India, Saudi to link power grids using subsea cable

NEW DELHI :India and Saudi Arabia agreed to link their power grids, underscoring a deepening energy alliance that could significantly boost the reliability of power grids in both countries and foster economic development.

The agreement on linking power grids follows another more expansive infrastructure connectivity project plan to develop an India-Middle East-Europe economic corridor. The project, announced on 9 September during the G20 summit, envisages a rail and shipping corridor connecting India, the United Arab Emirates (UAE), Saudi Arabia, the European Union, France, Italy, Germany and the US.

The agreement was signed on Sunday by the Union minister for new and renewable energy, R.K. Singh, and the minister of energy for the Kingdom of Saudi Arabia, Abdulaziz bin Salman bin Abdulaziz Al Saud, a government statement said.

Mint first reported on 25 April that India plans to interconnect the national power grids of the two countries through a subsea cable.

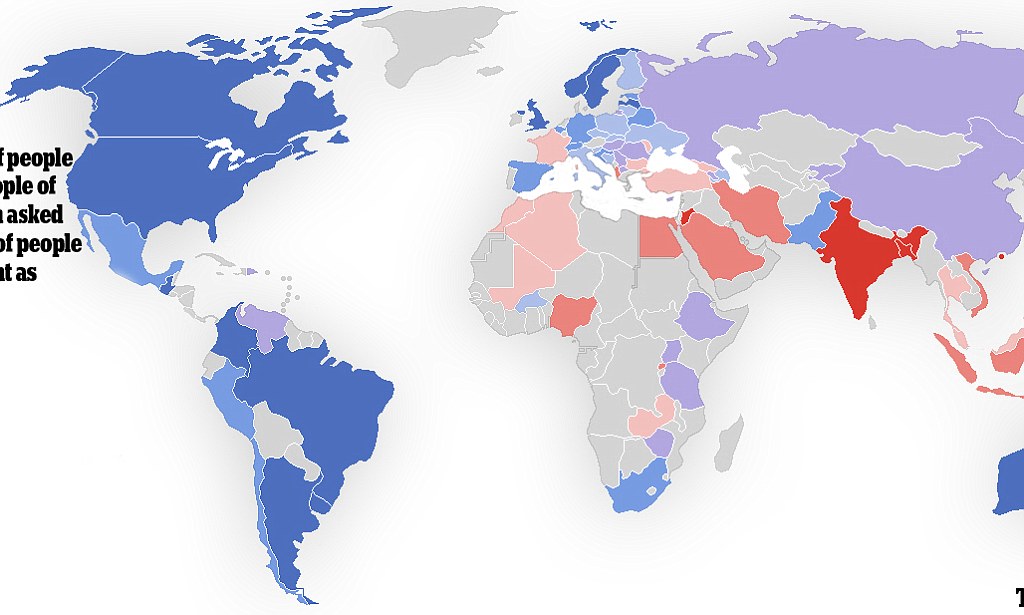

India has been exploring linking its power grid with those of Saudi Arabia and the UAE through subsea cables from its west coast and with the power grid of Singapore from the east coast. By sharing power resources across regions, countries can reduce the need for costly renewable energy storage solutions and improve the reliability of their power grids. India’s pursuit of grid interconnectivity could also prove critical to its long-term economic and energy security goals. India is pursuing the One Sun One World One Grid (OSOWOG) plan, which aims to connect countries through a global power grid.

A task force set up by the power ministry has examined the feasibility of interconnecting the regional grids of Southeast Asia, South Asia, the Middle East, Africa, and Europe for sharing renewable energy.

According to the agreement signed on Monday, apart from grid interconnectivity, India and Saudi Arabia will cooperate in the areas of renewable energy, energy efficiency, hydrogen, electricity, petroleum, natural gas, strategic petroleum reserves and energy security.

The pact also aims to encourage bilateral investment in renewable energy, electricity, hydrogen and storage, along with investments in conventional fuels like oil and gas. Saudi Arabia has traditionally been a major supplier of oil to India.

However, India has been actively exploring strategies to diversify its energy resources because of the significant turbulence in the global energy markets following Russia’s incursion into Ukraine.

The India-Saudi pact also involves cooperation between the nations to combat climate change through the development of technologies, including carbon capture, utilization and storage, and circular economy. It would also promote digital transformation, innovation, cybersecurity and artificial intelligence in the field of energy, along with help working on developing qualitative partnerships between the two countries to localize materials, products and services related to all sectors of energy, supply chains and its technologies, the statement said.

The agreement on linking power grids follows another more expansive infrastructure connectivity project plan to develop an India-Middle East-Europe economic corridor

www.google.com