Black_cats

ELITE MEMBER

- Joined

- Dec 31, 2010

- Messages

- 10,024

- Reaction score

- -5

No scope to settle trade in Russian ruble: Cenbank

25 September, 2023, 10:10 am

Last modified: 25 September, 2023, 11:37 am

Bangladesh has no scope to settle trade in Russian currency as there is no currency swap arrangement between the two nations for this purpose.

However, the Russian embassy in Dhaka in a recent post on its official X (formerly Twitter) account said that the Russian government has approved a list of more than 30 friendly and neutral countries, banks, and brokers that will be allowed to trade in the Russian currency and derivatives market. Bangladesh is among the countries on this list.

In response to the Russian embassy tweet, Mezbaul Haque, executive director and spokesperson of the Bangladesh Bank, however, said the central bank of Bangladesh has no agreement with Russia about trading in the Russian currency, ruble, and therefore it is not official.

The Bangladesh Bank can trade only in the official currency which is approved by the International Monetary Fund (IMF) as a reserve currency, he maintained.

The sudden tweet by the Russian Embassy came at a time when over $300 million repayment against total loans of nearly $12 billion that Russia provided for the Rooppur project remained pending for more than a year due to no payment option in dollars following US sanctions.

Bangladesh used to settle payments with Russia in dollars prior to the sanctions.

The Bangladesh Bank kept the repayment amount in an escrow account, according to a central bank source.

An escrow is a contractual arrangement in which a third party receives and disburses money or property for the primary transacting parties, with the disbursement dependent on conditions agreed to by the transacting parties.

Bangladesh has an agreement with India to settle trade in the rupee despite that currency is not a reserve currency. In this case, the government can take such a decision, he added.

Mezbaul Haque added that Bangladesh did not go for such an agreement with Russia as inter transaction amount is very insignificant between the two nations.

When asked why the Russian Embassy in Dhaka suddenly tweeted about settling trade in the Russian currency without having any arrangement with the Bangladesh Bank, he said they have no answer in this regard. He suggested TBS contact the foreign ministry about this.

Asked how he saw this from a geopolitical perspective in the absence of such an agreement with Bangladesh, State Minister for Foreign Affairs Md Shahriar Alam said, "On Russian Embassy's social media post, we have checked with our Mission in Moscow, which informed that the issue is related to money market, not about cross-border trade. Banks and brokers from the 30 countries in the list are now allowed to invest in the money market and derivatives market in Russia. Our Mission is trying to gather more information on this.

"The step seems to be an attempt to reduce pressure on rouble from capital outflows by bringing in foreign investment into the Russian currency market.

"Inclusion of Bangladesh in this list indicates that Russia has trust and confidence in Bangladesh and the financial ability of our banks."

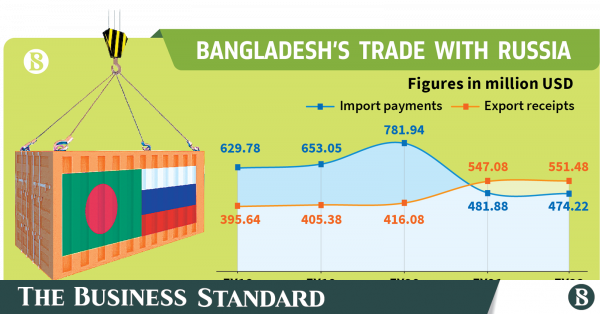

Bangladesh Bank data show that Bangladesh had a trade surplus with Russia in FY21 and FY22 due to a drastic fall in imports.

In FY22, Bangladesh's imports from Russia amounted to $474 million, while exports reached $551 million. Import figures were higher at $781 million in FY20 but decreased to $481 million in FY21, while exports increased from $416 million to $481 million during the same period.

In April this year, the Economic Relations Division (ERD) decided to repay the Rooppur Nuclear Power Plant project to Russia in yuan as US sanctions on Russian banks have forced the two nations to settle payments using the Chinese currency, moving away from the US dollar.

The decision was taken following a request by Moscow in March last year to halt loan repayments after losing access to the global payment channel SWIFT due to Western sanctions.

Dhaka, Moscow agree to settle Rooppur payments in Chinese yuan

However, the decision was not executed yet.

In 2020, Moscow offered Dhaka a bilateral currency swap arrangement for trade settlement, but the move was put on the back burner following US sanctions.

Russia then offered the Bangladesh Bank to join the SPFS, a payment channel developed by Moscow, but Bangladeshi banks were unwilling to join. Bangladesh proposed that Russia settle trade in the Chinese currency as the yuan became a reserve currency in 2018.

In response to that, Russia claimed a conversion loss of currency, which the Bangladesh Bank did not agree to pay. After lengthy discussions, both countries have agreed to settle trade in yuan, also known as renminbi.

www.tbsnews.net

www.tbsnews.net

ECONOMY

Jebun Nesa Alo25 September, 2023, 10:10 am

Last modified: 25 September, 2023, 11:37 am

The Bangladesh Bank can trade only in the official currency which is approved by the International Monetary Fund (IMF) as a reserve currency

Bangladesh has no scope to settle trade in Russian currency as there is no currency swap arrangement between the two nations for this purpose.

However, the Russian embassy in Dhaka in a recent post on its official X (formerly Twitter) account said that the Russian government has approved a list of more than 30 friendly and neutral countries, banks, and brokers that will be allowed to trade in the Russian currency and derivatives market. Bangladesh is among the countries on this list.

In response to the Russian embassy tweet, Mezbaul Haque, executive director and spokesperson of the Bangladesh Bank, however, said the central bank of Bangladesh has no agreement with Russia about trading in the Russian currency, ruble, and therefore it is not official.

The Bangladesh Bank can trade only in the official currency which is approved by the International Monetary Fund (IMF) as a reserve currency, he maintained.

The sudden tweet by the Russian Embassy came at a time when over $300 million repayment against total loans of nearly $12 billion that Russia provided for the Rooppur project remained pending for more than a year due to no payment option in dollars following US sanctions.

Bangladesh used to settle payments with Russia in dollars prior to the sanctions.

The Bangladesh Bank kept the repayment amount in an escrow account, according to a central bank source.

An escrow is a contractual arrangement in which a third party receives and disburses money or property for the primary transacting parties, with the disbursement dependent on conditions agreed to by the transacting parties.

Bangladesh has an agreement with India to settle trade in the rupee despite that currency is not a reserve currency. In this case, the government can take such a decision, he added.

Mezbaul Haque added that Bangladesh did not go for such an agreement with Russia as inter transaction amount is very insignificant between the two nations.

When asked why the Russian Embassy in Dhaka suddenly tweeted about settling trade in the Russian currency without having any arrangement with the Bangladesh Bank, he said they have no answer in this regard. He suggested TBS contact the foreign ministry about this.

Asked how he saw this from a geopolitical perspective in the absence of such an agreement with Bangladesh, State Minister for Foreign Affairs Md Shahriar Alam said, "On Russian Embassy's social media post, we have checked with our Mission in Moscow, which informed that the issue is related to money market, not about cross-border trade. Banks and brokers from the 30 countries in the list are now allowed to invest in the money market and derivatives market in Russia. Our Mission is trying to gather more information on this.

"The step seems to be an attempt to reduce pressure on rouble from capital outflows by bringing in foreign investment into the Russian currency market.

"Inclusion of Bangladesh in this list indicates that Russia has trust and confidence in Bangladesh and the financial ability of our banks."

Bangladesh Bank data show that Bangladesh had a trade surplus with Russia in FY21 and FY22 due to a drastic fall in imports.

In FY22, Bangladesh's imports from Russia amounted to $474 million, while exports reached $551 million. Import figures were higher at $781 million in FY20 but decreased to $481 million in FY21, while exports increased from $416 million to $481 million during the same period.

In April this year, the Economic Relations Division (ERD) decided to repay the Rooppur Nuclear Power Plant project to Russia in yuan as US sanctions on Russian banks have forced the two nations to settle payments using the Chinese currency, moving away from the US dollar.

The decision was taken following a request by Moscow in March last year to halt loan repayments after losing access to the global payment channel SWIFT due to Western sanctions.

Dhaka, Moscow agree to settle Rooppur payments in Chinese yuan

However, the decision was not executed yet.

In 2020, Moscow offered Dhaka a bilateral currency swap arrangement for trade settlement, but the move was put on the back burner following US sanctions.

Russia then offered the Bangladesh Bank to join the SPFS, a payment channel developed by Moscow, but Bangladeshi banks were unwilling to join. Bangladesh proposed that Russia settle trade in the Chinese currency as the yuan became a reserve currency in 2018.

In response to that, Russia claimed a conversion loss of currency, which the Bangladesh Bank did not agree to pay. After lengthy discussions, both countries have agreed to settle trade in yuan, also known as renminbi.

No scope to settle trade in Russian ruble: Cenbank

The Bangladesh Bank can trade only in the official currency which is approved by the International Monetary Fund (IMF) as a reserve currency