NG Missile Vessels

FULL MEMBER

- Joined

- Apr 9, 2023

- Messages

- 1,600

- Reaction score

- 0

- Country

- Location

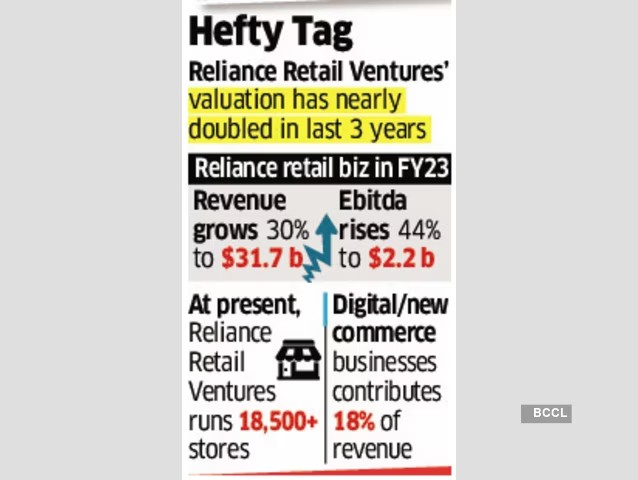

Mumbai|Kolkata: Qatar Investment Authority (QIA) agreed to invest ₹8,278 crore ($1 billion) in Reliance Retail Ventures (RRVL) at an equity valuation of ₹8.2 lakh crore ($100 billion), making it the single largest investment by the sovereign wealth fund of the gas-rich country in India.

RRVL, the holding company of Reliance Retail Ltd (RRL), had diluted 10.1% stake and raised over $6 billion in 2020 from several financial sponsors and sovereign wealth funds (SWFs) such as KKR, General Atlantic, TPG, Silver Lake, L Catterton, Abu Dhabi Investment Authority, Mubadala and Public Investment Fund of Saudi Arabia.

QIA and RRVL announced the deal on Wednesday. The capital raise, at a 97% premium to the last round (₹4.2 lakh crore), sets a new valuation benchmark for a larger $3-4 billion raise being planned by RRVL, said people in the know.

Europe Meeting

The funding round from financial investors including SWFs from South-East Asia is part of a value-unlocking exercise ahead of a planned listing, said people in the know.

At $100 billion, RRVL, with over 18,000 stores, will outpace global peers such as Tesco, Carrefour, Uniqlo and JD.com.

In India, Reliance Retail, the largest in the segment by sales and profit already, will be almost 3.5 times the value of the largest listed retail chain, Avenue Supermarts, which owns DMart. Its $31-billion revenue is about 2.5 times the combined scale of the next three Indian retailers.

"We look forward to benefiting from QIA's global experience and strong track record of value creation," said Isha Mukesh Ambani, director, RRVL. "The investment by QIA is a strong endorsement of a positive outlook towards the Indian economy and Reliance's retail business model, strategy and execution capabilities.

Leaders from both sides are said to have met recently in Europe to seal the deal. Talks had been stuck for weeks over a valuation mismatch, and picked up momentum last month.

QIA's investment will translate into a minority equity stake of 0.99% in RRVL on a fully diluted basis.

ET reported on July 26 that QIA and Reliance were nearing a fundraising exercise. The company last month announced the cancellation and buyback of all minority shares of RRL at Rs 1,360 per share. RRVL, which held 99.93% of Reliance Retail Ltd, will wholly own the retail business after the buyback.

www.google.com

www.google.com

RRVL, the holding company of Reliance Retail Ltd (RRL), had diluted 10.1% stake and raised over $6 billion in 2020 from several financial sponsors and sovereign wealth funds (SWFs) such as KKR, General Atlantic, TPG, Silver Lake, L Catterton, Abu Dhabi Investment Authority, Mubadala and Public Investment Fund of Saudi Arabia.

QIA and RRVL announced the deal on Wednesday. The capital raise, at a 97% premium to the last round (₹4.2 lakh crore), sets a new valuation benchmark for a larger $3-4 billion raise being planned by RRVL, said people in the know.

Europe Meeting

The funding round from financial investors including SWFs from South-East Asia is part of a value-unlocking exercise ahead of a planned listing, said people in the know.

At $100 billion, RRVL, with over 18,000 stores, will outpace global peers such as Tesco, Carrefour, Uniqlo and JD.com.

In India, Reliance Retail, the largest in the segment by sales and profit already, will be almost 3.5 times the value of the largest listed retail chain, Avenue Supermarts, which owns DMart. Its $31-billion revenue is about 2.5 times the combined scale of the next three Indian retailers.

"We look forward to benefiting from QIA's global experience and strong track record of value creation," said Isha Mukesh Ambani, director, RRVL. "The investment by QIA is a strong endorsement of a positive outlook towards the Indian economy and Reliance's retail business model, strategy and execution capabilities.

Leaders from both sides are said to have met recently in Europe to seal the deal. Talks had been stuck for weeks over a valuation mismatch, and picked up momentum last month.

QIA's investment will translate into a minority equity stake of 0.99% in RRVL on a fully diluted basis.

ET reported on July 26 that QIA and Reliance were nearing a fundraising exercise. The company last month announced the cancellation and buyback of all minority shares of RRL at Rs 1,360 per share. RRVL, which held 99.93% of Reliance Retail Ltd, will wholly own the retail business after the buyback.

QIA to invest $1 billion in Reliance Retail Ventures

RRVL, the holding company of Reliance Retail Ltd (RRL), had diluted 10.1% stake and raised over $6 billion in 2020 from several financial sponsors and sovereign wealth funds (SWFs) such as KKR, General Atlantic, TPG, Silver Lake, L Catterton, Abu Dhabi Investment Authority, Mubadala and Public...