Tax incentive removal: Why the proposal raises concern over long-term financing

For yearly income of Tk 600,000, a taxpayer has to pay Tk 25,000 tax to the government exchequer. But if he/she has invested up to TK 120,000 out of the income in the secondary market, the yearly tax payment will be reduced to Tk 7,000 with Tk 18,000 rebated. Thus, the investor can have a big chun

Tax incentive removal: Why the proposal raises concern over long-term financing

MOHAMMAD MUFAZZAL

Published :May 12, 2023 02:10 PM

Updated :

May 12, 2023 02:10 PM

Share this news

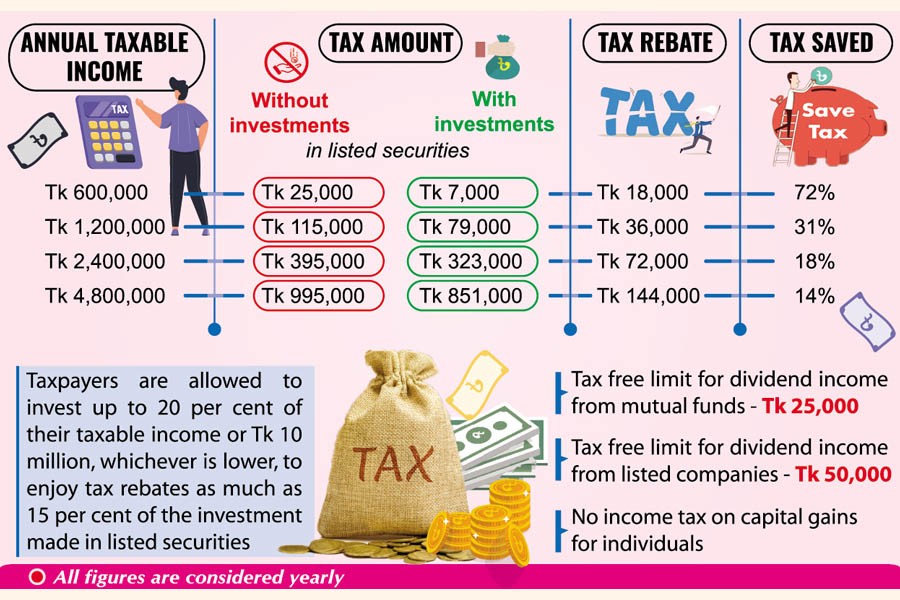

For yearly income of Tk 600,000, a taxpayer has to pay Tk 25,000 tax to the government exchequer. But if he/she has invested up to TK 120,000 out of the income in the secondary market, the yearly tax payment will be reduced to Tk 7,000 with Tk 18,000 rebated.

Thus, the investor can have a big chunk of tax -- 72 per cent in here -- saved.

Tax payers are allowed to invest up to 20 per cent of their taxable income or Tk 10 million, whichever is lower, to enjoy tax rebates as much as 15 per cent of the investment made in listed securities.

The finance ministry has recently discussed a proposal to remove in the upcoming budget of FY24 existing tax benefits given to investors for injecting money into the stock market.

The discussion was spearheaded by Finance Minister AHM Mustafa Kamal. However, a top official of the Bangladesh Securities and Exchange Commission (BSEC) said the market regulator had not been talked to before the proposal was prepared.

"We will talk to the high-ups of the government next week in this regard," he added.

In an earlier directive, the ministry (MoF) itself asked regulatory bodies, including the central bank and the National Board of Revenue, to discuss with the BSEC before taking any decision that may affect the capital market.

The tax incentive, if withdrawn, will divert money from the secondary market that has already been suffering from liquidity crisis for gloomy economic outlook since the beginning of the Russia-Ukraine war.

It will also diminish the possibility of the market becoming an established source of long-term financing for business entities, said Md Nojibur Rahman, a former chairman of the NBR.

The capital market is the main source of long-term financing in other countries, he said.

"Unfortunately, the situation is different in Bangladesh."

The removal of tax rebate will lead to a chain of negative ramifications on the economy, said Mr Rahman.

Incentives are important to encourage investors to put money in shares, debenture and mutual funds listed on the stock exchanges.

There is a fear that the move will trigger withdrawal of investments from the secondary market, said M Anis Ud Dowla, president of the Bangladesh Association of Publicly Listed Companies (BAPLC).

"The funds are likely to be injected in the instruments having tax rebates," he added.

The tax-free limit at present for dividend income from mutual funds is Tk 25,000 a year and the amount is Tk 50,000 for dividend income from investments made in listed companies.

The revenue board finds it difficult to calculate and monitor investments in secondary shares and that is why its officials reportedly are mulling a proposal for withdrawing tax rebates.

On this, former NBR chairman Mr. Rahman said the NBR could learn from practices in other countries where revenue boards work with stock exchanges for tax collection from the stock market.

After the outbreak of the war, listed securities saw steep price corrections. The securities regulator then imposed floor price to contain freefall of stocks.

As a result, the market has become highly illiquid as majority companies have plunged to the floor price and remained unmoved for a lack of buyers.

BSEC Chairman Shibli Rubayat Ul Islam refused to make any comment instantly on the proposal. BAPLC President Mr Dowla lamented that the revenue board never sits with them ahead of any budget proposal. "Our suggestions are hardly communicated to them [NBR officials]," he said.

mufazzal.fe@gmail.com