@LeveragedBuyout @SvenSvensonov

I think low prices would hurt Shale production in following ways

1. In short term, it may lead to closing down of Shale wells or may lead to bankrupting of investors, though i doubt that latter is possible as any competent investor would protect his Shale oil investment by buying options for low Oil price.

2.It would discourage further investment in Shale. As

@SvenSvensonov has pointed out, Shale prices are decreasing due to technology innovation.But if Shale stops making profit, those technological improvements would cease for the lack of investment.This would mean that Shale would not have the same technological edge as it would have had Oil prices remained high ,when Oil prices rise after two years.

3.If Shale close down/drop down, it would require some time in order to even come at full production let alone, account for increased consumption that would have occurred in meantime.

4.Saudis by driving Shale out of production would be showing their economic muscle thus spooking investors that any investment in Shale would be unsafe.

5.Decrease in Oil prices would increase production costs. Production costs not only depends on technological cost of fracking, it also depends upon cost of raising capital. If investment in Shale is seen as risky and/or unstable, it would increase borrowing cost of shale producers as interests would rise since investors would need to recoup their investment in short time.

6. It may also be a ploy to increase demand. Demand of Oil is not elastic.Once increased, it is very difficult to be scaled back as most of infrastructure to consume Oil is in place.

I may be reading this wrong but Saudi intention does not seem to be that of kill Shale but harm it to the extent that it would take some time to recover thus allowing Saudis to enjoy relatively high Oil price ( though not vulgar high) for longer time period and to preempt any further technological advancement in Shale technology.Even Saudi would become irrelevant if production cost of Shale fall below $30 per barrel.

7. Opec may have been spooked by increase in popularity of renewables. Personally i believe that Oil driven growth is an abomination, and economy should go green for sustainability of planet, but at same time i am aware of the fact that it would take anywhere between 20 to 80 years for solar and fusion power respectively to become competitive, Thus in the meantime we have to make peace with Hydrocarbon based growth; but if low Oil prices start hurting research in solar energy ( low prices would not hurt fusion, as all of research is funded by governments and even that as international consortium ), taxes on Oil should be raised to offset price drop.

,BTW You should post more on economics. You are most economically literate member on this forum.

Thank you for your kind words,

@anonymus. I try my best to contribute in whatever small way I can (this is a defense forum, after all). You raise some great points, but please allow me to explain why I am relatively unconcerned.

From the perspective of shale business:

1) Profit: Eventually, this price war will hurt, but I anticipate it will take more than 5 years. Why? Because most of the costs of the existing shale oil production has already been sunk. To continue producing at the rate that we are today, we would of course have to invest more. But even if the price drops to a level where it is no longer profitable to invest, the sunset of existing production would still inject a significant amount of supply into the market. Will Saudi Arabia keep up this price war for years on end? Doubtful.

2) Investor outlook and cost of capital: The shale oil businesses have very strong balance sheets, so capital will not be an issue for them in the medium term. As

@SvenSvensonov has already pointed out, technology continues to improve and the cost of production is dropping, not increasing, so it will be harder and harder to kill shale as more time passes. I doubt the cost of production will ever fall below Saudi's, but the level of pain that Saudi would have to endure just to achieve a temporary victory is outside of the realm of comprehension (and I assure you that even if fracking were suspended, it would resume once prices rose again).

From the perspective of the United States:

1) Low oil prices are unambiguously good, whether it's from our own fracking operations or Saudi Arabia.

2) Saudi Arabia is terribly shortsighted if it is engaging in a price war to kill fracking while ignoring its real competition, which is the non-OPEC oil production world. I can't emphasize enough how important Mexico's recent energy reforms are, and what that will do for world supply. Add in a stabilizing Iraq, the potential for Nigeria to clean up its mess, the possibility of a deal with Iran that allows to to export oil again, the possibility that Venezuela will eventually liquidate its authoritarian leadership and run its energy sector competently, reconciliation with Russia, etc. and you can see that oil supply is going to continue increasing even if fracking gets killed (which isn't going to happen).

Add in the infighting in OPEC (you think the other OPEC members will just roll over and cut their own production to support prices, while Saudi increases production and gains market share?), and the sky is the limit on oil supplies.

3) Between continuously tightening fuel efficiency standards in cars, the green movement's push for renewables, and our switch to natural gas as a major energy source (and we are awash in natural gas, no matter what happens elsewhere in the world) the US is becoming less dependent on oil in general. US consumption, per the EIA:

In short, fracking is extremely hard to kill, and the process would be extremely painful (if not impossible) for Saudi to achieve. It's unambiguously a buyer's market in oil, and that will not change for several years at least.

@Chinese-Dragon has already pointed out China's own potential for fracking, and who knows what else is available in the SCS--so growing demand from China will not necessarily help OPEC out.

I appreciate your emphasis on the capital markets in your analysis--these are the factors analysts will be looking at, and traders will be hedging against. We will not see the sort of "super spike" that happened before 2008, and "peak oil" keeps getting delayed. I am going to steal from Goldman Sachs a bit here:

As we have discussed, we believe it is in OPEC’s interest to share the burden of balancing the oil market surplus with US shale oil production (and Price decline continues to lead deteriorating fundamentals). This can only be achieved by reducing output at a modest pace at first to allow for low prices to slow US production growth. In particular, any large cut that would lead to a large price rally would be self-negating as it would enable US producers to hedge 2015 production and sustain elevated production growth.

OPEC's dilemma:

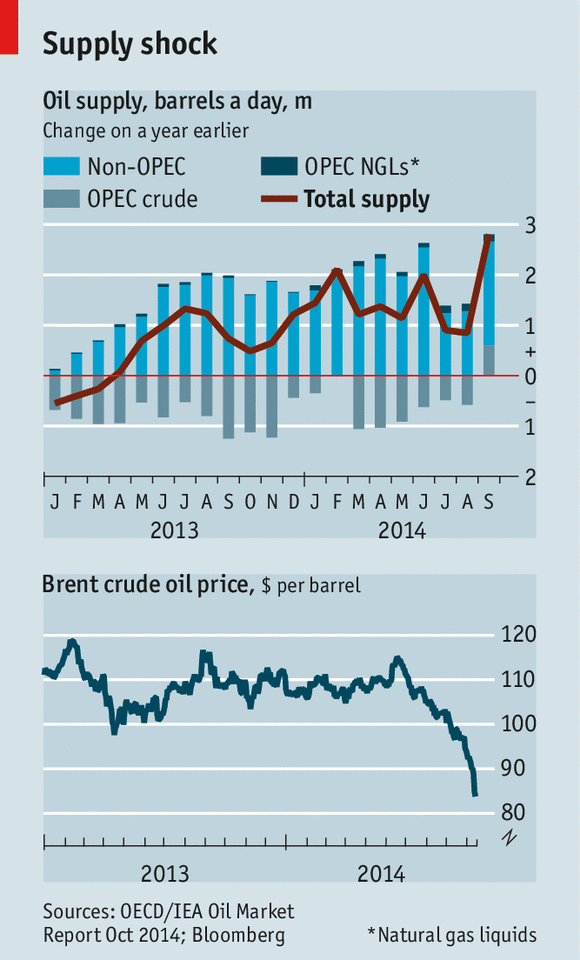

(without getting too technical, what this chart shows is that even in the most aggressive capacity-cutting scenario, brent wouldn't even return to $100 by Q2 2015, and since OPEC [Saudi] isn't interested in cutting production, that means it's possible prices will continue to fall to ~$60 by Q2 2015.)

I am happy to take Saudi's money, and I am certain India is as well.