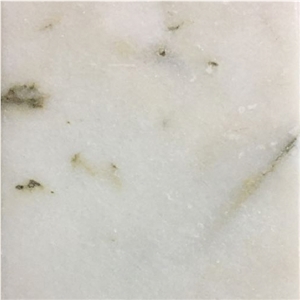

Ziarat White Tiles

Type : Marble

Origin : Ziarat, Pakistan

Available Thickness : 2cm

Available Finishes : Polished

Perfect for : Flooring, Stairs, Countertops

Pakistan’s Gemstones: An Overview

Pakistan is home to many varieties of minerals, some of which make it prominent in the mineral world, such as peridot, aquamarine, topaz (various colours: violet and pink, golden and champagne), ruby, emerald, rare-earth minerals bastnaesite and xenotime, sphene, tourmaline, and many varieties and types of quartz.

Sphene. Northern Areas, Pakistan, 3.4 cm high. (Photo:

Jeffrey Scovil; Gem:

Bill Larson Collection)

Pakistan shares a long and porous border (2430 km) with Afghanistan. This has effectively resulted in a full influx of all types of Afghan minerals into Pakistan, from which they are traded. Pakistan’s northwestern city of Peshawar serves as the first, direct, and only market for all minerals found in both these countries since 1979, after the Soviet Union invaded Afghanistan. Before the invasion, Pakistan’s only port city of Karachi held the bigger market of gem minerals (only facet rough and gems) in Pakistan. Following Peshawar’s rise in prominence, Karachi’s significance and role in gem minerals was reduced to those of little significance.

A Brief History of the Mining and Business of Gemstones in Pakistan

Pakistan came into existence in 1947 after partition of the subcontinent. A review of its history before the British rule reveals that its people and kings cherished gemstones highly. The relics of the Gandhara and Indus civilisations are a testimony to this fact. After its founding, Pakistan has given little, if not negligent, attention to this sector.

Gemstones Corporation of Pakistan was established in 1979 to effectively explore Pakistan’s own share of wealth in minerals and to facilitate gemstone mining and business in Pakistan. It had some valuable influence but ultimately was liquidated in 1997 and hence abandoned. There are two bodies now working for the welfare and growth of this industry in Pakistan: Trade Development Authority of Pakistan (formerly Export Promotion Bureau) and All Pakistan Commercial Exporters Association of Rough & Un-Polished Precious & Semi Precious Stones (APCEA). Since 1994, the annual Pakistan Gems and Mineral Show has been held in Peshawar with their joint collaboration, during four days in October. It has not as yet, however, attracted any potential buyers from abroad. Its few stalls on display cannot fulfill any of the requisite needs of experienced buyers from abroad, especially the USA and Europe.

Spessartine. Northern Areas, Pakistan, 5.0 cm high. (Photo:

Jeffrey Scovil; Gem:

Bill Larson Collection)

The northern and northwestern parts of Pakistan are shrouded by the three world-famous ranges called Hindukush, Himalaya, and Karakorum. In these mountains have been found nearly all the minerals Pakistan currently offers to the world market, including aquamarine, topaz, peridot, ruby, emerald, amethyst, morganite, zoisite, spinel, sphene, and tourmaline.

The question arises as to how these were explored: by the very people living in and beside the hills

and not as a result of any government involvement or support, a fact that the government of Pakistan cannot refute. In the industrial minerals sector, of course, the government-owned mining corporation is effective and has been of great help to local investors. Pakistan, through its one body, the Ministry of Petroleum and Natural Resources, has always recruited foreign investment in mining precious and semi-precious stones in Pakistan. But the rhetoric of the ministry is so inadequate and ineffective that no influential mining venture by any foreign institutes or individuals has taken place. One significant reason is the reputation for unreliability in the survey/analysis reports conducted by any government-sponsored institute in Pakistan.

Moving Forward

Pakistan must look into this situation very seriously. It can conduct such surveys by any reputable/foreign-based institutes to attract foreign investors in this sector. But the locals who have ever ventured into such activity have only stories of failure to tell.

In industrial mining, lease by provincial/local government exists, and in the case of precious/semi-precious stones it has been observed in emerald (Swat, Frontier Province), ruby (Pakistan’s Kashmir), and topaz (Katlung, Mardan District, Frontier Province), but has resulted in loss and/or failure for venturers.

Beryl: Northern Areas, Pakistan, 9.3 cm high. (Photo:

Jeffrey Scovil; Gem:

Bill Larson Collection)

It is important to stress here that the non-professional residents of mining areas are actually the ones who mine these jewels of earth in their hazardous, traditional way of mining. They usually form groups that initiate diggings and blastings, distributing the costs that may incur during the mining period. This process is something that the Government of Pakistan has failed to control or investigate. The resulting product is compromised in terms of quality and quantity. Mining ventures in precious and semi-precious stones are uncontrollable in Pakistan because they are undertaken by its people without any permission, support, or guidance from the government.

Pakistan, based on its potential in mineral wealth, can become a great hub of the gemstone industry, on a scale comparable to that of Brazil, provided it takes a few essential, locally effective steps that can enhance the exploration of resources and growth of business. The most useful step: full and supportive involvement of the government with its own people as well as the foreigners involved in this industry. The establishment by Pakistan of the Gems and Gemological Institute, in Peshawar in 2001, is an investment that ultimately will bear fruit.

Mining Areas

The few potential/major gemstone mining areas in Pakistan are: (only major gemstones yielded are mentioned)

KP Province

- Swat (Malakand division) – Emerald, various types of quartz, and epidote

- Dir (Malakand division) – Corundum and quartz

- Mansehra (Hazara division) – Corundum and smoky quartz

- Kohistan (Hazara division) – Peridot

- Peshawar district (Frontier province) – Quartz with astrophyllite/reibeckite fiber inclusions, xenotime, and bastnaesite

- Mohmand Agency – Emerald, clinozoisite, sphene, and epidote

- Bajaur Agency – Emerald, garnet, and orange-colour scapolite

- Khyber Agency – Quartz with astrophyllite/reibeckite fibers inclusions, xenotime, and bastnaesite

- North and South Waziristan Agencies – Faden quartz, diamond quartz, phantom quartz, chlorite-included quartz, and window quartz

Northern Areas

- Chilas (Diamer district) – Alluvial diopside, zircon, rutile quartz, aquamarine, and tourmaline

- Gilgi , Hunza, and Shigar (Gilgit district) – Aquamarine, topaz (golden and white), emerald (new find), ruby, pollucite, rutile quartz, morganite, apatite, spinel, and pargasite

- Shengus, Stak Nala, and Tormiq Nala (Baltistan Skardu Road, Baltistan district) – Aquamarine, topaz, tourmaline, apatite, sphene, morganite, and quartz

- Shigar Proper (near Skardu, Baltistan district) – Apatite, zoisite, rutile quartz, epidote, and morganite

- Childee, Kashmal, and Yuno (Shigar area, near Skardu, Baltistan district) – Aquamarine, emerald-colour tourmaline, apatite, morganite, topaz, and quartz

- Hyderabad, Testun, Dassu, Net Tahirabad, and Goyungo (Shigar area, Baltistan district) – Topaz (best golden colour here), aquamarine, tourmaline, morganite, rare earth minerals, apatite, quartz, and new find emerald

- Appu Aligund, Fuljo, Braldu, Bashu, and Karma (Baltistan district) – Tourmaline, aquamarine, garnets,diopside, ruby, pargasite, emerald, topaz, amethyst, scheelite, and quartz

- Khappalu and near Siachin area (Gaanshai area, Baltistan district) – Aquamarine, amethyst, and fine golden rutile quartz

Baluchistan Province

- Kharan district – Brookite, anatase, and quartz

- Chaman (near Quetta) – Diamond quartz, window quartz, quartz on prehnite-base, and faden quartz included by chlorite