beijingwalker

ELITE MEMBER

- Joined

- Nov 4, 2011

- Messages

- 65,195

- Reaction score

- -55

- Country

- Location

China’s July automobile exports jump 63 per cent, helping extend the lead over Japan as the world’s biggest vehicle-exporting economy

Published: 3:15pm, 13 Aug, 2023

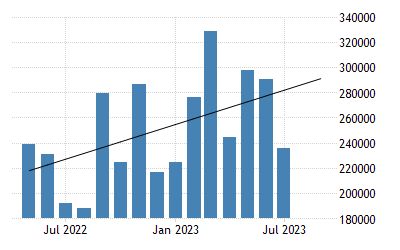

China’s July overseas shipments jumped 63 per cent to 310,000 vehicles from a year ago, raising the total to 2.65 million units in the first seven months of the year

Local brands made up 248,000 units, or 80 per cent, of July’s exports, according to data compiled by the China Passenger Car Association

China’s home-grown marques delivered more automobiles abroad in July, driving a two-thirds jump in monthly exports that extended the nation’s lead over Japan as the world’s largest vehicle exporter. July’s overseas shipments jumped 63 per cent to 310,000 vehicles from a year ago, raising the total to 2.65 million units in the first seven months of the year, according to data compiled by the China Passenger Car Association (CPCA). Local brands made up 248,000 units, or 80 per cent, of July’s exports, CPCA said. “Carmakers maintained a growth trajectory for exports and rising demand for Chinese vehicles are encouraging assemblers to ramp up production,” said Gao Shen, an independent analyst in Shanghai. “More Chinese automotive firms are now looking to bolster sales in overseas markets.” The latest numbers widened China’s 15.8-per cent lead over Japan. China exported 2.34 million vehicles in the first half, more than the 2.02 million Japanese marques reported by the Japan Automobile Manufacturers Association (JJAMA). Japan exported 3.5 million vehicles in 2022.

This aerial photo taken on July 5, 2023, shows cars to be loaded for export at Yantai Port in east China’s Shandong province on July 21, 2023. Photo: Xinhua

To be sure, China’s July exports growth slowed by 24.4 per cent compared with June’s shipments of 410,000 units. Still, analysts said growth may pick up over the coming months as Chinese-made vehicles are increasingly well received by consumers in some developing countries.

Some assemblers in China – a left-hand drive market – are developing right-hand drive vehicles for exports. Hozon New Energy Automobile of Shanghai and Great Wall Motor in the Hebei provincial city of Baoding announced plans last week to ship right-hand drive vehicles to Indonesia.

undated photograph of 4,000 Neta electric cars by Hozon New Energy Automobile, bound for exports. Photo: Weibo

Hozon has begun taking orders for its flagship Neta S electric sedan, and the compact sports-utility vehicles (SUV) Neta U-II and Neta V. Great Wall, China’s largest maker of SUVs, said it would sell several models including the Tank 500 and Haval H6 models in Indonesia.

The CPCA did not disclose the number of EV exports in July, but Canalys predicted in June that China’s overseas sales of pure electric and plug-in hybrid vehicles are expected to reach 1.3 million units in 2023, almost double the number of 679,000 units last year. They will contribute to a surge in combined exports of petrol and battery-powered vehicles to 4.4 million units from 3.11 million in 2022, the research firm added.

Chinese EVs are “value for money and high-quality products, and they can beat most of foreign brands,” Canalys said.

China is the world’s largest automotive and EV market where about 200 EV assemblers are competing against each other to develop green and smart cars that can define the future of mobility. EV sales in mainland China will rise by 35 per cent this year to 8.8 million units, UBS analyst Paul Gong forecast in April. China’s buoyant car exports stood in a contrast to the country’s falling exports of commodities so far this year.

www.google.com

www.google.com

Published: 3:15pm, 13 Aug, 2023

China’s July overseas shipments jumped 63 per cent to 310,000 vehicles from a year ago, raising the total to 2.65 million units in the first seven months of the year

Local brands made up 248,000 units, or 80 per cent, of July’s exports, according to data compiled by the China Passenger Car Association

China’s home-grown marques delivered more automobiles abroad in July, driving a two-thirds jump in monthly exports that extended the nation’s lead over Japan as the world’s largest vehicle exporter. July’s overseas shipments jumped 63 per cent to 310,000 vehicles from a year ago, raising the total to 2.65 million units in the first seven months of the year, according to data compiled by the China Passenger Car Association (CPCA). Local brands made up 248,000 units, or 80 per cent, of July’s exports, CPCA said. “Carmakers maintained a growth trajectory for exports and rising demand for Chinese vehicles are encouraging assemblers to ramp up production,” said Gao Shen, an independent analyst in Shanghai. “More Chinese automotive firms are now looking to bolster sales in overseas markets.” The latest numbers widened China’s 15.8-per cent lead over Japan. China exported 2.34 million vehicles in the first half, more than the 2.02 million Japanese marques reported by the Japan Automobile Manufacturers Association (JJAMA). Japan exported 3.5 million vehicles in 2022.

This aerial photo taken on July 5, 2023, shows cars to be loaded for export at Yantai Port in east China’s Shandong province on July 21, 2023. Photo: Xinhua

To be sure, China’s July exports growth slowed by 24.4 per cent compared with June’s shipments of 410,000 units. Still, analysts said growth may pick up over the coming months as Chinese-made vehicles are increasingly well received by consumers in some developing countries.

Some assemblers in China – a left-hand drive market – are developing right-hand drive vehicles for exports. Hozon New Energy Automobile of Shanghai and Great Wall Motor in the Hebei provincial city of Baoding announced plans last week to ship right-hand drive vehicles to Indonesia.

undated photograph of 4,000 Neta electric cars by Hozon New Energy Automobile, bound for exports. Photo: Weibo

Hozon has begun taking orders for its flagship Neta S electric sedan, and the compact sports-utility vehicles (SUV) Neta U-II and Neta V. Great Wall, China’s largest maker of SUVs, said it would sell several models including the Tank 500 and Haval H6 models in Indonesia.

The CPCA did not disclose the number of EV exports in July, but Canalys predicted in June that China’s overseas sales of pure electric and plug-in hybrid vehicles are expected to reach 1.3 million units in 2023, almost double the number of 679,000 units last year. They will contribute to a surge in combined exports of petrol and battery-powered vehicles to 4.4 million units from 3.11 million in 2022, the research firm added.

Chinese EVs are “value for money and high-quality products, and they can beat most of foreign brands,” Canalys said.

China is the world’s largest automotive and EV market where about 200 EV assemblers are competing against each other to develop green and smart cars that can define the future of mobility. EV sales in mainland China will rise by 35 per cent this year to 8.8 million units, UBS analyst Paul Gong forecast in April. China’s buoyant car exports stood in a contrast to the country’s falling exports of commodities so far this year.

China’s July vehicle exports soar 63 per cent, widening lead over Japan

The latest data widened China’s lead over Japan. China exported 2.34 million vehicles in the first half, more than Japan’s 2.02 million units, according to the Japan Automobile Manufacturers Association.

Last edited: