivals for the ongoing marketing season by end of October have touched 6.26 million bales (of 170kg), which is 81 percent higher than same period last year!

But of course, FY21 is a poor indicator, as national cotton output during that season had collapsed to a 40-year low, due to devastating rains, locust attacks, and poor germination rate. Although it is improbable that chronic challenges such as seed quality could have fixed themselves in one season, favourable weather seems to have helped yield positive results.

On national basis, cotton arrivals seem to be on track to achieve revised target (by Central Cotton Assessment Committee) of 9.37 million bales, which would be 33 percent greater than official estimate for FY21; and not 75 percent higher, as has been incorrectly claimed by SAPM on Food Security. Official documents from GoP claimed national output of 7.064 million bales during FY21, which was 25 percent greater than PCGA’s cotton arrivals for the season. At the time, GoP failed to explain why its official estimate did not reconcile with PCGA’s figures, but lately seems to be relying on PCGA’s estimate for last year in its official communication (refer to PM’s latest speech, televised yesterday, which claimed cotton output in FY22 is higher by 81 percent).

Either way, national cotton output is significantly higher over last year, which is good news for the textile industry and farm incomes, as cotton prices have rallied locally post-harvest in line with international commodity market. Earlier estimates of cotton import bill during FY22 have also been thrown into a flux, as import requirement may now reduce significantly, yielding much-needed foreign exchange savings.

Although it is hard to conclude what truly turned the tide of cotton production in the ongoing season, some clues are now becoming apparent. Using PCGA’s arrivals as proxy, it appears that per acre yield in Punjab may clock in at roughly 650 kg per hectare, 20 percent higher than last year (assuming 60 percent seasonal arrivals received in Punjab, to date).

Meanwhile, yield in Sindh may touch 1,300kg per hectare, close to highest ever, even if it is assumed that the province has already recorded over 75 percent of total seasonal arrivals. If correct, cotton yield in Sindh during FY22 shall be twice of last year. Recall that cotton growing districts of Sindh were worst affected by late monsoon rains last year, which led to provincial cotton output declining to its lowest in 25 years.

Moreover, it may be useful to remember that at 1.3 million hectares, area under cotton in Punjab during current season is lowest since at least 1970s. If per acre yield in Punjab remains rangebound close to 10-year average, provincial output may underperform, clocking in at 5 million bales – same as last year.

Which would mean that the bulk of improvement in cotton output in FY22 shall come from Sindh, which ostensibly has not been a part of Kissan Card and other farm support packages by federal government. Pakistan may very well claim victory in the battle against cotton decline, but maybe give credit where its due?