ghazi52

PDF THINK TANK: ANALYST

- Joined

- Mar 21, 2007

- Messages

- 102,926

- Reaction score

- 106

- Country

- Location

.,.,.,

October 8, 2023

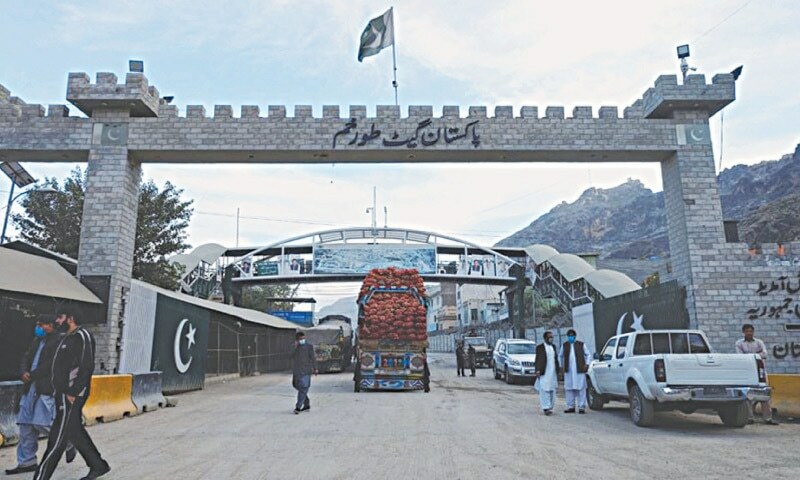

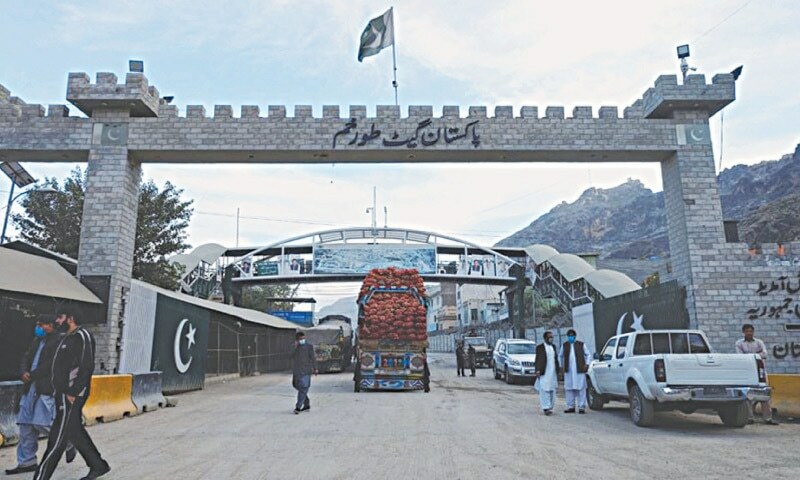

This file photo shows the gate at Torkham, the historic trade route and border crossing between Afghanistan and Pakistan. — Reuters

• Transit cargo grows in the second year of Taliban rule

• Cargo flow jumps 39pc, number of containers up from 74,316 last year to 102,886 in FY23

• Cargo value soars from $4bn to $6.7bn, up 67pc • Smuggling-prone items surge 63pc to $3.7bn

ISLAMABAD: In a significant development since the Taliban’s takeover of Kabul, the flow of Afghan transit cargoes has witnessed a substantial surge in one year.

The number of containers under Afghan transit trade transporting goods through Pakistan has increased by nearly 39 per cent, reaching a total of 102,886 containers in the 2022-23 from 74,316 containers in the previous year, according to official data compiled by Pakistan Customs.

The first two months of the current fiscal year have seen a persistent upward trend in cargo volumes, totalling nearly 15,000 containers. The projected total for containers in fiscal year 2024 is approximately 130,000.

It has been observed that transit cargoes have experienced a surge during the second year of the Taliban government despite the absence of banking facilities and the unavailability of US dollars within Afghanistan.

The surge in transit cargoes highlights a notable shift in the country’s trade dynamics amidst the changing political landscape.

Since the Taliban’s takeover of Kabul on Aug 15, 2021, Islamabad provided tax and duty exemptions on various commodities imports, including fruits and vegetables. Besides, from July 6 last year, the government also allowed the trade of all products via land routes to Kabul in rupees.

In a bid to ensure the continued supply of essential food and non-food commodities, Pakistani government allowed the trade in rupee to support the Kabul government. This move comes as a result of the United States imposing restrictions on the Taliban-led government in Afghanistan.

According to a customs official, the flow of cargo, which previously declined, has now witnessed a remarkable increase.

In a remarkable series of fluctuations, the assessed import value of transit cargoes experienced a notable trajectory over the past few years. Starting at a staggering $4.5bn in the fiscal year 2019-20, the value dipped slightly to $4.4bn in the subsequent year of 2020-21. However, the following year witnessed a further decline, with the import value settling at $4.01bn in 2021-22.

Astonishingly, the trend took a sudden turn in the fiscal year 2022-23, as the assessed import value skyrocketed to an impressive $6.7bn, an increase of 67pc over the previous year. The import value for July and August of FY24 stood at $1.14bn. The full year projection is $6.8bn for FY24.

Smuggling-prone items

The total import value of smuggling-prone items under transit cargo has witnessed a staggering 63pc surge, soaring from $2.287bn in the previous year to an astonishing $3.731bn in FY23. This substantial increase highlights the growing prevalence of smuggling activities in the transit sector, raising concerns among authorities and stakeholders alike.

During the year under review, there was a significant 40pc increase in the quantity of smuggling-prone items, according to recorded data.

In the fiscal year 2023, the transit trade sector witnessed a significant surge in imports, with a staggering $2bn worth of cotton and cotton fabrics, artificial fabric (including filament yarn and staple fibre), and knitted fabric. This marked a substantial increase of 32pc compared to the previous year.

Additionally, imports of electrical machinery, home appliances, and personal appliances reached a value of $633m, reflecting a notable growth of 39pc from the previous year. Furthermore, the transit trade sector saw a remarkable rise in the import of tyres, with a total worth of $401m, indicating a substantial increase of 43pc from the previous year.

The import value of tea stood at $182m, perfumes $51m, soap $22m, blankets $75m, and footwear $50m in FY23.

In a significant decline, the consumption of the smuggling-prone products within Pakistani households fell from $16.262bn in the previous year to $9.809bn in FY23. During the year under review, there was a significant decline of 66pc in the quantity of these imports. This make a strong correlation of smuggling-prone items consumption in Pakistan.

There are multiple justifications for the sudden rise in cargo imports under Afghan transit trade agreement. The State Bank of Pakistan has withdrawn filing of financial instrument along with goods declaration in July 2021.

Restrictions on cargoes

The government has made three major decisions pertaining to the Afghan transit trade agreement. One of these decisions involves the imposition of a 10pc processing fee on items that are imported under this agreement.

In a subsequent development, a decision has been made to shift the responsibility of guaranteeing goods from insurance companies to banks. Afghan transit importers are required to deposit a specific amount of duty and taxes in banks as a bank guarantee. This guarantee is subsequently returned to the importers once the goods successfully cross the border into Afghanistan.

The import of nearly $4bn worth smuggling-prone items were banned under the transit agreement through a commerce ministry order SRO1397(1)12023. This is a major decision that might elicit strong reaction from Afghanistan.

Imports and transit via Afghanistan

Pakistani authorities are express concerns over potential restrictions on liquefied petroleum gas (LPG) imports from Central Asian states via Afghanistan. In Pakistan, the availability of LPG is not only falling short of domestic demands, but its price is also soaring. LPG clearance is underway at Torkham and Chaman border stations.

In a bid to satisfy the demands of its populace, Pakistan has resorted to importing a variety of seasonal vegetables, with a particular focus on tomatoes, onions and potatoes duty-free from Afghanistan. Restrictions and delays have a direct impact on price fluctuations in domestic markets.

In a notable trade development, Pakistan has been exporting kinnows and fish to its neighbouring country, Afghanistan. This cross-border trade has recently gained significant attention.

In a development that has garnered significant attention, experts predict that the Taliban-led government is unlikely to respond with retaliatory measures aimed at restricting transit or imports from Pakistan.

Pakistani officials are expressing concerns over the potential repercussions of implementing a ban on items within the transit trade agreement, as they fear it may provoke a response from the Taliban government.

According to the United Nations Convention, landlocked countries have the legitimate right to import goods through the territorial waters of their neighbouring countries.

Surge in Afghan transit cargo raises smuggling concerns

Mubarak Zeb KhanOctober 8, 2023

This file photo shows the gate at Torkham, the historic trade route and border crossing between Afghanistan and Pakistan. — Reuters

• Transit cargo grows in the second year of Taliban rule

• Cargo flow jumps 39pc, number of containers up from 74,316 last year to 102,886 in FY23

• Cargo value soars from $4bn to $6.7bn, up 67pc • Smuggling-prone items surge 63pc to $3.7bn

ISLAMABAD: In a significant development since the Taliban’s takeover of Kabul, the flow of Afghan transit cargoes has witnessed a substantial surge in one year.

The number of containers under Afghan transit trade transporting goods through Pakistan has increased by nearly 39 per cent, reaching a total of 102,886 containers in the 2022-23 from 74,316 containers in the previous year, according to official data compiled by Pakistan Customs.

The first two months of the current fiscal year have seen a persistent upward trend in cargo volumes, totalling nearly 15,000 containers. The projected total for containers in fiscal year 2024 is approximately 130,000.

It has been observed that transit cargoes have experienced a surge during the second year of the Taliban government despite the absence of banking facilities and the unavailability of US dollars within Afghanistan.

The surge in transit cargoes highlights a notable shift in the country’s trade dynamics amidst the changing political landscape.

Since the Taliban’s takeover of Kabul on Aug 15, 2021, Islamabad provided tax and duty exemptions on various commodities imports, including fruits and vegetables. Besides, from July 6 last year, the government also allowed the trade of all products via land routes to Kabul in rupees.

In a bid to ensure the continued supply of essential food and non-food commodities, Pakistani government allowed the trade in rupee to support the Kabul government. This move comes as a result of the United States imposing restrictions on the Taliban-led government in Afghanistan.

According to a customs official, the flow of cargo, which previously declined, has now witnessed a remarkable increase.

In a remarkable series of fluctuations, the assessed import value of transit cargoes experienced a notable trajectory over the past few years. Starting at a staggering $4.5bn in the fiscal year 2019-20, the value dipped slightly to $4.4bn in the subsequent year of 2020-21. However, the following year witnessed a further decline, with the import value settling at $4.01bn in 2021-22.

Astonishingly, the trend took a sudden turn in the fiscal year 2022-23, as the assessed import value skyrocketed to an impressive $6.7bn, an increase of 67pc over the previous year. The import value for July and August of FY24 stood at $1.14bn. The full year projection is $6.8bn for FY24.

Smuggling-prone items

The total import value of smuggling-prone items under transit cargo has witnessed a staggering 63pc surge, soaring from $2.287bn in the previous year to an astonishing $3.731bn in FY23. This substantial increase highlights the growing prevalence of smuggling activities in the transit sector, raising concerns among authorities and stakeholders alike.

During the year under review, there was a significant 40pc increase in the quantity of smuggling-prone items, according to recorded data.

In the fiscal year 2023, the transit trade sector witnessed a significant surge in imports, with a staggering $2bn worth of cotton and cotton fabrics, artificial fabric (including filament yarn and staple fibre), and knitted fabric. This marked a substantial increase of 32pc compared to the previous year.

Additionally, imports of electrical machinery, home appliances, and personal appliances reached a value of $633m, reflecting a notable growth of 39pc from the previous year. Furthermore, the transit trade sector saw a remarkable rise in the import of tyres, with a total worth of $401m, indicating a substantial increase of 43pc from the previous year.

The import value of tea stood at $182m, perfumes $51m, soap $22m, blankets $75m, and footwear $50m in FY23.

In a significant decline, the consumption of the smuggling-prone products within Pakistani households fell from $16.262bn in the previous year to $9.809bn in FY23. During the year under review, there was a significant decline of 66pc in the quantity of these imports. This make a strong correlation of smuggling-prone items consumption in Pakistan.

There are multiple justifications for the sudden rise in cargo imports under Afghan transit trade agreement. The State Bank of Pakistan has withdrawn filing of financial instrument along with goods declaration in July 2021.

Restrictions on cargoes

The government has made three major decisions pertaining to the Afghan transit trade agreement. One of these decisions involves the imposition of a 10pc processing fee on items that are imported under this agreement.

In a subsequent development, a decision has been made to shift the responsibility of guaranteeing goods from insurance companies to banks. Afghan transit importers are required to deposit a specific amount of duty and taxes in banks as a bank guarantee. This guarantee is subsequently returned to the importers once the goods successfully cross the border into Afghanistan.

The import of nearly $4bn worth smuggling-prone items were banned under the transit agreement through a commerce ministry order SRO1397(1)12023. This is a major decision that might elicit strong reaction from Afghanistan.

Imports and transit via Afghanistan

Pakistani authorities are express concerns over potential restrictions on liquefied petroleum gas (LPG) imports from Central Asian states via Afghanistan. In Pakistan, the availability of LPG is not only falling short of domestic demands, but its price is also soaring. LPG clearance is underway at Torkham and Chaman border stations.

In a bid to satisfy the demands of its populace, Pakistan has resorted to importing a variety of seasonal vegetables, with a particular focus on tomatoes, onions and potatoes duty-free from Afghanistan. Restrictions and delays have a direct impact on price fluctuations in domestic markets.

In a notable trade development, Pakistan has been exporting kinnows and fish to its neighbouring country, Afghanistan. This cross-border trade has recently gained significant attention.

In a development that has garnered significant attention, experts predict that the Taliban-led government is unlikely to respond with retaliatory measures aimed at restricting transit or imports from Pakistan.

Pakistani officials are expressing concerns over the potential repercussions of implementing a ban on items within the transit trade agreement, as they fear it may provoke a response from the Taliban government.

According to the United Nations Convention, landlocked countries have the legitimate right to import goods through the territorial waters of their neighbouring countries.

Surge in Afghan transit cargo raises smuggling concerns

Transit cargo grows in the second year of Taliban rule; cargo flow jumps 39pc, number of containers up from 74,316 last year.

www.dawn.com