The National Debt Explained

The federal or national debt is simply the net accumulation of the federal government's annual budget deficits

To make an analogy, fiscal deficits are the trees, and federal debt is the forest.

There is a federal debt because the US Federal Government spends more than it collects. The Treasury Department has to issue treasury bills, treasury notes and treasury bonds to compensate for the difference: financing its deficit by borrowing from the public (which includes both domestic and foreign investors, as well as corporations and other governments)

Government borrowing, for the national debt shortfall, can also be in other forms – issuing other financial securities, or even borrowing from world-level organizations like the World Bank or private financial institutions. Since it is a borrowing at a governmental or national level, it is termed

national debt,

government debt,

federal debt or

public debt.

The total amount of money that can be borrowed by the government without further authorization by Congress is known as the

total public debt subject to limit. Any amount to be borrowed above this level has to receive additional approval from the legislative branch.

The national debt can only be reduced through five mechanisms: increased taxation, reduced spending, debt restructuring, monetization of the debt or outright default. The federal budget process directly deals with taxation and spending levels and can create recommendations for restructuring or possible default.

Debt has been a part of this country's operations since its beginning. The U.S. government first found itself in debt in 1790, following the Revolutionary War. Since then, the debt has been fueled over the centuries by more war, economic recession and inflation.

In modern times, the government has struggled to spend less than it takes in for over 60 years, making balanced budgets nearly impossible.

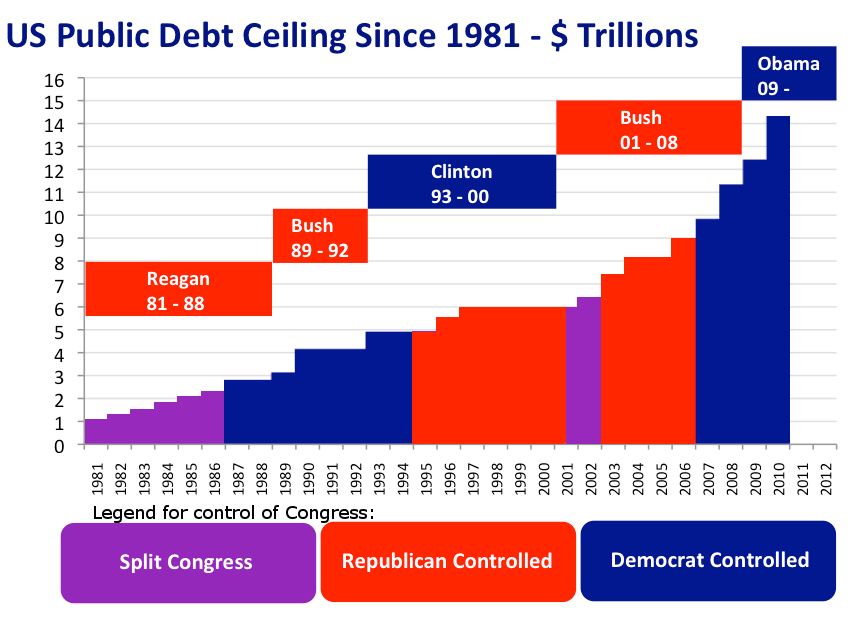

The level of national debt spiked significantly during President Ronald Reagan's tenure, and subsequent presidents have continued this upward trend. The

treasurydirect.gov website indicates that over the last two decades, the U.S. national debt has consistently increased (see chart here

http://www.investopedia.com/updates/usa-national-debt/). Only briefly during the heyday of the economic markets and the Clinton administration in the late 1990s has the U.S. seen debt levels trend down in a material manner.

Political disagreements about the impact of national debt and methods of debt reduction have historically led to many gridlocks in Congress and delays in budget proposal, approval and appropriation. Whenever the debt limit is maxed out by spending and interest obligations, the president must ask Congress to increase it. For example, in September 2013 the

debt ceiling was $16.699 trillion, and the government briefly shut down over disagreements on raising the limit.

From a public policy standpoint, the issuance of debt is typically accepted by the public, so long as the proceeds are used to stimulate the growth of the economy in a manner that will lead to the country's long-term prosperity. However, when debt is raised simply to fund public consumption, such as proceeds used for

Medicare, Social Security and

Medicaid, the use of debt loses a significant amount of support. When debt is used to fund economic expansion, current and future generations stand to reap the rewards. However, debt used to fuel consumption only presents advantages to the current generation.

What Goes into the Current National Debt?

As indicated above, debt is the net accumulation of budget deficits. It is important to look at the top expenses, as they constitute the major factors of national debt. The top expenses in the U.S. are identified as follows (based on the Federal Budget 2016 Total Outlay Figures):

- Healthcare Programs (includes Medicare & Medicaid): A total of $1.1 trillion (USD) is allocated to healthcare benefit programs, which includes Medicare and Medicaid.

- Social Security Program/Pensions: Aimed at providing financial security to the retired, the total Social Security and other expenditures are $1 trillion.

- Defense Budget Expenses: The portion of national budget which is allocated for military related expenditures. Currently, $1.1 trillion is earmarked for the U.S. Defense Budget.

- Others: Transportation, veteran benefits, international affairs, education and training, etc. are also expenses the government has to take care of. Interestingly, the common public belief is that spending on international affairs consumes a lot of resources and expenses, but in truth, such expenditures lie within the lower rung in the list.

What's Made the National Debt Worse?

History tells us that among the top expenses, the Social Security program, defense and Medicare were the primary expenses even during the times when the national debt levels were low, as they last were in the 1990s. Then how did the situation worsen? There are various opinions on the matter:

- The overburdened Social Security system: Some argue that the mechanism to finance the Social Security system has led to increased expenditures without obvious payoff. Payments are collected from present day workers and used for immediate benefits — that is, payments to existing beneficiaries. Due to the increasing number of retirees and their longer life spans, the size and cost of payments has skyrocketed. Parents having fewer kids are limiting the pool of present-day contributing workers. Recent economic downturns have also led to stagnant pay. Overall, limited incoming and more outgoing cash flows are making Social Security a big component of the national debt.

- Continued tax cuts introduced during the George W. Bush era: A Center on Budget and Policy Priorities report indicates that the continuing the legacy of Bush's policies and tax cuts are holding up the government’s income, thereby forcing large debts.

- Healthcare entitlements: The cost and expenditures toward the Medicare and Medicaid programs have exceeded the projected figures. The general price rise in medical costs has been the hidden culprit, surpassing inflation by a wide margin.

- Economic stimulus and related expenses: The U.S. economy has not been that healthy over the last 15 years. There was a tightening of the growth rates to a more narrow range and a higher frequency of recessions – even before the Great Recession began in late 2007. Trying to bring the economy back to life led to further costs and expenditure – the Stimulus Package of 2009, tax-cuts, jobless benefits and financial industry bailouts have led to further expenses at the national level. These efforts have managed to give a survival push to the economy, but returns are yet to be realized, leading these to be “pure expenses.”

- The Iraq, Libya and Afghan wars: Primarily within the defense budget, the continued involvement in these engagements has cost the U.S. dearly in the last decade, adding to huge debt. The public outrage also stems from the belief that situations in these countries were not having any direct serious impact for U.S. security, as they are geographically far-off. Around $1.3 trillion has been spent on these engagements, which is a huge burden on national debt. Some of these still continue, increasing the costs further.

While outlays have increased, incoming revenues have been hit. Among the top income sources for the government:

- Individual Income Taxes: This is the topmost contributor to Uncle Sam's revenues: Individual taxpayers contribute nearly half of annual tax receipts. The challenge, along with the aforementioned Bush tax cuts, has been stagnant U.S. salaries, and hence limited tax collection.

- Social Security, Retirement & Payroll Contributions: This has been the second major sector for government income, but contributions have not really increased since 2006 and even dipped in 2010 and 2011. Limited jobs and lower or stagnant salaries have been the blockade for increases in this stream of government income.

- Corporate Income Taxes: The third largest piece of the pie in the government income chart, corporate tax inflow peaked in 2007, but since then has been showing a declining trend. Add to that the required stimulus and bailouts of the financial sector, and corporate taxes have shown high swings leading to uncertain income for the government.

- Excise Taxes: Similar to corporate taxes, excise taxes too have shown dismal collections.

In a nutshell, the economic scenario in the last decade has led to more expenses and diminishing income sources, which has caused the national debt to spike to $19.3 trillion, or about $59,794 per person, as of fiscal year 2016.

http://www.investopedia.com/updates/usa-national-debt/

Interesting how:

- this does not take into account the effect of preventive medicine, or taking action early on to avoid more severe illness and larger costs later on. Uncovered patients end up going to the emergency wards (i.e. more expensive) when it is already (almost) too late

- this does not take into account how other countries DO manage to provide healthcare and social security programs, without incurring a similar government deficit.

- spending on any public good is seen as a bad thing.

- this does not address the fundamental problem of politicians promising fewer taxes but better government (which includes said programs, not just 'more efficient' government organisation and public good delivery): you can't have good government and public services without suitable taxation, unless you are Norway or Saudi Arabia and your economic floats on oil, or the Netherlands and your economy floats on domestic natural gas etc.

- half the federal personnel is DoD and military....

Related:

https://www.thebalance.com/us-debt-crisis-summary-timeline-and-solutions-3306288

https://www.thebalance.com/u-s-debt-default-3306295

https://www.thebalance.com/current-u-s-federal-budget-deficit-3305783

US federal debt held by the public as a percentage of GDP, from 1790 to 2013, projected to 2038